Kazakhstan Eyes Gold-to-Bitcoin Shift Amid Safe-Haven Rally

SAFE/USDT

$1,671,508.49

$0.1055 / $0.0958

Change: $0.009700 (10.13%)

+0.0050%

Longs pay

Contents

Gold’s all-time high above $4,420 per ounce on December 22, 2025, has intensified discussions on gold Bitcoin rotation, as investors weigh safe-haven options amid inflation and geopolitical tensions. Bitcoin sentiment is rising, but historical data shows mixed results for capital shifts from gold to BTC.

-

Gold Bitcoin rotation refers to investors moving funds from gold to Bitcoin during uncertain times, potentially boosting BTC prices.

-

Macroeconomic pressures like persistent inflation are driving demand for both assets, with gold leading the current rally.

-

Kazakhstan’s reported plan to sell gold reserves worth up to $300 million for Bitcoin highlights growing institutional interest in crypto diversification.

Explore gold Bitcoin rotation amid gold’s ATH surge above $4,420. Learn how Kazakhstan’s strategy and investor sentiment could impact BTC. Stay informed on crypto trends—read more now.

What is gold Bitcoin rotation and why does it matter now?

Gold Bitcoin rotation describes the potential shift of investment capital from gold to Bitcoin, particularly when traditional safe-havens like gold reach peaks amid economic volatility. As gold surged to a record $4,420 per ounce on December 22, 2025, driven by inflation fears and geopolitical risks, Bitcoin traders are watching closely for inflows. This rotation could signal Bitcoin’s maturation as a digital alternative to gold, though past patterns indicate it’s not guaranteed.

How is Kazakhstan influencing gold Bitcoin rotation?

Kazakhstan’s central bank is reportedly considering selling portions of its gold reserves to invest up to $300 million in Bitcoin and other cryptocurrencies, according to local financial reports. This move comes as gold prices climb, allowing for profitable sales at all-time highs. Experts note that such sovereign actions could encourage other nations to diversify reserves, blending traditional assets with digital ones. Data from the World Gold Council shows central banks added 483 tons of gold in 2024, but crypto adoption is accelerating among emerging markets. If executed, Kazakhstan’s strategy might demonstrate proactive reserve management, trading gold’s stability for Bitcoin’s growth potential. Analysts from Bloomberg Intelligence emphasize that this reflects broader trends in digital asset integration by governments.

Source: X

While gold’s rally underscores its role as a hedge against uncertainty, Bitcoin’s appeal lies in its limited supply and decentralized nature. Central banks like those in Russia and El Salvador have already incorporated Bitcoin into reserves, per reports from the International Monetary Fund. Kazakhstan’s potential pivot could add momentum, but regulatory hurdles in the country remain a factor.

Frequently Asked Questions

Will Kazakhstan really sell gold reserves for Bitcoin investment?

Reports indicate Kazakhstan’s central bank is exploring the sale of gold at current highs to fund up to $300 million in Bitcoin purchases, as a diversification tactic. This aligns with global trends where nations seek higher yields from crypto, though official confirmation is pending from government statements.

How does investor sentiment compare gold and Bitcoin for long-term holding?

Recent polls show Bitcoin outpacing gold in long-term preference, with 62.4% of respondents choosing BTC over gold or silver for a hypothetical $100,000 investment by 2028. This reflects growing confidence in Bitcoin’s potential as a store of value, even as gold maintains its traditional edge in short-term crises.

Source: X

Peter Schiff, a prominent gold proponent, conducted this poll to underscore his skepticism toward Bitcoin, yet the results favored BTC decisively. Financial analysts from JPMorgan have noted similar shifts, attributing them to younger demographics viewing Bitcoin as “digital gold.”

