Kraken Acquires Backed Finance to Potentially Expand xStocks on Solana and Ethereum

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

Kraken’s acquisition of Backed Finance AG grants the exchange full control over the xStocks tokenized-equity platform, enhancing its expansion into regulated real-world assets. This move integrates tokenized stocks and ETFs for 24/7 trading on blockchains like Solana and Ethereum, with over $10 billion in volume since launch.

-

Kraken gains complete ownership of xStocks, a platform offering over 60 tokenized equities including blue-chip stocks like Apple and Tesla.

-

The acquisition supports tighter integration with Kraken’s global money app and expansion to more blockchains and markets.

-

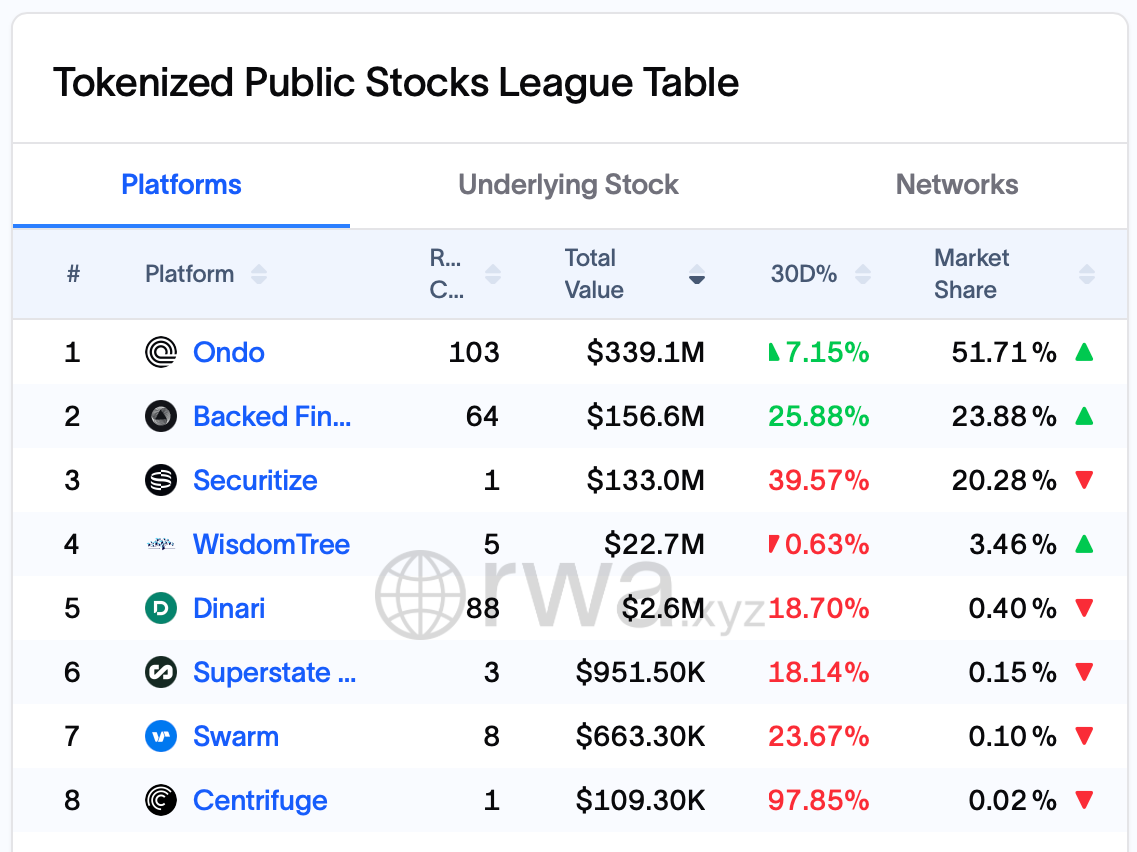

Tokenized assets have seen $10 billion in combined exchange and onchain volume, with regulated issuers like Backed holding 24% market share per RWA.xyz data.

Kraken acquires Backed Finance AG to control xStocks tokenized equities platform. Explore how this boosts real-world assets trading on blockchain. Stay updated on crypto acquisitions and RWA trends for investment insights.

