MegaETH to Refund $500M Pre-Deposit Funds After Sloppy Execution

ETH/USDT

$15,764,184,570.61

$1,937.17 / $1,835.36

Change: $101.81 (5.55%)

-0.0004%

Shorts pay

Contents

MegaETH is refunding all $500 million raised in its pre-deposit campaign due to execution flaws and compliance requirements. The project admitted sloppy handling led to technical crashes and communication issues, prompting a full reset to ensure proper disclosures and user trust before mainnet launch.

-

MegaETH refund announcement: Full $500 million returned after chaotic 25 November launch plagued by site crashes and cap errors.

-

Depositors receive refunds via audited smart contract, with team promising to remember contributions for future opportunities.

-

Compliance concerns cited, including inadequate risk disclosures and last-minute changes, raising potential regulatory risks.

MegaETH refund: Full $500M pre-deposit return announced amid execution failures. Learn why compliance drove the reset and what’s next for USDm bridge users. Stay updated on crypto developments.

What is the MegaETH refund and why is it happening?

MegaETH refund refers to the project’s decision to return approximately $500 million in funds collected during its troubled pre-deposit bridge campaign on 25 November. The initiative aimed to preload collateral for 1:1 USDm conversions at mainnet launch but faltered due to operational mishaps. On 27 November, the team acknowledged these issues and committed to issuing full refunds to all participants to realign with compliance standards and rebuild confidence.

How did the MegaETH pre-deposit campaign go wrong?

The campaign unraveled quickly after launch, starting with site crashes that halted access for over an hour, frustrating users eager to participate. A initial $250 million cap filled in just 156 seconds, excluding many retail investors and sparking widespread complaints. Further complications arose from a multisig configuration error, setting a 4/4 signature threshold instead of the intended 3/4, which a user identified and triggered prematurely. The team responded with frantic adjustments, shifting caps from $1 billion to $400 million and then $500 million, but these changes lacked clear communication, leading to confusion and accusations of poor management. Community reactions were divided, with about 60% expressing bearish views on platforms like X, labeling the event a disorganized spectacle despite the evident high demand in a challenging market. According to on-chain data, these events locked funds across multiple deposit waves, amplifying the fallout. Experts in blockchain operations note that such high-stakes launches require rigorous testing, a step MegaETH evidently overlooked.

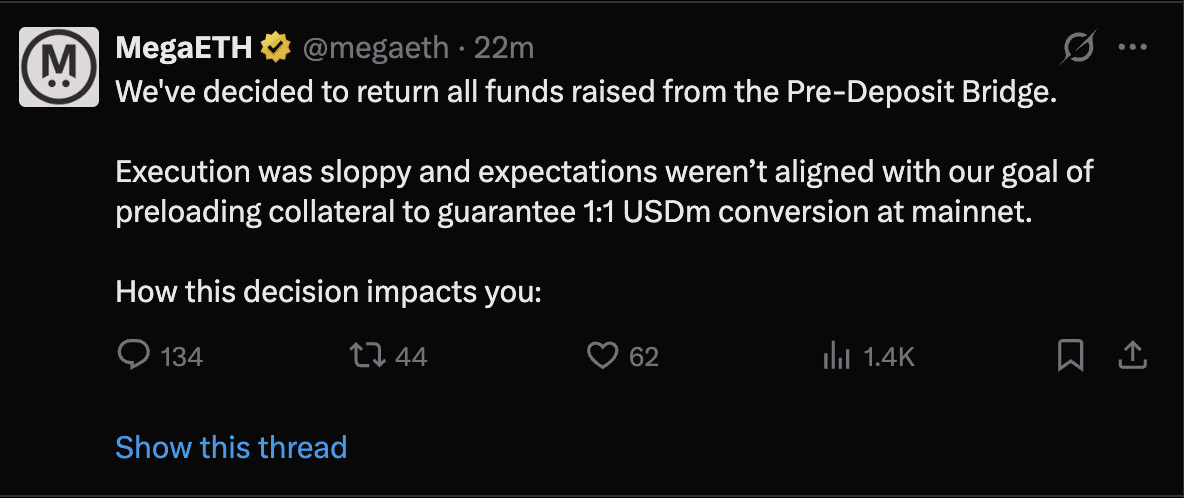

MegaETH has pulled the emergency brake on its disastrous pre-deposit campaign, announcing on 27 November that it will refund all $500 million raised just two days earlier in what the team now admits was a “sloppy” execution plagued by operational failures.

Source: X

The decision represents a complete reset for the project, which saw its 25 November bridge launch descend into hours of crashes, cap changes, and accusations of mismanagement—culminating in approximately $500 million locked across multiple waves of deposits marked by technical errors and communication breakdowns.

Frequently Asked Questions

What caused the need for the MegaETH refund of pre-deposit funds?

The MegaETH refund stems from execution shortcomings in the 25 November campaign, including website outages, erroneous multisig settings, and abrupt cap modifications without sufficient user notifications. These factors created operational chaos and potential compliance violations, leading the team to refund all $500 million to mitigate risks and ensure fair practices moving forward.

