Japan May Adopt 20% Flat Crypto Tax Rate in 2026 Reform

Contents

Japan’s crypto tax reform proposes a flat 20% rate on profits, replacing the current tiered system that reaches up to 55%. This change aims to align cryptocurrency taxation with equities and investment funds, potentially boosting adoption by reducing barriers for investors.

-

Current system treats crypto as miscellaneous income, taxed from 5% to 45% plus 10% inhabitant tax for high earners.

-

Proposed flat 20% rate matches taxation on stocks and funds, simplifying compliance.

-

Reform backed by Financial Services Agency (FSA) bill for 2026, including enhanced investor protections and oversight.

Japan crypto tax reform: Shift to 20% flat rate on crypto gains eases high taxes up to 55%, aligning with stocks. Discover impacts on investors and market growth in this key update.

What Is Japan’s Proposed Crypto Tax Reform?

Japan crypto tax reform involves introducing a uniform 20% tax rate on cryptocurrency profits, eliminating the existing progressive structure that can exceed 55% for high-income individuals. The Financial Services Agency (FSA) first proposed these changes in November 2025, with government support to submit a bill in early 2026. This move seeks to standardize crypto taxation alongside traditional assets like stocks, fostering a more equitable environment for digital asset holders.

Under present rules, crypto gains fall under miscellaneous income, subjecting them to income tax brackets ranging from 5% to 45%, plus potential local inhabitant taxes adding up to 10%. In contrast, profits from equities and investment trusts face a straightforward 20% levy. The reform, reported by Nikkei Asia, addresses long-standing industry calls for parity, potentially encouraging broader participation in the crypto market.

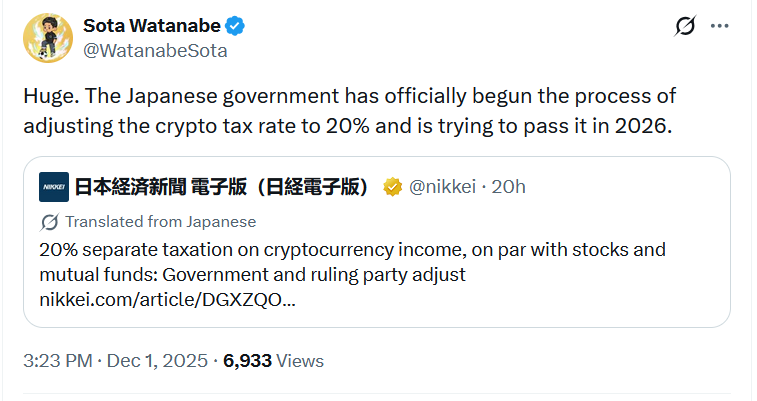

Source: Sota Watanabe

The FSA’s framework also emphasizes robust investor safeguards, amending the Financial Instruments and Exchange Act to prohibit insider trading in crypto and mandate clearer disclosure of investment risks. These measures aim to build trust while streamlining tax processes.

How Does Japan’s Crypto Tax Reform Align with Other Assets?

The proposed Japan crypto tax reform brings cryptocurrency under the same 20% flat tax umbrella as equities and investment trusts, which currently enjoy this rate on capital gains. This alignment eliminates the punitive miscellaneous income classification, where rates escalate with overall earnings—potentially hitting 55% when combined with local taxes. According to FSA outlines, the change simplifies reporting and reduces disincentives for holding or trading digital assets.

Industry data from the Japan Blockchain Association (JBA) highlights how the tiered system has constrained growth; a 2023 JBA survey noted that over 60% of potential investors cited high taxes as a barrier. By matching stock taxation, the reform could unlock billions in dormant capital, as seen in markets like the U.S. where favorable rates correlate with higher trading volumes. Experts, including JBA representatives, argue this parity will position Japan as a competitive hub for Web3 innovation without compromising fiscal responsibility.

“This adjustment removes the biggest obstacle for Web3 businesses and encourages public engagement with crypto assets,” stated a JBA policy letter from July 2023. The FSA’s bill, set for the 2026 Diet session, integrates these tax tweaks with stricter regulations, such as bans on non-public information trading, ensuring a balanced regulatory evolution.

Frequently Asked Questions

What Is the Timeline for Japan’s Crypto Tax Reform Implementation?

The Financial Services Agency plans to introduce the bill during the regular National Diet session in early 2026. If approved, the flat 20% rate on crypto profits would likely take effect shortly thereafter, aligning with amendments to the Financial Instruments and Exchange Act for comprehensive oversight.

Will Japan’s Crypto Tax Changes Affect Businesses and Individuals Equally?

Yes, the reform applies a uniform 20% rate to both individual and corporate crypto gains, replacing the miscellaneous income category. This levels the playing field with other investments, benefiting traders and firms by simplifying tax calculations and reducing effective rates for higher earners who previously faced up to 55% burdens.

The Japan Blockchain Association has advocated for this shift since 2023, emphasizing its role in supporting domestic Web3 operations. While the FSA began warming to the idea in September 2024, the current momentum reflects a consensus across government and industry stakeholders.

Key Takeaways

- Flat 20% Tax Rate: Replaces tiered system up to 55%, matching equities for fairer crypto taxation.

- Investor Protections Enhanced: Bill includes bans on insider trading and better disclosures to safeguard market integrity.

- Market Boost Potential: Lower rates could drive adoption; industry groups like JBA predict increased Web3 activity and investment.

Conclusion

Japan’s crypto tax reform marks a pivotal step toward integrating digital assets into the mainstream financial landscape, with a flat 20% rate on profits addressing longstanding inequities compared to stocks and funds. Supported by the FSA and ruling coalition, this initiative—coupled with robust oversight—promises to invigorate the domestic crypto sector. As the 2026 bill progresses, investors should monitor updates to capitalize on these opportunities for diversified portfolios.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026