Michael Selig Backs Crypto Market Oversight in CFTC Confirmation Hearing

Contents

Michael Selig, nominated by President Donald Trump to chair the CFTC, expressed strong support for robust oversight in digital asset markets during his Senate confirmation hearing. He emphasized the need for a “cop on the beat” to regulate spot digital commodities while avoiding enforcement-heavy approaches that could push firms offshore, highlighting the sector’s growth to nearly $4 trillion.

-

Selig advocates for CFTC leadership in digital asset regulation, focusing on spot markets and onchain applications to foster innovation without excessive enforcement.

-

Senators from both parties questioned his views on DeFi and potential conflicts, with Selig stressing diverse viewpoints and clear rules.

-

The digital asset economy has expanded to approximately $4 trillion, underscoring the urgency for balanced regulation as per Selig’s testimony.

Michael Selig’s CFTC confirmation hearing highlights push for digital asset oversight amid $4T market growth. Learn his stance on DeFi, enforcement, and agency leadership. Stay informed on crypto regulation updates.

What Did Michael Selig Say About Digital Asset Regulation in His CFTC Confirmation Hearing?

Michael Selig, currently serving as chief counsel for the crypto task force at the US Securities and Exchange Commission, outlined a balanced approach to digital asset regulation during his Senate Agriculture Committee hearing on Wednesday. He supported establishing a “cop on the beat” for these markets to ensure stability and innovation, while cautioning against a regulation-by-enforcement model that might drive companies overseas. Selig highlighted the rapid evolution of the digital asset economy, now valued at nearly $4 trillion, as a pivotal moment requiring thoughtful oversight.

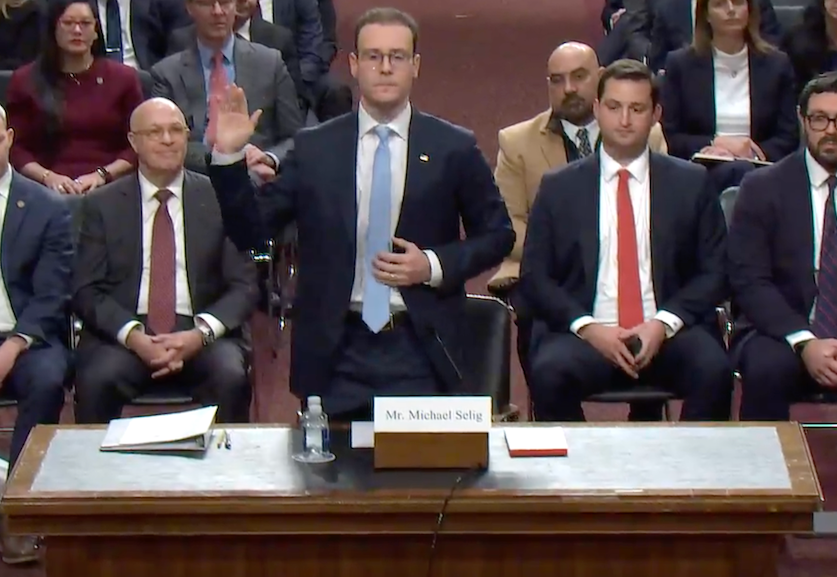

Michael Selig addressing lawmakers on Wednesday’s confirmation hearing. Source: US Senate Agriculture Committee

Selig’s testimony came as part of his nomination process to succeed Caroline Pham as the sole commissioner and chair of the Commodity Futures Trading Commission (CFTC). President Donald Trump selected Selig after withdrawing an earlier nominee, Brian Quintenz. The hearing addressed key concerns from lawmakers across the political spectrum, including potential conflicts of interest from his SEC background and his policy positions on emerging financial technologies.

In his opening remarks, Selig drew from his experience advising diverse market participants, including digital asset firms. He stressed the importance of proactive rulemaking over punitive actions, noting that unclear regulations could stifle growth in this burgeoning sector. “We’re at a unique moment in the history of our financial markets,” Selig stated, pointing to the emergence of new technologies, products, and platforms that have transformed digital assets from a niche interest into a major economic force.

