Marshall Islands UBI: Tokenized USDM1 and Blockchain

ALT/USDT

$3,538,004.28

$0.007400 / $0.007030

Change: $0.000370 (5.26%)

-0.0139%

Shorts pay

Contents

Guidepost Solutions CEO Julie Myers Wood stated that blockchain technology is an effective tool for managing social benefit programs but noted significant challenges regarding regulatory compliance and sanctions. The company provided consulting to the Marshall Islands government on the compliance and sanctions framework for the tokenized USDM1 bond backed 1:1 by short-term US Treasury bills.

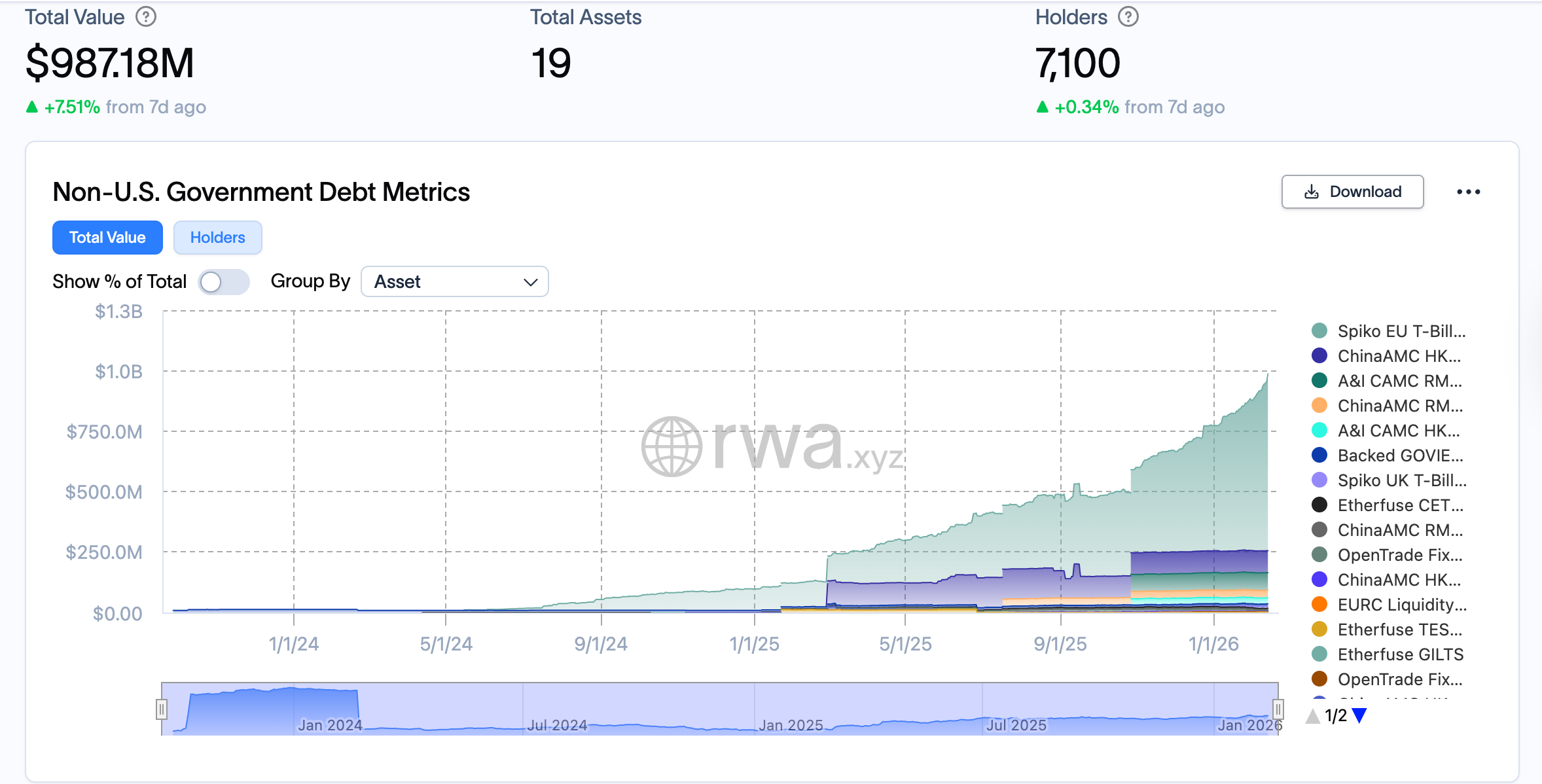

Non-US tokenized government debt market is growing. Source: RWA.XYZ

What is the Marshall Islands USDM1 Tokenized Bond?

USDM1 is a stablecoin-like tokenized bond backed 1:1 by short-term US Treasury bills. This structure brings the liquidity of traditional bonds to the blockchain. Token holders can access instant onchain redemption, eliminating T+2 settlement delays in traditional markets. The Marshall Islands government is using this token in its Universal Basic Income (UBI) program launched in November 2025.

Guidepost Solutions' Blockchain Consulting

In an interview with Cointelegraph, Julie Myers Wood emphasized that digital delivery accelerates the process and leaves an auditable trail. Blockchain's immutable ledger feature enables transparent tracking of payments; every transaction becomes verifiable on explorers. The company's consulting covers OFAC sanctions and FATF standards compliance.

UBI Program Details and Digital Payments

The government delivers quarterly payments to citizens via mobile wallets. This system uses smart contracts for automatic distribution: eligibility checks are performed onchain, minimizing fraud risk. Costs are reduced by 80%, and delays are eliminated. In the future, the program can be expanded with DAO-based governance.

