LEO Token Risks Further Decline After 25% Drop as Sentiment Shifts Bearish

SPK/USDT

$5,969,853.79

$0.020535 / $0.01808

Change: $0.002455 (13.58%)

+0.0050%

Longs pay

Contents

The Unus Sed Leo (LEO) token has experienced a sharp 25% price drop in the last 24 hours, making it the market’s biggest loser with a $6.26 billion market cap. Bearish sentiment among investors and heavy selling pressure are driving the decline, risking further drops below two-year lows.

-

LEO’s 25% plunge erases 2025 gains, turning yearly performance negative amid widespread investor caution.

-

Bullish sentiment has plummeted from 72% to 14% in days, with 58% of 30,200 surveyed investors opting to sell.

-

Technical indicators show caution but potential for rebound, as the token nears a key 2024 demand zone after a $47,000 spot market sell-off.

Discover why Unus Sed Leo LEO token price is dropping 25% and what it means for investors. Analyze charts, sentiment, and indicators for informed decisions on this volatile crypto. Stay updated on LEO’s market risks today.

What is causing the Unus Sed Leo LEO token price drop?

Unus Sed Leo (LEO) token price drop stems from a rapid shift in market sentiment, with the asset losing 25% of its value in just 24 hours to become the biggest market loser. This decline, affecting its $6.26 billion market capitalization, reflects heavy selling pressure as 58% of tracked investors turned bearish. Broader market caution has amplified the drop, erasing all 2025 gains and positioning LEO for potential further losses below established two-year levels.

How far could the LEO token decline extend?