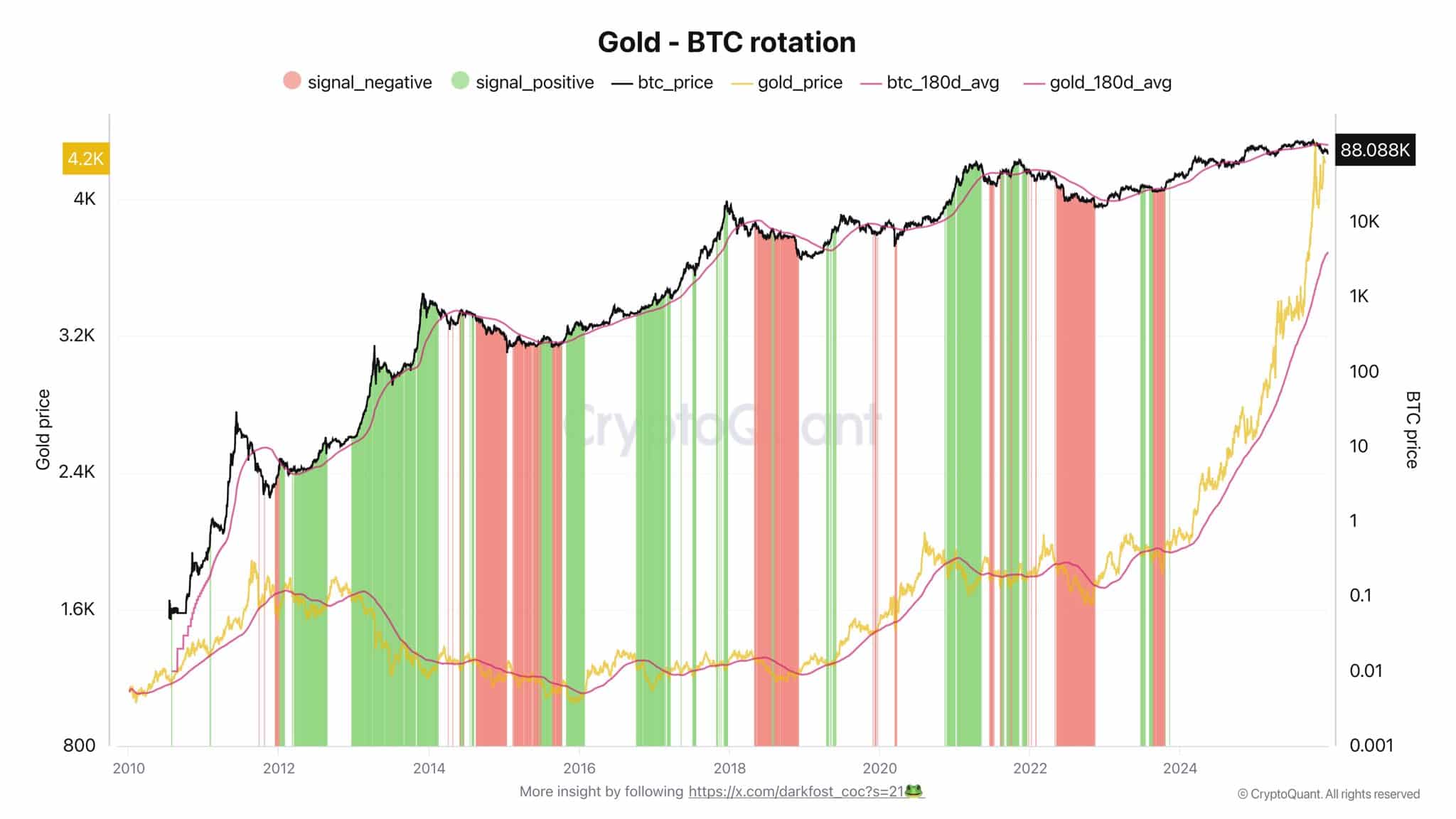

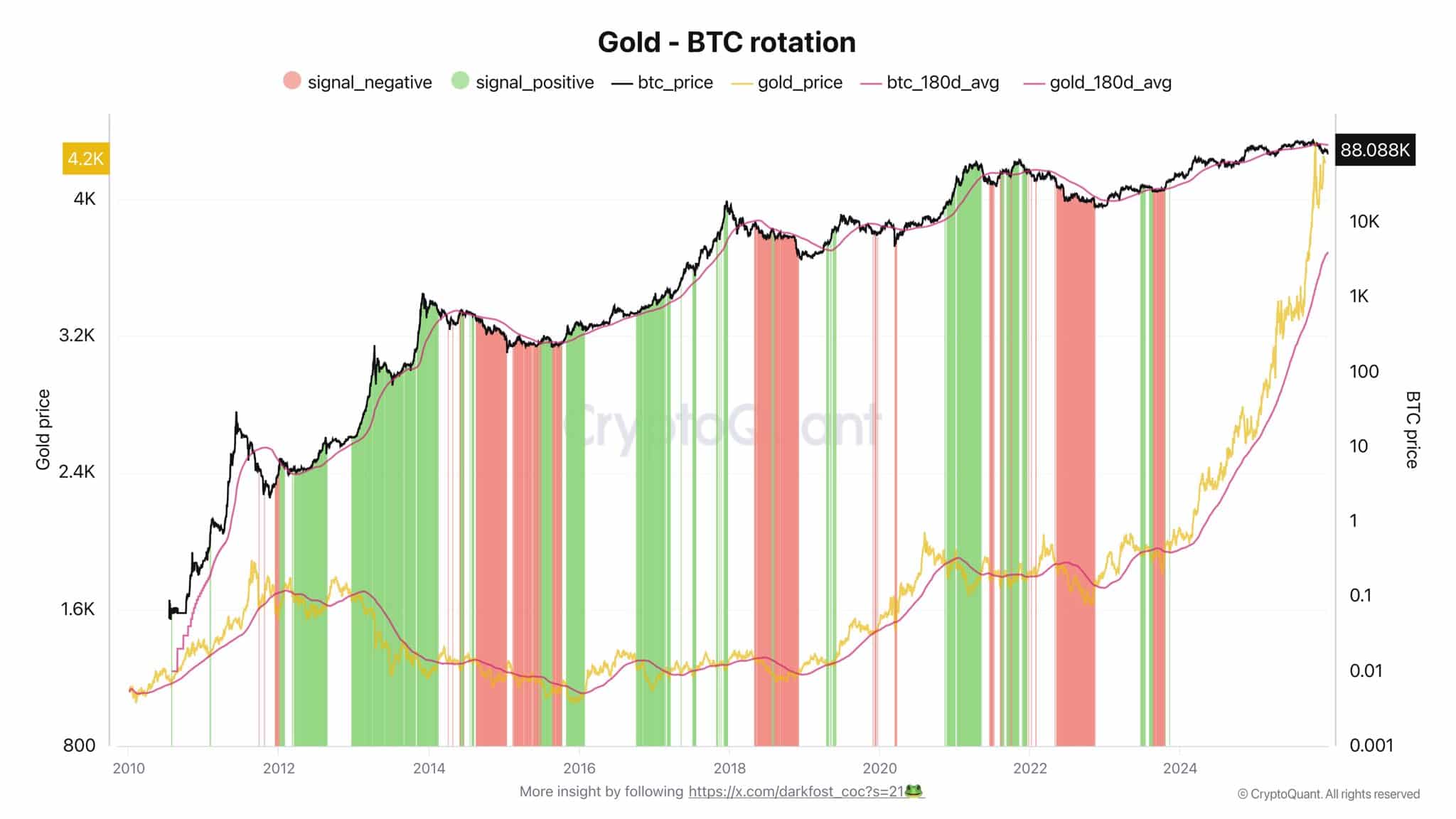

Bitcoin’s price hovered around $88,000 on the day of gold’s peak, per data from CoinMarketCap. This proximity in timing has fueled speculation, but correlation coefficients between the two assets have fluctuated between 0.2 and 0.6 over the past year, according to CryptoQuant metrics. In periods of high inflation, both often rise together, serving complementary roles in portfolios.

Source: CryptoQuant

Historical analysis using 180-day moving averages reveals that gold Bitcoin rotation isn’t a reliable pattern. Analyst Darkfost from CryptoQuant pointed out that Bitcoin outperforms when it’s above its average while gold is below, but during mutual weakness, both decline. Over five market cycles since 2017, instances of clear rotation occurred only 40% of the time, with synchronized movements more common. The Federal Reserve’s recent minutes highlight ongoing inflation pressures, which could sustain demand for both assets without favoring one definitively.

Geopolitical events, such as tensions in the Middle East and trade disputes, have bolstered gold’s appeal, with spot prices up 28% year-to-date in 2025. Bitcoin, meanwhile, has gained 45% over the same period, driven by ETF inflows exceeding $20 billion, as reported by Grayscale Investments. Portfolio managers at BlackRock recommend a 5-10% allocation to each for balanced risk exposure.

Key Takeaways

- Gold’s ATH sparks rotation talk: The surge to $4,420 reflects safe-haven demand, but Bitcoin’s response depends on broader market signals.

- Sovereign moves matter: Kazakhstan’s potential gold sale for BTC could inspire global reserve diversification, per IMF observations.

- Sentiment favors BTC long-term: Polls show 62.4% preference for Bitcoin, urging investors to monitor capital flows closely.

Conclusion

As gold Bitcoin rotation narratives gain traction following gold’s all-time high on December 22, 2025, and Kazakhstan’s strategic considerations, the interplay between these assets underscores evolving investor strategies in uncertain times. While historical data tempers expectations for automatic shifts, rising sentiment toward Bitcoin points to its enduring role in modern portfolios. Investors should track central bank actions and macroeconomic indicators for opportunities, ensuring diversified holdings amid ongoing volatility.