KlariVis: Banks Lost 78M$ Deposits to Coinbase

ALT/USDT

$12,295,497.44

$0.009290 / $0.008510

Change: $0.000780 (9.17%)

-0.0147%

Shorts pay

Contents

KlariVis Report: Coinbase Activity in 92 Community Banks

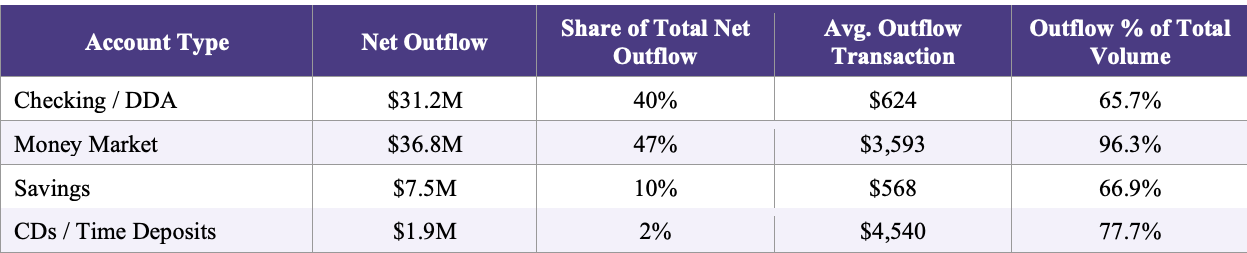

KlariVis banking data company's analysis detected that customers in 90% of the 92 community banks in its sample were transacting with Coinbase. According to data where transaction direction was determined in 53 banks, for every $1 inflow, there was $2.77 outflow, resulting in a net deposit loss of $78.3 million over 13 months. The examined 225,577 transactions mostly originated from money market accounts, with 96.3% of these being transfers to the exchange.

Source: KlariVis report

Outflow Rates by Bank Size

In small banks (deposits under $1 billion), the outflow rate was 82-84%, while in larger ones it stayed at 66-67%. Total outflow was $122.4 million, inflow $44.2 million. These data show that small banks are more affected by the crypto migration; intense transfers through money market accounts increase liquidity pressure.

Potential Impacts on a National Scale

The report states that if this trend holds nationally, more than 3,500 of the 3,950 community banks could have similar activity. This situation could affect the role of community banks—with $4.9 trillion in deposits—in small business and agricultural lending. Net loss rates concretize the shift from traditional finance to crypto.

Source: Brian Armstrong

CLARITY Act and Crypto-Bank Tension

The analysis reflects the tension between banks and crypto companies regarding stablecoin yields in CLARITY Act discussions; Bank of America CEO Brian Moynihan warns of a $6 trillion migration, while Coinbase CEO Brian Armstrong opposes restrictions. These outflows continue despite volatility in the crypto market.

Crypto Market Context: ALT Technical Analysis

Despite the flow of bank deposits to Coinbase, altcoins are under pressure. ALT is trading at $0.01 with a 3.18% drop (24h change). RSI at 34.39 giving an oversold signal, with downtrend dominant; Supertrend bearish, EMA20 $0.0090. Supports: S1 $0.0078 (strong, 1.52% distance), S2 $0.0069. Resistances: R1 $0.0082 (3.54%), R2 $0.0093. For detailed review, visit ALT detailed analysis and ALT futures pages. These data align with the report's timing, reflecting market sentiment.