MicroStrategy’s Bearish Fractal May Foreshadow Bitcoin’s Extended Downturn

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

MicroStrategy’s bearish fractal patterns and insider sales are signaling potential downside risks for Bitcoin, mirroring a 2021-2022 downtrend that lasted over 600 days. With Bitcoin down 33% from its peak, historical December performances suggest possible further declines if selling pressure continues.

-

MicroStrategy holds over 9,000 BTC in its treasury, valued at billions, making its stock movements a key indicator for Bitcoin trends.

-

Recent insider transactions have raised concerns, with millions in shares sold amid a forming bearish structure.

-

Bitcoin’s current 33% drawdown from all-time highs aligns with past patterns that led to significant December losses, per market data from TradingView and Alphractal.

Explore how MicroStrategy’s stock signals Bitcoin’s next moves in this analysis of bearish fractals and market trends. Stay informed on crypto volatility—read now for key insights into potential downturns.

What is the impact of MicroStrategy on Bitcoin’s outlook?

MicroStrategy, a major corporate Bitcoin holder, influences the cryptocurrency’s market sentiment through its treasury strategy and stock performance. The company’s recent acquisition of 9,062 BTC in November underscores its commitment, but emerging bearish patterns in its shares could pressure Bitcoin prices. Historically, MicroStrategy’s declines have correlated with Bitcoin pullbacks, as seen in the 2021-2022 cycle.

How does MSTR’s bearish fractal affect Bitcoin?

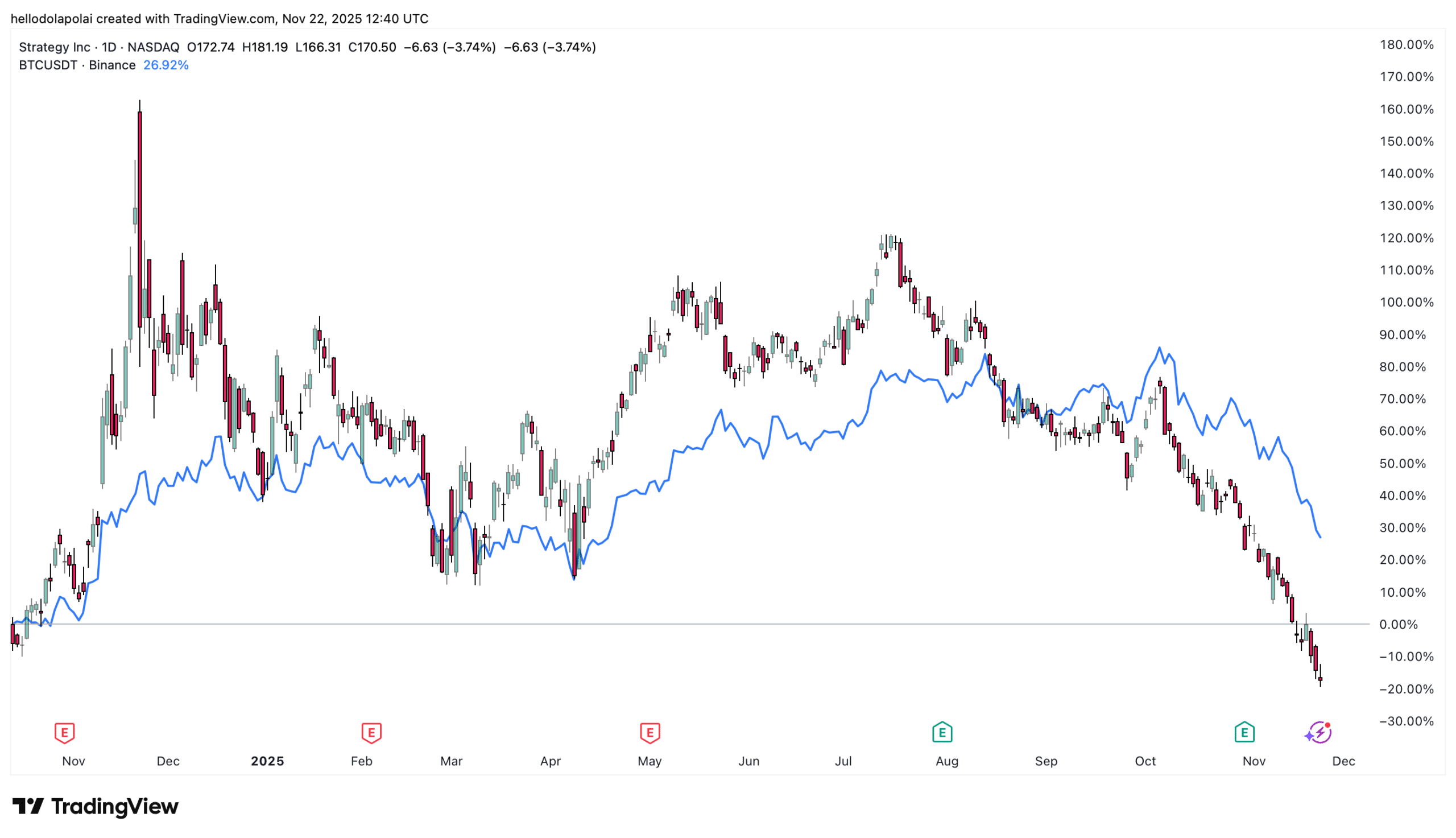

MicroStrategy’s stock has developed a fractal pattern resembling its prolonged downtrend from 2021 to 2022, which spanned 689 days and coincided with Bitcoin’s broader correction. Current insider sales, totaling millions of dollars by company executives, have accelerated this trend, now at about 364 days. When aligned with Bitcoin’s chart via TradingView data, this suggests a potential extension to 325 more days of downside, possibly bottoming around October 2026. The stock’s NAV multiple of 0.95 indicates it’s trading at a discount to its Bitcoin assets, yet the correlation persists.

Source: X

Market observers note that such patterns do not predict outcomes with certainty, but the historical alignment between MicroStrategy and Bitcoin provides a cautionary signal for investors monitoring treasury strategies.

Frequently Asked Questions

Why are MicroStrategy insiders selling shares amid Bitcoin holdings?

Insider sales at MicroStrategy, including those by directors, have exceeded millions in value, occurring as the stock enters a bearish phase. This follows the company’s strategy of holding substantial Bitcoin, but personal financial decisions may drive these transactions. Data from regulatory filings shows no direct tie to Bitcoin sales, maintaining the firm’s long-term accumulation approach.

Will Bitcoin repeat past December declines based on current trends?

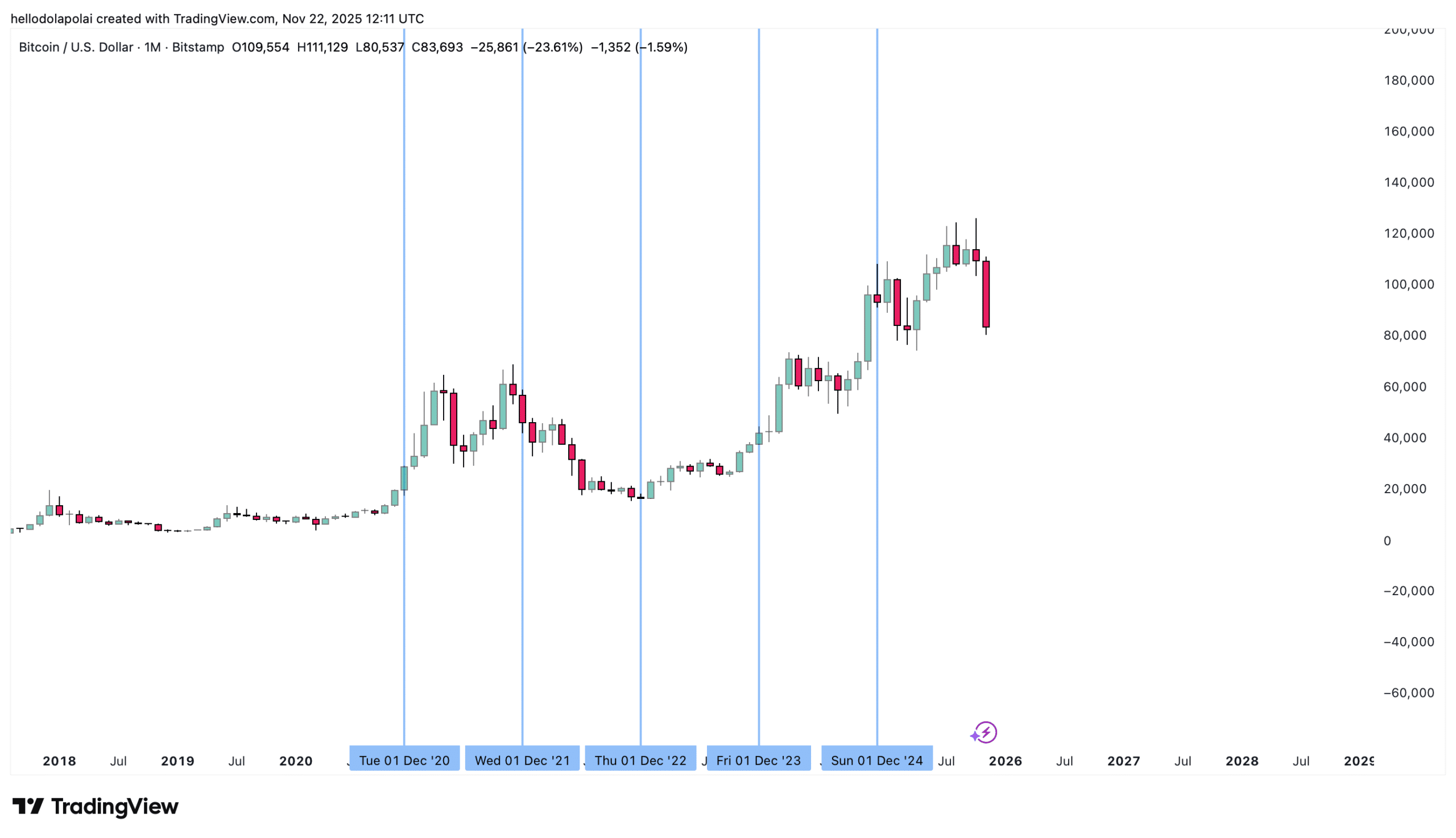

Bitcoin’s history shows mixed December results: gains in several years preceded rallies, while 2021 saw continued losses into a bear market. With a 33% drop from highs now, patterns from Alphractal indicate potential for volatility, but no definitive repeat. Investors should watch liquidity and broader market capitalization shifts for clearer signals.

Source: TradingView

Source: Alphractal

Key Takeaways

- MicroStrategy’s treasury role: Holding $56.23 billion in Bitcoin, the firm’s actions directly tie to market sentiment, with recent additions of 9,062 BTC reinforcing its influence.

- Bearish fractal implications: The pattern, lasting 364 days so far, echoes a year-long 2021-2022 decline, potentially leading Bitcoin to lower levels through mid-2026.

- December volatility risks: Bitcoin’s 33% pullback mirrors past setups for losses, urging investors to monitor liquidity amid a $1.54 trillion market cap wipeout.

Source: TradingView

Market data from sources like TradingView and Alphractal highlight Bitcoin’s December variability: bullish in years like 2017 and 2020, leading to rallies, but bearish in 2021, extending into a cycle low. The current four-year cycle position suggests parallels to prior corrections, with $800 billion in Bitcoin-specific outflows contributing to the pressure. Expert commentary from market analysts emphasizes structural weakness, stating, “The crypto market just flashed one of the clearest signs of structural weakness. And this opens the door to heavy volatility in the coming days—both up and down.”

Overall, the broader cryptocurrency ecosystem faces declining liquidity, with total market capitalization down $1.54 trillion since October peaks. This includes heavy exits from both Bitcoin and altcoins, per aggregated exchange data. MicroStrategy’s Net Asset Value dynamics, trading at a 0.95 multiple, reflect undervaluation against its Bitcoin reserves, yet the bearish sentiment spillover remains a concern.

Analyses from platforms like COINOTAG indicate that while historical precedents offer insights, current conditions—driven by macroeconomic factors and institutional flows—could alter trajectories. Investors tracking MicroStrategy Bitcoin outlook should prioritize risk management, given the correlation’s strength in past cycles.

Conclusion

In summary, MicroStrategy’s bearish fractal and insider activities are key factors in the current MicroStrategy Bitcoin outlook, historically linking to Bitcoin’s downside moves as seen in 2021-2022. With a 33% drawdown and potential December volatility, the market’s $1.54 trillion loss underscores ongoing pressure. As 2025 progresses within the four-year cycle, staying vigilant on liquidity and treasury strategies will be essential for navigating future trends—consider diversifying portfolios to mitigate risks ahead.