MOVE Crypto Hints at Potential Bottom After 12% Rally and Network Surge

Contents

The MOVE crypto price has surged over 12% in the past 24 hours, driven by increased network activity, new DeFi partnerships, and a technical breakout from a prolonged downtrend, signaling potential recovery after a year of declines.

-

MOVE transitioned from Ethereum Layer 2 to a standalone Layer 1 blockchain, boosting its ecosystem fundamentals.

-

Trading volume doubled to over $84 million, reflecting heightened investor interest and liquidity.

-

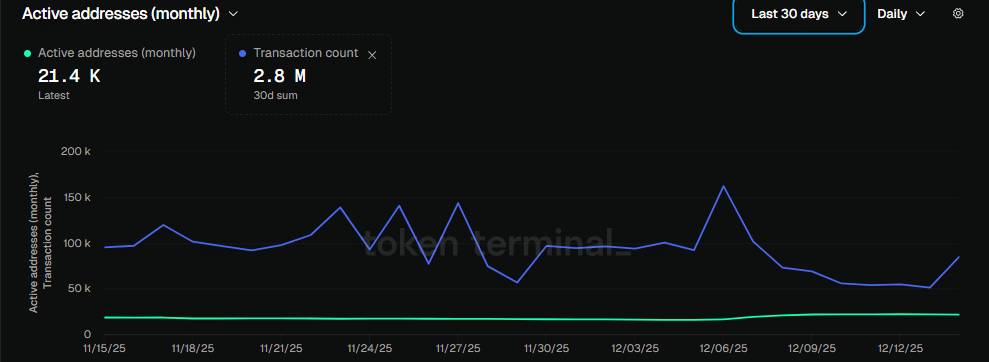

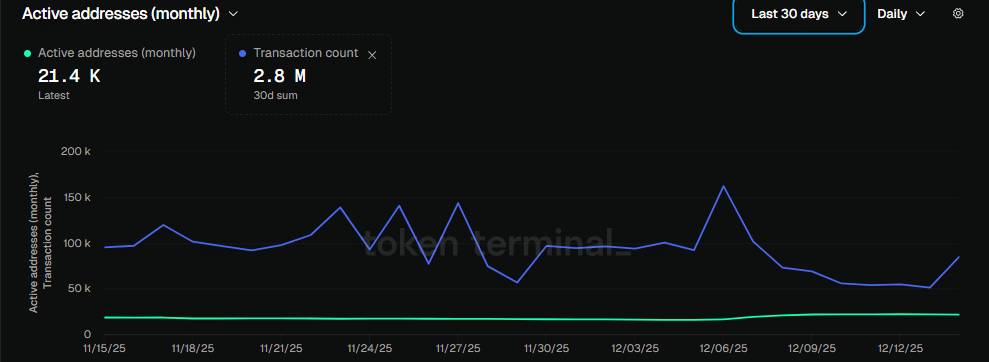

Active monthly addresses rose 17% to 21.4K, with transaction counts jumping to 2.8 million monthly, per on-chain data.

MOVE crypto price rallies 12% amid surging network activity and DeFi integrations. Discover why this Layer 1 token is gaining momentum and what it means for investors today. Stay updated on crypto trends.

What is driving the MOVE crypto price surge today?

MOVE crypto price experienced a notable 12% increase in the last 24 hours, marking the second consecutive day of gains as the token breaks out from a year-long downtrend. This rally coincides with enhanced network fundamentals and rising on-chain activity, transitioning Movement from an Ethereum Layer 2 solution to a robust standalone Layer 1 blockchain. According to CoinMarketCap data, trading volume has doubled to exceed $84 million, underscoring growing market participation.

How has network activity contributed to the MOVE crypto momentum?

The Movement network has seen significant upticks in user engagement, with active monthly addresses climbing 17% to 21.4K as of recent reports. This surge indicates a revitalized ecosystem since early December, even as prices had previously languished. Total accounts created now approach 570,000, supported by 28,837 deployed contracts from 4,710 deployers, based on Movement Explorer metrics.

