LUNC Surges 49% to One-Month High Amid Potential Terra Revival

LUNC/USDT

$75,272,953.89

$0.00004453 / $0.00003833

Change: $0.0000062 (16.18%)

-0.0160%

Shorts pay

Contents

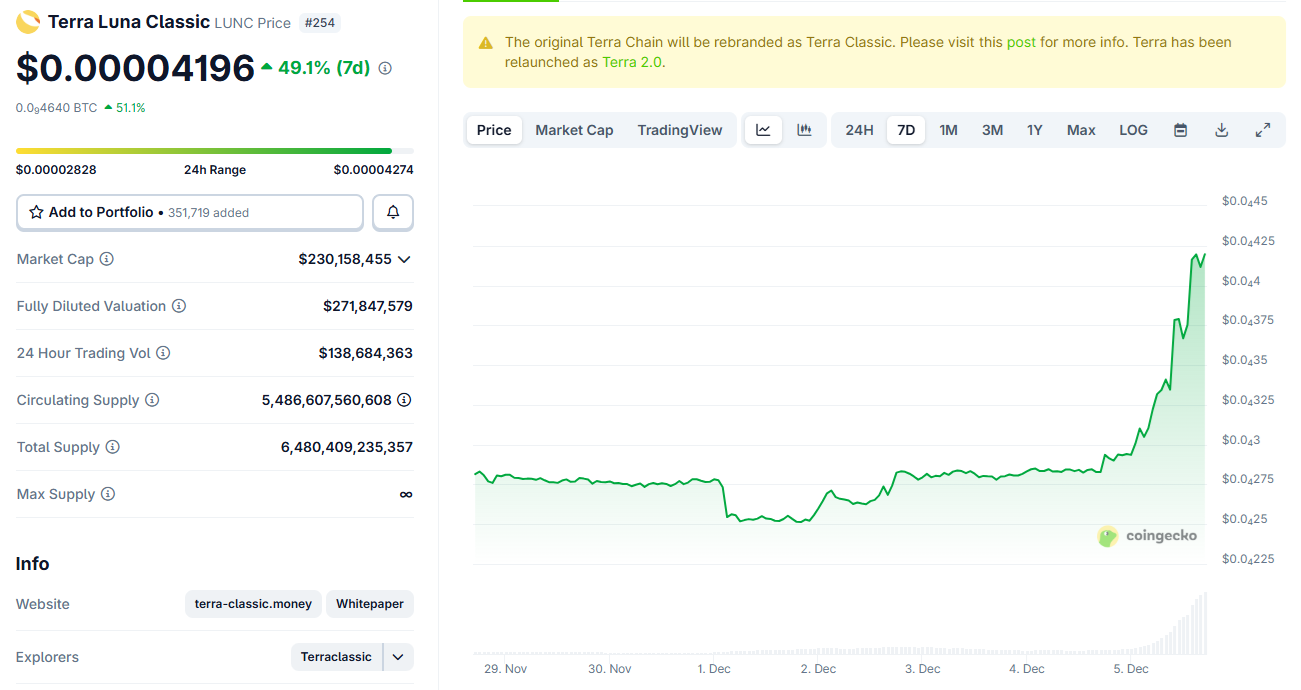

The LUNC token, representing Terra Luna Classic, surged over 49% to a one-month high of $0.000040, fueled by renewed community interest and exposure during Binance Blockchain Week. This rally reflects ongoing efforts to revive the protocol with improved risk management, signaling potential value for the original Terra chain.

-

LUNC exposure at Binance Blockchain Week: A moderator’s display of an old Luna T-shirt reignited interest in the defunct project.

-

Trading volume exploded 10 times to $128 million in 24 hours, the highest since January, driven by hype on major exchanges like Binance.

-

Community proposals for protocol relaunch: Efforts focus on enhancing DeFi capabilities, with website traffic spiking alongside the price surge.

LUNC rally surges 49% to one-month high amid Terra Luna Classic revival buzz. Explore causes, sustainability, and future prospects in this crypto update. Read now for insights!

What is Causing the Recent LUNC Rally?

LUNC rally stems from a mix of nostalgic exposure and community-driven revival efforts for Terra Luna Classic. The token, born from the original Terra chain after its 2022 collapse, climbed over 49% in the past day, hitting $0.000040 amid anticipation of a fresh value proposition. This uptick coincides with similar gains in LUNA, the Terra 2.0 token, highlighting competitive dynamics in the ecosystem’s potential resurgence.

