LUNC Rallies Sharply on Do Kwon Case News and Burns: Potential for Sustained Gains?

LUNC/USDT

$75,272,953.89

$0.00004453 / $0.00003833

Change: $0.0000062 (16.18%)

-0.0160%

Shorts pay

Contents

Terra Luna Classic (LUNC) has experienced a dramatic 90% price surge in the last 24 hours, driven by short liquidations exceeding $5 million and heightened token burns surpassing 427 billion weekly. Despite founder Do Kwon’s impending fraud sentencing on December 11, market momentum remains bullish as traders react to renewed interest.

-

LUNC ranks second among trending tokens on CoinMarketCap amid the rally.

-

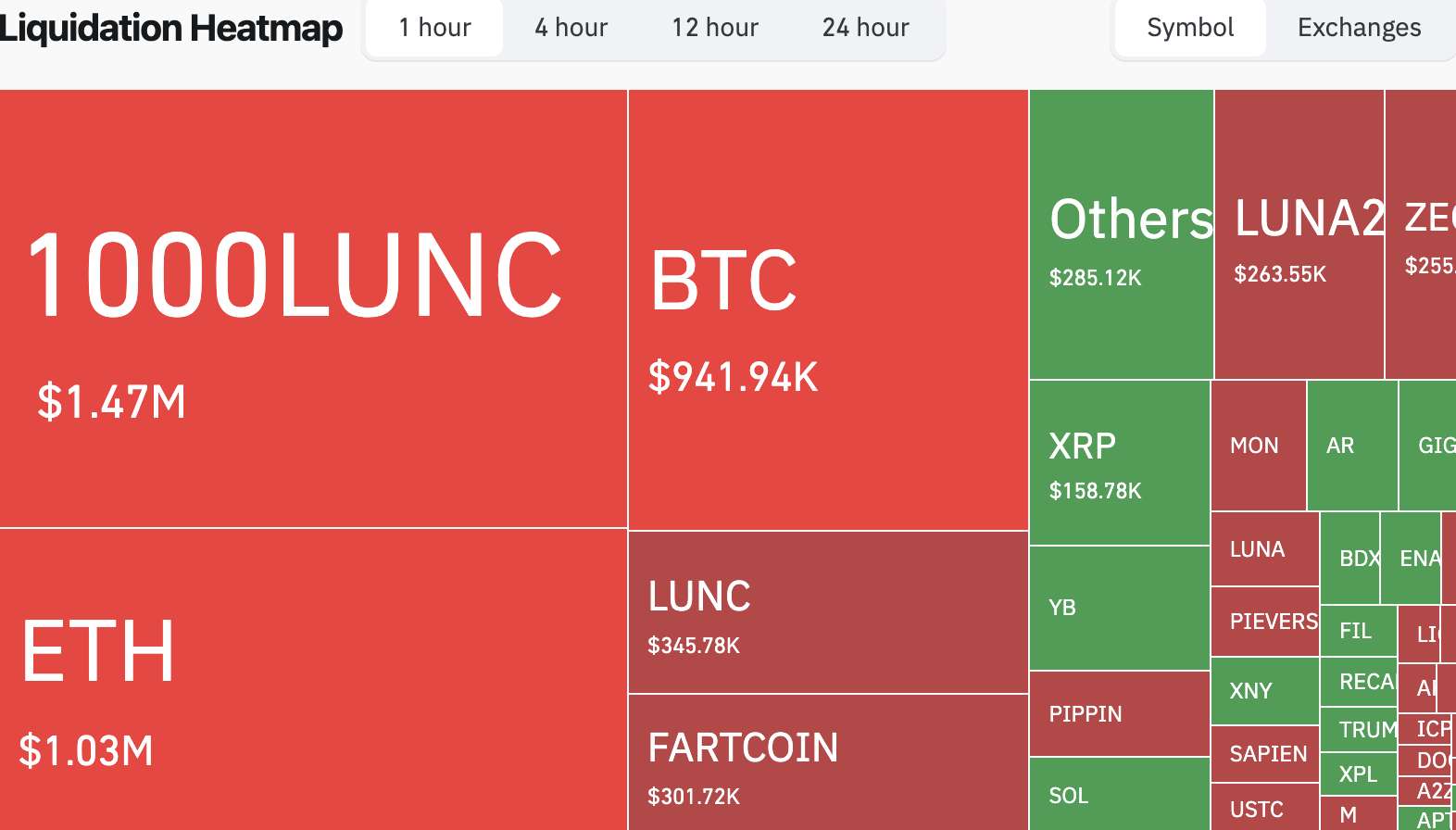

Short liquidations for LUNC topped all cryptocurrencies, wiping out over $1.47 million in one hour.

