JPMorgan Under Scrutiny for Alleged Debanking of Bitcoin Platform Strike

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

The JPMorgan crypto debanking controversy erupted when Strike CEO Jack Mallers accused the bank of closing his account and blocking customer deposits, citing alleged fraudulent activities. This incident reignites debates on “Operation Chokepoint 2.0,” where financial institutions restrict crypto firms, potentially driving innovation overseas. Senator Cynthia Lummis criticized the move as harmful to U.S. digital asset leadership.

-

JPMorgan’s alleged actions against Strike highlight ongoing tensions between traditional banks and crypto platforms.

-

Crypto community backlash includes calls to end debanking practices that stifle innovation.

-

Statistics show $28 billion laundered via crypto since 2024, but banks like JPMorgan have faced $40 billion in fines for illicit activities since 2000.

Discover the JPMorgan crypto debanking scandal shaking the industry. Learn how it impacts Bitcoin payments and what Senator Lummis says. Stay informed on U.S. policy shifts—read now for key insights!

What is the JPMorgan crypto debanking controversy?

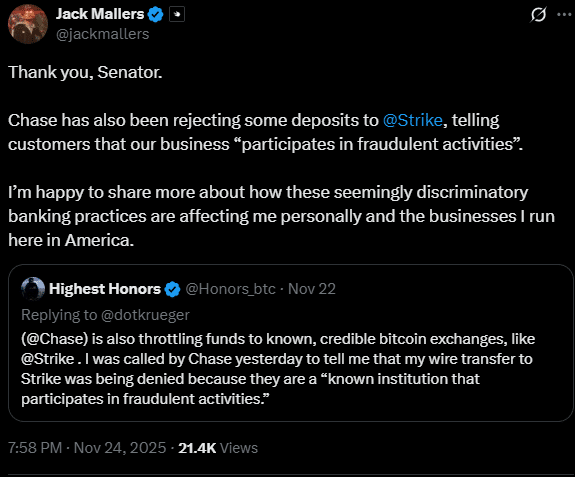

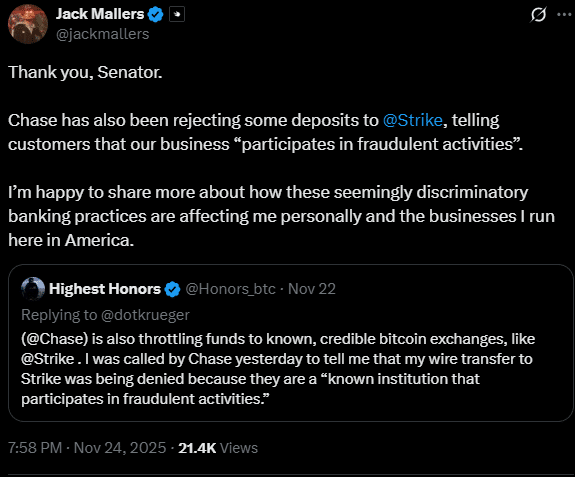

Crypto debanking refers to instances where traditional banks terminate services to cryptocurrency-related businesses, often due to perceived risks. In this case, Jack Mallers, CEO of Bitcoin-focused payment platform Strike, publicly stated that JPMorgan Chase closed his personal account and prevented some customers from depositing funds into Strike, alleging involvement in “known fraudulent activities.” This development, reported in late 2025, has drawn sharp criticism from the crypto sector, echoing past regulatory pressures and raising questions about fair access to banking for digital asset firms.

How did Senator Cynthia Lummis respond to the JPMorgan crypto debanking incident?

Senator Cynthia Lummis, a vocal proponent of Bitcoin and digital assets, condemned JPMorgan’s reported actions as a continuation of “Operation Chokepoint 2.0,” a term used by the industry to describe systematic efforts to restrict crypto entities from banking services. She stated, “Operation Chokepoint 2.0 regrettably lives on. It’s past time we put it to rest to make America the digital asset capital of the world.” This backlash underscores broader concerns that such debanking could push crypto innovation and investment abroad, undermining U.S. leadership in the sector. During the previous administration, many banks viewed crypto firms as high reputational risks amid intense regulatory scrutiny, leading to widespread account closures. Lummis’s comments align with recent policy shifts; following the 2025 inauguration of the pro-crypto Trump administration, an executive order was signed in August to promote fair banking practices. This order directed the Federal Reserve and other regulators to eliminate criteria like “reputational risk” that had been used to justify debanking. The White House emphasized that digital assets had been unfairly targeted, yet incidents like this suggest lingering challenges. Expert analyses from financial watchdogs indicate that while progress has been made, isolated cases persist, potentially eroding trust between traditional finance and emerging technologies.