Transaction volumes further highlight this growth: daily counts rose from 50.9K to 84.9K over two days, pushing the monthly total to 2.8 million. Such metrics, drawn from reliable on-chain analytics like Token Terminal, demonstrate a clear shift toward higher utilization, which often correlates with sustained price appreciation in blockchain projects.

Experts in the crypto space, including blockchain analysts, note that this activity boom aligns with broader Layer 1 adoption trends. For instance, one industry observer commented on the importance of organic growth: “Rising transaction volumes without price spikes earlier suggest genuine utility building, positioning MOVE for long-term stability.”

Movement [MOVE] crypto could have found its bottom after a year of decline. Movement transitioned from an Ethereum Layer 2 (L2) blockchain to a full standalone L1.

In the past 24 hours, MOVE spiked by more than 12%, as per CoinMarketCap data, extending its rally for the second consecutive day. The daily trading volume doubled, exceeding the $84 million mark.

Beyond its technical breakout, fundamentals and network activity also drove the rally for MOVE.

On fundamentals, Movement has partnered with more than 10 DeFi applications, which now funnel funds into the ecosystem through fees. This revenue is used in MOVE’s buyback program, which reduces the amount of circulating supply in the market.

For context, the main alliance in the ecosystem was the LayerBank partnership. Its ULAB token launch on the MOVE network added about $2.30 million, fueling more DeFi integration.

Source: Token Terminal

The total Number of Accounts created almost hit 570,000, while deployed contracts were 28,837 from 4,710 deployers, as per Movement Explorer data.

Additionally, the Transaction Count grew from 50.9K to 84.9K in two days. This brought the monthly sum to 2.8 million transactions, affirming the shift in activity.

All these on-chain metrics supported the growth in price over the past two days. Is the technical setup good enough to say MOVE will sustain the trend?

Will the altcoin maintain momentum?