LUNC went vertical based on short-term hype | Source: Coingecko

LUNC went vertical based on short-term hype | Source: CoingeckoFollowing the Terra ecosystem’s dramatic crash, which led to a hard fork creating Terra 2.0 and leaving LUNC as the legacy token, a dedicated community has kept the project alive. Data from Coingecko shows LUNC outperforming LUNA briefly during this surge, with both tokens reaching one-month peaks—LUNA at $0.09. This movement underscores the resilience of crypto communities, even for assets tied to past failures, as traders speculate on redemption narratives.

The broader market context adds layers to the LUNC rally. While Bitcoin and Ethereum maintain steady positions, smaller altcoins like LUNC often amplify volatility through targeted hype. According to on-chain analytics from platforms like Dune Analytics, transaction volumes on the Terra Classic chain have ticked up modestly, though total value locked in DeFi remains under $1 million. This indicates the rally is more sentiment-driven than fundamentally anchored at present.

Why Did LUNC Rise Suddenly?

The sudden LUNC rally gained momentum from a viral moment at Binance Blockchain Week, where a moderator sported a vintage Luna T-shirt, evoking memories of the pre-crash era. This low-key exposure went viral on social media, boosting mindshare by 193% in a single day, per LunarCrush metrics—albeit from a niche baseline.

Trading activity exploded, with daily volume jumping from $10 million to $128 million, marking the highest levels since January 2025. The LUNC/USDT pair on Binance, which has evaded delisting despite the project’s turmoil, absorbed this influx efficiently due to its liquidity. Community forums, such as those on Reddit and Telegram, buzzed with discussions on relaunching the protocol, emphasizing better risk mechanisms to prevent past algorithmic stablecoin failures.

This surge also mirrored a minor uptick in FTT, the FTX token, suggesting a theme of “zombie coin” revivals in crypto. Terra Classic’s website saw a parallel spike in visitors, reflecting genuine curiosity. However, DeFi utility lags; TerraSwap, the chain’s primary decentralized exchange, shows limited activity. Experts like those from Messari Research note that while hype drives short-term gains, sustainable growth requires concrete upgrades, such as the upcoming chain enhancements aimed at DeFi competitiveness.

Historically, LUNC has experienced similar pumps tied to community campaigns or external news, but retention has been fleeting. Current sentiment indicators from Santiment reveal elevated social volume, yet on-chain metrics like active addresses remain subdued compared to peaks in 2023. As Terra’s founder Do Kwon faces sentencing on December 11, 2025, prediction markets on platforms like Polymarket lean toward a 9-12 year term, potentially fueling further speculation without direct project ties.

Frequently Asked Questions

Is the LUNC Rally a Sign of Terra Luna Classic’s Long-Term Comeback?

The LUNC rally indicates short-term hype rather than a confirmed comeback for Terra Luna Classic. While volume and interest have surged, liquidity in DeFi applications stays low under $1 million, and past rallies have faded quickly. Community upgrades could build value, but experts advise caution until on-chain activity sustains.

What Factors Influence LUNC Price Movements Today?

LUNC price movements today are driven by social media buzz, exchange liquidity, and ecosystem news like protocol upgrades. For instance, the recent 49% gain followed event exposure, boosting trading to $128 million. Traders should monitor sentiment tools and avoid overexposure given the token’s illiquidity outside core pairs.

Key Takeaways

- Hype from Events Drives Gains: The Binance Blockchain Week T-shirt moment exemplifies how nostalgia can spark rapid rallies in legacy tokens like LUNC.

- Volume Surge Signals Interest: Trading hit $128 million, up 10x, but DeFi TVL remains minimal, highlighting the need for utility development.

- Monitor Legal Developments: Do Kwon’s December 11 sentencing could amplify volatility, though it won’t directly impact the decentralized chain—stay informed for trading decisions.

Conclusion

The LUNC rally and parallel LUNA uptick underscore the enduring appeal of Terra Luna Classic amid crypto’s recovery narratives. With communities pushing for DeFi revamps and risk mitigations, the ecosystem shows signs of life beyond its 2022 crash. As upgrades unfold and market dynamics evolve, investors eyeing Terra Luna Classic comeback should prioritize on-chain progress over fleeting hype—position yourself for potential long-term value in this resilient space.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026