MicroStrategy’s Bitcoin Purchase Halt: Signs of Caution Amid Market Volatility and Uncertain Future

BTC/USDT

$17,366,629,629.18

$71,554.95 / $68,531.50

Change: $3,023.45 (4.41%)

-0.0023%

Shorts pay

Contents

-

Strategy pauses Bitcoin purchases amid ongoing market volatility, signaling caution with $5.91 billion in unrealized losses at stake.

-

As one of the largest Bitcoin holders globally, Strategy’s pause may indicate deeper liquidity concerns or a strategic wait for more favorable conditions.

-

“Michael Saylor’s average BTC cost basis is ~$67,500. A 15% drop puts MicroStrategy deep in the red,” noted Edward Farina, reflecting community concerns.

Strategy halts Bitcoin purchases amid market volatility, raising concerns over its $5.91 billion unrealized losses and future institutional confidence.

MicroStrategy’s Bitcoin Purchase Pause: Cautious Signal or Liquidity Move?

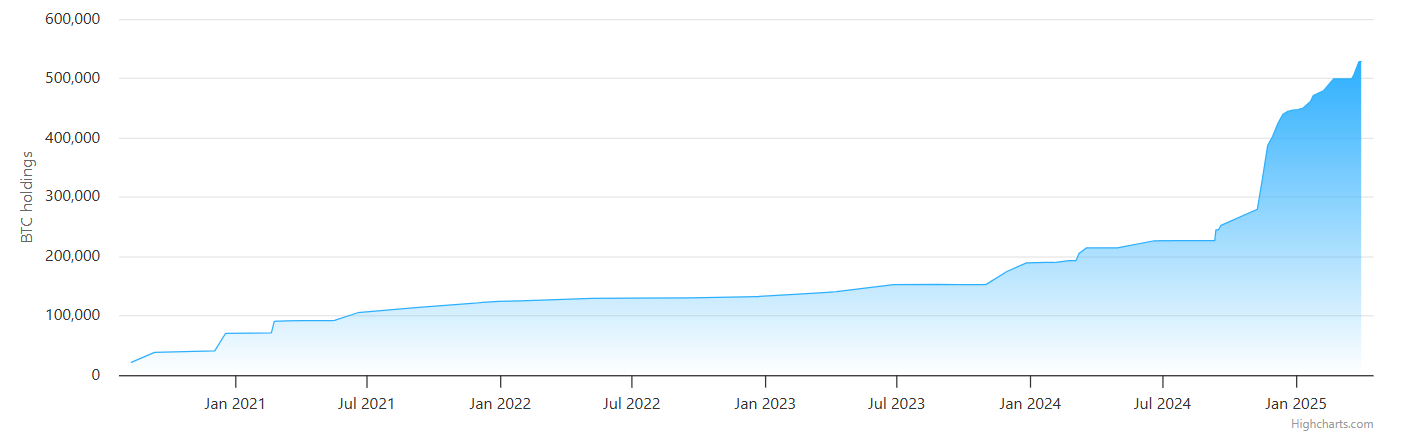

Since Michael Saylor has led Strategy (formerly MicroStrategy) in acquiring Bitcoin, the firm has consistently ranked as one of the world’s largest BTC holders. Up until now, 2025 has seen Strategy spend approximately $2 billion on Bitcoin through two major acquisitions.

However, the company publicly reported that it did not make any Bitcoin purchases last week and also refrained from selling any stock.

This recent interruption in buying activity is not unprecedented, as Strategy also paused acquisitions in February. Yet, the current scenario feels markedly different given fears regarding an impending recession in the United States.

Management’s decision to pause Bitcoin acquisitions suggests a cautious, wait-and-see strategy amid persistent market volatility, possibly indicating their anticipation of further bitcoin price declines before resuming purchases.

Both traditional finance (TradFi) and the cryptocurrency markets have experienced steep liquidations, with many corporate Bitcoin holders facing substantial losses.

MicroStrategy Bitcoin Holdings Over Time. Source: Bitcoin Treasuries

The firm may be attempting to disrupt its historical streak of consecutive purchases to mitigate additional downside risks until clearer market trends become apparent.

Conversely, several critics have adopted a more severe perspective. According to the recent Form 8-K, Strategy faces $5.91 billion in unrealized losses from its Bitcoin holdings. These developments have compounded worries regarding the firm’s liquidity, tax obligations, and excessive leverage.

MSTR Stock Price Chart. Source: Google Finance

Some community members have expressed doubts about Saylor’s ability to navigate these challenges:

“Michael Saylor’s average BTC cost basis is ~$67,500. A 15% drop puts MicroStrategy deep in the red. That’s the thin line between ‘visionary CEO’ and ‘leveraged lunatic with a God complex,’” remarked Edward Farina on social media.

What’s Next for Strategy?

Strategy plays a pivotal role in instilling confidence within the Bitcoin ecosystem. Given this position, any decision to sell would likely attract significant market attention, with even minor changes in purchase strategies being closely monitored by the crypto community.

Simultaneously, various firms are swiftly developing novel ETF tools aimed at shorting Strategy, hoping for its decline. What might be the optimal path forward?

To date, Saylor has remained silent amidst these market fluctuations, possibly waiting to seize the opportunity for a hefty Bitcoin purchase when the market reaches a bottom.

Alternatively, it may find itself immobilized due to compounding debt and unrealized losses. Currently, the uncertainty surrounding Strategy’s decisions signals broader apprehension among institutional investors regarding the current conditions in the cryptocurrency market.

This cautious posture might indicate a potential pause before re-entering the accumulation phase, contingent on improvements in market fundamentals.

Conclusion

In conclusion, Strategy’s decision to halt Bitcoin purchases amid significant unrealized losses serves as a critical indicator of market sentiment and institutional confidence in cryptocurrency. As investors monitor the situation closely, the firm’s future actions could have profound implications for the broader crypto landscape.