Jito Foundation Considers US Return for Solana MEV Platform Amid Regulatory Clarity

JTO/USDT

$18,537,842.69

$0.2798 / $0.2523

Change: $0.0275 (10.90%)

-0.0075%

Shorts pay

Contents

The Jito Foundation is relocating back to the United States following recent regulatory improvements in the crypto sector, including clearer guidelines on digital assets. This move reverses its previous offshore operations prompted by hostile banking and SEC policies under Operation Chokepoint 2.0, signaling a more welcoming environment for blockchain innovation.

-

Jito Foundation’s US return highlights shifting crypto regulations post-2024 election.

-

The organization builds MEV infrastructure for Solana, enabling efficient transaction processing.

-

Debanking issues persist in 2025, with executives like Strike’s CEO reporting account closures by major banks.

Jito Foundation returns to US amid crypto regulatory thaw: Discover how clearer rules and new SEC leadership are boosting blockchain projects like Solana’s MEV tools. Explore impacts and ongoing challenges—read now for insights on the evolving digital asset landscape.

What is the Jito Foundation and why is it returning to the US?

The Jito Foundation, a nonprofit dedicated to advancing the Jito platform on the Solana blockchain, is relocating its operations back to the United States. This decision stems from significant regulatory advancements, such as the enactment of the GENIUS stablecoin legislation and ongoing efforts toward a comprehensive crypto market structure bill. Previously displaced by aggressive enforcement actions, the foundation now sees a stable path for growth under the new SEC leadership appointed after the 2024 presidential election.

How did Operation Chokepoint 2.0 impact the Jito Foundation?

The Jito Foundation faced severe challenges during the era of Operation Chokepoint 2.0, an informal campaign by regulators and banks to restrict financial services to the cryptocurrency industry. This led to widespread debanking, where traditional banks refused to handle transactions or provide accounts for crypto-related entities. According to Lucas Bruder, co-founder and CEO of Jito Labs—known pseudonymously as “buffalu”—the foundation was compelled to operate overseas because “Banks wouldn’t service us. Vendors wouldn’t contract with us. Every product decision carried real but unquantifiable legal risk from a hostile and capricious regulatory agency gone rogue.”

Bruder’s statement underscores the broader plight of crypto developers during this period. Jito, as a key player in maximal extractable value (MEV) infrastructure for Solana, specializes in optimizing transaction ordering to maximize efficiency and profitability. MEV involves the strategic rearrangement of blockchain transactions to capture additional fees through activities like arbitrage or preventing front-running exploits. Data from blockchain analytics firms indicates that Solana’s MEV opportunities have generated over $100 million in rewards for validators in 2024 alone, highlighting the platform’s importance in the DeFi ecosystem.

Regulatory pressures under the prior SEC administration, led by Gary Gensler, created an environment of uncertainty. Experts from organizations like the Blockchain Association have noted that such policies stifled innovation, forcing more than a dozen crypto firms to relocate internationally between 2022 and 2024. The Jito Foundation’s offshore shift was a direct response to these dynamics, but recent changes—including the confirmation of Paul Atkins as SEC chair—have paved the way for repatriation.

Source: buffalu

The GENIUS stablecoin bill, passed in late 2024, establishes a federal framework for stablecoin issuance, providing much-needed clarity on compliance requirements. Lawmakers are also advancing a crypto market structure bill that aims to delineate securities from commodities in digital assets, potentially exempting protocols like Jito from stringent oversight. These developments, combined with a pro-innovation stance from the new administration, have restored confidence among industry leaders.

Bruder further emphasized that the return is not just symbolic but practical, allowing the foundation to access domestic talent pools and partnerships previously out of reach. Financial analysts from firms like Galaxy Digital estimate that a friendlier regulatory climate could inject billions into US-based blockchain projects over the next few years.

Frequently Asked Questions

What is maximal extractable value (MEV) and how does Jito utilize it on Solana?

Maximal extractable value (MEV) represents the additional profits validators or traders can extract by influencing transaction order in a blockchain block, such as through arbitrage or liquidation opportunities. Jito enhances Solana’s MEV by providing specialized infrastructure that bundles transactions efficiently, reducing network congestion and distributing rewards more equitably among participants—boosting overall ecosystem security and user experience.

Is Operation Chokepoint 2.0 still affecting the crypto industry in 2025?

Yes, despite a more supportive federal stance, Operation Chokepoint 2.0 tactics linger through banking practices that limit crypto access. Executives report ongoing debanking, such as account closures at major institutions without explanation, even for long-term clients—highlighting the need for continued legislative safeguards to protect innovation.

