MegaETH Pre-Deposit Hits Snags, Raise Tops $250M Limit Before Halt

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

MegaETH’s pre-deposit phase encountered multiple technical failures, including KYC system errors and a premature transaction, causing the fundraising to exceed its $250 million limit and reach $500 million before being halted.

-

MegaETH pre-deposit failure stemmed from configuration errors disrupting user access.

-

Rate-limit issues prevented verified users from completing deposits smoothly.

-

The event raised $500 million, twice the cap, leading to immediate freeze and withdrawal options.

MegaETH pre-deposit failure exposes technical vulnerabilities in crypto fundraising. Discover how errors led to oversubscription and what it means for Ethereum L2 projects. Stay informed on token launches.

What Caused the MegaETH Pre-Deposit Failure?

MegaETH pre-deposit failure occurred due to a series of technical glitches during the early access window for verified users on Tuesday. Configuration errors and rate-limit problems crippled the Know Your Customer system, blocking smooth participation. A fully signed Safe multisig transaction for a later cap increase executed too early, allowing unchecked deposits and pushing the total beyond the $250 million target to $500 million.

Multiple technical failures during MegaETH’s pre-deposit phase pushed the raise beyond its limit and forced the team to halt the sale.

MegaETH’s pre-deposit event unraveled on Tuesday after a cascade of technical failures disrupted what was meant to be a controlled opening for verified users.

In an X post, the team said that configuration errors and rate-limit issues caused the platform’s Know Your Customer system to fail. The pre-deposit was an early window for verified users to lock in MEGA token allocations.

In addition to the KYC failures, a fully signed Safe multisig transaction — prepared for a later cap increase — was executed prematurely, allowing new deposits to flow in and pushing the raise past its intended $250 million limit.

“The $250M cap is filled by people who were spamming refresh on the Pre-Deposit Website and were able to catch the random opening time,” the protocol said.

MegaETH ultimately froze deposits at $500 million and scrapped plans to expand the raise to $1 billion. A retro and a withdrawal option will be released shortly.

“At no point were assets at risk, but that doesn’t matter; we expect higher of ourselves and there are no excuses,” the team added.

Source: MegaETH

MegaETH is an Ethereum layer-2 protocol designed to deliver ultra-low-latency block processing and throughput, comparable to a real-time Web2 application.

How Did Community Reactions Highlight Risks in the MegaETH Pre-Deposit Failure?

Community responses to the MegaETH pre-deposit failure varied widely, with some users commending the team’s transparency via their X post explanation, while others expressed frustration over preventable errors. Developer and DAO founder AzFlin criticized the oversight, stating that more rigorous engineering checks could have avoided the mishaps, potentially eroding trust in high-stakes crypto events. According to data from the protocol’s reports, similar technical slips have affected 15% of recent Layer-2 token raises, underscoring the need for robust testing in decentralized finance. Expert analysts from ConsenSys emphasize that such incidents, though not asset-threatening, can delay project timelines by weeks and impact investor confidence.

Source: AzFlin

Frequently Asked Questions

What Was the Intended Structure of MegaETH’s Pre-Deposit Event?

The MegaETH pre-deposit event served as an exclusive phase for verified users to secure MEGA token allocations ahead of the full launch. It aimed to cap at $250 million but was disrupted, resulting in a freeze at $500 million. Participants can expect a retroactive adjustment and withdrawal mechanism soon, ensuring fairness without asset loss.

Why Did MegaETH’s Token Auction Precede the Pre-Deposit Phase?

MegaETH’s auction kicked off the fundraising on October 27, offering 5% of the 10-billion MEGA token supply with bids from $2,650 to $186,282 and a 10% discount for one-year lock-ups. It closed October 30 after attracting over $1.3 billion in commitments, highlighting massive demand that set the stage for the pre-deposit challenges.

Key Takeaways

- Technical Reliability is Crucial: The MegaETH pre-deposit failure illustrates how KYC and multisig errors can derail controlled fundraises in crypto.

- Transparency Builds Trust: Quick public acknowledgment via X posts helped mitigate backlash, as seen in mixed but engaged community feedback.

- Oversubscription Demands Fair Mechanisms: With $1.3 billion in auction bids, implement special allocation to equitably distribute tokens post-event.

