Is the BTC Correction Halfway Through the Bear Market?

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

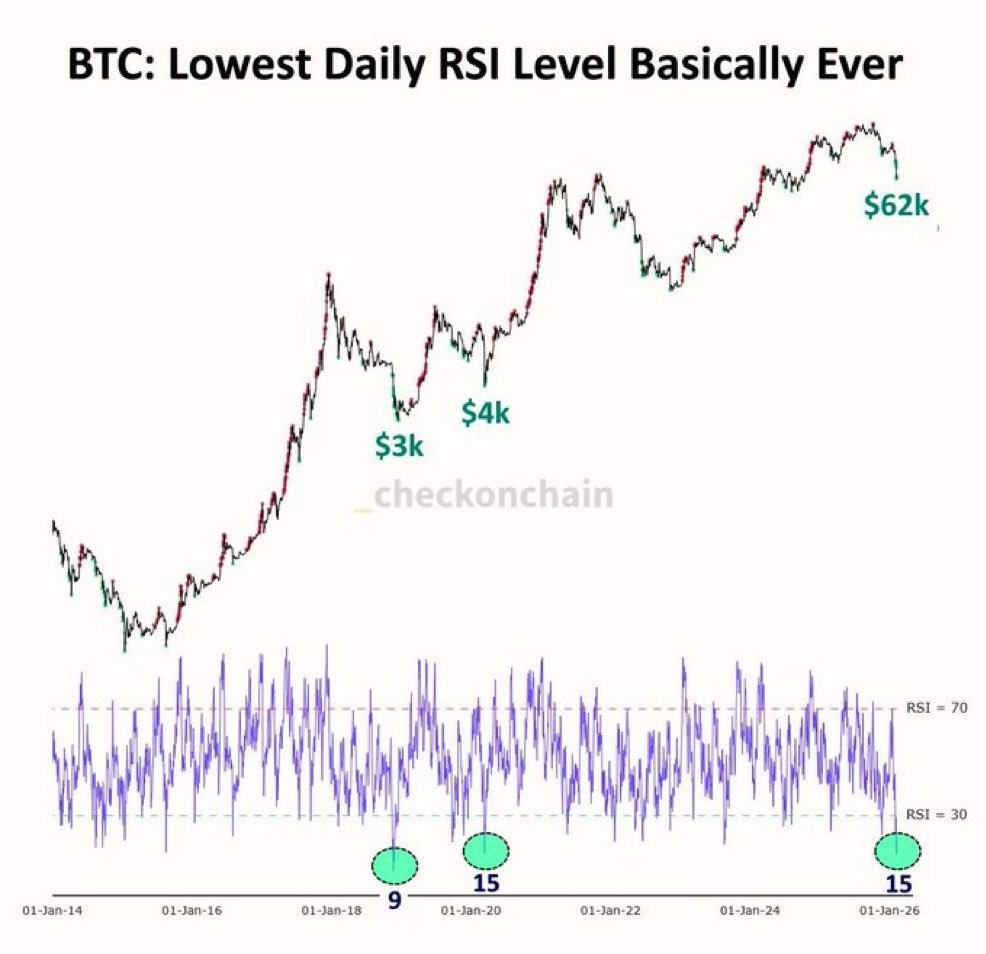

According to Kaiko Research, Bitcoin's (BTC) sharp correction at the beginning of the month could be the critical "halfway point" of the current bear market. BTC fell to $59,930 on Friday, marking its lowest level since October 2024, and experienced the largest correction since the 2024 Bitcoin halving with a 32% drop. The market has transitioned from post-halving euphoria to a historically 12-month bear market period. On-chain metrics and token performances point to critical technical support levels where the four-year cycle framework is being tested, the report was shared with Cointelegraph.

Bitcoin halving cycles, all-time chart. Source: Kaiko Research

Technical Analysis of BTC Correction

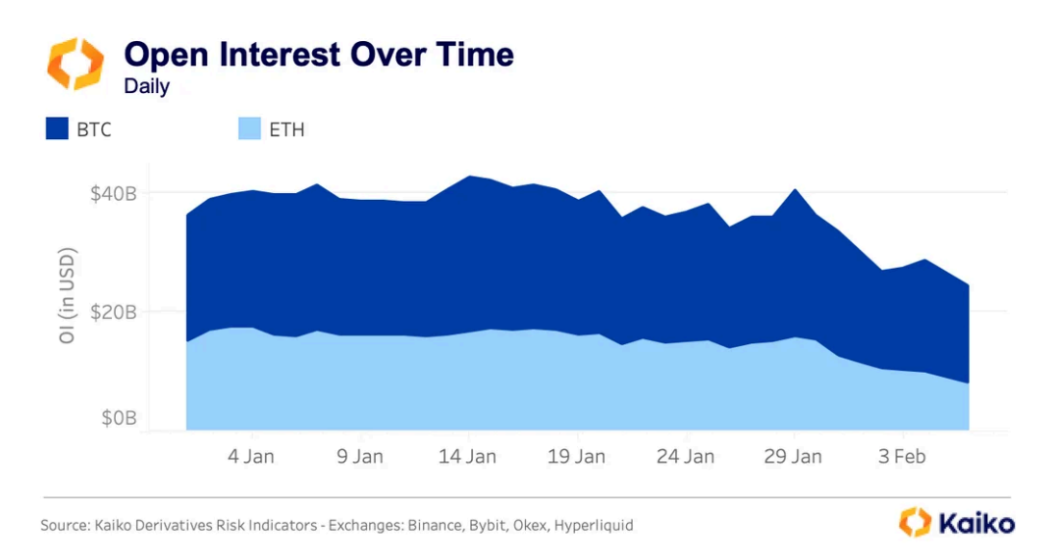

Total spot crypto trading volume on the top 10 centralized exchanges fell 30% in November to $700 billion (from $1 trillion in October). BTC and Ether (ETH) futures open interest decreased 14% last week to $25 billion, reflecting ongoing deleveraging. BTC has aligned with the four-year halving cycle since the beginning of the year. According to current data, BTC price is at $69,226, RSI at 32.09 in the oversold region, and downtrend dominant.

Open interest for BTC and ETH futures, top 10 exchanges. Source: Kaiko Research

Source: Michaël van de Poppe

Critical Support and Resistance Levels for BTC

- Supports: S1: 62.179$ (72/100 ⭐ Strong, -9.89% distance)

- S2: 65.849$ (69/100 ⭐ Strong, -4.57% distance)

- Resistances: R1: 70.183$ (75/100 ⭐ Strong, +1.71% distance)

- R2: 91.200$ (69/100 ⭐ Strong, +32.17% distance)

Recent news is supportive: On February 9, Bitcoin ETFs saw $144.9 million in net inflows, Binance SAFU Fund added another 4,225 BTC ($299.6 million) reaching a total of 10,455 BTC. Click for detailed BTC analysis.

Frequently Asked Questions About BTC

When will the BTC bear market end?

According to historical cycles, it may last 12 months after halving, with critical supports being tested.

What do BTC ETF inflows mean?

Positive flows ($144.9M) indicate institutional demand and may signal recovery.

Check BTC futures and ETH spot analysis.