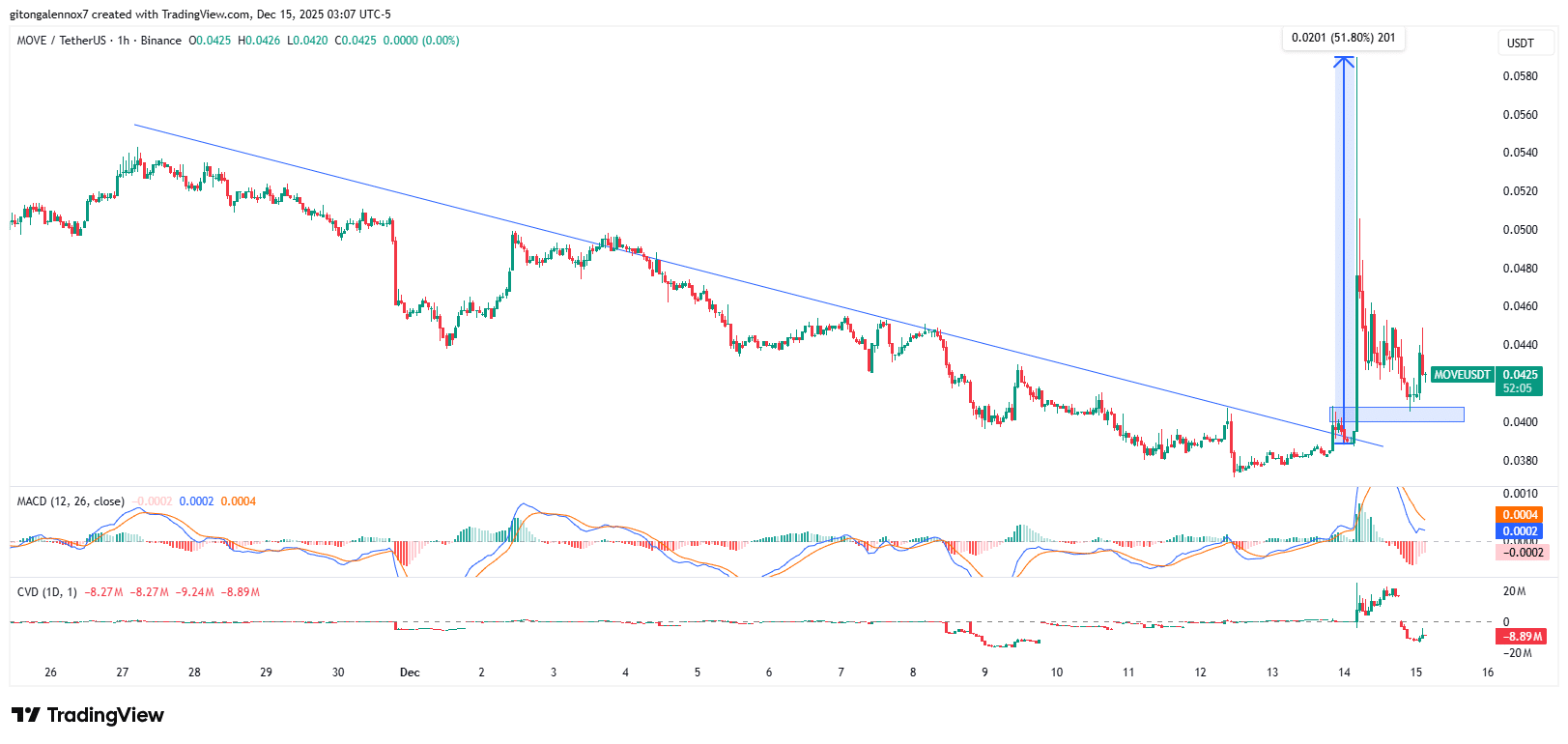

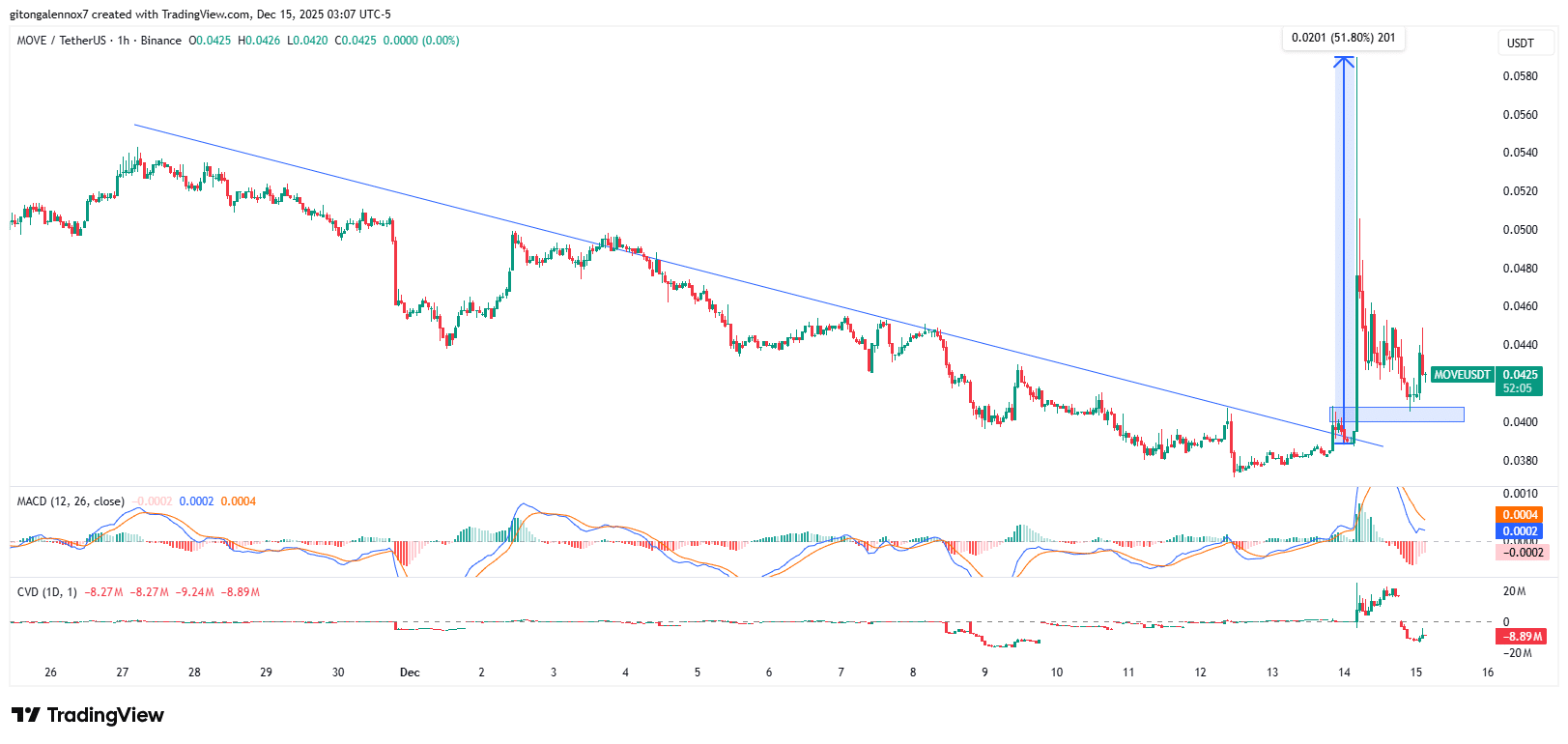

On the hourly charts, MOVE broke above the descending trendline resistance that had held price for over two months since the October 10th crash.

Still, the altcoin had been in a downtrend since its post-launch rally, which ended on December 25th, 2024, when the MOVE crypto price slightly surpassed the $1.50 mark.

After this breakout, the MOVE price rallied more than 51% but was instantly rejected. The price fell and seemed to be stabilizing around $0.0418. Holding above this level and breaching $0.0600 for a new higher high would mean a continued uptrend. Otherwise, sellers stay in control.

However, in this timeframe, sellers showed momentum, as seen in the MACD bars. Furthermore, the Cumulative Volume Delta (CVD) was negative, at $8.35 million, meaning selling was the dominant activity after the short rally.

Source: TradingView

While the altcoin was bullish on the day, sellers were not ready to relinquish dominance. MOVE was trading in a bear market, but bulls had thrown the first hints of potential reversal after a year of decline.

The reversal stays alive, though a market shift on bigger timeframes was needed for confirmation.

Technical indicators like the MACD and CVD suggest caution, as bearish pressures persist despite the recent uptick. Holding key support at $0.0418 remains crucial for bulls to maintain control and push toward $0.0600 resistance.

In the broader context, MOVE’s evolution to a Layer 1 chain positions it competitively against other altcoins, potentially attracting more developers and users. Data from TradingView charts illustrates this hourly breakout, but longer-term confirmation is essential for sustained momentum.

Frequently Asked Questions

What caused the recent 12% rally in MOVE crypto price?