50x Growth in the Tokenized US Treasury Market

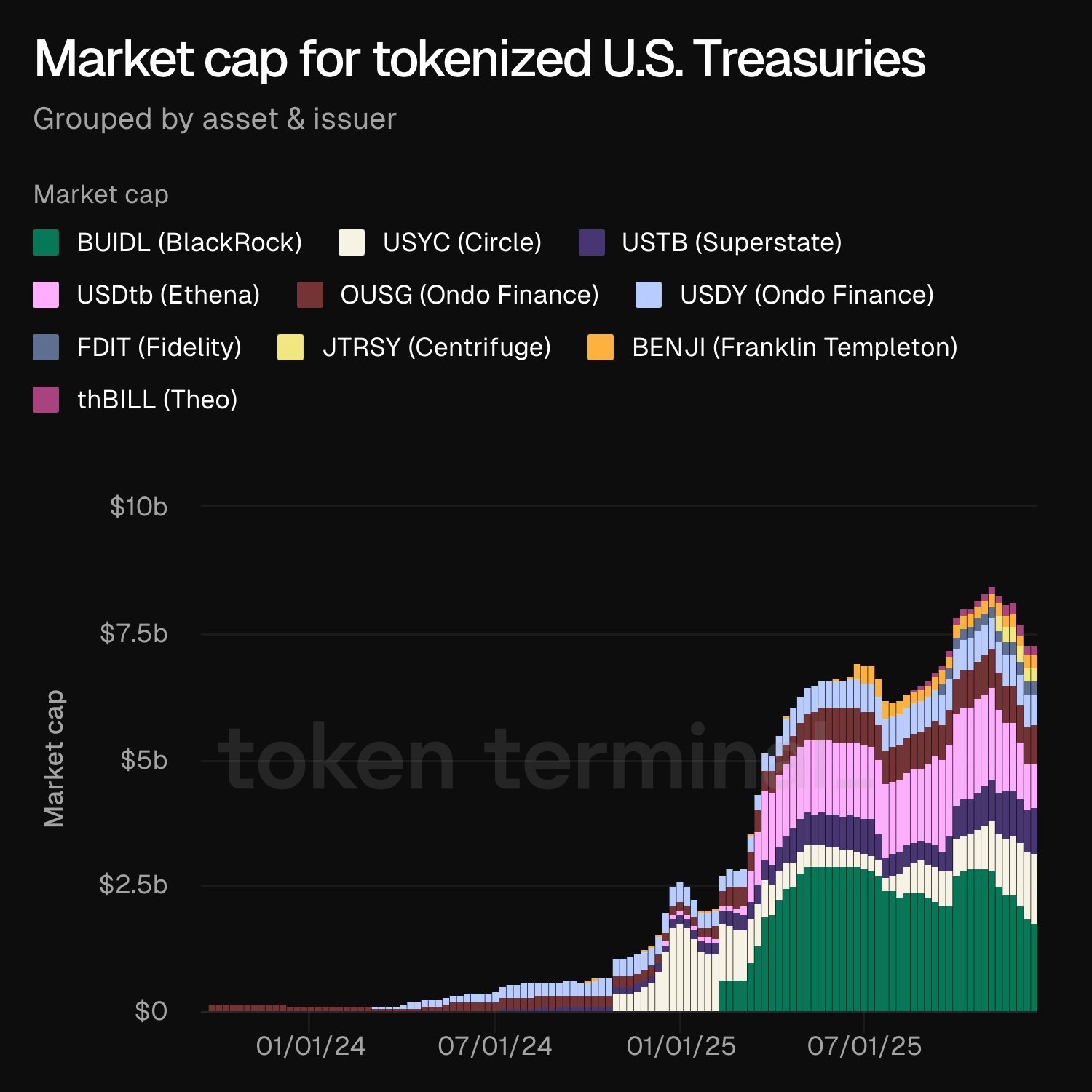

Tokenized US Treasury market has grown 50x since 2024. Source: Token Terminal

The market has grown 50 times since 2024 according to Token Terminal data. Fractional ownership and 24/7 trading opportunities are attracting retail investors. Taurus SA co-founder Lamine Brahimi predicts the market will reach $300 billion.

Regulatory Challenges: AML, KYC, and Sanctions

While governments aim to reduce delays with tokenized bonds, AML rules, sanctions, and KYC are major risks. Offshore structures can conflict with US regulations. Wood suggests hybrid compliance models: privacy is protected with zero-knowledge proofs while ensuring compliance.

ALT Technical Analysis: In the Context of the RWA Sector

RWA tokenization growth is impacting projects like ALT. As of 2026-02-14 18:31 UTC, ALT: $0.01 (+2.83% 24h). RSI 43.04 (neutral), downtrend, bearish Supertrend. EMA20: $0.0094.

| Support | Price | Score | Distance | Sources |

|---|---|---|---|---|

| S1 | $0.0089 | 70/100 ⭐ STRONG | -2.09% | Ichimoku Senkou A, Cloud Bottom, Prev Day Close |

| S2 | $0.0082 | 68/100 ⭐ STRONG | -9.79% | Fibo |

| Resistance | Price | Score | Distance | Sources |

|---|---|---|---|---|

| R1 | $0.0094 | 73/100 ⭐ STRONG | +3.41% | Fibo 0.214, R2, BB Middle, SMA 20 |

| R2 | $0.0100 | 67/100 ⭐ STRONG | +10.01% | ATR Upper, R3, Fibo 0.236 |

RWA rally could revitalize ALT futures. If S1 breaks, bearish continues; above R1 is a bullish signal. Click for detailed ALT analysis.