Jupiter Cuts JUP Airdrop Size for 2026 to Mitigate Token Dilution

JUP/USDT

$27,373,528.12

$0.1554 / $0.1447

Change: $0.0107 (7.39%)

-0.0060%

Shorts pay

Contents

Jupiter Exchange has reduced its Jupuary 2026 airdrop from a potential 700 million JUP tokens to just 200 million to prevent further token dilution and stabilize the JUP price after previous events led to sell-offs by newcomers.

-

Jupuary 2026 airdrop limited to 200M JUP tokens, focusing on fee-paying users only.

-

New eligibility rules exclude non-paying users, with a snapshot on January 30, 2026.

-

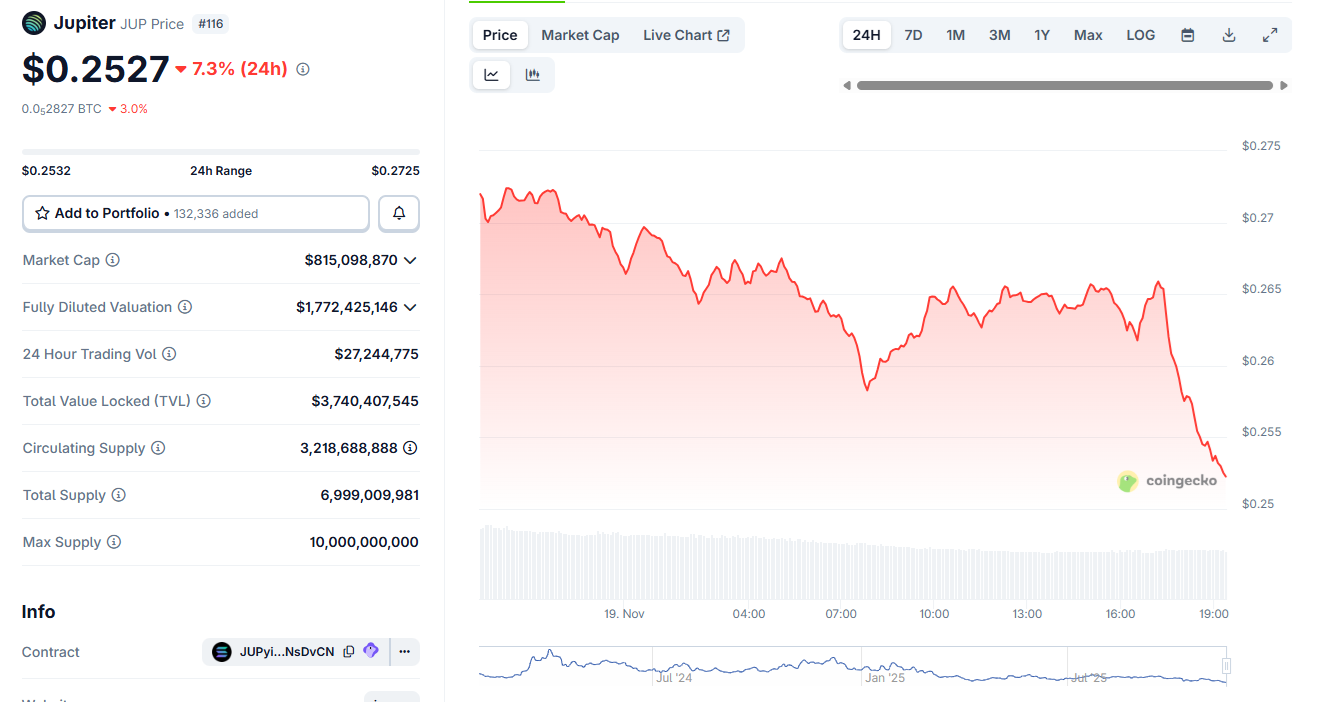

Token allocation includes 25M for stakers and 175M for users; JUP price hit an all-time low of $0.25 amid ongoing pressure, per Coingecko data.

Discover how Jupiter’s Jupuary 2026 airdrop changes aim to curb JUP dilution and boost stability. Learn eligibility updates and impacts on Solana’s DEX leader—stay informed on crypto developments today.

What is the Jupiter Jupuary 2026 Airdrop Reduction?

The Jupiter Jupuary 2026 airdrop marks a significant adjustment by the Solana-based DEX aggregator to distribute fewer tokens and refine participation rules, aiming to mitigate the dilution effects seen in prior events. Originally approved for up to 700 million JUP tokens through community governance, the allocation has been scaled back to 200 million, prioritizing long-term holders and active contributors. This move follows feedback from the 2025 Jupuary, where broad rewards to all users, including recent entrants, triggered immediate sell-offs that depressed the JUP token price.

The decision underscores Jupiter’s commitment to sustainable growth within the Solana ecosystem, where the platform serves as a key liquidity hub. By limiting the airdrop, Jupiter seeks to balance community incentives with market health, ensuring that rewards support ecosystem expansion without overwhelming token supply.

How Have Eligibility Rules Changed for the Jupiter Jupuary 2026 Airdrop?

