JPMorgan’s Leveraged Bitcoin Notes Face Backlash from Crypto Community

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

JPMorgan has filed with the SEC to launch leveraged Bitcoin notes, offering 1.5 times the gains or losses on BTC through December 2028, set for a December 2025 debut. This move has sparked backlash from the Bitcoin community, accusing the bank of competing with crypto treasury firms like MicroStrategy and spreading doubt about their strategies.

-

The notes track Bitcoin’s price with 1.5x leverage, amplifying returns for investors until the product’s end date.

-

Bitcoin supporters criticize JPMorgan for entering the space as a direct rival to corporate BTC holders like MicroStrategy.

-

MSCI’s proposed rule change excludes firms with over 50% crypto assets from indexes, potentially impacting passive investments and forcing asset sales, according to industry data showing trillions in index-managed funds.

Discover JPMorgan Bitcoin notes details and community backlash against this leveraged BTC product. Learn how it competes with MicroStrategy’s strategy. Stay updated on crypto finance trends—read more now!

What Are JPMorgan’s Bitcoin Notes and Why the Controversy?

JPMorgan Bitcoin notes represent a new leveraged investment product designed to provide investors with amplified exposure to Bitcoin’s price movements. Filed with the U.S. Securities and Exchange Commission, these notes will deliver 1.5 times the performance of BTC—whether gains or losses—through December 2028, with a planned launch in December 2025. This structured product aims to appeal to institutional investors seeking enhanced returns in the cryptocurrency market without direct ownership of the asset.

How Do These Notes Impact Bitcoin Treasury Companies Like MicroStrategy?

The introduction of JPMorgan’s Bitcoin notes has ignited fierce debate within the cryptocurrency ecosystem, particularly among supporters of Bitcoin treasury strategies pioneered by companies like MicroStrategy. As the largest corporate holder of BTC, MicroStrategy has amassed significant holdings, positioning itself as a bridge between traditional finance and digital assets. Critics argue that JPMorgan, a traditional banking powerhouse, is now positioning itself as a competitor by offering similar exposure through its notes, potentially undermining the value proposition of pure-play crypto treasury firms.

According to the SEC filing, the notes are unsecured obligations of JPMorgan Chase Financial Company LLC, maturing in December 2028. They promise to pay investors based on 150% of Bitcoin’s daily return, calculated using a reference rate tied to the CME CF Bitcoin Reference Rate. This leverage could attract yield-seeking investors but also introduces heightened risks, especially in volatile markets where amplified losses might deter conservative portfolios.

The Bitcoin community views this as more than mere product diversification. On social platforms like X (formerly Twitter), users have accused JPMorgan of fostering fear, uncertainty, and doubt (FUD) about firms like MicroStrategy. One prominent Bitcoiner commented, “Saylor opened the door to the $300 trillion bond market and $145 trillion fixed income market. Now, JP Morgan is launching Bitcoin-backed bonds to compete,” highlighting how institutions once critical of corporate BTC adoption are now emulating it. This sentiment echoes broader tensions between legacy finance and decentralized innovation.

