Is the BTC Market at a Permanent Bottom? Matrixport Analysis

BTC/USDT

$15,625,149,390.75

$70,126.67 / $68,000.00

Change: $2,126.67 (3.13%)

-0.0011%

Shorts pay

Contents

Crypto market sentiment has fallen to extremely low levels, and according to Matrixport analysts, a “permanent bottom” that exhausts selling pressure may form. In Matrixport’s Bitcoin (BTC) Fear and Greed Index, the 21-day moving average fell below zero and started rising, indicating that selling pressure is easing and the market is stabilizing. The firm warns that prices could fall further in the short term, while noting that historically these negative readings have offered entry opportunities.

Bitcoin sentiment hits extreme lows. Source: Matrixport

BTC Fear and Greed Index in Historical Decline

Matrixport metric was at similar lows after market drops in June 2024 and November 2025. Alternative.me Fear and Greed Index at 10/100 is the lowest “extreme fear” level since June 2022. If BTC closes February negative, it will experience the longest monthly loss streak since 2018. These levels, as we also emphasize on our BTC detailed analysis pages, usually give recovery signals.

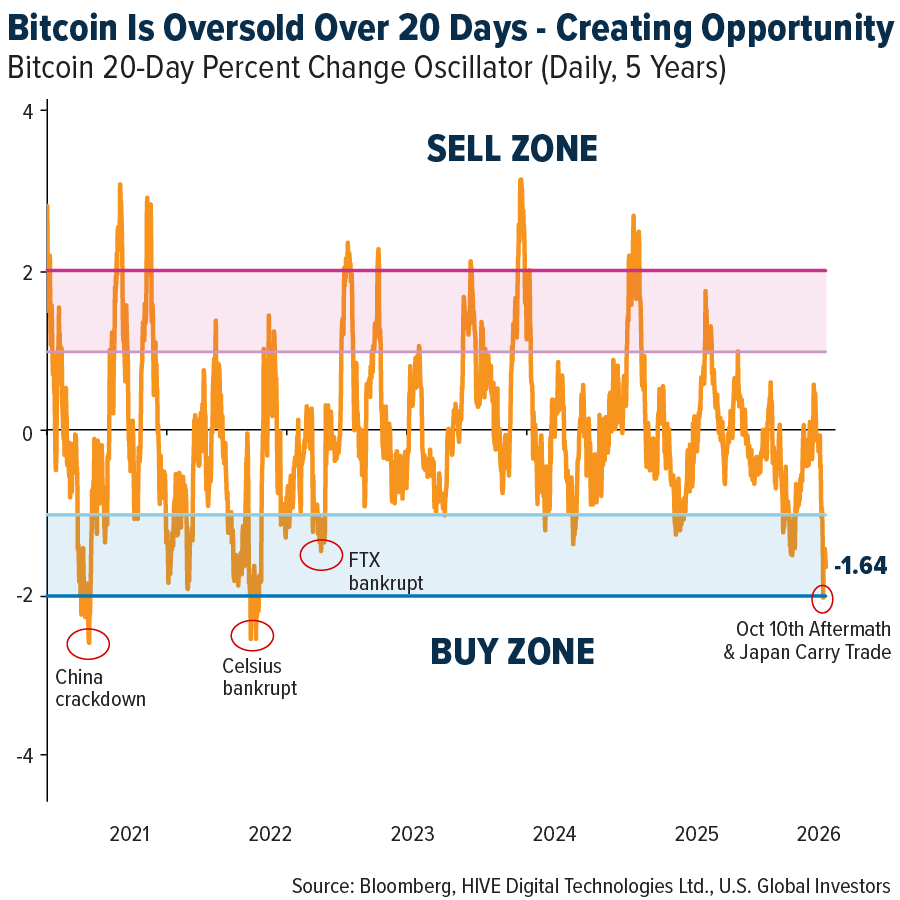

Hive Chairman’s BTC Oversold Zone Analysis

Hive Chairman Frank Holmes stated that BTC is two standard deviations below its 20-day average, seen three times in the last five years, paving the way for short-term bounces; he remains optimistic long-term.

BTC is in historic oversold territory, creating opportunity. Source: Hive

Current BTC Technical Indicators and RSI Oversold

BTC price at 68,355.22 USD level, 24-hour change -0.06%. RSI at 35.67 in oversold region, trend downtrend and Supertrend bearish. Trading below EMA 20: 72,841.75 USD. The table below shows critical levels:

| Level | Price (USD) | Score | Distance | Sources |

|---|---|---|---|---|

| S1 (Strong Support) | 65,486.81 | 74/100 ⭐ | -4.36% | Keltner Lower, Fibo 0.114 |

| S2 (Strong Support) | 60,000.00 | 65/100 ⭐ | -12.37% | Fibo 0.0 |

| R1 (Strong Resistance) | 70,104.47 | 86/100 ⭐ | +2.38% | R3, Prev Day High |

| R2 (Medium Resistance) | 83,623.68 | 58/100 | +22.13% | BB |

The oversold condition in RSI creates short-term rebound potential. Check BTC futures for detailed charts.

Positive Reversal in Weekly BTC Candlestick Chart

Latest breaking news: Bitcoin weekly candlestick chart has turned positive and rose 8% from its lowest level with 1 day 12 hours to weekly close. This is a signal consistent with Matrixport’s bottom prediction.

Metaplanet BTC Losses Market Impact

Metaplanet announced a net loss of 619 million dollars in Bitcoin valuation but BTC holdings reached 35.102 BTC. Corporate losses are increasing overall market fear but HODL strategy supports long-term optimism. Similar situations in the past triggered bottoms.

Strategic Recommendations for BTC Investors

- Short-term, monitor S1 support (around 65K).

- Watch for entry opportunities with oversold RSI.

- Let Holmes’ optimism guide long-term holders.