IRYS Short-Term Bullish Outlook Faces Airdrop Concentration Risks

Contents

The Irys token price has surged 76.2% in the last 24 hours, trading around key support levels amid its recent mainnet launch on November 25, 2025. Short-term bullish momentum persists, but on-chain concerns about airdrop distribution could influence future stability, warranting cautious optimism for investors.

-

IRYS mainnet launch boosts confidence: The network went live on November 25, 2025, positioning itself as a high-throughput data backbone for AI applications.

-

Token airdrop scrutiny: On-chain analysis reveals potential concentration risks, with 20% of allocation possibly controlled by one entity.

-

Price action analysis: A 76.2% gain highlights buyer defense, but limited historical data restricts long-term forecasts; a Bitget trading event added to positive sentiment.

Discover the Irys token price surge of 76.2% post-mainnet launch and on-chain insights. Explore bullish short-term outlook amid airdrop concerns—stay informed on crypto trends today.

What is the current price outlook for the Irys token?

The Irys token exhibits a short-term bullish outlook following its 76.2% price increase over the past 24 hours, driven by the recent mainnet activation on November 25, 2025. This surge reflects growing investor interest in its role as a scalable data infrastructure for AI workloads, though on-chain irregularities in airdrop distribution introduce potential downside risks. Technical indicators suggest sustained momentum if support levels hold.

How do on-chain developments affect the Irys token price?