The rally stems from a combination of DeFi partnerships, including over 10 integrations like LayerBank’s ULAB token launch adding $2.30 million in value, alongside a buyback program reducing circulating supply. Network activity metrics, such as 17% growth in active addresses to 21.4K, further fueled the surge, per CoinMarketCap and on-chain data.

Is MOVE crypto a good investment after its transition to Layer 1?

MOVE’s shift to a standalone Layer 1 blockchain enhances scalability and attracts DeFi activity, with monthly transactions reaching 2.8 million. While recent gains show promise, investors should monitor technical levels like $0.0418 support and broader market trends for informed decisions, as volatility remains high in the crypto space.

Key Takeaways

- MOVE Crypto Fundamentals Strengthen: Partnerships with over 10 DeFi apps and a buyback program reduce supply, driving ecosystem revenue and price support.

- Network Activity Surges: Active addresses up 17% to 21.4K, with transactions hitting 2.8 million monthly, indicating robust user engagement per Movement Explorer.

- Technical Outlook Cautious: Breakout above trendline resistance offers reversal potential, but holding $0.0418 is key; monitor MACD and CVD for seller dominance.

Conclusion

The MOVE crypto price rally reflects solid fundamentals from DeFi integrations and heightened network activity on its Layer 1 blockchain, potentially marking the end of a year-long decline. As on-chain metrics like transaction volumes and active addresses continue to climb, supported by data from sources such as Token Terminal and Movement Explorer, the token shows signs of revitalization. Investors should watch for sustained breaks above $0.0600 to confirm upward momentum, keeping an eye on broader crypto market dynamics for future opportunities.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026