-

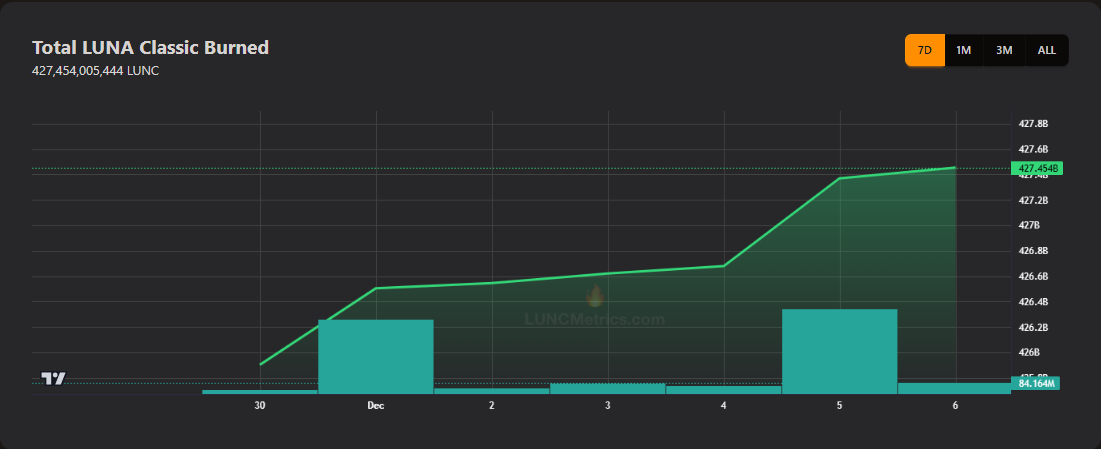

Weekly token burns reached 427 billion LUNC, with daily burns at 84 million, reducing circulating supply significantly.

Discover the factors behind Terra Luna Classic’s explosive 90% surge despite legal challenges. Explore short liquidations, burns, and technical indicators driving LUNC’s momentum. Stay updated on crypto trends today.

What is causing the recent LUNC price surge?

LUNC price surge stems primarily from massive short liquidations and aggressive token burn initiatives, coinciding with discussions around Do Kwon’s legal proceedings. Over the past day, LUNC climbed more than 90%, hitting $0.00007088, as liquidations alone exceeded $5.19 million in 12 hours. This unexpected rally defies the typical negative sentiment from the founder’s guilty plea to fraud charges linked to the 2022 collapse.

How have short liquidations fueled LUNC’s momentum?

Short liquidations have been a pivotal force in the LUNC price surge, triggering a cascade of buying pressure. According to CoinGlass data, LUNC recorded the highest short position wipeouts among major assets, surpassing even Ethereum and Bitcoin. In a single hour, over $1.47 million in shorts were liquidated, representing about 10% of total market short liquidations during that period. This activity amplified the price movement, as forced closures by overleveraged traders pushed LUNC higher. The related token LUNA saw some parallel activity, though at a lower volume, indicating broader interest in the Terra ecosystem without diluting LUNC’s gains entirely. Market analysts note that such liquidations often create self-reinforcing rallies in volatile assets like LUNC, where sentiment can shift rapidly.

Source: CoinGlass

Frequently Asked Questions

Why is LUNC surging despite Do Kwon’s guilty plea?

LUNC’s surge occurs amid anticipation for Do Kwon’s sentencing on December 11 for fraud related to the Terra collapse. Although the plea typically signals bearish pressure, traders are focusing on positive catalysts like burns and liquidations. This disconnect highlights how market dynamics can override legal news in short-term crypto trading, with LUNC now second on CoinMarketCap’s trending list.

Will LUNC’s price continue its upward trend after the breakout?