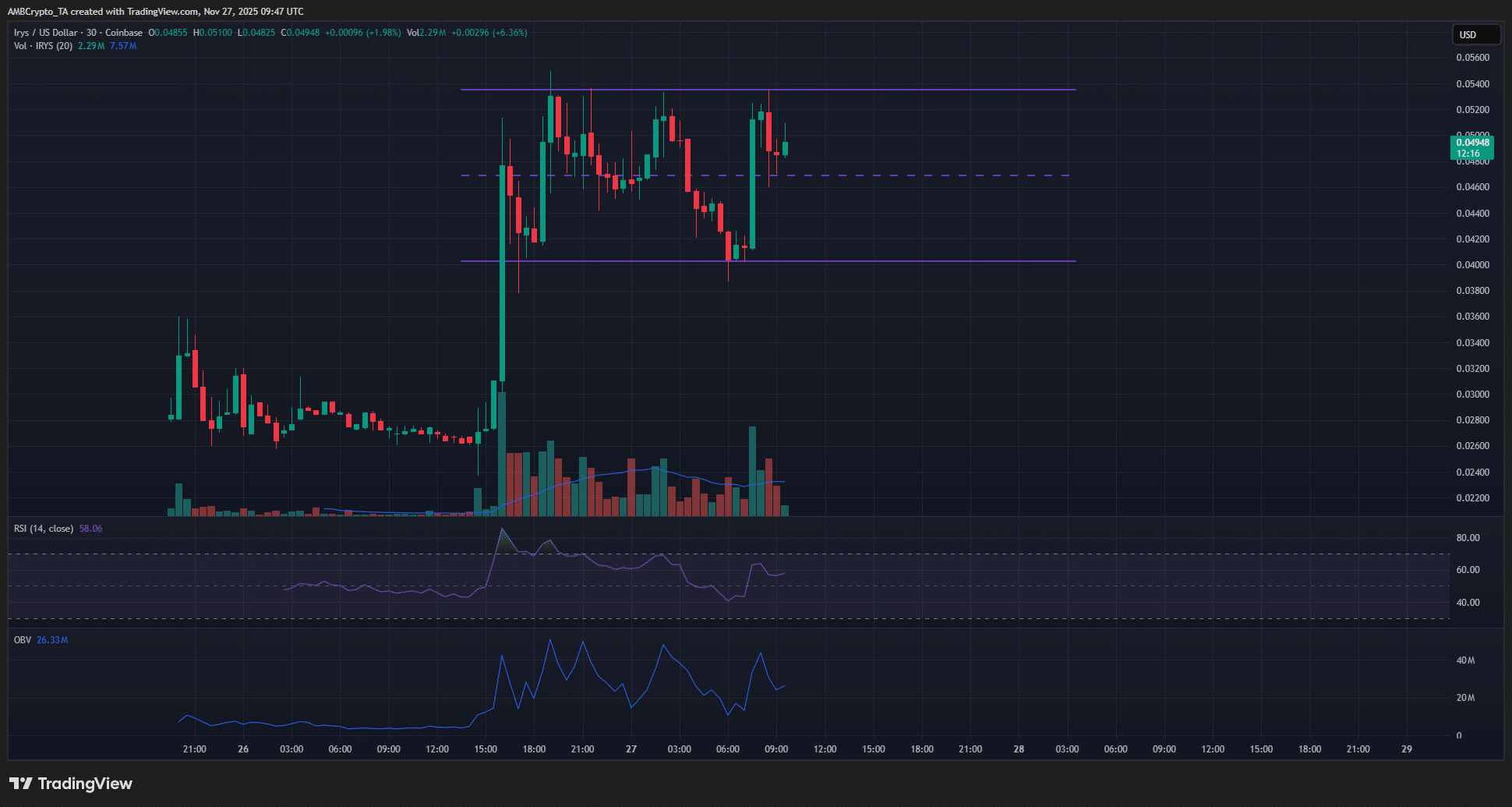

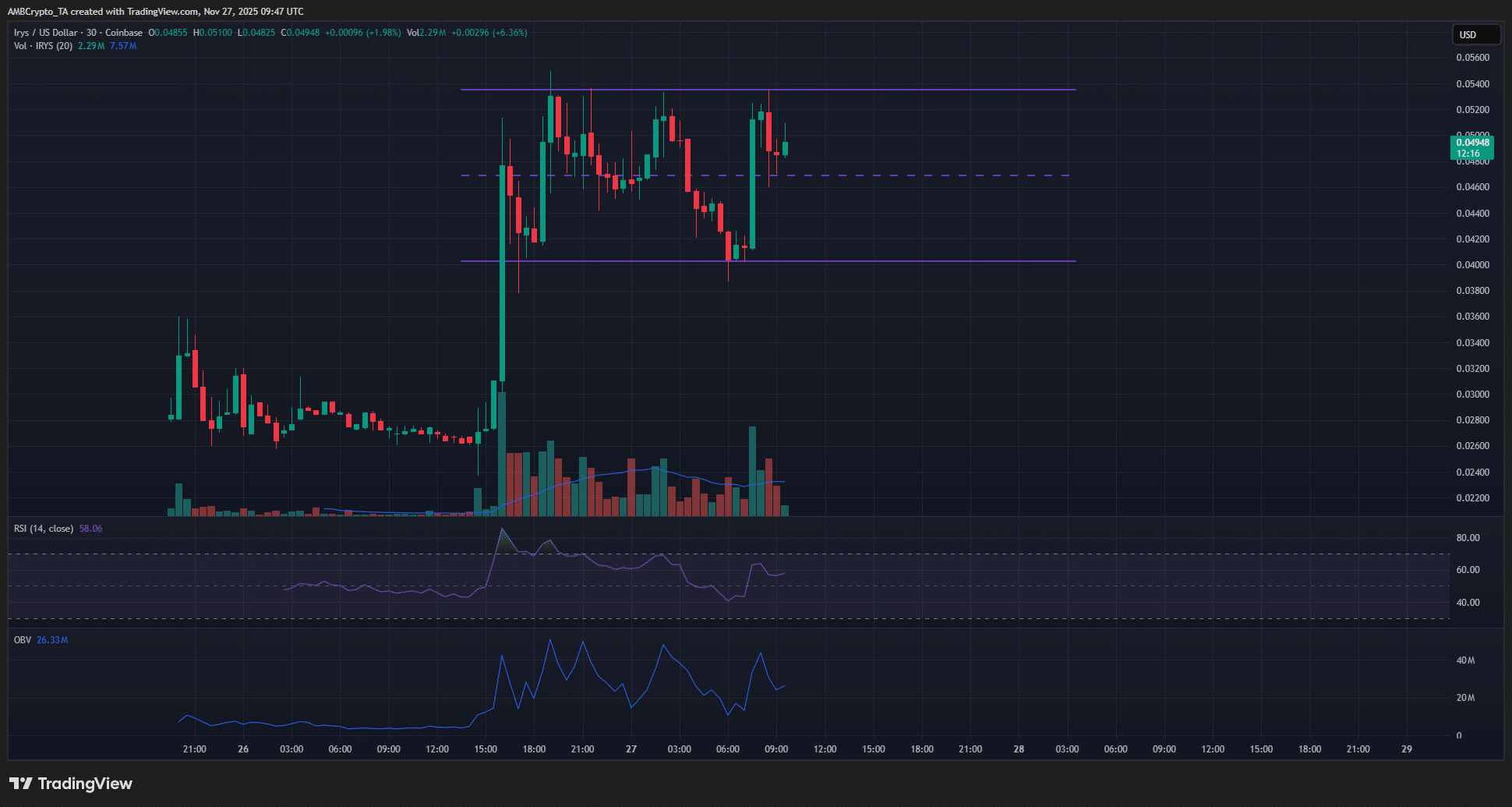

On-chain investigators have highlighted significant clustering in wallet holdings following the Irys token airdrop, with reports indicating that approximately 20% of the total allocation may be controlled by a single entity. This concentration raises concerns about possible coordinated selling pressure that could dampen price growth in the near term. According to data from blockchain explorers, such distributions have historically led to volatility in newly launched tokens, as seen in similar cases with emerging layer-1 projects. Experts from firms like Messari note that transparent tokenomics are crucial for maintaining network trust, emphasizing the need for Irys to address these findings promptly. The project’s high-throughput design, capable of handling AI-scale data processing, remains a strong fundamental, but resolving these on-chain issues will be pivotal for long-term price stability. Trading volume has spiked alongside the price rally, indicating active market participation, yet the On-Balance Volume (OBV) indicator shows oscillation, mirroring the price’s range-bound behavior between $0.04 and $0.053.

Frequently Asked Questions

What factors are driving the recent Irys token price increase?

The Irys token price has climbed 76.2% in 24 hours primarily due to the mainnet launch on November 25, 2025, which underscores its utility as a data backbone for the AI economy. A Bitget trading competition offering 740,000 IRYS in rewards has further fueled positive sentiment, attracting new liquidity and buyer interest to the young network.

Is the Irys token a good short-term investment given on-chain airdrop concerns?

While the Irys token shows short-term bullish signs from recent price action and launch hype, on-chain airdrop findings suggest caution. With limited historical data, investors should monitor wallet cluster developments closely, as unresolved concentration could lead to sell-offs, but the project’s AI-focused infrastructure provides a solid foundation for potential growth.

Key Takeaways

- Strong Launch Momentum: The Irys mainnet activation on November 25, 2025, has propelled the token’s 76.2% gain, highlighting its promise in AI data handling.

- On-Chain Risks: Sleuths’ discovery of 20% airdrop concentration in single-entity wallets poses a threat to price stability through potential dumps.