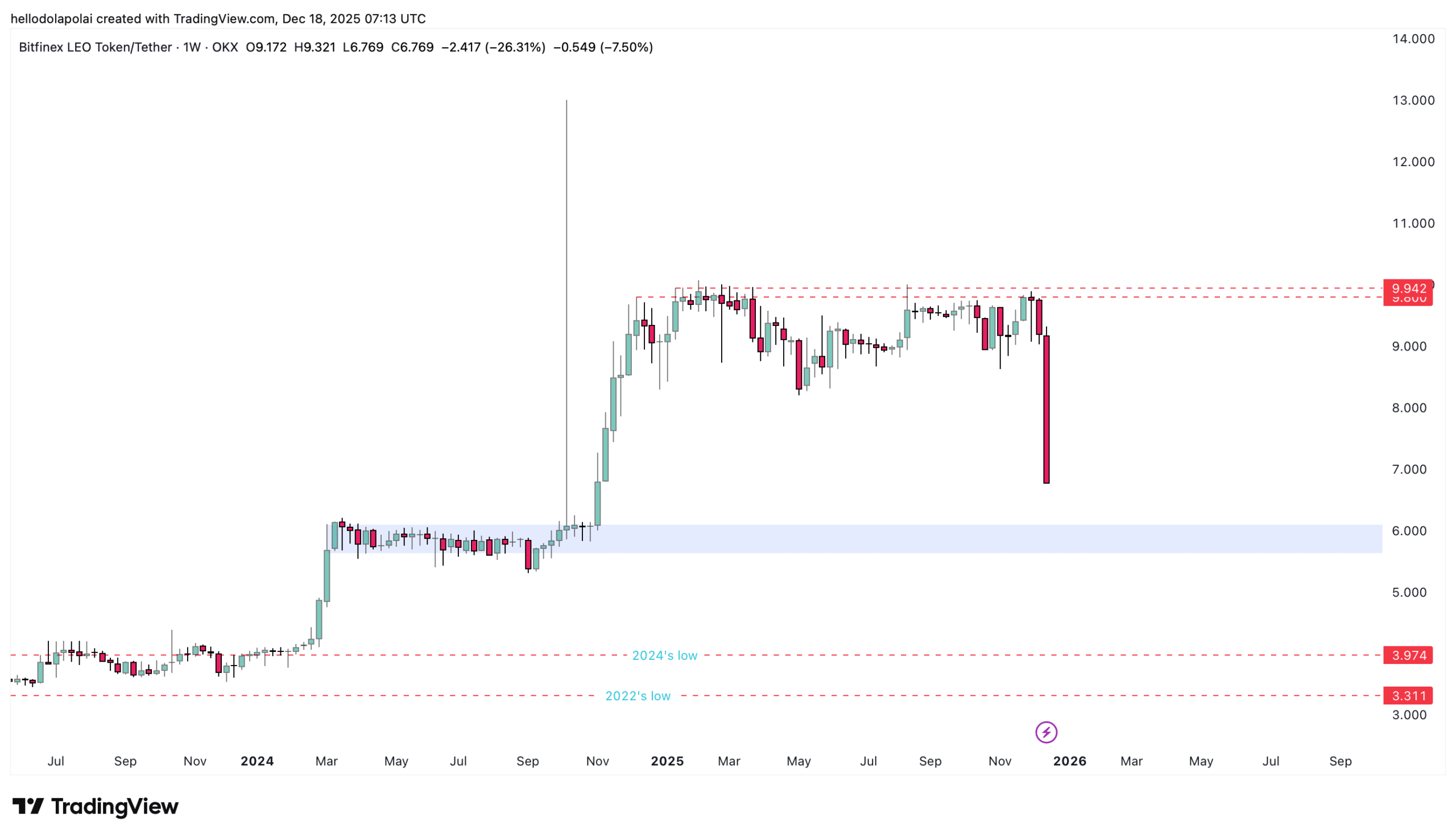

The ongoing LEO token decline has already wiped out its 2025 progress, and technical analysis indicates vulnerability to deeper retracements. A key demand zone from March to November 2024, visible as a consolidation area on price charts, stands as the next support level; breaching it could lead to retesting 2024 lows. If selling intensifies, the token might even approach 2022 bottoms, though historical patterns suggest zones like this often attract buyers due to unfilled orders. Data from TradingView highlights this zone’s significance, where past breakouts followed prolonged sideways action, potentially offering a rebound opportunity if momentum shifts.

Unus Sed Leo [LEO] has emerged as the biggest loser in the market over the past 24 hours. The token, with a market capitalization of $6.26 billion, saw its value drop by 25% at press time.

Market sentiment suggests that the current outlook could further accelerate the decline, with the asset at risk of falling well below levels established over the past 730 days.

LEO wipes out gains

LEO has wiped out its accumulated gains from the past year and has now turned negative, posting a notable deficit.

The decline became more pronounced over the past 48 hours, as investors positioned against a potential rally and broadly shifted to a bearish stance.

Source: CoinMarketCap

Community sentiment data shows that among 30,200 investors, bullish sentiment dropped sharply from 72% on the 15th of December to just 14% at the time of writing.

With a significant 58% of investors selling, the impact has been far from negligible. This pressure has already been reflected in the spot market, which has seen minimal activity over time but still recorded a $47,000 sell-off.

A further decline could take shape if more investors turn bearish on the chart.

Market experts, including those from CoinMarketCap analytics, note that such sentiment shifts often precede extended corrections in utility tokens like LEO, which powers the Bitfinex ecosystem. According to on-chain data observers, the sell-off volume aligns with broader crypto market jitters, where even established assets face pressure from macroeconomic factors.

Frequently Asked Questions

Why is Unus Sed Leo LEO experiencing such a rapid price drop in 2025?

The Unus Sed Leo LEO price drop in 2025 results from a surge in bearish investor sentiment, dropping from 72% bullish to 14% in mere days. Heavy selling by 58% of surveyed holders has erased yearly gains, with spot market outflows totaling $47,000. This reflects positioning against rallies amid overall market caution, per CoinMarketCap data.

Will the LEO token price recover soon after this decline?

While the LEO token price may face short-term pressure, technical indicators like the Money Flow Index entering oversold territory suggest seller exhaustion could lead to a rebound. The Accumulation Distribution remains positive despite recent dips, indicating bulls retain control. However, a breach of the 2024 demand zone might delay recovery, as historical patterns from TradingView show.

Despite the recent drop wiping out its entire 2025 gains, market analysis shows that LEO’s 2024 gains are now also at risk.

The chart shows that LEO is only one demand zone away from retesting its 2024 price level.

This demand zone, highlighted by a blue rectangle, acted as a consolidation area between March and November 2024. After that period of consolidation, the asset eventually broke out.

Source: TradingView

Typically, unfilled orders tend to remain within such zones, which could act as a potential catalyst if price retraces into this area.

However, if selling momentum intensifies, LEO could extend its decline beyond this level, placing 2024 prices as the next phase, with a revisit of the 2022 low not ruled out.

Financial analysts emphasize that LEO’s ties to exchange utility make it sensitive to trading volume fluctuations. A report from TradingView’s technical team underscores how demand zones in 2024 provided stability before breakouts, suggesting current levels could similarly influence future price action if volume picks up.

