JPMorgan’s IBIT-Linked Note Sparks Questions on Bitcoin Dip Role

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

JPMorgan’s recent filing for a structured note linked to BlackRock’s IBIT ETF came amid Bitcoin’s 30% Q4 slide and MicroStrategy FUD, raising questions about potential influence on the dip. This move highlights shifting institutional strategies in cryptocurrency exposure.

-

Bitcoin’s Q4 decline saw a 30% drop, triggered by high open interest and liquidations exceeding $20 billion in one day.

-

MicroStrategy faced intensified pressure after JPMorgan’s margin hikes on its positions from 50% to 95%, forcing unwinds.

-

The new JPMorgan product offers indirect Bitcoin exposure via a three-year note tied to IBIT, coinciding with BTC reclaiming $90,000 levels.

Explore JPMorgan’s role in Bitcoin’s dip and its new IBIT-linked note. Discover institutional shifts amid market volatility and MicroStrategy’s response in this crypto analysis.

Did JPMorgan Influence Bitcoin’s Recent Dip?

JPMorgan’s actions, including margin requirement increases on MicroStrategy positions and a proposal to exclude Bitcoin-heavy firms from indices, coincided with Bitcoin’s sharp Q4 decline. This 30% drop from peak levels erased billions in market value, amplified by over $20 billion in liquidations. While market forces like high open interest played a role, these institutional moves fueled widespread fear, uncertainty, and doubt among investors.

How Did JPMorgan’s Margin Hikes Impact MicroStrategy?

MicroStrategy, a major Bitcoin holder, experienced significant pressure following JPMorgan’s decision to raise margin requirements on its stock positions from 50% to 95%. This adjustment made leveraged holdings far more costly, prompting forced sales and contributing to a 70% plunge in MSTR shares. According to market data, this unwind aligned with Bitcoin’s descent below $80,000, affecting long-term holders who began offloading assets. The Fear & Greed Index reached record lows, underscoring the panic. Experts note that such regulatory and financial pressures from traditional banks like JPMorgan can accelerate crypto market corrections, as seen in the record ETF outflows during this period.

In the broader context, JPMorgan’s earlier proposal to the MSCI index provider sought to bar companies with predominantly Bitcoin balance sheets from inclusion. This stance, combined with the margin changes, created a perfect storm for Bitcoin-related equities. Traders de-risked positions opened amid October’s bullish sentiment, when Bitcoin open interest peaked at $94 billion. The resulting cascade led to a 7.13% single-day drop for BTC, wiping out optimistic bets.

Despite the turmoil, institutional interest persists. MicroStrategy demonstrated resilience by transferring 58,390 BTC, valued at approximately $5.1 billion, to Fidelity’s custody. This move enhances security and privacy for its holdings, signaling unwavering commitment even as Q4 unfolded contrary to expectations.

How JPMorgan’s New Structured Note Ties to BlackRock’s IBIT

JPMorgan has introduced a three-year structured note that provides investors with exposure to Bitcoin through BlackRock’s iShares Bitcoin Trust (IBIT) ETF. Rather than direct cryptocurrency ownership, the note’s payout mirrors IBIT’s performance, offering a regulated, bank-backed alternative for traditional investors wary of holding BTC outright. This product launch follows Bitcoin’s volatile Q4, where the asset bled 20% before rebounding over 5% in the last 24 hours to surpass $90,000.

Source: X

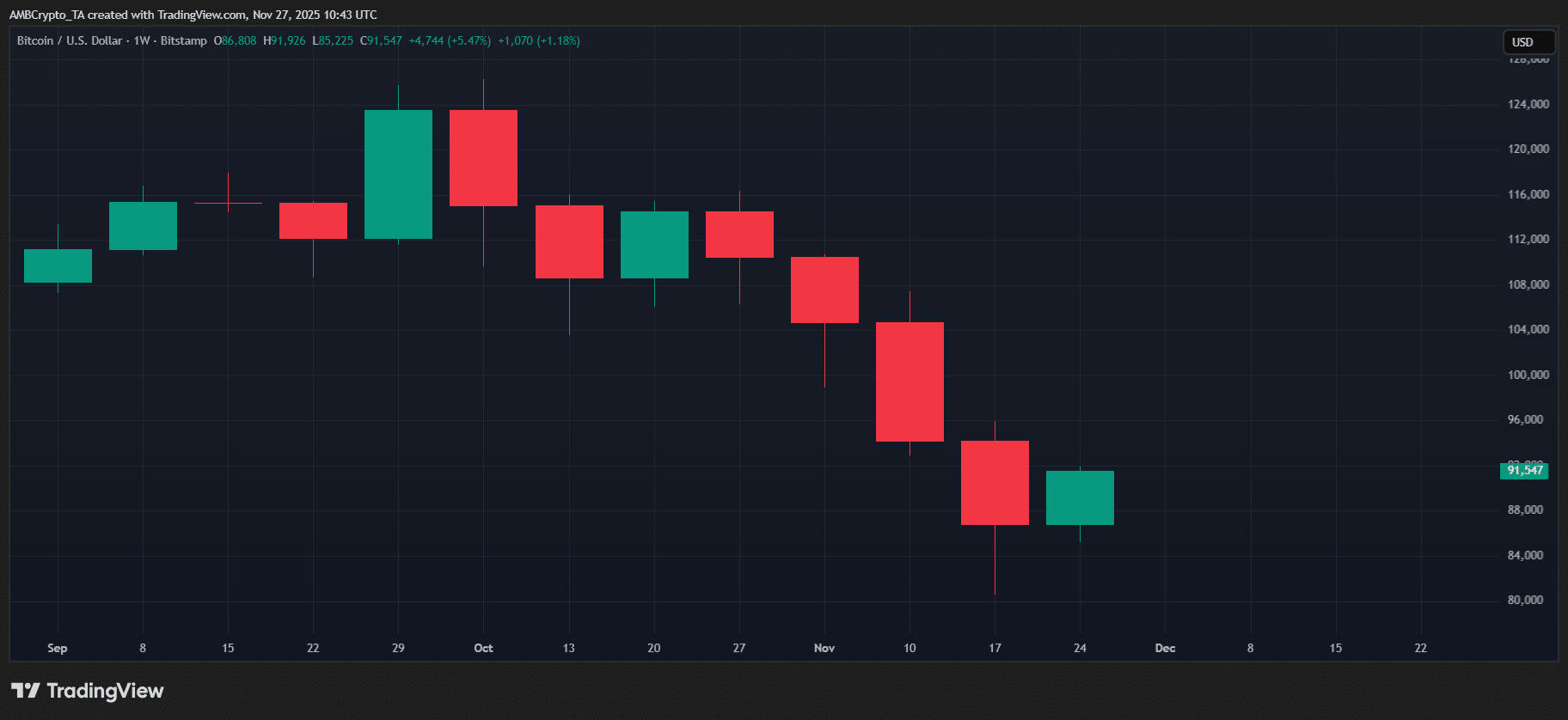

The timing of this filing, immediately after Bitcoin’s dip and MicroStrategy’s challenges, has sparked debate among analysts. While JPMorgan maintains its product diversifies client portfolios, the sequence suggests a strategic pivot toward controlled crypto exposure. Data from CoinMarketCap indicates this announcement correlated with Bitcoin’s recovery, breaking a streak of four negative weekly candles.

Source: TradingView (BTC/USDT)

This development underscores Bitcoin’s maturation as an asset class. Traditional finance giants like JPMorgan are increasingly integrating it into offerings, potentially stabilizing future volatility. The structured note appeals to conservative investors, providing upside potential without the risks of direct custody. As per reports from financial regulatory filings, similar products have gained traction since the approval of spot Bitcoin ETFs earlier in the year.

Frequently Asked Questions

What Role Did JPMorgan Play in MicroStrategy’s Q4 Challenges?

JPMorgan raised margin requirements on MicroStrategy positions to 95%, up from 50%, which increased borrowing costs and led to forced liquidations. This, alongside a proposal to exclude Bitcoin-dominant firms from indices, intensified selling pressure on MSTR shares, contributing to a 70% decline amid broader market FUD.

Is JPMorgan’s IBIT Note a Sign of Mainstream Bitcoin Adoption?

Yes, the three-year structured note linked to BlackRock’s IBIT represents a bridge for institutional investors seeking Bitcoin exposure through familiar financial instruments. It arrived after a turbulent quarter, aligning with BTC’s rebound and highlighting banks’ growing comfort with cryptocurrency integration.

Key Takeaways

- Strategic Timing: JPMorgan’s IBIT-linked note filing followed Bitcoin’s 30% Q4 dip and MicroStrategy pressures, potentially signaling a calculated institutional entry into crypto.

- MicroStrategy’s Response: Despite a 70% share drop, MSTR transferred 58,390 BTC to Fidelity for enhanced security, reaffirming its long-term Bitcoin strategy.

- Market Recovery: Bitcoin surged over 5% post-announcement, reclaiming $90,000 and breaking a negative streak, driven by renewed institutional interest.

Conclusion

The interplay between JPMorgan’s influence on Bitcoin’s dip and its launch of an IBIT-tied structured note illustrates the evolving dynamics of cryptocurrency in traditional finance. MicroStrategy’s steadfast holdings amid volatility further demonstrate Bitcoin’s resilience as an institutional asset. As banks like JPMorgan deepen involvement, expect continued integration and potential stabilization. Investors should monitor regulatory filings and market indicators for upcoming opportunities in this space.