Metaplanet Boosts Bitcoin Holdings to 35,102 BTC Amid Rising Leverage Risks

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

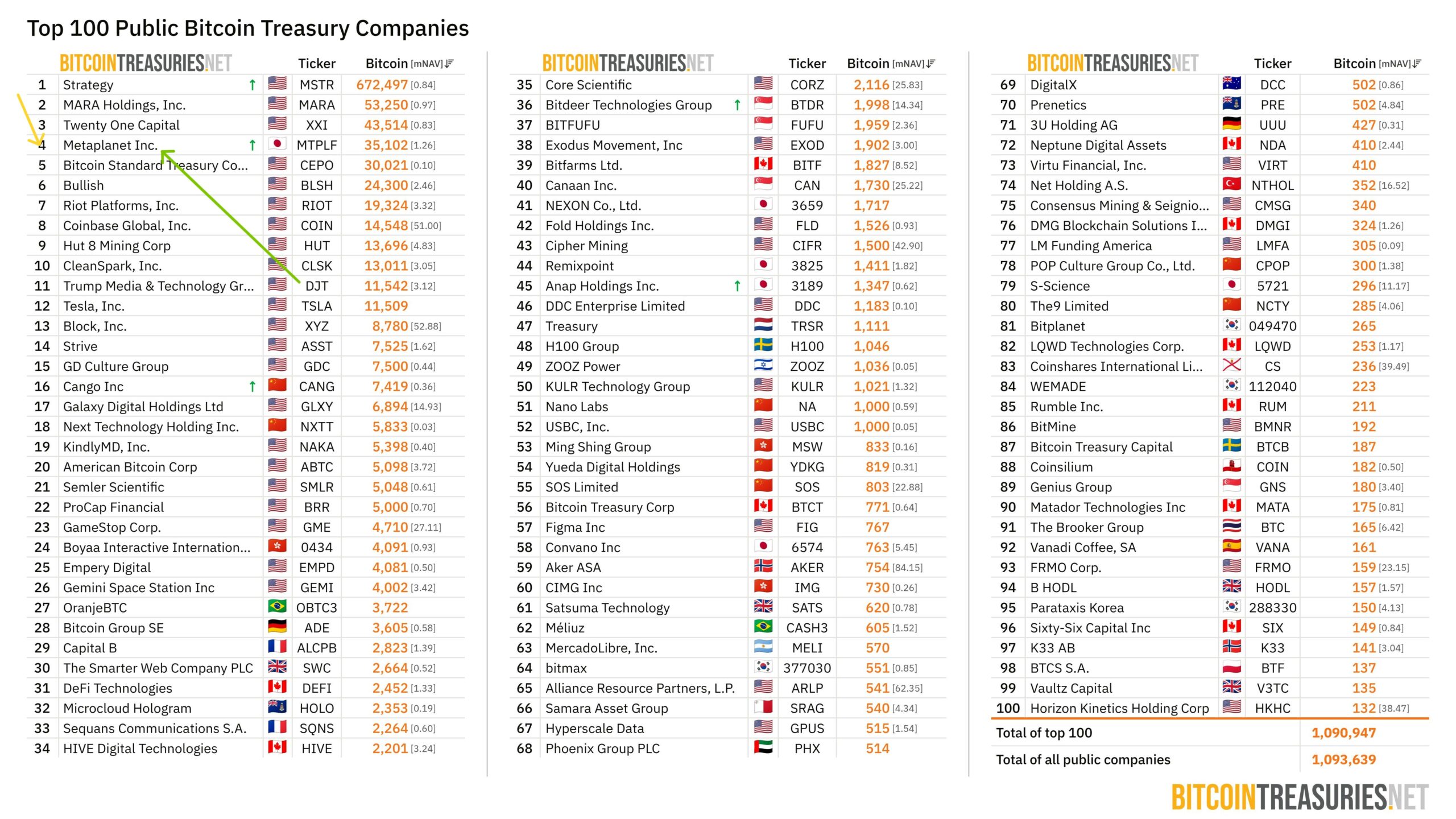

Metaplanet resumed aggressive Bitcoin purchases on December 30, acquiring 4,279 BTC for ¥69.855 billion, boosting total holdings to 35,102 BTC and securing fourth place among public companies worldwide.

-

Metaplanet ranks fourth globally in public Bitcoin treasuries despite a prior pause.

-

Purchases funded via equity issuance and $280 million in Bitcoin-collateralized loans.

-

Total holdings valued amid unrealized losses exceeding $500 million as Bitcoin trades below average cost of ¥15.9 million per BTC.

Metaplanet Bitcoin purchases surge with 4,279 BTC added for ¥69.855B, totaling 35,102 BTC. Explore funding strategies, risks, and market impact. Stay ahead in crypto investments today!

Source: Bitcoin Treasuries

What are Metaplanet’s latest Bitcoin purchases?

Metaplanet Bitcoin purchases resumed aggressively on December 30 with the acquisition of 4,279 BTC valued at ¥69.855 billion. This brought the company’s total holdings to 35,102 BTC, positioning it as the fourth-largest public Bitcoin treasury holder globally, according to Bitcoin Treasuries data. The move occurred despite Bitcoin trading below Metaplanet’s average acquisition cost.

How is Metaplanet funding its Bitcoin accumulation strategy?

Metaplanet finances its Bitcoin accumulation through a combination of equity issuance and Bitcoin-collateralized debt facilities. In the fourth quarter of 2025, the company secured $280 million in such loans, which were fully utilized by December 29. Additionally, it raised ¥21.249 billion by issuing 23.61 million Class B preferred shares, fully diluting share counts. These methods increase Bitcoin exposure per share while introducing leverage. Management tracks BTC Yield and BTC Gain as key metrics, though they exclude debt obligations and unrealized losses. Bitcoin Treasuries reports highlight this approach as central to Metaplanet’s treasury strategy, with the average purchase price at ¥15,945,691 per BTC as of December 30, leading to over $500 million in unrealized losses given current market prices below this threshold.

Frequently Asked Questions

What is the current size of Metaplanet’s Bitcoin holdings after the latest purchase?

Following the December 30 acquisition of 4,279 BTC, Metaplanet’s total Bitcoin holdings stand at 35,102 BTC. This ranks the company fourth among public entities worldwide, per Bitcoin Treasuries rankings, underscoring its commitment to Bitcoin as a core treasury asset despite market volatility.

Is Metaplanet still buying Bitcoin below its average cost?

Yes, Metaplanet continued its Bitcoin purchases even as prices dipped below the firm’s average acquisition cost of about ¥15.9 million per BTC. This strategy reflects long-term conviction, funded by equity and debt, though it amplifies balance sheet sensitivity to price fluctuations.

Key Takeaways

- Aggressive accumulation: Metaplanet added 4,279 BTC to reach 35,102 total, holding fourth place globally.

- Funding mix: Relies on $280 million loans and ¥21.249 billion equity raise, increasing dilution and leverage.

- Risk awareness: Faces $500+ million unrealized losses; monitor BTC recovery for shareholder value.

Conclusion

Metaplanet’s Bitcoin purchases have propelled it to a top-tier position among public holders with 35,102 BTC, funded strategically through equity and debt amid unrealized losses. Bitcoin Treasuries data affirms its global ranking. As market dynamics evolve, investors should track BTC price recovery and leverage risks for informed decisions on this Metaplanet Bitcoin accumulation play.