What is Kraken’s Acquisition of Backed Finance AG?

Kraken’s acquisition of Backed Finance AG provides the US-based crypto exchange with full ownership of the xStocks tokenized-equity platform, a key step in its strategy to deepen involvement in regulated real-world assets. Announced on a Tuesday, the deal allows Kraken to more seamlessly integrate xStocks’ issuance, trading, and settlement features into its existing products, including the global money app. This acquisition follows Kraken’s recent expansions and aims to broaden support across additional blockchains and international markets.

How Do Tokenized Equities Like xStocks Work?

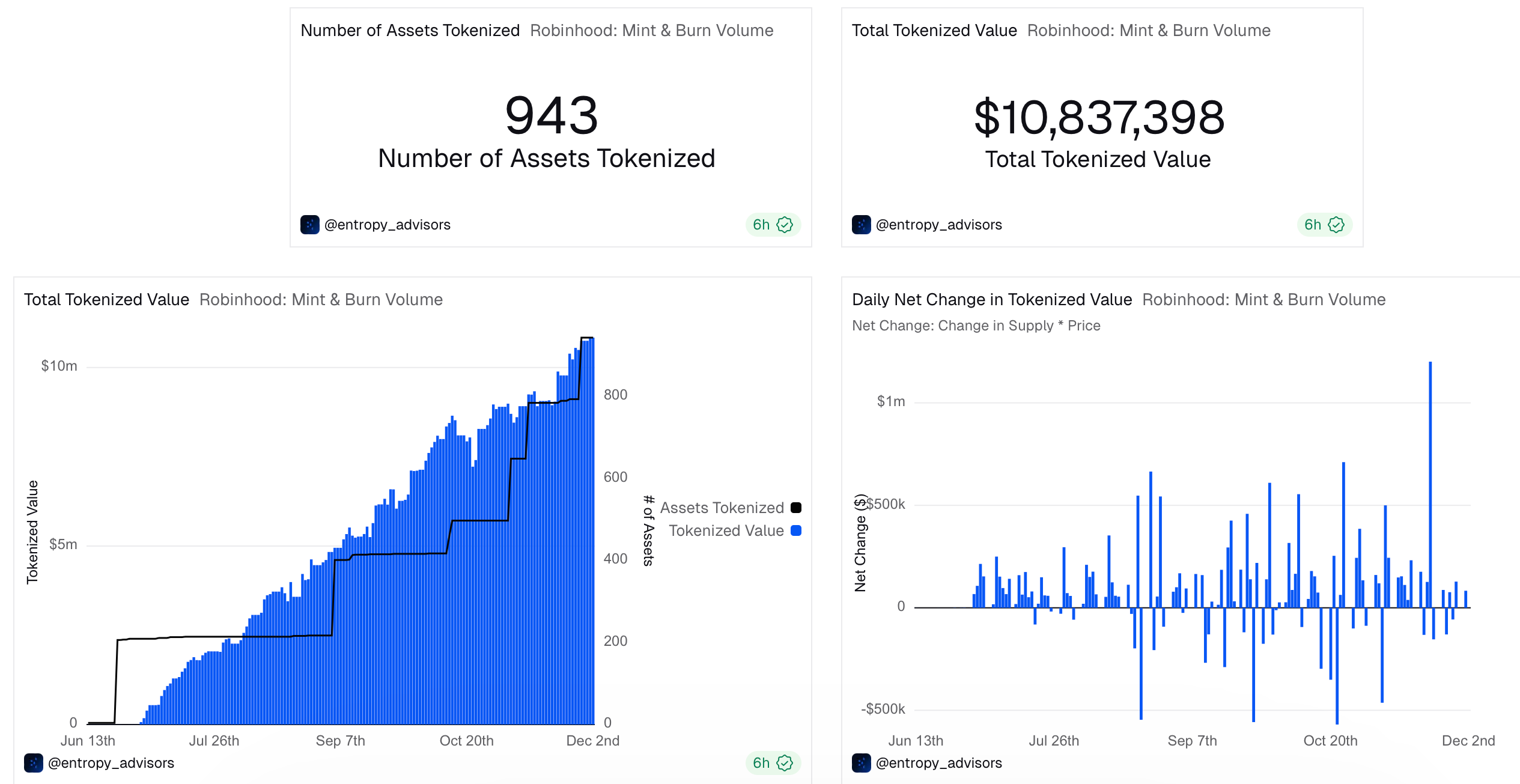

Tokenized equities represent ownership of traditional stocks or ETFs on a blockchain, enabling 24/7 trading, self-custody, and interoperability across networks. xStocks, developed by Backed Finance AG, currently features over 60 such products, including tokenized versions of major companies like Netflix, Meta, Coinbase, Amazon, Nvidia, McDonald’s, Apple, Tesla, and Microsoft. Launched earlier this year on Solana and Ethereum, the platform has achieved more than $10 billion in combined exchange and onchain trading volume. According to data from Dune Analytics, similar tokenized stock offerings on platforms like Robinhood have reached an onchain value of about $10.8 million across 943 assets on Arbitrum. RWA.xyz reports that regulated tokenized public stocks total around $656 million in value, with monthly transfer volumes exceeding $1.14 billion and approximately 118,000 holders. Among issuers, Ondo leads with 52% market share, followed by Backed Finance at 24% and Securitize at 20%. Experts note that this growth reflects increasing institutional interest in blockchain-based securities for their efficiency and global accessibility. “Tokenization bridges traditional finance with blockchain, offering unprecedented liquidity,” states a financial analyst from a leading market research firm. The technology ensures compliance with regulations while allowing seamless transfers without intermediaries.

Robinhood tokenized stocks data. Source: Dune Analytics

This acquisition builds on Kraken’s earlier rollout of xStocks to eligible European users in September, providing tokenized access to blue-chip equities. Kraken also manages the xStocks Alliance, a collaborative network of blockchains and trading venues. The deal will unify this ecosystem, fostering greater interoperability and liquidity as more markets adopt tokenized equities. Financial terms were not disclosed, aligning with Kraken’s pattern of strategic, undisclosed purchases this year.