Source: X

The JPMorgan crypto debanking issue has divided opinions within financial circles, with some defending the bank’s caution due to the sector’s association with illicit finance. Economist Steve Hanke pointed out that criminal networks have laundered approximately $28 billion through cryptocurrencies since 2024, according to reports from global financial intelligence units. This figure highlights legitimate concerns over money laundering risks in the crypto space, where anonymous transactions can facilitate illegal activities if not properly regulated. However, critics like John Deaton, a former U.S. Senate candidate and crypto advocate, countered that traditional banks bear significant responsibility for financial crimes. Deaton noted that JPMorgan has paid over $40 billion in fines for various illicit activities since 2000, a sum that dwarfs penalties levied against most crypto entities combined. He argued, “Since 2000 JPMorgan alone has paid $40 billion in fines for illicit activity—significantly less than the total fined all crypto companies.” This exchange illustrates the hypocrisy perceived by many in the industry, where legacy institutions scrutinize newcomers while overlooking their own histories.

Further complicating the narrative, even President Donald Trump referenced similar experiences in August 2025, claiming that JPMorgan and Bank of America had rejected his deposits. He attributed this to political motivations, tying it to broader debanking patterns targeting pro-crypto figures. Such anecdotes fuel speculation that while regulatory environments have improved, underlying biases against digital assets may endure. Industry experts from organizations like the Blockchain Association emphasize the need for clear guidelines to bridge the gap, ensuring crypto firms can access essential banking without undue hurdles. As of late 2025, JPMorgan has not issued an official statement on the Strike matter, leaving the crypto community in anticipation of further developments.

The resurgence of crypto debanking practices raises alarms about the stability of the U.S. financial ecosystem for digital innovations. Strike, known for its efficient Bitcoin payment solutions, relies on seamless banking integrations to serve users globally. Mallers’s revelations, shared via public platforms, prompted immediate backlash, with users and influencers labeling the bank’s actions as anti-competitive. This incident occurs against a backdrop of evolving policies; the 2025 executive order aimed to dismantle barriers, yet enforcement appears uneven. Financial analysts suggest that without stronger oversight, such events could deter investment, with venture capital flows to U.S. crypto startups potentially declining by 15-20% if debanking persists, based on preliminary data from industry reports.

Looking at historical context, “Operation Chokepoint 2.0” emerged during heightened regulatory focus under the prior administration, where banks were implicitly pressured to distance themselves from high-risk sectors like crypto. This led to closures affecting major players, from exchanges to mining operations. The shift to a more supportive stance in 2025 brought optimism, but cases like this test the administration’s commitment. Senator Lummis’s intervention adds political weight, potentially spurring congressional hearings or additional executive measures to safeguard the industry.

Frequently Asked Questions

What caused the JPMorgan crypto debanking controversy involving Strike?

Jack Mallers, CEO of Strike, accused JPMorgan Chase of closing his account and blocking customer deposits due to claims of fraudulent activities. This action, detailed in his public statements, revives concerns over banks’ reluctance to serve crypto firms, impacting Bitcoin payment accessibility for users.

Is crypto debanking still happening under the 2025 Trump administration?

Yes, despite the August 2025 executive order promoting fair banking for digital assets, isolated incidents like the JPMorgan-Strike dispute indicate that debanking persists. The order directed regulators to remove reputational risk assessments, but full implementation varies, as voiced by experts and lawmakers like Senator Lummis.

Key Takeaways

- Renewed Scrutiny on Banks: JPMorgan’s alleged debanking of Strike underscores persistent tensions, potentially violating recent policy directives aimed at supporting crypto integration.

- Political Backlash: Senator Lummis’s criticism highlights risks of driving digital asset growth overseas, echoing “Operation Chokepoint 2.0” legacies.

- Balanced Perspectives: While crypto laundering risks total $28 billion since 2024, banks like JPMorgan have incurred $40 billion in fines—urging equitable regulatory approaches.

Conclusion

The JPMorgan crypto debanking controversy exemplifies the fragile balance between traditional finance and the burgeoning digital asset sector, with Senator Lummis’s warnings emphasizing the need for sustained policy reforms. As incidents like the Strike account closure persist despite 2025’s executive order, the industry must advocate for transparent banking access to foster innovation. Looking ahead, resolving these frictions could solidify the U.S. as a global hub for cryptocurrencies, benefiting investors and users alike—monitor developments closely for emerging opportunities.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026