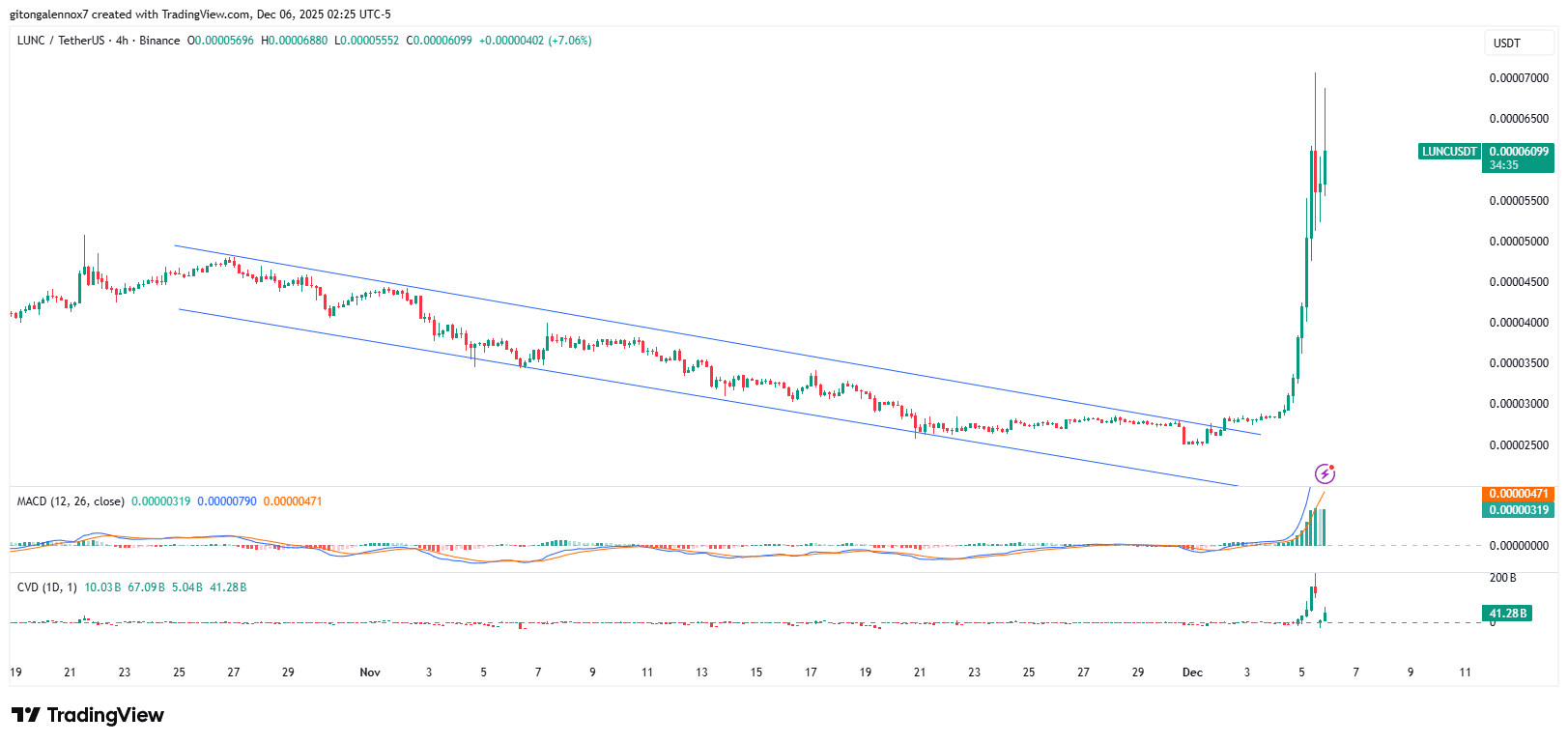

Yes, LUNC’s price could sustain its momentum if buyers hold above the recent breakout level from a descending channel on the four-hour chart. The MACD shows strong bullish bars, and cumulative volume delta favors buyers at over $41 million. However, resistance near July’s high of $0.00007088 may cap gains unless volume persists.

Key Takeaways

- Short Liquidations Drive Rally: Over $5 million in shorts liquidated in 12 hours, accounting for 10% of total market activity and accelerating LUNC’s 90% gain.

- Token Burns Reduce Supply: Weekly burns hit 427 billion LUNC, with Terre Form Labs contributing 58%, enhancing scarcity and supporting price appreciation.