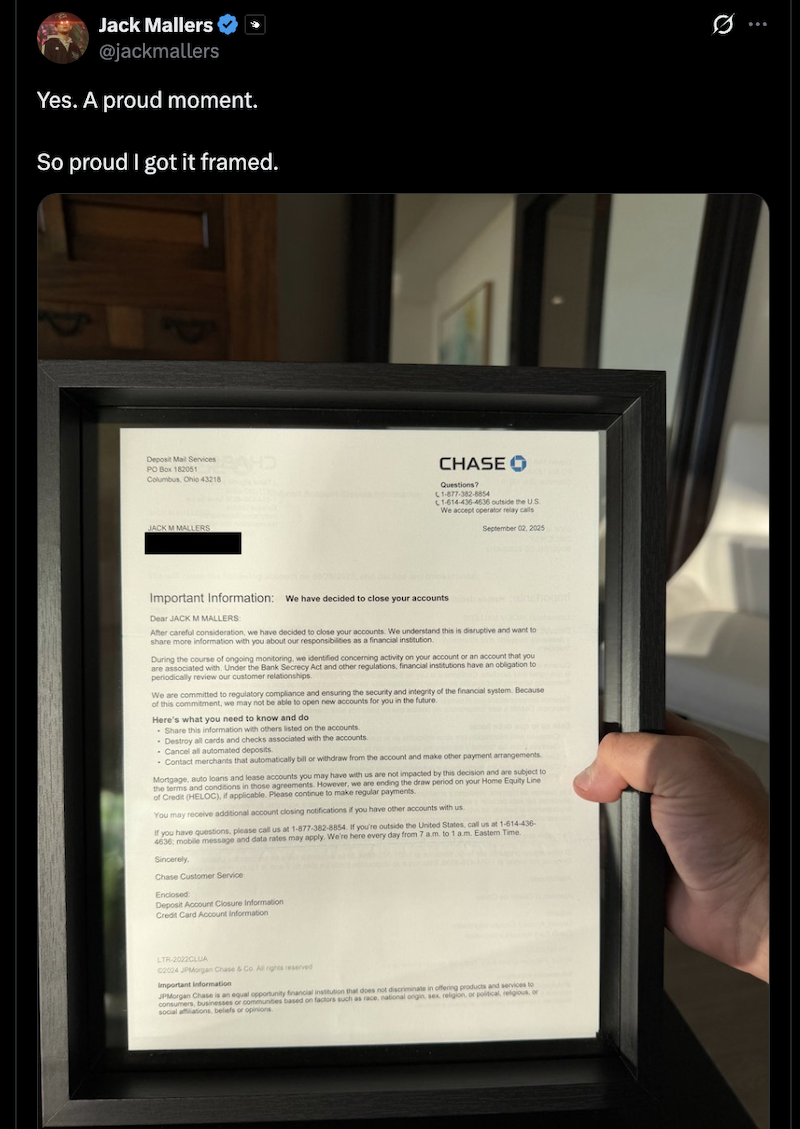

Even as the US crypto landscape improves, reports of debanking continue to surface from industry insiders. In November 2024, Jack Mallers, CEO of the Bitcoin Lightning Network payments firm Strike, revealed that JPMorgan Chase abruptly closed his personal bank account. Mallers, whose father had been a client for over 30 years, noted that the bank provided no specific reason for the action, underscoring the opaque nature of these decisions.

Jack Mallers shares a framed copy of the debanking letter he received from JPMorgan Chase. Source: Jack Mallers

This incident aligns with warnings from venture capitalist Alex Rampell of Andreessen Horowitz, who in August 2024 highlighted alternative pressure tactics employed by banks. These include imposing exorbitant fees on transfers to crypto wallets, exchanges, or Web3 applications, or outright blocking payments to certain digital asset providers. Rampell described these measures as a subtler continuation of regulatory overreach, affecting startups and established firms alike.

The persistence of such issues raises questions about the full extent of the regulatory thaw. While the SEC under Paul Atkins has signaled a shift toward technology-neutral policies, banking regulators like the Office of the Comptroller of the Currency (OCC) and the Federal Deposit Insurance Corporation (FDIC) maintain conservative stances on crypto exposures. Industry surveys conducted by the Chamber of Digital Commerce in early 2025 reveal that 40% of crypto businesses still face servicing barriers from traditional banks, compared to 65% in 2023.

‘Grow up… We debank Democrats, we debank Republicans:’ JPMorgan CEO Jamie Dimon reportedly stated in a recent interview, acknowledging the bank’s broad application of risk policies without political bias. However, critics argue this non-discriminatory approach still hampers legitimate innovation. Mallers’ experience exemplifies how personal and professional boundaries blur in these enforcement actions, potentially deterring talent from entering the sector.

Rampell’s observations point to evolving strategies: rather than outright closures, banks are increasingly using compliance hurdles to discourage crypto involvement. For instance, transfers to platforms like Coinbase or decentralized protocols may incur fees up to 5% or be flagged for enhanced due diligence, adding operational friction. Data from Chainalysis shows that such restrictions contributed to a 15% drop in US-based crypto transaction volumes in Q1 2025, despite global growth.

These challenges persist amid broader optimism. The Jito Foundation’s return serves as a bellwether for other projects eyeing US operations. Foundations like those behind Ethereum layer-2 solutions and NFT marketplaces are monitoring the situation, with some already announcing exploratory domestic setups. Expert commentary from regulatory scholars at Cornell Law School emphasizes that while federal progress is encouraging, state-level variations and private sector inertia could prolong full normalization.

Key Takeaways

- Regulatory Progress Drives Relocation: The Jito Foundation’s US return is fueled by the GENIUS bill and incoming crypto market structure legislation, creating a predictable framework for Solana-based innovation.

- MEV Infrastructure Vital for Solana: Jito’s tools optimize transaction efficiency, capturing over $100 million in rewards in 2024 and enhancing network resilience against exploits.

- Debanking Challenges Remain: Industry leaders urge stronger protections, as banks continue aggressive tactics—stay informed and advocate for balanced policies to support growth.

Conclusion

The Jito Foundation’s return to the US marks a pivotal moment in the evolving crypto regulatory landscape, reflecting clearer rules that benefit MEV infrastructure on networks like Solana. While Operation Chokepoint 2.0’s shadow lingers through persistent debanking, the momentum from recent legislative wins and SEC reforms promises sustained innovation. As the industry adapts, stakeholders should prioritize compliance and collaboration to capitalize on this pro-crypto shift—positioning the United States as a global leader in digital assets moving forward.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026