Will MegaETH depositors get their full funds back after the refund announcement?

Yes, all depositors are set to receive complete refunds through a newly developed smart contract that is undergoing independent audits for security. The process is expected to complete shortly, restoring funds to original wallets while the team works on a more stable bridge relaunch aligned with regulatory best practices.

Key Takeaways

- Sloppy execution led to refund: MegaETH’s admission of operational failures, like crashes and config errors, forced the full $500 million return to protect users and comply with standards.

- Compliance as a key driver: References to adhering to disclosure best practices highlight regulatory pressures influencing the decision to reset the campaign.

- Future mainnet implications: With December launch still planned, the team must address these issues to regain trust; depositors’ contributions are noted for potential future incentives.

“Execution was sloppy” – Team admits failures

In a detailed post on X, MegaETH openly addressed the core issues behind the campaign’s collapse. The team stated that their handling fell short of the objective to securely preload collateral for seamless USDm conversions upon mainnet activation. This transparency aims to restore credibility amid the backlash. The post outlined specific failures, emphasizing lessons learned for upcoming phases. Blockchain analysts from firms like Chainalysis have observed that similar incidents in layer-2 projects often stem from insufficient stress testing under high demand, a factor evident here given the rapid fund influx.

“Execution was sloppy and expectations weren’t aligned with our goal of preloading collateral to guarantee 1:1 USDm conversion at mainnet.”

The admission comes after the 25 November launch featured a series of mishaps that eroded participant trust and highlighted preparation gaps.

- Site crashes that left the bridge down for an hour, preventing timely deposits.

- A $250M cap that filled in 156 seconds, locking out most retail participants and fueling inequality concerns.

- A catastrophic multisig error where the team accidentally set 4/4 signature requirements instead of 3/4, delaying operations.

- User actions, such as one spotting and executing a transaction 34 minutes early to correct the blunder.

- Multiple emergency cap adjustments from $1B to $400M and then $500M as the team scrambled to regain control amid surging participation.

At the peak of the disorder, community sentiment on social platforms leaned bearish by roughly 60%, with detractors decrying the mismanagement while supporters highlighted the $500 million lockup as proof of strong market interest even in downturns. Data from Dune Analytics corroborates the scale, showing deposit volumes spiking beyond projections within minutes.

Compliance concerns drive decision

Beyond technical woes, the refund decision underscores deeper compliance challenges that could have invited scrutiny from regulators. The announcement explicitly mentions the need for all communications to align with legal standards, phrased in formal terms that imply consultation with legal advisors.

“All comms, however, need to follow compliance standards. [i.e. ‘we must adhere to best practices in our disclosures at this juncture’].”

This language points to risks in areas like incomplete risk warnings to users, unplanned cap alterations without announcements, and the pre-deposit model’s possible classification under securities regulations. In the evolving crypto landscape, projects face increasing oversight from bodies like the SEC, where transparency failures can lead to investigations. By initiating refunds and pledging enhanced disclosures, MegaETH positions itself to avert such outcomes. Industry reports from sources like CoinDesk indicate that over 20% of recent token launches have encountered similar compliance hurdles, often resulting in delays or penalties.

- Inadequate disclosure of terms and risks to participants during the high-pressure launch.

- Last-minute changes to caps without proper communication, potentially misleading investors.

- Potential securities law implications of the pre-deposit structure, especially with locked funds.

Through this reset, emphasizing “compliance standards” and “best practices,” the project seeks to fortify its operations against future legal challenges and foster a more reliable ecosystem.

The path forward

Despite the setback, MegaETH remains committed to its December mainnet rollout, viewing the refund as a necessary pivot to refine the USDm bridge. The team is deploying an audited smart contract for refunds, ensuring secure and prompt fund returns. Participants can expect notifications soon, with assurances that their involvement will factor into upcoming incentives. However, the episode has cast doubts on the project’s readiness, as rebuilding trust requires not just fixes but demonstrated competence. Observers in the DeFi space, drawing from past Ethereum scaling projects, stress that thorough audits and beta testing are essential to prevent recurrences. For the broader crypto community, this serves as a reminder of the volatility in unproven bridges, urging caution in early-stage engagements.

For now, depositors await the audited refund contract and hope their funds return “shortly.” Whether they’ll trust MegaETH enough to participate again when the bridge reopens remains to be seen, but the project’s transparency in admitting faults could pave the way for redemption.

Conclusion

The MegaETH refund marks a pivotal moment for the project, addressing the chaos of the pre-deposit campaign through full $500 million returns driven by execution lapses and compliance concerns. By prioritizing user refunds and regulatory adherence, MegaETH demonstrates accountability in a sector rife with pitfalls. As the mainnet approaches, stakeholders should monitor updates closely; this reset could ultimately strengthen the platform’s foundation, offering more secure opportunities in the USDm bridge ecosystem. Investors are encouraged to review project roadmaps and conduct due diligence before engaging in future campaigns.