MicroStrategy Urges MSCI to Retain MSTR in Indexes Amid Bitcoin Holdings Expansion

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

MicroStrategy is actively lobbying MSCI to keep its stock (MSTR) in major indexes like the MSCI World Index, despite increasing its Bitcoin holdings to 650,000 BTC. This comes amid consultations on excluding digital asset treasury firms due to volatility concerns.

-

MicroStrategy’s efforts focus on highlighting the company’s strategic value beyond Bitcoin exposure.

-

MSCI’s consultation on digital asset treasuries ends December 31, 2025, with decisions by January 15, 2026.

-

MSTR stock has declined 54% over the past year, reflecting Bitcoin’s price drop below $90,000, per TradingView data.

MicroStrategy urges MSCI to retain MSTR in indexes amid Bitcoin holdings surge to 650,000 BTC. Explore the implications for digital asset firms and index inclusion. Stay informed on crypto market shifts—read more now.

What is MicroStrategy’s Role in the MSCI World Index?

MicroStrategy’s MSTR stock was added to the MSCI World Index in May 2024, becoming one of the largest inclusions due to its Bitcoin-focused treasury strategy. This addition highlighted the growing integration of cryptocurrency-linked firms into traditional financial benchmarks. However, ongoing consultations threaten its position amid concerns over volatility.

Why is MSCI Considering Excluding Digital Asset Treasury Firms?

MSCI launched a consultation in October 2025 to evaluate removing digital asset treasury (DAT) companies, including MicroStrategy, from its Global Standard Indexes. The review stems from increased volatility linked to Bitcoin holdings, with firms like MicroStrategy holding substantial BTC reserves. According to MSCI’s announcement, the process involves stakeholder input until December 31, 2025, with final decisions expected by January 15, 2026. Expert analysis from financial institutions like JPMorgan suggests potential outflows of up to $2.8 billion if exclusions occur, though MicroStrategy’s CEO Michael Saylor has questioned the precision of these estimates. MSCI, a leading index provider tracking over 1,300 companies across 23 developed markets, aims to maintain index stability. Saylor emphasized ongoing engagement, stating the company is communicating directly with MSCI to underscore its broader business merits. This move follows a boom in DAT stocks during July 2025, but subsequent declines, including MSTR’s 54% drop over the past year, have amplified scrutiny. Data from TradingView illustrates this downturn, tying it to Bitcoin’s fall below $90,000. Saylor noted at a recent event that equity volatility is inherent due to the firm’s amplified Bitcoin exposure: if Bitcoin drops 30-40%, MSTR equity falls more sharply.

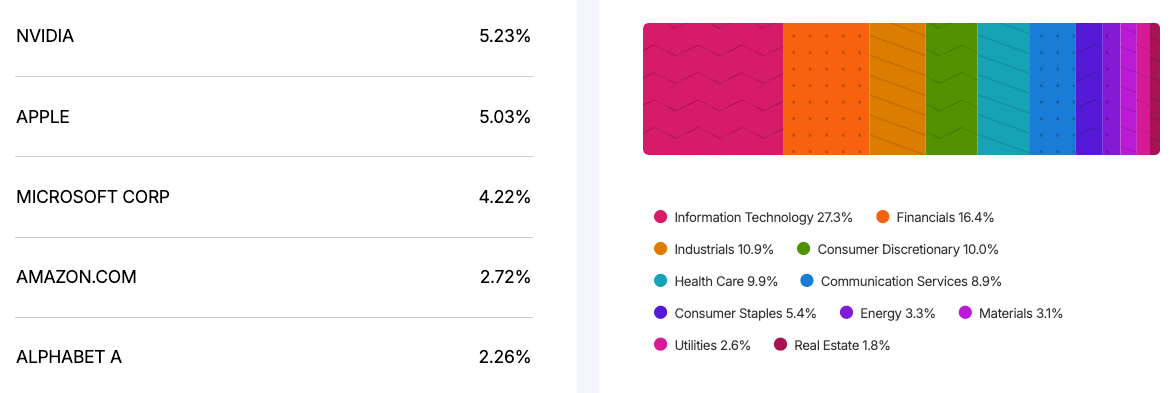

Top five constituents of the MSCI World index and sector weights. Source: MSCI

The MSCI World Index, originally launched in 1986 by Morgan Stanley Capital International, serves as a key benchmark for global equities. It encompasses large and mid-cap firms, with technology leaders like Nvidia and Apple comprising over 10% of its weight. MicroStrategy’s inclusion in May 2024 marked a pivotal moment, three years after it began its Bitcoin accumulation strategy, reaching 214,000 BTC by then. Today, holdings stand at 650,000 BTC, a symbolic milestone even as 2025 targets were lowered amid market pressures.

Japanese firm Metaplanet provides a comparative example in the DAT sector. By mid-October 2025, its enterprise value fell below its Bitcoin holdings, signaling challenges for similar strategies. MicroStrategy recently established a $1.44 billion U.S. dollar reserve to cover preferred stock dividends and debt interest, demonstrating financial prudence. Saylor has indicated Bitcoin sales would be a last resort if net asset value drops or capital access tightens.

Strategy (MSTR) stock has dropped by 54% in the past year. Source: TradingView

Frequently Asked Questions

What Happens if MicroStrategy is Excluded from MSCI Indexes?

If excluded, MicroStrategy could face significant outflows, potentially $2.8 billion according to JPMorgan estimates, impacting investor funds tracking the indexes. This might pressure MSTR stock prices further, though the company is advocating for retention based on its overall value. Final rulings are due in early 2026.

How Has MicroStrategy’s Bitcoin Strategy Affected Its Stock Performance?

MicroStrategy’s aggressive Bitcoin purchases, now at 650,000 BTC, have amplified stock volatility, with MSTR dropping 54% in the past year as Bitcoin fell below $90,000. This treasury approach boosts upside in rallies but heightens downside risks, as Saylor explained: equity falls more than Bitcoin in downturns.

Key Takeaways

- MSCI Consultation Impact: The ongoing review of digital asset treasuries could reshape index inclusion for crypto-exposed firms like MicroStrategy.

- Bitcoin Holdings Milestone: Despite market dips, MicroStrategy holds 650,000 BTC, supported by a new $1.44 billion reserve for financial obligations.

- Advocacy Efforts: CEO Michael Saylor is engaging MSCI to retain MSTR, challenging volatility concerns with strategic communications.

Conclusion

MicroStrategy’s push to stay in the MSCI World Index underscores the tensions between digital asset treasury strategies and traditional indexing. With Bitcoin holdings at 650,000 BTC and a 54% stock decline reflecting broader crypto volatility, the outcome of MSCI’s consultation will influence investor sentiment. As decisions approach in January 2026, firms must balance innovation with stability—watch for updates on how this evolves in the crypto landscape.