The updated eligibility for the Jupiter Jupuary 2026 airdrop shifts focus to genuine platform engagement, restricting rewards to fee-paying users who have contributed to Jupiter’s operations. A new snapshot will capture qualifying activities on January 30, 2026, excluding passive or newcomer participants who previously diluted value through quick sales. This criterion aims to reward committed users, with allocations split as 25 million JUP for stakers and 175 million for those involved in fee-generating activities like swaps and aggregations.

Additionally, the announcement highlights eligibility for buyers of the KIRBY token, integrating it into the reward structure to foster cross-protocol synergy. Of the total 200 million JUP, a portion will form a bonus pool intended for staking, with further distributions planned ahead of the 2027 Jupiter conference. Another 300 million tokens are reserved for Jupnet, Jupiter’s emerging omnichain liquidity network, which promises enhanced interoperability across blockchains.

These changes reflect broader lessons from the 2025 event, where unrestricted access led to market volatility. According to on-chain data from sources like Dune Analytics, previous airdrops correlated with a 20-30% price drop post-distribution due to sell pressure. Jupiter’s DAO emphasized in community calls that this targeted approach will preserve JUP’s value, potentially stabilizing it above recent lows. Experts in DeFi governance, such as those from the Solana Foundation, have noted that such refinements are essential for DEX aggregators to maintain trust and utility in volatile markets.

Beyond the airdrop, Jupiter is implementing measures to reduce circulating supply. The recent approval to burn 130 million JUP from the Litterbox treasury removes tokens permanently, while staking incentives have locked a record 730 million JUP—over 40% of the total supply. Participants who stake their airdrop rewards for a full year will receive bonuses, further encouraging long-term commitment. To access the new Metis aggregation engine, users must deposit 10,000 JUP for a self-hosted binary, with priority granted only after staking, effectively sidelining spam and locking more tokens from circulation.

Frequently Asked Questions

What Is the Total Allocation for the Jupiter Jupuary 2026 Airdrop and How Is It Distributed?

The Jupiter Jupuary 2026 airdrop totals 200 million JUP tokens, a deliberate reduction from the 700 million cap to avoid dilution. Distribution breaks down to 25 million for stakers and 175 million for fee-paying users active before the January 30, 2026 snapshot, with remaining tokens reserved for bonuses and future initiatives like Jupnet.

Why Did Jupiter Reduce the Jupuary Airdrop Size for 2026?

Jupiter reduced the Jupuary 2026 airdrop to counteract the dilution and price pressure from the 2025 event, where newcomers sold rewards immediately, driving JUP to lows. This adjustment, decided via DAO following community feedback, prioritizes sustainability for Solana’s leading DEX aggregator by rewarding engaged users and stabilizing token economics.

Key Takeaways

- Reduced Airdrop Size: Only 200 million JUP tokens for Jupuary 2026, down from 700 million, to prevent supply overload and support price recovery.

- Stricter Eligibility: Limited to fee-paying users and stakers, with a January 30, 2026 snapshot ensuring rewards go to active contributors on the Solana network.

- Ecosystem Enhancements: Includes KIRBY token integration, JUP burns, and staking bonuses to lock supply and drive long-term adoption of Jupiter’s tools like Metis.

Conclusion

The Jupiter Jupuary 2026 airdrop reduction represents a strategic pivot for the DEX aggregator on Solana, balancing community rewards with token health amid past dilution challenges. By capping distribution at 200 million JUP and refining eligibility to fee-paying users, Jupiter reinforces its position as a mature player in DeFi, with initiatives like Jupnet poised to expand liquidity solutions. As the platform continues to generate nearly $2 million in daily fees through its evolving multi-task features—including lending locks exceeding $1 billion and the new Desktop wallet—users can anticipate greater stability and innovation. Monitor upcoming snapshots and staking opportunities to participate effectively in this dynamic ecosystem.

JUP dropped to a new all-time low after the news of a smaller Jupuary event. JUP has felt constant selling pressure, despite the growth of Jupiter as one of the key Solana apps. | Source: Coingecko

JUP dropped to a new all-time low after the news of a smaller Jupuary event. JUP has felt constant selling pressure, despite the growth of Jupiter as one of the key Solana apps. | Source: CoingeckoJupiter’s native JUP token continues to face headwinds, recently touching an all-time low of $0.25 following announcements about the scaled-back airdrop and ecosystem allocations. Open interest has dipped to $35 million, even with listings on major exchanges like Binance, highlighting persistent selling dynamics. Despite this, the platform’s fundamentals remain strong: as a top fee generator on Solana, Jupiter has diversified into lending, mobile updates, portfolio tracking, and airdrop verification tools.

The DAO’s proactive steps, including the 130 million JUP burn and staking mandates for advanced features, signal a focus on scarcity and utility. Community reactions to the 2025 Jupuary—where broad inclusivity led to accusations of profit-taking by short-term users—directly informed these changes, ensuring future events foster loyalty rather than volatility. Analysts from platforms like Messari point out that such governance adaptations are crucial for Solana protocols to thrive amid market cycles, positioning Jupiter for resilience as it integrates omnichain capabilities through Jupnet.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026