Investors Weigh XRP’s Future After 53% Surge Amid Profit-Taking and Whale Accumulation Dynamics

XRP/USDT

$2,431,226,288.85

$1.4703 / $1.4052

Change: $0.0651 (4.63%)

-0.0145%

Shorts pay

Contents

-

XRP has surged 53% year-to-date, igniting debates among investors about the sustainability of this rally and what lies ahead.

-

The asset’s performance has also shown correlation with Bitcoin’s peaks, leading to speculation about its potential to hit $4.

-

“Despite profit-taking, whales are showing long-term conviction, potentially driving XRP to new highs,” reports COINOTAG.

Explore XRP’s remarkable surge and the factors influencing investor decisions as it eye a potential $4 target amidst market fluctuations.

Understanding XRP’s Impressive Bull Run

XRP’s climb above $3 has been notable, particularly as it has posted a 40% monthly gain with much of this growth occurring in the New Year. This considerable upswing raises questions about its sustainability, especially since the relative strength index (RSI) indicates a shift from neutral to overbought conditions in a mere three days. Many traders view these benchmarks as signals for potential profit-taking, a natural reaction in bullish markets.

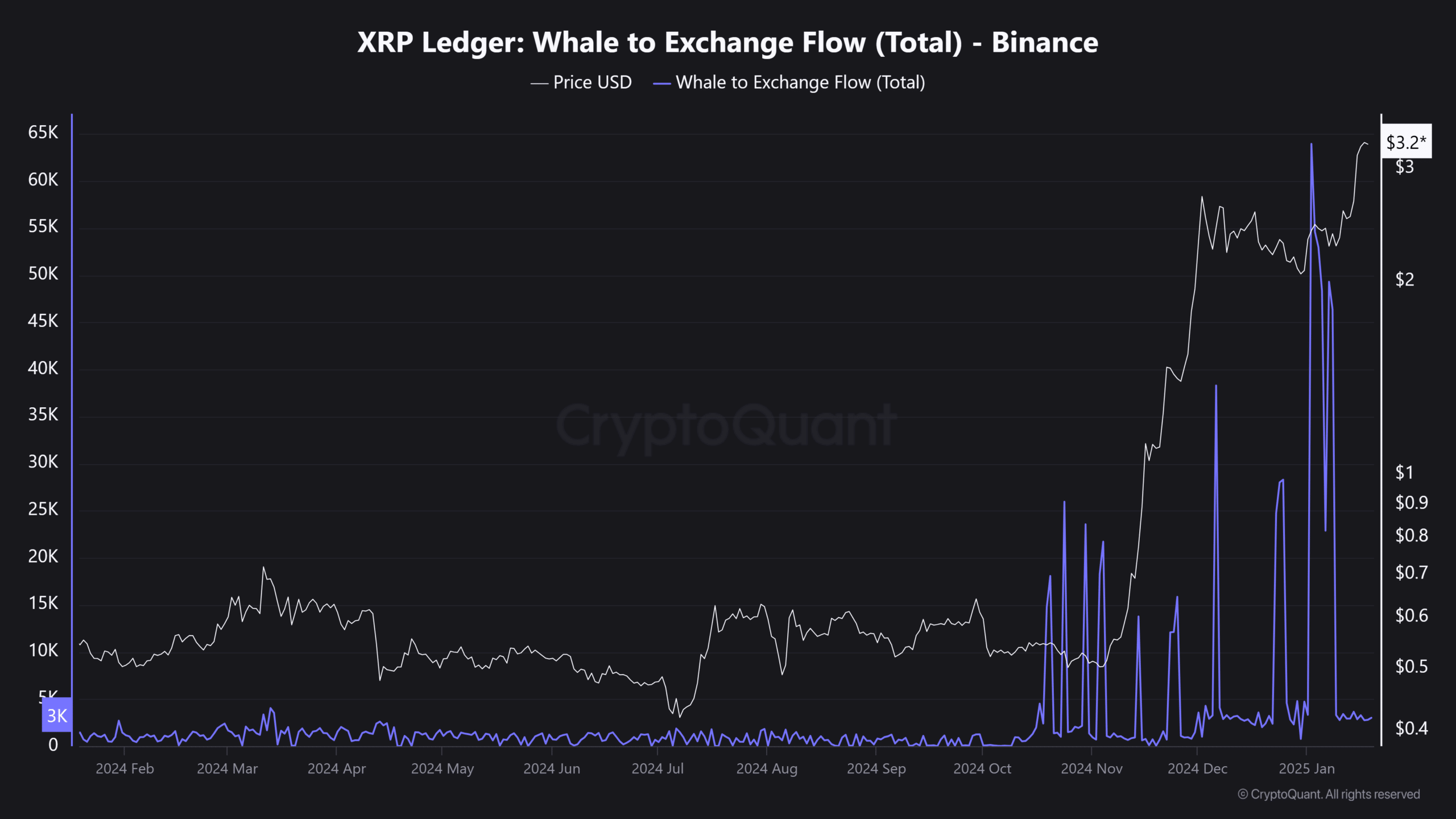

During the recent rally, the influx of XRP into major exchanges like Binance has witnessed a staggering 1567% increase in two days alone, totaling nearly 350 million XRP. This significant flow suggests that many traders are indeed locking in profits after a substantial lift.

Source: CryptoQuant

Despite the cashing out by traders, large investors or ‘whales’ remain steadfast, holding around $4 billion in XRP since the last significant market uptick. Their data indicates that they are positioning for a much longer-term gain, hinting that we may not see the expected large sell-offs that many analysts anticipated.

The Impact of Market Dynamics

As XRP approached $3.50—just 11% shy of its all-time high—the market experienced a swift pullback, evidenced by an 8% dip at the time of reporting. This seemed to arise from a shift in supply and demand dynamics within the trading environment, signaling an economic imbalance.

The overall sentiment has shifted towards selling in the perpetual markets, evident from the taker buy/sell ratio that now favors short positions. Exchange data revealed a dramatic $8.44 million in long liquidations, a significant marker of shifting sentiment.

Notably, while these indicators point to growing caution in the futures market, the Open Interest (OI) experienced only a 0.70% decline. The potential exists for more long positions to be squeezed if this trend continues, particularly as market volatility is expected to rise in the context of Bitcoin’s performance and engagement.

Source: CryptoQuant

Interestingly, despite the market fluctuations, the spot market remains resilient. The hesitance from whales to engage in aggressive selling underscores a profound level of conviction that may bode well for XRP’s future trajectory.

Conclusion

In summary, XRP’s recent performance portrays a complex interplay of bullish sentiment and market dynamics. While profit-taking among traders is evident, the steadfastness of whales could signal continued support for XRP, potentially eyeing a push towards $4. Investors should remain vigilant as market conditions evolve and maintain awareness about upcoming adjustments in both the spot and futures markets.

Comments

Other Articles

Revolut Adds Solana Support for Potential Crypto Transfers and Staking

December 3, 2025 at 06:56 PM UTC

Kiyosaki Sells Bitcoin Portion for Real Assets, Eyes Future Accumulation

November 22, 2025 at 11:03 AM UTC

21Shares Secures SEC Approval for Spot XRP ETF, Trading Likely Next Week

November 21, 2025 at 06:02 AM UTC