- Monitor Key Levels: Watch the $0.04-$0.053 range; a breakout could confirm bullish trends, while on-chain clarity is essential for sustained confidence.

IRYS bullish in the short-term as buyers defend…

Source: IRYS/USD on TradingView

In the 30-minute chart, the Irys token price has formed a range between $0.04 and $0.053, with buyers actively defending the lower boundary to maintain upward pressure. This consolidation phase indicates indecision, but the overall 76.2% rise since launch demonstrates robust initial support. The On-Balance Volume remains flat, suggesting no clear dominance yet between buyers and sellers.

The Irys network, designed for high storage and throughput to support AI-driven applications, has garnered attention for its potential in the evolving crypto-AI intersection. As per reports from blockchain analytics platforms, the airdrop’s wallet distribution patterns continue to be a focal point, with no official rebuttal from the project team at this stage. Financial analysts from CoinMetrics emphasize that such early-stage transparency issues can either resolve into stronger community trust or lead to prolonged market skepticism.

Given the token’s nascent stage, long-term projections are premature, but the short-term technical setup favors bulls if the range holds. Participation in events like the Bitget competition, distributing 740,000 IRYS tokens, has contributed to heightened visibility and trading activity, potentially solidifying the bullish narrative in the immediate future.

Investors should remain vigilant regarding on-chain updates, as further revelations could sway sentiment. The project’s architecture promises scalability for data-intensive AI operations, positioning IRYS as a contender in the specialized blockchain space.

Conclusion

The Irys token price rally of 76.2% post-mainnet launch on November 25, 2025, underscores its on-chain developments and AI utility potential, despite airdrop concentration concerns flagged by investigators. With a short-term bullish outlook supported by buyer defense and promotional events, the network’s ability to address transparency issues will determine sustained growth. As the crypto landscape evolves, monitoring Irys closely could reveal opportunities in the AI-data fusion sector—consider evaluating your portfolio strategies accordingly.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.