Long-Term Bitcoin Holders Shift Strategies Amid Selling Pressure and Market Adjustments

BTC/USDT

$25,688,978,986.00

$71,632.08 / $68,176.47

Change: $3,455.61 (5.07%)

-0.0000%

Shorts pay

Contents

-

Bitcoin’s ongoing mid-range trading has seen long-term holders increasingly cashing in, signifying a shift in market dynamics.

-

Market indicators reveal a notable change in seller behavior, suggesting potential hurdles for BTC’s near-term price stability.

-

A key observation from COINOTAG highlighted that while long-term holders are selling, ultra-long-term holders remain steadfast, potentially influencing market resilience.

Bitcoin trading shows long-term holders selling while ultra-long-term investors hold steady, shaping current market dynamics and price movements.

Long-term holders begin selling Bitcoin

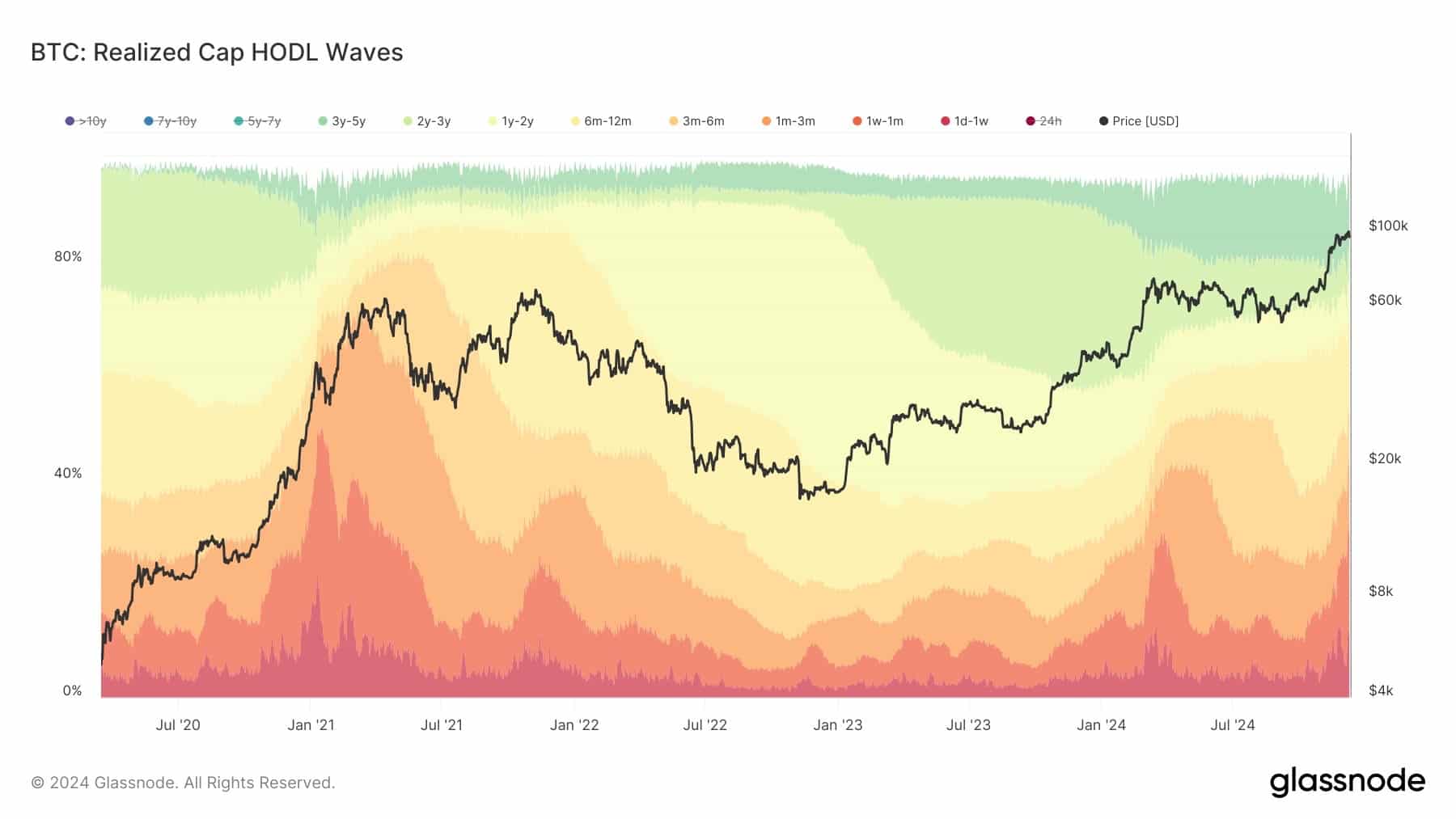

Recent data from Glassnode indicates a marked trend among long-term Bitcoin holders who are actively engaging in profit-taking. This change does not include “Ultra Long-Term Holders” who remain committed to their investments, having held their BTC for over seven years. Digging deeper, long-term holders—identified as those possessing BTC for over six months—have decreased their holdings by about 10%, dropping from over 60% to closer to 50% as evidenced in recent analytics.

This shift in BTC ownership dynamics is reshaping the interactions within the market. In the initial stages of a Bitcoin cycle, long-term and ultra-long-term holders generally dominate ownership. Nevertheless, with the elevation in selling pressure, the balance is increasingly adjusting. As more short-term holders enter, their collective influence grows stronger, while the market currently resides in an early to mid-range phase.