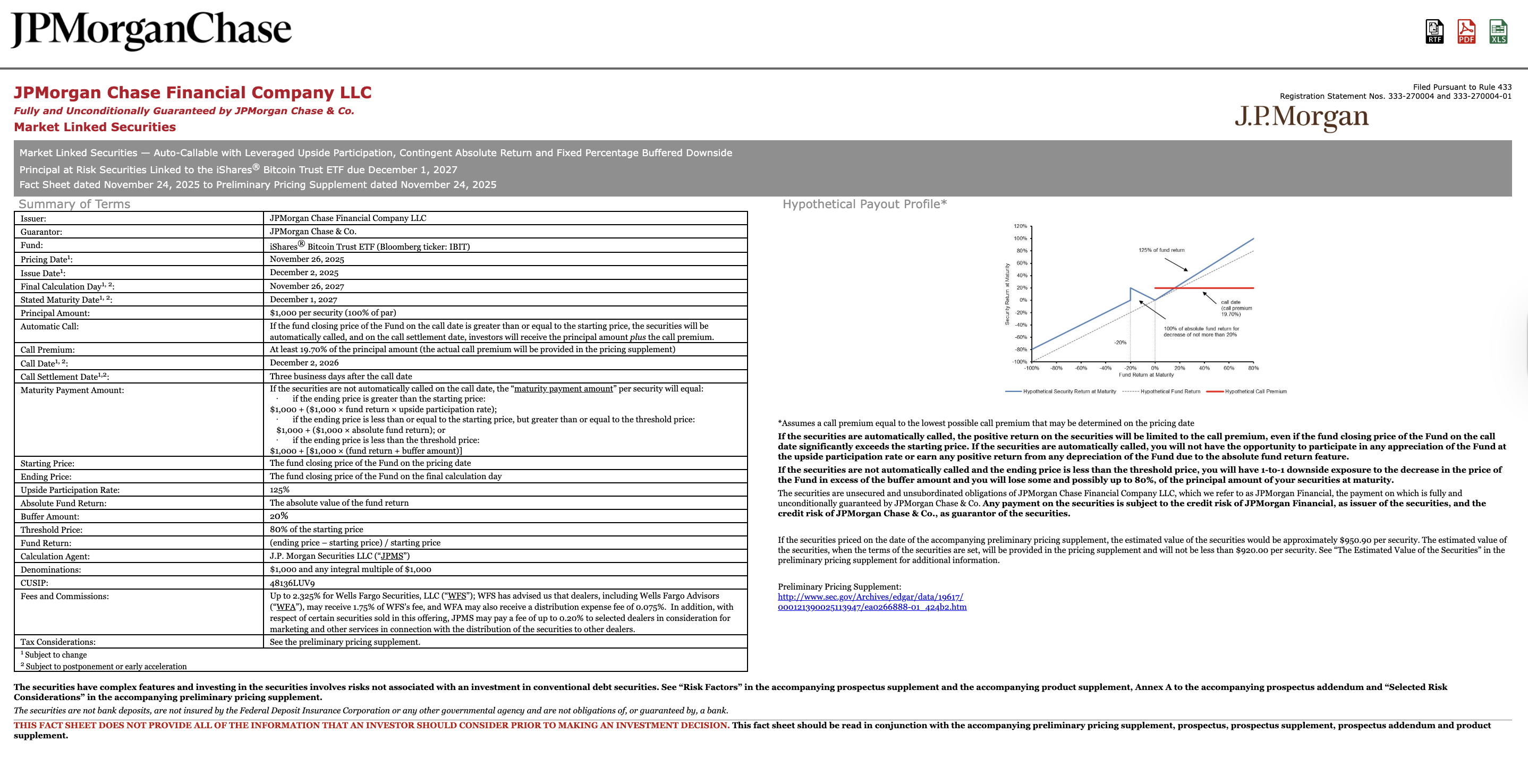

Fact sheet for JPMorgan’s Bitcoin notes. Source: JPMorgan

Bitcoin advocate Simon Dixon, founder of BnkToTheFuture, raised concerns about the notes’ potential systemic effects. He stated that the product exists “to trigger margin calls on Bitcoin-backed loans,” which could impose forced selling pressure from Bitcoin treasury companies during market downturns. Dixon’s analysis underscores worries that leveraged instruments like these might exacerbate volatility for holders of direct BTC positions, including corporates with treasury allocations exceeding billions in value.

In response to these developments, calls for boycotting JPMorgan have gained traction among crypto enthusiasts and MicroStrategy supporters. Online discussions urge Bitcoin holders to close accounts with the bank and divest from its shares, framing the notes as an aggressive encroachment on the crypto-native economy. This grassroots pushback illustrates the growing divide between Wall Street’s structured products and the principles of Bitcoin maximalism.

Source: The Bitcoin Therapist

Related: Strike CEO debanked by JPMorgan, Lummis sounds ‘Chokepoint 2.0’ alarm

How Is MSCI’s Proposed Rule Change Fueling the Clash Over JPMorgan Bitcoin Notes?

