Klarna Launches USD-Pegged KlarnaUSD Stablecoin on Stripe’s Tempo Blockchain

AVAX/USDT

$238,066,046.97

$8.98 / $8.42

Change: $0.5600 (6.65%)

+0.0001%

Longs pay

Contents

Klarna, the EU-licensed digital bank, has introduced KlarnaUSD, marking the first stablecoin issuance on Tempo, the layer-1 blockchain from Stripe and Paradigm. Pegged 1:1 to the US dollar, it’s live on testnet now, with mainnet rollout planned for 2026 to streamline international payments and enhance efficiency.

-

KlarnaUSD leverages Bridge’s infrastructure for secure, scalable stablecoin operations.

-

This launch builds on Klarna’s established payments collaboration with Stripe in 26 markets worldwide.

-

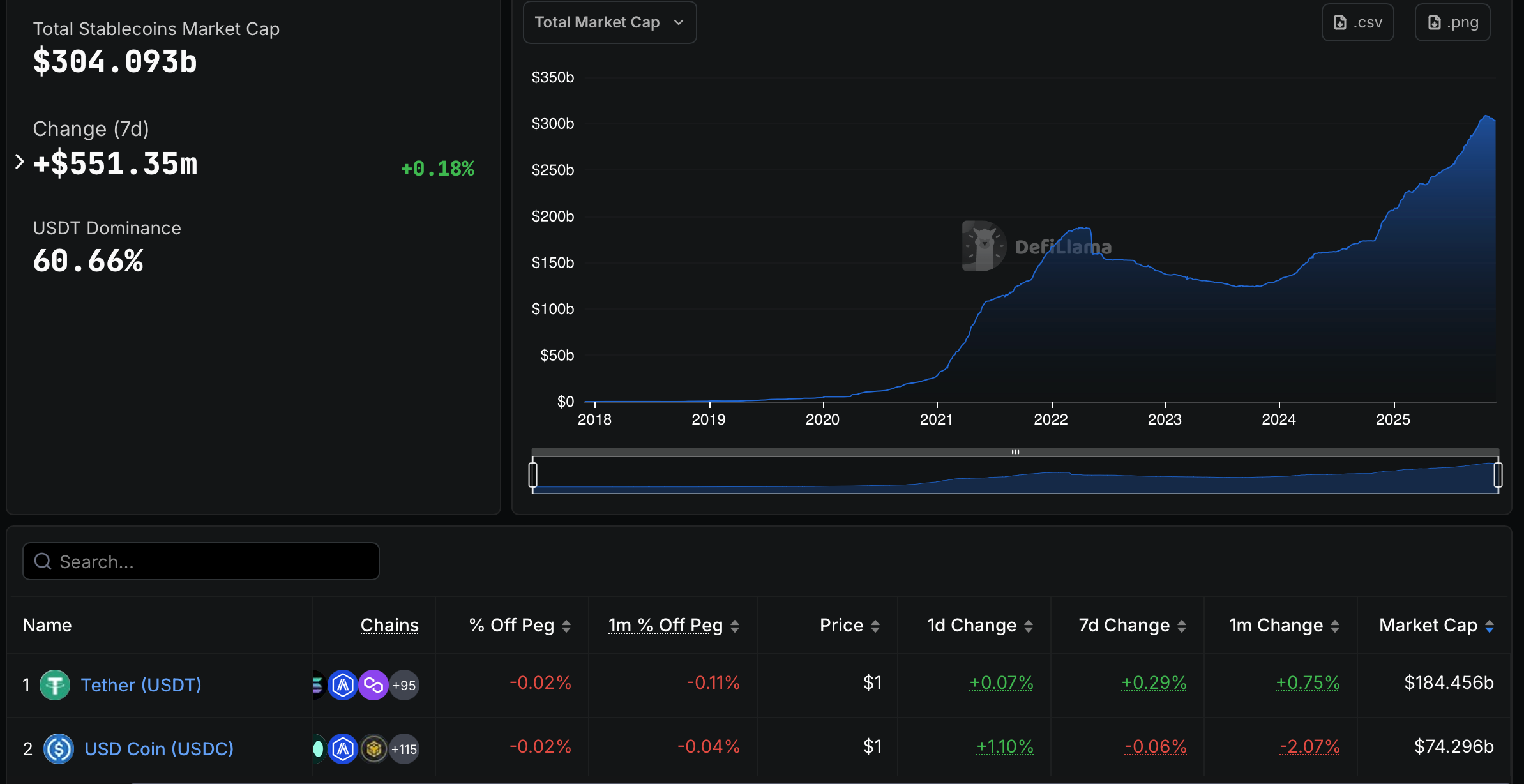

The stablecoin sector has surged to $304 billion in market cap, dominated by Tether’s USDT at $184 billion and Circle’s USDC at $74.3 billion, per DefiLlama data.

KlarnaUSD stablecoin launches on Tempo blockchain, pioneering fintech integration. Explore its USD peg, testnet status, and role in cutting payment costs amid a booming $304B stablecoin market. Dive into crypto’s financial evolution today.

What is KlarnaUSD Stablecoin?