- Bullish Technical Signals: Breakout above bearish channel and positive MACD indicate potential for further upside, though sellers are testing resistance levels.

Conclusion

The LUNC price surge illustrates the complex interplay of legal developments, on-chain reductions, and trading mechanics in the cryptocurrency space. With short liquidations and robust token burns propelling the asset to new heights despite Do Kwon’s challenges, investors should monitor upcoming sentencing outcomes closely. As the Terra ecosystem evolves, staying informed on these dynamics could reveal opportunities for strategic positioning in volatile markets.

Understanding the Broader Context of LUNC’s Revival

Terra Luna Classic, the rebranded remnant of the original Terra blockchain after its catastrophic failure in 2022, continues to draw attention from the crypto community. The recent LUNC price surge not only reflects speculative trading but also underscores ongoing efforts by the community to revive the network through deflationary measures. Since the collapse, which wiped out billions in value and led to Do Kwon’s arrest, LUNC holders have pushed for aggressive burns to combat inflation and restore confidence.

Do Kwon’s role remains central to the narrative. His guilty plea to multiple counts of fraud and market manipulation, as reported by U.S. authorities, was expected to dampen enthusiasm. Yet, the market’s contrarian response suggests that traders are betting on resolution rather than further uncertainty. The December 11 decision could impose significant penalties, potentially influencing regulatory scrutiny on similar projects, but for now, it serves as a focal point for volatility.

Impact of Token Burns on LUNC’s Supply Dynamics

Token burns have emerged as a cornerstone of LUNC’s recovery strategy, directly addressing the token’s hyperinflationary history. In the past week, over 427 billion LUNC tokens were removed from circulation, a sharp increase from prior periods. Daily burns reached 84.164 million on the latest reporting day, building on the previous day’s 691.625 million reduction. Notably, December 1 and December 5 saw peaks exceeding 600 million each, demonstrating consistent community and developer commitment.

Source: LUNC Burn Tracker

Terre Form Labs led these efforts, burning approximately 58% of the total, which highlights institutional involvement in the ecosystem’s stabilization. Experts from blockchain analytics firms emphasize that such supply reductions can create upward price pressure by enhancing scarcity, especially in a market recovering from depegging events. This mechanism, combined with transaction fees and community proposals, positions LUNC for potential long-term viability if adoption grows.

Technical Analysis: Breaking Barriers

From a charting perspective, LUNC’s performance has been remarkable. The token broke out of a multi-month descending trend channel on the four-hour timeframe, signaling a shift from prolonged consolidation that began in early November. This breakout, occurring on December 2, was accompanied by surging trading volume, pushing the price from a low of $0.00002739 to $0.00007088—a 157% increase over two days.

Source: TradingView

The Moving Average Convergence Divergence (MACD) indicator displays prominent green bars, confirming bullish divergence and momentum strength. Additionally, the Cumulative Volume Delta (CVD) has climbed beyond $41 million in net buying volume, reinforcing buyer dominance. However, the rally faces headwinds at the $0.00007088 level, which aligns with July’s local highs and could act as a psychological barrier. If bears regain control here, a pullback to support around $0.000050 might ensue, but sustained volume could propel LUNC toward $0.00010.

Broader market conditions also play a role. With Bitcoin and Ethereum showing stability, altcoins like LUNC benefit from risk-on sentiment. CoinMarketCap data places LUNC as the second-most trending token, indicating widespread retail interest that could prolong the uptrend.

Potential Risks and Market Sentiment

While the LUNC price surge appears robust, risks loom from the legal front. Do Kwon’s case could lead to asset seizures or further ecosystem disruptions, as noted by legal experts in financial publications. Sentiment indicators, such as social media buzz around the sentencing, have spiked, but fear of prolonged uncertainty might trigger profit-taking.

On-chain metrics provide reassurance: Transaction volumes are up, and holder distribution shows accumulation by long-term addresses. According to Glassnode analytics, large wallet activity has increased by 15% week-over-week, suggesting institutional confidence. Nonetheless, LUNC’s history of extreme volatility warrants caution; the token remains down over 99% from its all-time high, emphasizing the high-risk nature of such investments.

In summary, the convergence of liquidations, burns, and technical breakouts has catalyzed this rally, but sustainability hinges on external resolutions and market breadth. Crypto observers recommend diversified approaches and close monitoring of on-chain developments for informed decision-making.