Cautious, but not fully bearish

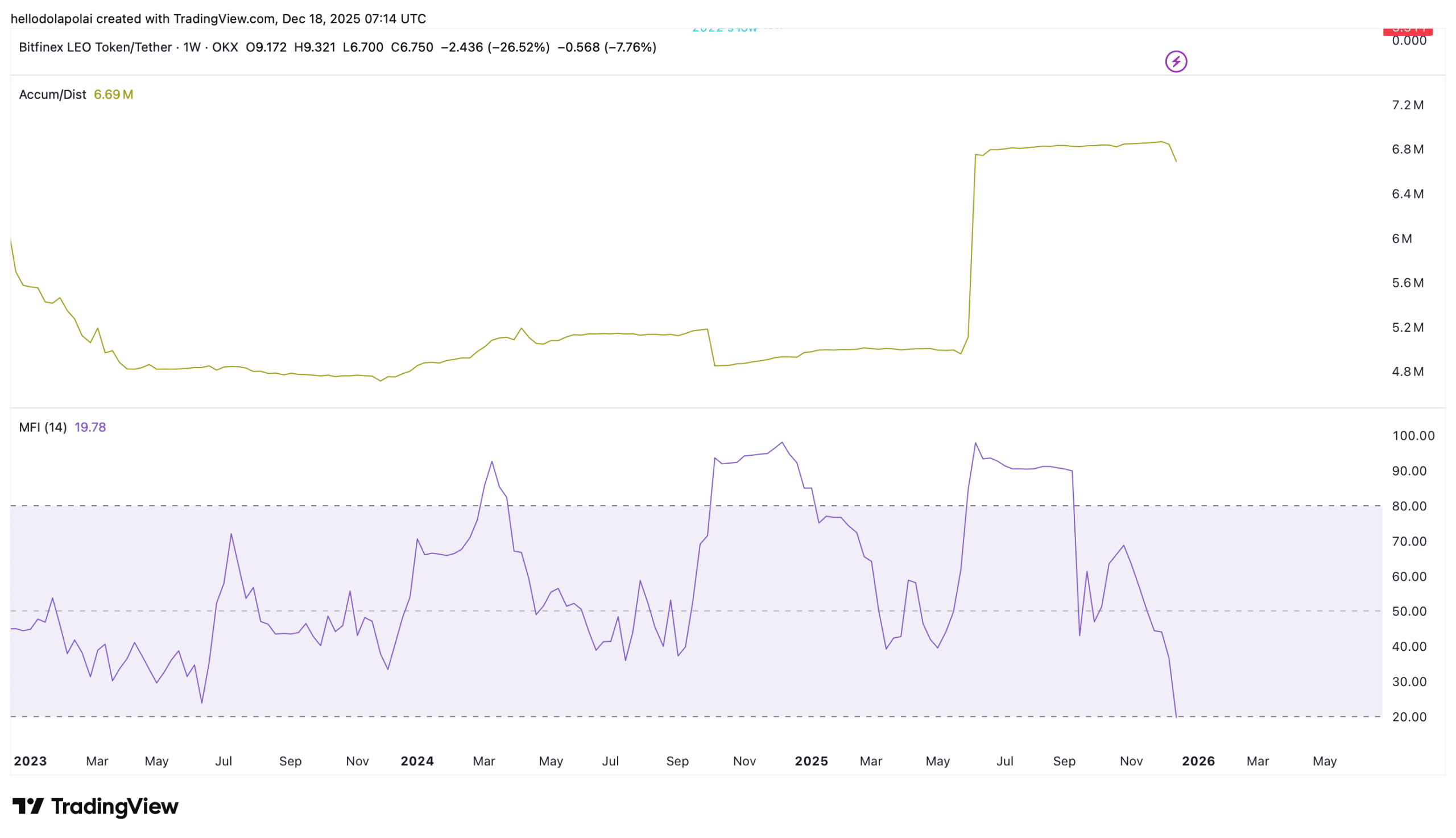

To assess the likelihood of a move into the previously identified demand zone, COINOTAG examined trends across key technical indicators.

The indicators suggest that the market remains cautious rather than outright bearish, leaving room for a potential rebound.

The Accumulation Distribution (AD) indicator has declined over the past day, slipping to 6.68 million, as of writing, its lowest level since the 16th of June.

Despite the dip, the indicator remains in positive territory, suggesting that the current selling phase appears corrective and that bulls still maintain overall control.

Source: TradingView

Further clarity comes from the Money Flow Index (MFI), which measures whether liquidity inflows signal buying or whether outflows indicate selling pressure.

The MFI has dropped into oversold territory, falling below the 20 mark. Historically, this level signals seller exhaustion and has often preceded market rebounds.

While the chart does not point to a specific rebound timeline and prices could still trend lower, the indicators suggest an increased likelihood of a faster recovery once selling pressure eases.

Experts in cryptocurrency technical analysis, such as those contributing to TradingView insights, point out that oversold MFI readings have historically led to 15-20% bounces for similar tokens. The positive AD line reinforces that accumulation persists beneath the surface, providing a foundation for potential stabilization.

Key Takeaways

- Sharp Sentiment Shift: LEO’s bullish outlook collapsed from 72% to 14%, driving a 25% price drop and $47,000 in spot sells among 30,200 investors.

- Technical Support Ahead: A 2024 demand zone looms as critical support; breaching it risks 2024 lows, but unfilled orders could spark buying interest.

- Rebound Potential: Oversold MFI below 20 and positive AD indicate corrective selling, suggesting exhausted bears and room for recovery if pressure eases.

Conclusion

The Unus Sed Leo LEO token price drop highlights the volatility inherent in crypto markets, fueled by plummeting sentiment and selling pressure that has erased 2025 gains. While technical indicators like MFI and AD point to cautious rather than fully bearish conditions, the proximity to key 2024 support levels underscores ongoing risks for further declines. Investors should monitor these zones closely, as a rebound could materialize with renewed buying, positioning LEO for potential stabilization in the coming weeks.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026