KlarnaUSD stablecoin is a new digital asset launched by Klarna, the Swedish fintech giant known for its buy-now-pay-later services. Pegged directly to the US dollar for stability, it operates on Tempo, a layer-1 blockchain developed by payments leader Stripe and venture firm Paradigm. This initiative positions Klarna as the first financial institution to issue a token on this innovative network, focusing initially on internal efficiencies like lowering international transaction fees across its global operations.

How Is KlarnaUSD Built and What Sets It Apart?

KlarnaUSD was developed using Bridge, a stablecoin infrastructure provider owned by Stripe, ensuring robust security and scalability from the ground up. Unlike traditional banking rails, it promises faster, lower-cost transfers, aligning with Klarna’s mission to modernize payments in its 26 markets. CEO Sebastian Siemiatkowski emphasized in the announcement, “Crypto is finally at a stage where it is fast, low-cost, secure, and built for scale. This is the beginning of Klarna in crypto.” Early applications target internal uses, such as optimizing cross-border payments within the company, without immediate plans for consumer installment integrations. This measured approach reflects Klarna’s expertise as an EU-licensed digital bank specializing in online checkouts and short-term credit, drawing on years of fintech innovation to bridge traditional finance and blockchain.

The Year of Stablecoins

2025 has emerged as a pivotal year for stablecoins, driven by regulatory clarity and institutional adoption. The GENIUS Act, enacted in the United States in July, provided a structured framework for stablecoin issuance, spurring innovation while addressing risks. This legislation has encouraged major players to enter the space, fostering competition and growth in digital dollar equivalents.

Building on this momentum, self-custodial wallet provider MetaMask unveiled its own stablecoin, mUSD, issued by Bridge and supported by liquidity from M0. Launched in September, mUSD has quickly gained traction, boasting a market capitalization of $844 million as of late 2025. This development highlights how established crypto tools are incorporating stable assets to enhance user experiences in decentralized finance.

In a similar vein, global payments firm Western Union announced in October its plans to integrate Solana for a stablecoin-based settlement system. Centered on its US Dollar Payment Token (USDPT) and a Digital Asset Network created with Anchorage Digital Bank, the initiative aims to facilitate efficient remittances. The full launch is scheduled for the first half of 2026, potentially transforming cross-border money transfers for millions.

Stablecoin market capitalization. Source: DefiLlama

Traditional finance giants are also deepening their involvement. Visa, for instance, expanded its stablecoin settlement capabilities in July by incorporating the Global Dollar (USDG) token. This upgrade enables seamless transactions on networks like Stellar and Avalanche, broadening access to stablecoin rails for merchants and institutions worldwide.

The overall stablecoin ecosystem reflects this surge, with total market capitalization reaching approximately $304 billion. Tether’s USDT leads with around $184 billion in circulation, followed closely by Circle’s USDC at $74.3 billion, according to data from DefiLlama. These figures underscore the growing reliance on stablecoins for everything from trading to everyday payments, as issuers compete on transparency, compliance, and utility.

Regulatory developments elsewhere add context to this expansion. In South Korea, discussions around a stablecoin framework have encountered hurdles, with regulators divided on the role of banks in issuance. This contrast highlights varying global approaches, yet the US GENIUS Act’s success has set a benchmark for balanced oversight that encourages innovation without undue risk.

Experts view these moves as a maturation of the crypto sector. As stablecoins bridge fiat and digital worlds, companies like Klarna are leveraging them to cut costs—potentially by up to 90% on international wires, based on industry benchmarks—and improve speed. A Klarna spokesperson noted to Cointelegraph that exploration remains in early stages, prioritizing internal efficiencies before broader applications.

Frequently Asked Questions

What Are the Initial Plans for KlarnaUSD Stablecoin Integration?

Klarna plans to use KlarnaUSD primarily for internal purposes, such as reducing international payment costs within its operations. As an EU-licensed bank, it focuses on secure, scalable applications across its 26 markets, with no immediate rollout to consumer buy-now-pay-later services. This cautious strategy ensures compliance and reliability from day one.

When Will KlarnaUSD Stablecoin Go Live on Mainnet and What Does That Mean?

KlarnaUSD is set to launch on Tempo’s mainnet in 2026, transitioning from its current testnet phase where developers are refining functionality. This mainnet activation will enable real-world transactions, offering users fast, low-fee USD-pegged transfers backed by Klarna’s financial infrastructure—making crypto payments as straightforward as traditional banking.

Key Takeaways

- Klarna Pioneers Stablecoin Issuance: As the first on Tempo blockchain, KlarnaUSD demonstrates fintech’s shift toward blockchain for efficient global payments.

- Regulatory Boost Drives Growth: The US GENIUS Act has catalyzed issuances like mUSD and USDPT, expanding the $304 billion stablecoin market led by USDT and USDC.

- Focus on Practical Utility: Initial uses emphasize cost savings in cross-border transactions; monitor for future consumer integrations to enhance everyday financial services.

Conclusion

KlarnaUSD stablecoin represents a significant step in integrating blockchain with traditional payments, leveraging Tempo’s infrastructure for USD-pegged stability and efficiency. Amid a thriving stablecoin landscape fueled by acts like GENIUS and innovations from Visa and Western Union, Klarna’s entry underscores crypto’s maturation for real-world finance. As mainnet approaches in 2026, expect broader adoption that could redefine international transfers—stay tuned for how this evolves the fintech ecosystem.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026