Keyrock: Treasury Bill Predicts BTC Price

BTC/USDT

$17,272,160,469.17

$68,476.22 / $66,621.06

Change: $1,855.16 (2.78%)

+0.0011%

Longs pay

Contents

Treasury Bill Issuance is the Primary Indicator of BTC Price

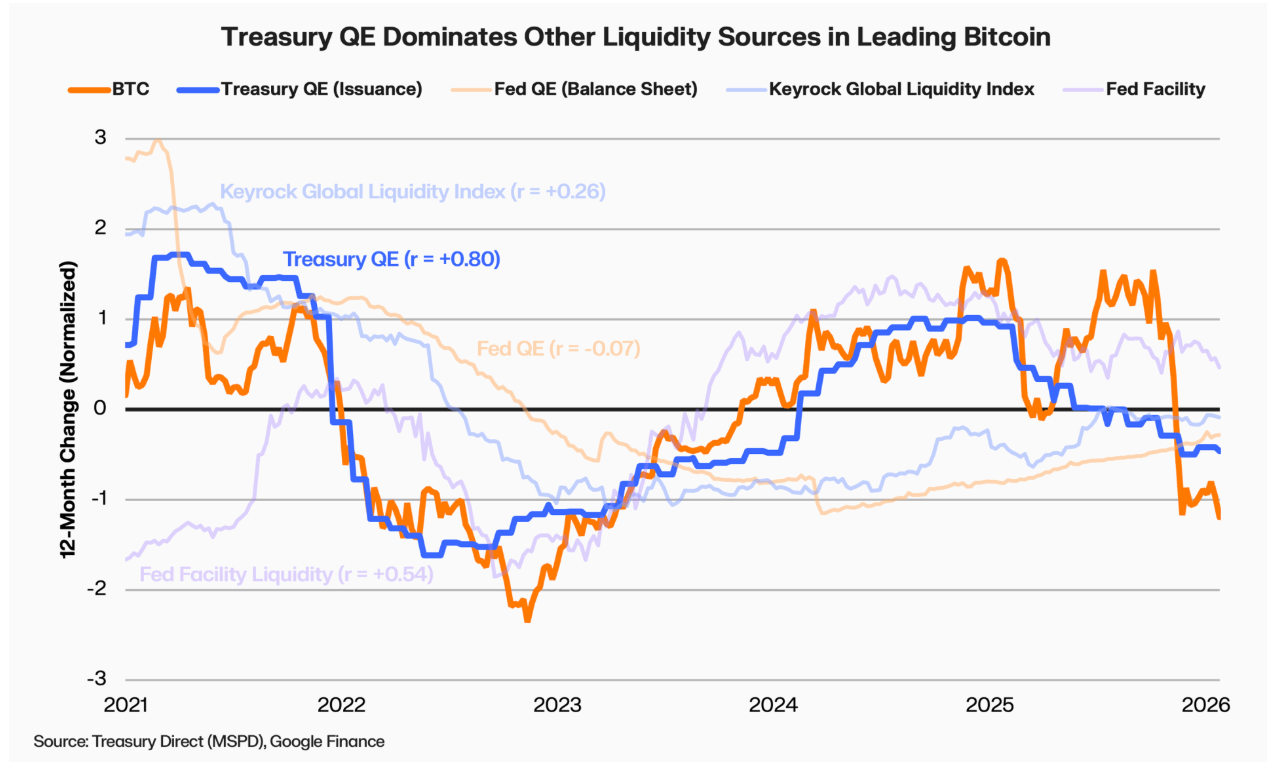

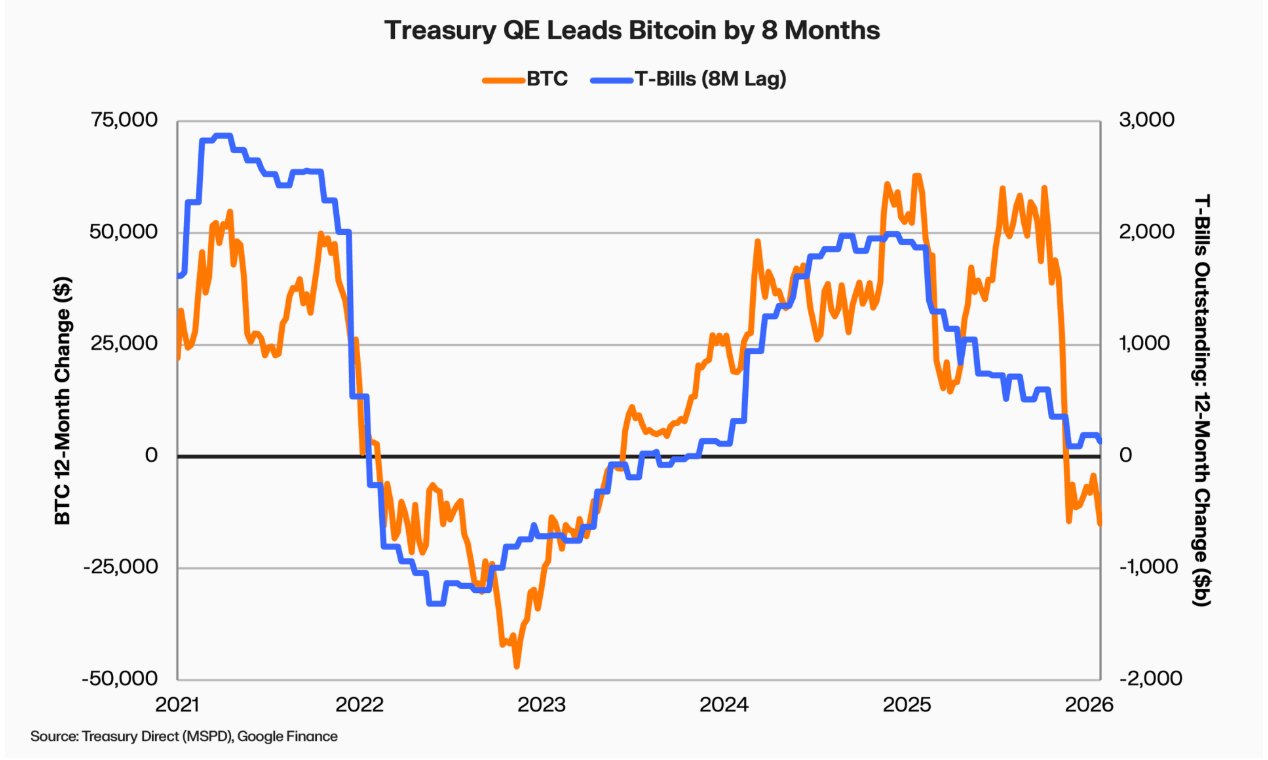

According to Keyrock crypto investment firm's new report, Treasury bill issuance is the primary liquidity metric affecting Bitcoin (BTC) price, and this metric takes precedence over the balance sheet sizes of the Federal Reserve or other central banks. Every 1-point change in global liquidity levels affects BTC price by 7.6% in the subsequent business quarter where new money is created. Since 2021, there has been an 80% correlation between Treasury bill issuance and BTC prices, with this metric predicting BTC prices about eight months in advance. An increase in issuance provides resource flow to the real economy and risk assets like BTC.

The impact of the US Treasury issuing T-bills on Bitcoin’s price compared with other methods of liquidity expansion. Source: Keyrock

Institutions Are Reducing BTC's Liquidity Sensitivity

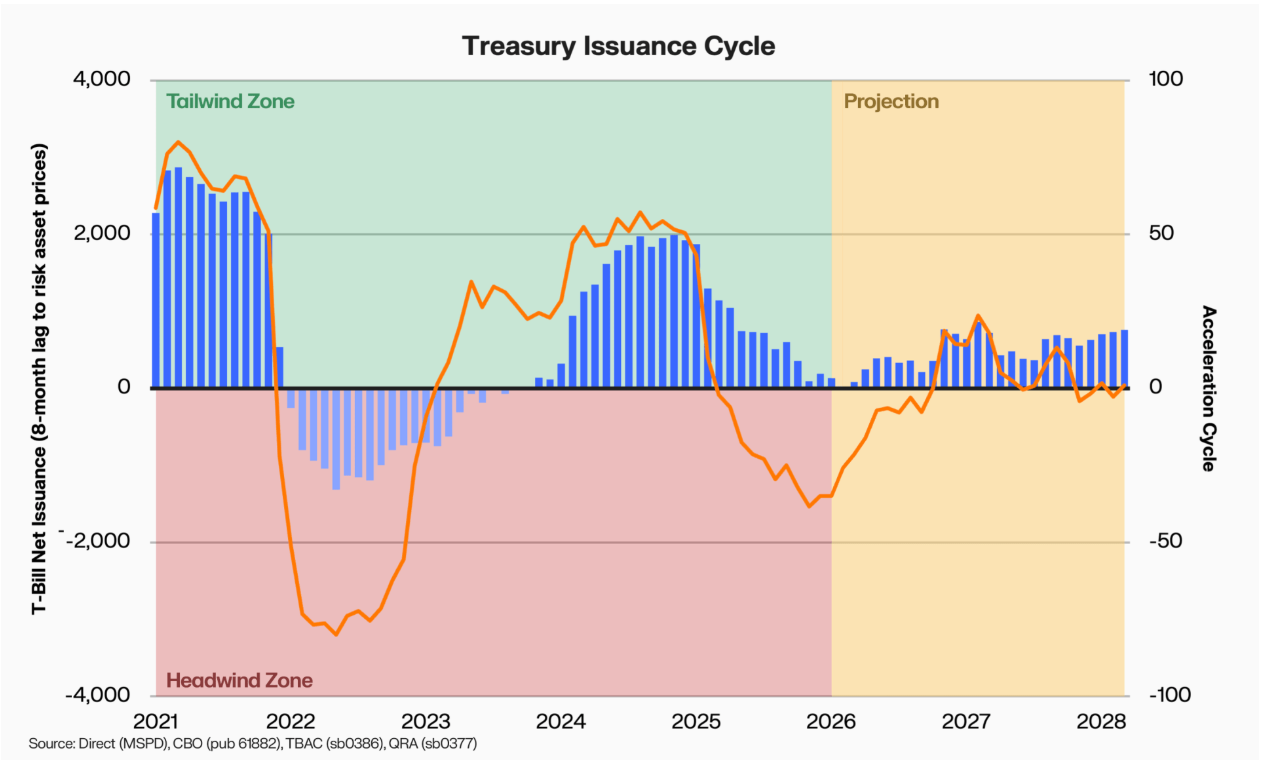

Institutions and ETFs have reduced BTC's sensitivity to liquidity conditions by 23%. The report refutes the common theory that Fed interest rate policy is the main driving force and predicts that global liquidity will affect BTC prices at the end of 2026 and beginning of 2027. With a large portion of the 38 trillion dollar US national debt being refinanced over the next four years, Treasury bill issuance is expected to reach 600-800 billion dollars annually. According to recent news, institutions like Metaplanet continue to accumulate BTC; despite experiencing valuation losses while holding 35.102 BTC, they trust in long-term liquidity flows.

The relationship between Treasury-led quantitative easing and Bitcoin’s price. Source: Keyrock

The cycle of T-bill issuance 2021-2028. Keyrock forecasts that T-bill issuance will start ramping up this year. Source: Keyrock

2026-2028 T-Bill Issuance and BTC Price Forecasts

Keyrock predicts that T-bill issuances will accelerate this year. This will provide liquidity to risk assets as an eight-month lead indicator for BTC. According to current BTC detailed analysis data, the price is at 66.424 USD, with a 24h -2.25% decline. RSI 33.84 (Oversold), downtrend continues. Strong supports: 65.050 USD (S1, 73% score) and 61.088 USD (S2).

BTC Mining and Future Security Developments

Hive mining company reported a 91M USD loss due to depreciation while increasing its hash rate. Ethan Heilman, author of BIP-360, stated that BTC needs 7 years for post-quantum security. These developments could support the BTC futures market with increasing liquidity. Resistances: 68.117 USD (R1).