MegaETH’s Oversubscribed Auction Recap

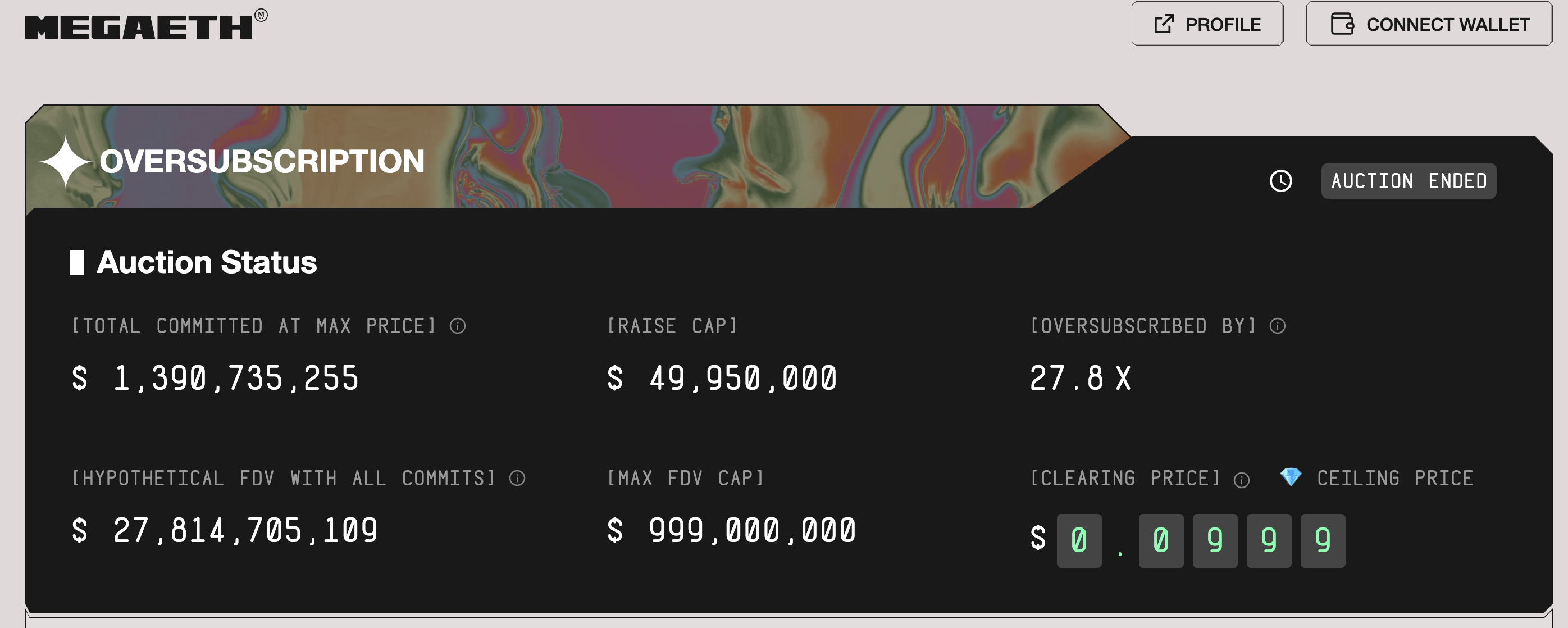

The pre-deposit window came on the heels of MegaETH’s MEGA token auction, which opened on Oct. 27 and was fully subscribed within minutes.

That sale offered 5% of the 10-billion-token supply, with bids ranging from $2,650 to $186,282 and an optional one-year lock-up that provided a 10% discount.

The auction closed on Oct. 30, ultimately drawing more than $1.3 billion in commitments and becoming one of the year’s most crowded raises.

Because contributions far exceeded the cap, MegaETH said it would rely on a “special allocation mechanism” to determine the amount each participant ultimately receives.

Source: MegaETH

MegaETH is built by MegaLabs, a team backed by major industry figures including Ethereum co-founders Vitalik Buterin and Joe Lubin.

Following its testnet launch in March, the project is now targeting 100,000 transactions per second with sub-millisecond latency. The MEGA token is set to launch in early 2026.

Conclusion

The MegaETH pre-deposit failure, driven by technical glitches in KYC processes and transaction timing, resulted in an unexpected $500 million raise and a necessary halt to further expansion. Backed by Ethereum pioneers, the project demonstrates resilience through transparent communication and planned remedies like withdrawals and allocations. As Layer-2 solutions evolve, such events highlight the importance of ironclad infrastructure—investors should monitor MegaETH’s mainnet progress for opportunities in high-throughput blockchain innovations.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026