The Senate Agriculture Committee is set to vote on his nomination as early as Thursday, according to the chamber’s calendar. Confirmation would mark a significant shift for the CFTC, which has operated with limited leadership recently, potentially influencing how spot digital commodity markets are supervised.

How Does Michael Selig Approach Decentralized Finance and Crypto Enforcement?

Senator John Boozman, the committee chair from Arkansas, urged the CFTC to assume a primary role in overseeing spot digital commodity trading, aligning with ongoing discussions around a market structure bill that could expand the agency’s authority over crypto assets. Boozman asserted, “The CFTC, and only the CFTC, should regulate the trading of digital commodities,” emphasizing the need for jurisdictional clarity in a fragmented regulatory landscape.

Selig responded thoughtfully to queries on decentralized finance (DeFi), describing it not merely as a trend but as encompassing onchain markets and applications. He advocated evaluating the specific features of these technologies, including whether intermediaries are involved, to craft appropriate rules. “When we’re thinking about DeFi, it’s something of a buzzword, but really we should be looking to onchain markets and onchain applications and thinking about the features of these applications as well as where there’s an actual intermediary involved,” Selig explained.

Regarding enforcement, Selig reiterated the necessity of vigilant supervision, particularly for spot digital asset commodity markets. He affirmed that having a “cop on the beat” is vitally important to protect investors and maintain market integrity without overreach. This stance draws from his SEC experience, where he has contributed to frameworks addressing crypto-related risks, supported by data from industry reports showing the sector’s volatility and growth potential.

Experts in financial regulation, such as those from the Brookings Institution, have echoed similar sentiments, noting that balanced oversight could prevent past crises like those seen in unregulated crypto exchanges. Selig’s position aligns with broader calls for the CFTC to lead in this space, potentially shaping legislation that integrates digital assets into traditional derivatives markets. His testimony included references to the agency’s existing tools, like surveillance mechanisms, which could be adapted for crypto without reinventing the wheel.

Statistics from recent market analyses indicate that digital asset trading volumes have surged, with spot markets alone handling billions daily. Selig’s emphasis on clear guidelines aims to mitigate risks such as fraud and manipulation, which have plagued the industry. By prioritizing technology-neutral rules, he seeks to encourage domestic innovation, countering trends where firms relocate to more lenient jurisdictions.

Frequently Asked Questions

What Are the Potential Conflicts of Interest for Michael Selig in His CFTC Nomination?

Michael Selig’s prior role at the SEC’s crypto task force raises questions about divided loyalties between agencies, but he assured lawmakers of his commitment to impartiality. With experience advising digital asset firms, Selig pledged to recuse himself from matters involving past clients, focusing on CFTC priorities like derivatives oversight. This approach, detailed in his 45-minute testimony, aims to build trust amid the nomination process.

How Might Selig’s Confirmation Impact Crypto Regulation Under the Trump Administration?

If confirmed, Michael Selig could steer the CFTC toward expanded crypto authority, emphasizing spot market supervision and DeFi innovation in a way that suits voice queries on regulatory shifts. This would likely involve collaborating with the SEC for cohesive rules, reducing uncertainty for the $4 trillion digital asset sector and promoting stable growth under President Trump’s pro-business stance.

Key Takeaways

- Growth of Digital Assets: The sector has ballooned to nearly $4 trillion, necessitating urgent yet balanced regulatory frameworks to support expansion.

- Opposition to Enforcement-Heavy Regulation: Selig warns that aggressive tactics could offshore companies, advocating for clear, proactive rules instead.

- Push for CFTC Leadership: Lawmakers like Senator Boozman seek exclusive CFTC control over digital commodities, with Selig endorsing a supervisory “cop on the beat.”

Conclusion

Michael Selig’s confirmation hearing for CFTC chair underscores the evolving landscape of digital asset regulation, where his views on DeFi and spot markets could define the agency’s future role. With the digital economy at a crossroads, his emphasis on diverse leadership and measured oversight promises stability for investors. As the Senate advances his nomination, stakeholders should monitor developments for opportunities to engage in shaping crypto policies that balance innovation and protection.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026