The controversy surrounding JPMorgan Bitcoin notes intensified following a proposed policy change by MSCI, a leading provider of investment indexes formerly known as Morgan Stanley Capital International. MSCI’s draft rules, expected to take effect in January 2026, would exclude companies from its indexes if 50% or more of their assets consist of cryptocurrencies. This shift targets treasury firms heavily invested in digital assets, potentially reshaping how passive investment flows interact with the crypto sector.

JPMorgan highlighted this MSCI proposal in a November 2025 research note, prompting immediate backlash from the Bitcoin community and investors in firms like MicroStrategy. Index inclusion is crucial for attracting institutional capital; MSCI indexes guide trillions in assets under management worldwide. Exclusion could limit access to these passive inflows, estimated at over $15 trillion globally, forcing affected companies to liquidate crypto holdings to meet eligibility criteria and potentially depressing Bitcoin prices in the process.

Experts in financial indexing emphasize that such rules aim to mitigate perceived risks in volatile assets like BTC. However, Bitcoin proponents counter that this discriminates against innovative treasury strategies, stifling corporate adoption. MicroStrategy, with its BTC holdings valued at tens of billions, stands to lose significant visibility if excluded, as indexes drive algorithmic buying from ETFs and mutual funds. The proposal has been described by community figures as a “Chokepoint 2.0,” referencing past regulatory hurdles for crypto firms.

Magazine: Pakistan will deploy Bitcoin reserve in DeFi for yield, says Bilal Bin Saqib

To illustrate the stakes, consider MicroStrategy’s trajectory: Since adopting BTC as a primary treasury reserve in 2020, the company has outperformed traditional benchmarks, with its stock correlating closely to Bitcoin’s price. JPMorgan’s notes, by contrast, offer a synthetic alternative that bypasses direct ownership, appealing to risk-averse investors but criticized for lacking the transparency of on-chain holdings. Financial analysts note that while leveraged products like these have succeeded in other asset classes—such as equity-linked notes generating billions in issuance—they remain untested in crypto’s high-volatility environment.

The interplay between MSCI’s rules and JPMorgan’s filing highlights evolving dynamics in crypto finance. Treasury companies argue for inclusion based on BTC’s maturation as an asset class, backed by data from sources like the Cambridge Centre for Alternative Finance showing institutional crypto custody growing 20% annually. JPMorgan, managing over $3 trillion in assets, positions its notes as a compliant entry point, but community skepticism persists, viewing it as a ploy to capture market share from disruptors.

Frequently Asked Questions

What Is the Leverage Ratio in JPMorgan’s Bitcoin Notes?

The JPMorgan Bitcoin notes provide 1.5 times the daily return of Bitcoin, meaning investors experience amplified gains or losses based on BTC’s price fluctuations. This leverage applies through December 2028, with returns calculated using established reference rates for transparency and regulatory compliance.

How Might MSCI’s Rule Change Affect MicroStrategy’s Stock Performance?

MSCI’s proposed exclusion of crypto-heavy firms could reduce passive investment inflows to MicroStrategy, potentially pressuring its stock price as indexes rebalance. This might compel the company to adjust its BTC allocations to regain eligibility, impacting its treasury strategy amid Bitcoin’s market volatility.

Key Takeaways

- JPMorgan’s Entry into Leveraged BTC Products: The bank’s SEC filing signals traditional finance’s deepening involvement in crypto, offering 1.5x exposure to Bitcoin without direct ownership.

- Community Backlash and Boycott Calls: Bitcoin supporters accuse JPMorgan of FUD against treasury firms like MicroStrategy, urging account closures and share sales in protest.

- MSCI Policy Implications: Excluding crypto treasury companies from indexes could disrupt trillions in passive flows, forcing asset sales and heightening market pressures—monitor for updates on adoption trends.

Conclusion

The launch of JPMorgan Bitcoin notes and MSCI’s proposed index changes underscore the intensifying rivalry between conventional banking and Bitcoin treasury strategies exemplified by MicroStrategy. As these developments unfold, they could reshape institutional access to crypto assets, balancing innovation with regulatory caution. Investors should stay informed on SEC approvals and MSCI’s final rules, positioning themselves for opportunities in this evolving landscape of digital finance.