Monero Recovery Gains Momentum Amid Rising Sentiment but Faces Key Resistance

XMR/USDT

$50,687,537.94

$344.61 / $324.07

Change: $20.54 (6.34%)

+0.0056%

Longs pay

Contents

Monero’s recovery in 2025 is driven by improved netflow of $1.87 million, stronger Chaikin Money Flow readings above zero, and rising community sentiment to 74%, supporting a 14% daily gain while facing descending resistance hurdles.

-

Positive netflow and accumulation: $4.68 million weekly inflow signals strong investor buying pressure.

-

Rising sentiment from 67.5% to 74% reflects growing optimism in the privacy token sector.

-

Bullish CMF above neutral; however, weak A/D trend may cap upside at $394.25 Fibonacci level with 54.6% sector gains.

Discover Monero recovery drivers in 2025: netflow surges and sentiment boost XMR 14%. Analyze charts and risks for informed trading decisions—stay ahead in crypto privacy tokens today.

What is Driving Monero’s Price Recovery?

Monero’s price recovery stems from renewed investor confidence, evidenced by a 14% daily increase amid a broader 54.6% gain in privacy tokens. Positive netflow of $1.87 million over 48 hours and weekly accumulation reaching $4.68 million—the second highest on record—have fueled buying pressure, stabilizing XMR near key support levels.

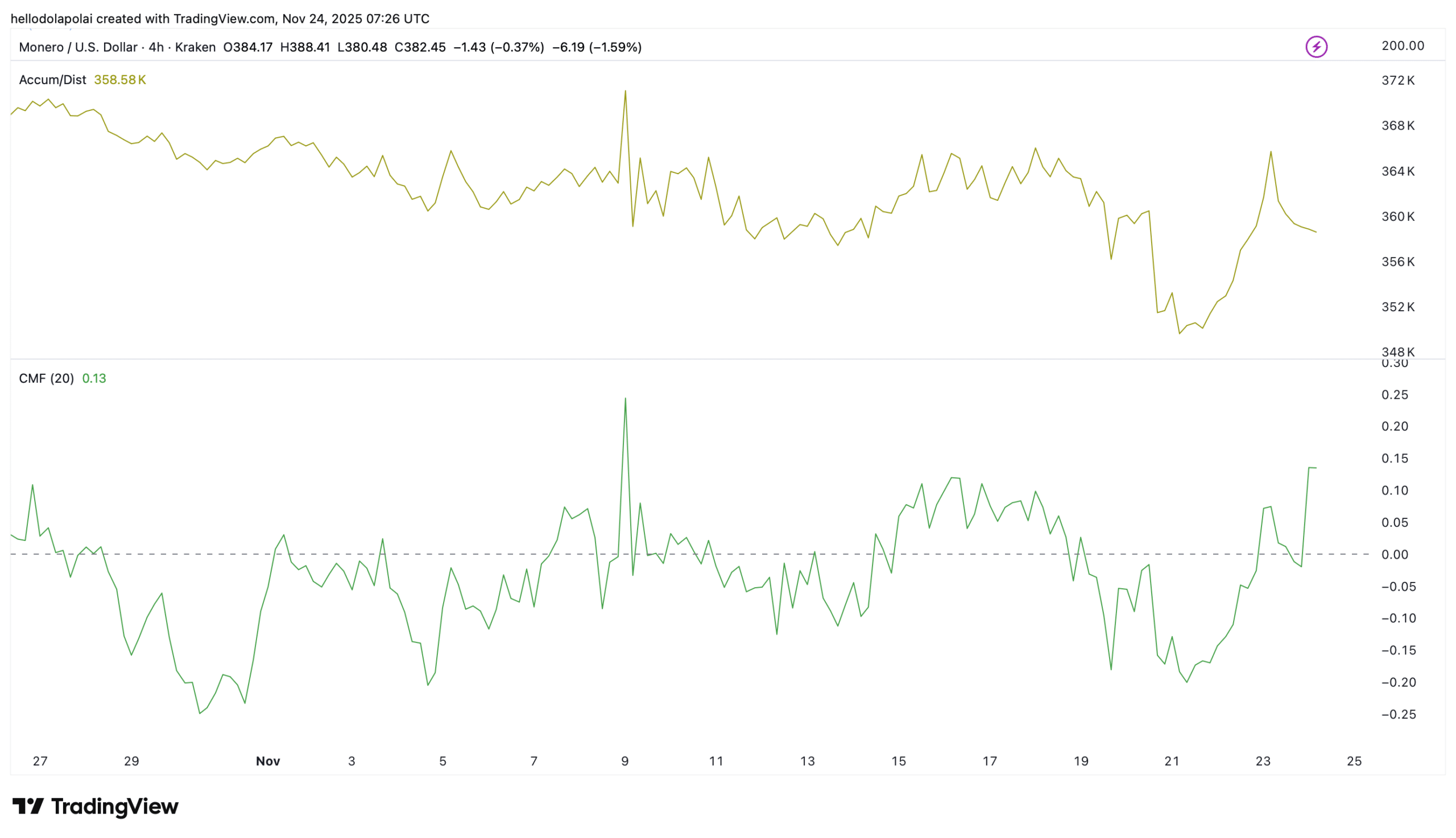

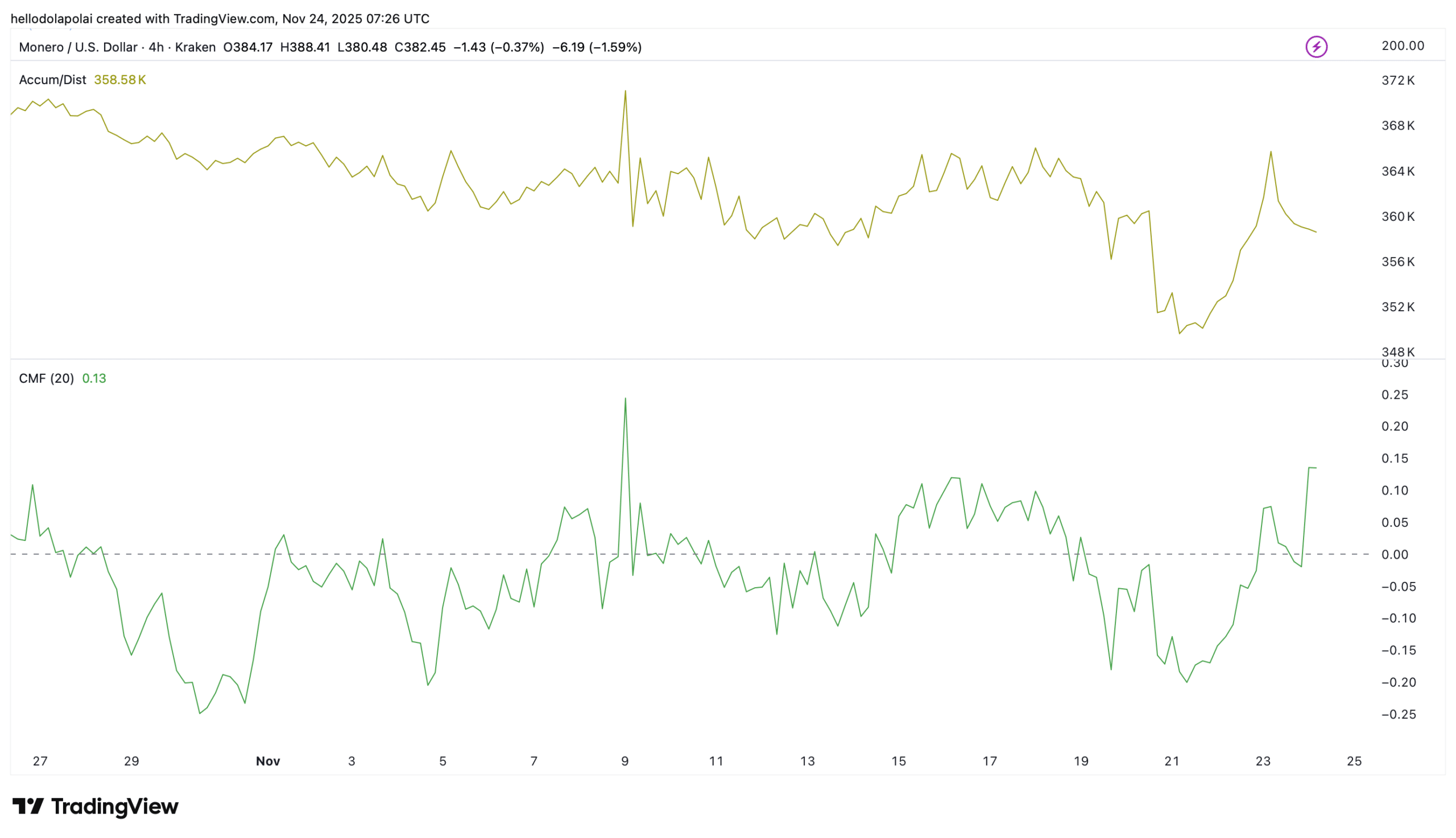

How Do Technical Indicators Influence XMR’s Momentum?

The Chaikin Money Flow (CMF) indicator, which gauges buying versus selling volume, stands above the zero line, indicating sustained buying interest that outweighs selling pressure. This aligns with a community sentiment surge to 74%, up from 67.5%, suggesting market participants expect further upside. According to data from CoinGlass, such netflow improvements often precede rallies in privacy-focused assets like Monero. However, the Accumulation/Distribution (A/D) line shows investors pausing, potentially awaiting lower entry points, which could temper immediate gains. Experts from TradingView analyses note that for a true breakout, both CMF and A/D must align positively to challenge the descending resistance trendline that has rejected price advances three times recently.

Frequently Asked Questions

What Factors Are Behind the Recent 14% Gain in Monero?

Monero’s 14% gain results from $1.87 million in positive netflow over 48 hours and $4.68 million in weekly accumulation, the second-largest ever. Rising sentiment to 74% and spot market buys reflect investor optimism in the privacy token category, which saw 54.6% weighted gains last month, per CoinGlass metrics.

Can Monero Sustain Its Recovery Against Resistance?

Yes, Monero’s recovery could sustain if CMF remains above zero and A/D rebounds, pushing toward the descending trendline. Currently at $394.25 on the 0.5 Fibonacci, a breakout needs improved momentum; otherwise, downside to lower supports is possible, as observed in TradingView charts for natural voice queries on XMR trends.

Key Takeaways

- Investor Confidence Boost: Netflow of $1.87 million and 74% sentiment indicate strong buying, marking the second-highest weekly accumulation at $4.68 million.

- Technical Support: CMF above zero supports bullish momentum, but weak A/D suggests caution near $394.25 Fibonacci level.

- Sector Strength: Privacy tokens up 54.6%; monitor resistance for breakout opportunities in Monero’s ongoing recovery.

Conclusion

Monero’s price recovery in 2025 highlights robust fundamentals like positive netflow and bullish CMF readings, alongside a thriving privacy token sector with 54.6% gains. While descending resistance at key levels poses challenges, sustained accumulation and sentiment improvements could drive further upside. Investors should track A/D trends closely and consider strategic positions for potential breakouts in this dynamic market.

Investors return with liquidity

The most recent gain in Monero [XMR] followed renewed confidence among investors in the market.

Community sentiment over the past 48 hours has reached 74%, up from about 67.5% previously.

A surge of this type suggested that investors anticipate a potential rally in the market. This optimism was reflected in spot market purchases.

Source: CoinGlass

CoinGlass data showed $1.87 million in positive Netflow during the period, confirming renewed buying pressure. This type of activity tends to add the necessary demand, reflecting growing investor conviction.

In fact, accumulation in the past week reached $4.68 million, the second-largest weekly accumulation recorded for the asset. A continued trend in this direction would be a positive development for the price.

Hurdles ahead for price

XMR’s chart showed early weakness despite renewed optimism. The price traded directly into a descending resistance trendline, creating immediate rejection pressure.

At press time, XMR hovered near the 0.5 Fibonacci Retracement at $394.25, a level that might offer short-term demand.

Source: TradingView

A rebound from the zone could trigger another move toward the descending trendline, which has rejected the price three times. Even so, repeated attempts at this resistance increased the chances of a future breakout if momentum improves.

Will bullish momentum hold?

The probability of a rebound on the chart remained moderately high, supported by bullish indicators.

This outlook is based on readings from the Chaikin Money Flow (CMF) and the Accumulation/Distribution (A/D) indicator.

For your context, the CMF measures the ratio of buy and sell volume to help determine the market’s potential direction.

At the time of writing, the CMF sat above the neutral zone (zero), implying that buying activity outweighs selling pressure.

Source: TradingView

However, the Accumulation/Distribution indicator showed that investors cooled off on buying the asset and were on the sidelines, potentially waiting to buy at lower levels.

A rebound in the A/D indicator would serve as confirmation that XMR could weaken the resistance zone.

If both the CMF and A/D trend downward simultaneously, XMR is likely to fail in sustaining a rally and may instead move toward the next nearest support level.