Kraken, which filed confidentially for a US IPO in November, has pursued aggressive growth through acquisitions. In May, it purchased NinjaTrader, a futures brokerage platform. September saw the addition of Breakout, a proprietary trading firm, and in October, Kraken acquired Small Exchange, a designated contract market. These moves position Kraken as a multifaceted player in both crypto and traditional finance intersections.

Regulated tokenized stock issuers. Source: RWA.xyz

Frequently Asked Questions

What Does Kraken’s Acquisition Mean for xStocks Users?

Kraken’s acquisition of Backed Finance AG ensures xStocks tokenized equities remain available with enhanced integration into Kraken’s ecosystem. Users can expect expanded blockchain support, improved liquidity through the xStocks Alliance, and continued 24/7 trading of over 60 assets like tokenized Apple and Tesla stocks, all while maintaining regulatory compliance.

Why Are Tokenized Equities Gaining Popularity in Crypto?

Tokenized equities are surging because they combine blockchain’s speed and accessibility with traditional stock ownership, allowing global, round-the-clock trading without banks. Platforms like xStocks on Solana and Ethereum enable self-custody and cross-network use, appealing to investors seeking efficient real-world asset exposure in the evolving crypto landscape.

Key Takeaways

- Strategic Expansion: Kraken’s purchase of Backed Finance AG solidifies its role in real-world assets, integrating xStocks for broader tokenized equity offerings.

- Market Growth: Tokenized stocks have hit $656 million in regulated value per RWA.xyz, with Backed’s 24% share underscoring the platform’s prominence amid $1.14 billion monthly volumes.

- Future Liquidity: Enhanced interoperability via the xStocks Alliance will boost trading efficiency; investors should monitor Kraken’s IPO progress for potential new opportunities.

Conclusion

Kraken’s acquisition of Backed Finance AG marks a pivotal advancement in tokenized equities, empowering the exchange to lead in regulated real-world assets through the xStocks platform. With over $10 billion in volume and growing adoption across blockchains like Solana and Ethereum, this development highlights the fusion of crypto innovation and traditional finance. As the market matures, stakeholders can anticipate increased liquidity and accessibility, positioning tokenized equities as a cornerstone of future investments—explore these trends to stay ahead in the dynamic crypto space.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026