Long-term holders losing interest in BTC

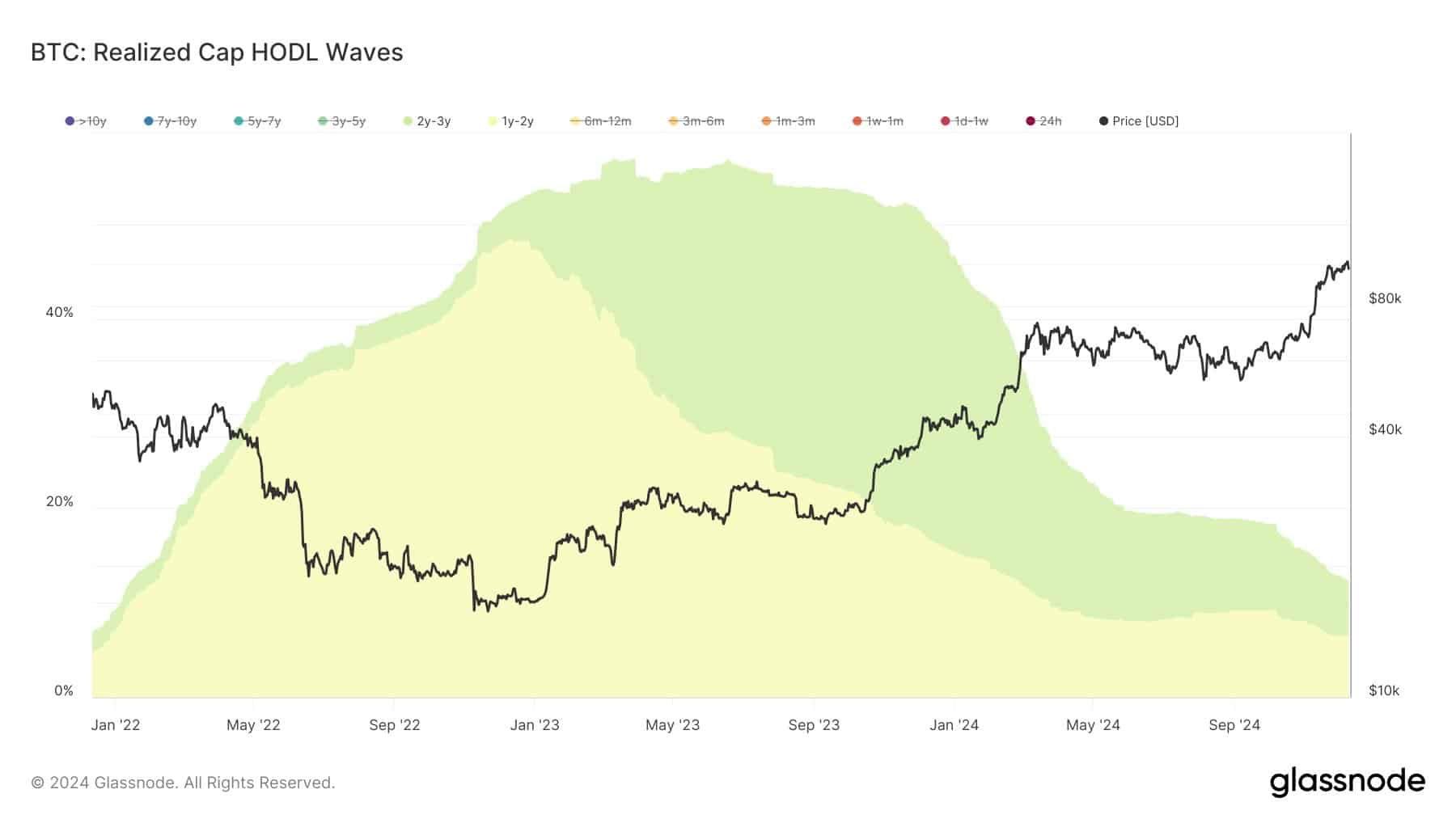

The declining interest among long-term Bitcoin holders is becoming more pronounced, particularly among those within various holding timeframes, such as 1–2 years and 3–5 years. This trend became particularly evident after these holders accumulated BTC during the previous bear market session from June to November. The data shows that the 3-5 year holding cohort has seen a reduction, with their share peaking at 15.3% but now resting at 13.9%, raising concerns regarding potential future price drops should selling pressures prevail.

In contrast to earlier market cycles, the introduction of Bitcoin Spot ETFs has added complexity. Institutional investors have been accumulating BTC but have now begun to decrease their holdings from 25% down to 16%. Nevertheless, there remains an underlying possibility for price recoveries as long-term holders have not yet liquidated significant portions of their assets, which may suggest they anticipate a further price rise before fully capitalizing on their investments.

Low demand for BTC puts pressure on price

Recent analytics by Hyblock highlight a concerning 50% imbalance in bids within a 1-2% depth of the order book, indicating overwhelming selling pressure coupled with weak demand. This demand-supply discrepancy is likely to exert further downward pressure on Bitcoin’s trading price.

Moreover, CryptoQuant’s findings show an uptick in available Bitcoin on exchanges, with deposits soaring by around 22,289 BTC. This trend has led to a cumulative increase in Exchange Netflow, indicating a growing supply of Bitcoin accessible on the market.

Conclusion

In summary, the Bitcoin market is experiencing significant shifts as long-term holders seek to capitalize on profits while the balance of ownership evolves. With ongoing selling pressures and a dwindling demand side, the potential for Bitcoin’s price to face further challenges remains. Observers are urged to monitor institutional behaviors and holder cohorts closely as they will likely dictate the trajectory of the market. A careful examination of these trends could offer insights into future pricing movements of Bitcoin.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC