MicroStrategy Raises $748M from Shares, Pauses Bitcoin Buys as Reserves Hit $2.19B

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

MicroStrategy has bolstered its cash reserves to $2.19 billion by selling 4.5 million common shares last week, while temporarily pausing its Bitcoin purchases amid market volatility in 2025. This move supports dividend payments and debt obligations without altering its core Bitcoin holdings of 671,268 BTC.

-

Share sale generates $747.8 million in proceeds, enhancing financial stability for MicroStrategy’s ongoing operations.

-

The company maintains a substantial USD reserve to cover at least 12 months of preferred stock dividends and interest expenses.

-

MicroStrategy holds 671,268 Bitcoin valued at an average purchase price of $74,972 per BTC, acquired for $50.33 billion total.

MicroStrategy’s Bitcoin strategy shifts with $747.8M share sale boosting cash to $2.19B, pausing BTC buys in 2025 downturn. Explore holdings and treasury impacts now.

What is MicroStrategy’s Current Bitcoin Strategy in 2025?

MicroStrategy’s Bitcoin strategy involves maintaining a robust treasury of digital assets while ensuring liquidity through diversified funding sources. In late 2025, the company sold common shares to increase its cash reserves, pausing further Bitcoin acquisitions to rebalance amid declining crypto markets. This approach prioritizes financial resilience without reducing its existing Bitcoin holdings.

MicroStrategy executive chairman Michael Saylor recently shared an update on the company’s financial position. The firm now holds cash reserves of $2.19 billion alongside its Bitcoin treasury of 671,268 BTC.

Source: Michael Saylor

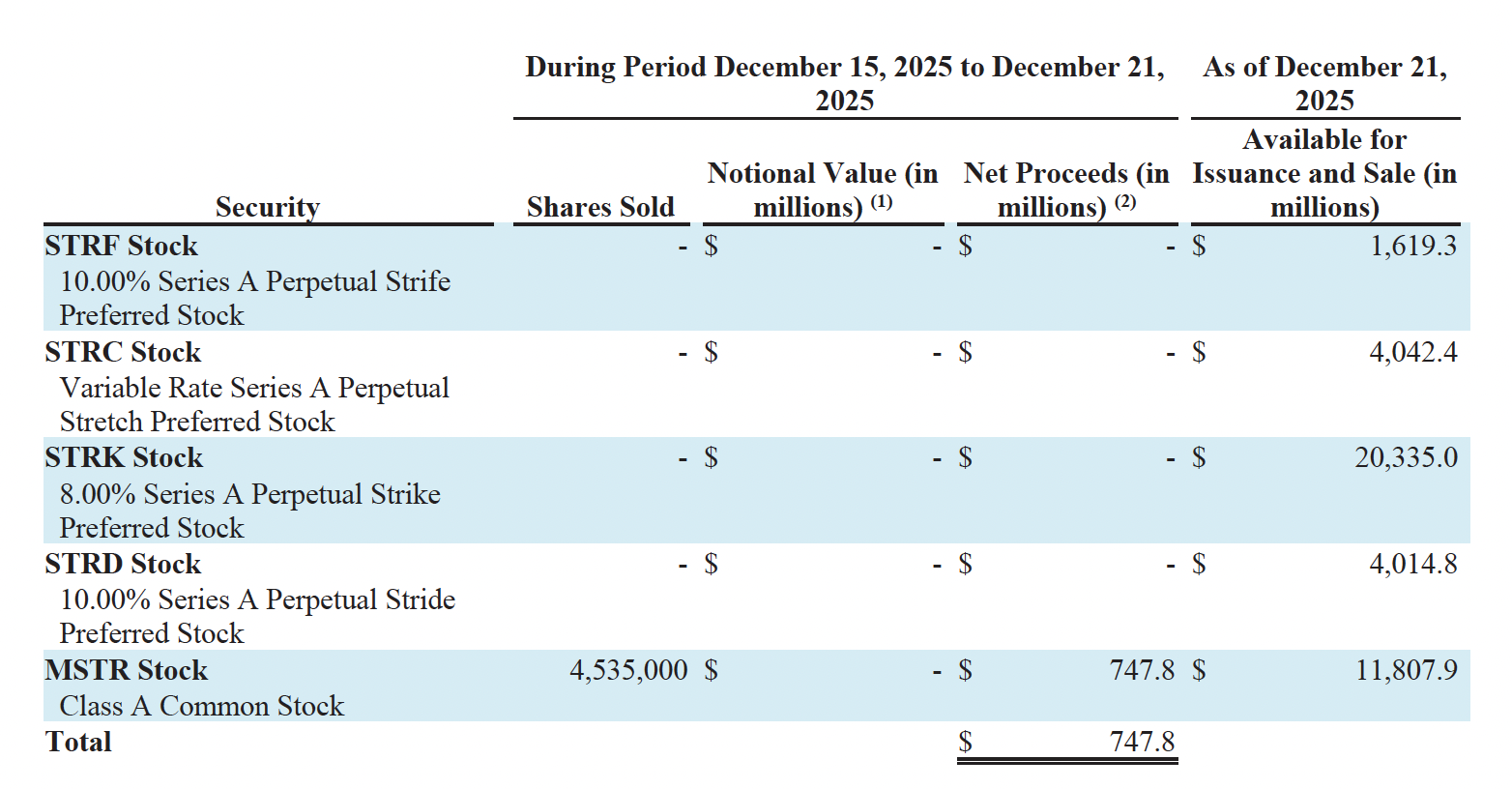

A recent regulatory filing reveals that MicroStrategy sold approximately 4.535 million shares of its Class A common stock between December 15 and 21, 2025. This transaction, part of its at-the-market offering program, yielded $747.8 million in net proceeds. No preferred stock was sold during this period.

In early December 2025, MicroStrategy established a dedicated US dollar reserve, initially valued at $1.44 billion. This reserve is designed to fund preferred stock dividends and interest on outstanding debt, providing a buffer against market uncertainties.

“MicroStrategy’s current intention is to maintain a USD Reserve in an amount sufficient to fund at least twelve months of its dividends, and MicroStrategy intends to strengthen the USD Reserve over time, with the goal of ultimately covering 24 months or more of its dividends,” the company stated in its announcement.

Form 8-K SEC filing. Source: MicroStrategy

The buildup of cash reserves coincides with a temporary halt in Bitcoin purchases. MicroStrategy’s total Bitcoin acquisitions to date cost $50.33 billion, with an average price of $74,972 per Bitcoin. The most recent purchase occurred on December 15, 2025, when it acquired 10,645 Bitcoin for $980.3 million at an average of $92,098 per token.

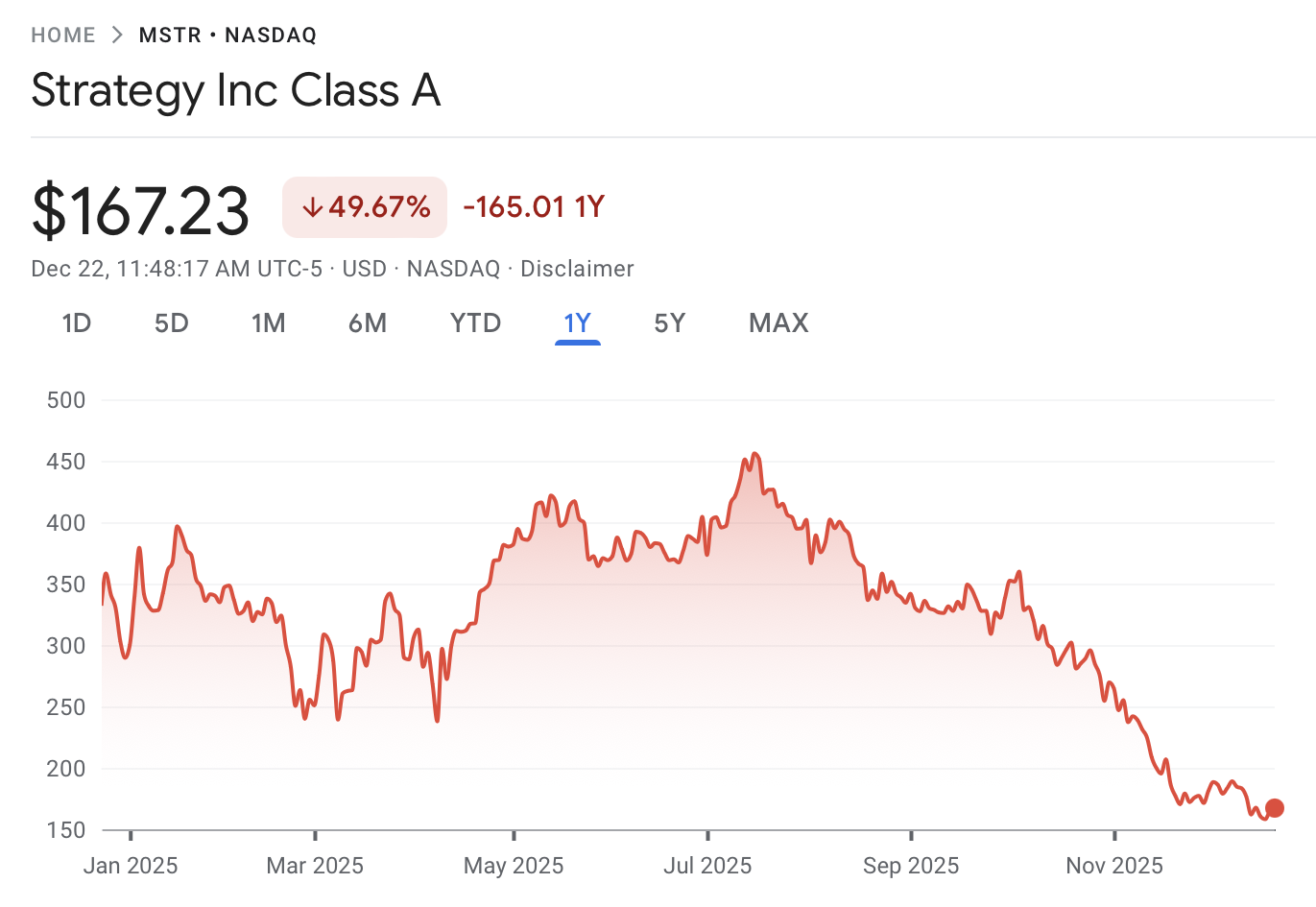

Over the past 12 months, MicroStrategy’s common stock has declined by nearly 50%, reflecting broader challenges in the cryptocurrency sector.

Source: Google Finance

How Are Bitcoin Treasury Companies Performing in the 2025 Bear Market?

Bitcoin treasury strategies have gained traction among corporations, but the 2025 bear market has tested their resilience. Companies adopting this model, inspired by MicroStrategy, initially saw stock gains but now face significant drawdowns as Bitcoin prices hover around $89,433, down 4.4% over the year.

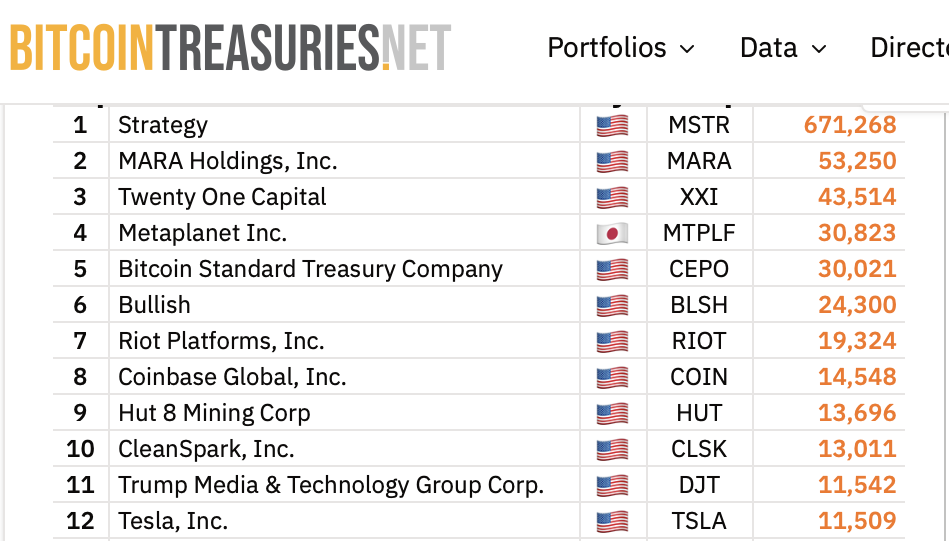

MicroStrategy remains the largest corporate holder with 671,268 BTC. Other firms, such as MARA Holdings—the second-largest holder with 53,250 BTC—have experienced a roughly 38% drop in share value this year. MARA, primarily a Bitcoin mining operation, exemplifies the volatility tied to crypto exposure.

Metaplanet, which launched its Bitcoin treasury in April 2024 and now holds 30,823 BTC as the fourth-largest holder, has seen its shares plummet about 75% in the last six months. Despite this, the stock remains up 26% year-to-date, showing some underlying strength.

These trends highlight the risks of heavy Bitcoin reliance. As per data from BitcoinTreasuries.NET, corporate adoption continues, but sustained market pressure in 2025 has led to reevaluations of treasury compositions. Experts note that while Bitcoin’s long-term value proposition endures, short-term liquidity management is crucial for survival.

Top Bitcoin treasury companies. Source: BitcoinTreasuries.NET

The shift toward Bitcoin as a treasury asset began accelerating in 2024, with multiple firms repositioning to hold digital assets. However, the ensuing market decline has wiped out initial enthusiasm, prompting adjustments like MicroStrategy’s recent pause on purchases. Financial analysts emphasize that diversified reserves, such as USD holdings, provide essential stability during downturns.

Michael Saylor has long advocated for Bitcoin as a superior store of value, often debating whether it functions more as money or a commodity. This perspective underpins MicroStrategy’s unwavering commitment, even as it navigates current challenges.

Frequently Asked Questions

What Are MicroStrategy’s Total Bitcoin Holdings and Acquisition Costs in 2025?

MicroStrategy holds 671,268 Bitcoin as of late 2025, acquired at a total cost of $50.33 billion with an average price of $74,972 per BTC. The latest addition was 10,645 BTC bought on December 15 for $980.3 million at $92,098 each, reflecting strategic timing before the purchase pause.

Why Did MicroStrategy Pause Bitcoin Purchases After Selling Shares?

MicroStrategy paused Bitcoin buys to rebalance its assets and build cash reserves amid the 2025 crypto downturn. The $747.8 million from share sales supports a USD reserve for dividends and debt, ensuring operational continuity while holding steady on existing BTC positions for long-term value.

Key Takeaways

- Cash Reserve Growth: MicroStrategy’s sale of 4.5 million shares added $747.8 million, elevating reserves to $2.19 billion to cover 12+ months of financial obligations.

- Bitcoin Holdings Stability: With 671,268 BTC at an average cost of $74,972, the firm prioritizes preservation over expansion during market volatility.

- Market-Wide Challenges: Peers like MARA Holdings and Metaplanet face 38% and 75% share drops, underscoring the need for liquidity in Bitcoin treasury strategies.

Conclusion

MicroStrategy’s Bitcoin strategy in 2025 demonstrates prudent financial management by leveraging share sales to fortify cash reserves while safeguarding its substantial BTC holdings. As corporate Bitcoin adoption faces bear market pressures, this balanced approach highlights the importance of liquidity alongside digital asset exposure. Investors should monitor ongoing developments, as MicroStrategy’s model continues to influence treasury trends—stay informed for potential shifts in the evolving crypto landscape.