Kyle Samani Leaves Multicoin: SOL Bull Signal

SOL/USDT

$4,011,144,559.29

$85.03 / $77.15

Change: $7.88 (10.21%)

-0.0149%

Shorts pay

Contents

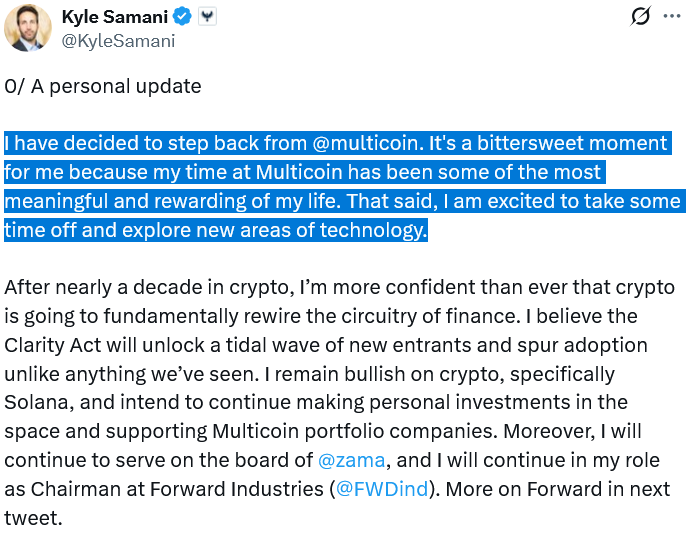

Multicoin Capital's co-founder Kyle Samani announced his departure from the executive partnership at the crypto investment firm after a 10-year tenure. Describing the separation as a "bittersweet moment," Samani stated that he will explore new technologies like AI, robotics, and longevity during his vacation. Emphasizing his strong belief in the crypto sector, he expressed that the "Clarity Act will fundamentally change finance" and maintained his bullish stance on SOL detailed analysis. He said he will continue to support his personal investments and Multicoin portfolio companies.

Kyle Samani's Reasons for Leaving Multicoin and Future Plans

Samani enabled Multicoin, founded in 2017, to reach $5.9 billion in assets under management through early investment in Solana. While stating that he will focus on non-crypto interests in his departure, he emphasized that he will not completely abandon his role in the sector. Although this move creates uncertainty among investors, it signals that Samani will continue his support in areas like SOL futures trading.

Samani's Criticisms of Ethereum and Bitcoin

He had previously criticized the Bitcoin and Ethereum ecosystems and was dissatisfied with Ethereum's scaling approaches. In the latest breaking news, Ethereum founder Vitalik Buterin admitted that L2s have deviated from the original vision, are not sufficiently scalable, and new approaches are needed. This validates Samani's preference for Solana's high-performance architecture.

Source: Kyle Samani

SOL Price: Current Technical Analysis and Levels

SOL is currently at $92.59, down -6.79% in 24 hours, with RSI at 25.20 (Oversold). Downtrend dominant, Supertrend bearish, EMA 20: $114.6077. Support and resistance levels are as follows:

| Level | Price | Score | Distance | Sources |

|---|---|---|---|---|

| S1 | 89.3000$ | 81/100 ⭐ Strong | -3.53% | Fib 0.000, Prev Day Low |

| S2 | 58.7272$ | 50/100 Medium | -36.56% | Fib 1.272, Pivot |

| R1 | 102.1136$ | 63/100 ⭐ Strong | +10.31% | Fib 0.114, Prev Day High |

| R2 | 93.0967$ | 59/100 Medium | +0.57% | R1, MACD Cross |

The oversold RSI indicates short-term recovery potential; the bullish scenario could strengthen with Clarity Act expectations.

Multicoin's Solana Success and Sector Impact

The firm stood out with its Solana investments. Although a deleted post from Samani's old X account claimed he lost faith in web3, it overshadows his current bullish stance. Multicoin believes that crypto will transform global finance with regulatory clarity and infrastructure maturity.

Risk and Opportunity Analysis for SOL Investors

- Risk: ETH L2 developments could increase competition for SOL.

- Opportunity: Samani support and Clarity Act could propel SOL to $100+ levels.

- Recommendation: Monitor S1 support, consider long positions on RSI recovery.

High correlation with BTC and ETH; general market recovery will support SOL.