MSCI Scrutiny on MicroStrategy Highlights Risks for Bitcoin-Heavy Treasuries

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

MicroStrategy’s potential MSCI exclusion poses risks to Bitcoin digital asset treasuries, with the top 100 holding over 1 million BTC. This scrutiny highlights vulnerabilities in single-asset heavy portfolios amid Q4’s bearish market, potentially triggering billions in outflows for index-tracking investors.

-

BTC dominance in treasuries exceeds 50% for key players like MicroStrategy, drawing regulatory and index scrutiny.

-

Q4 bearish trends amplify concerns for digital asset treasuries reliant on Bitcoin holdings.

-

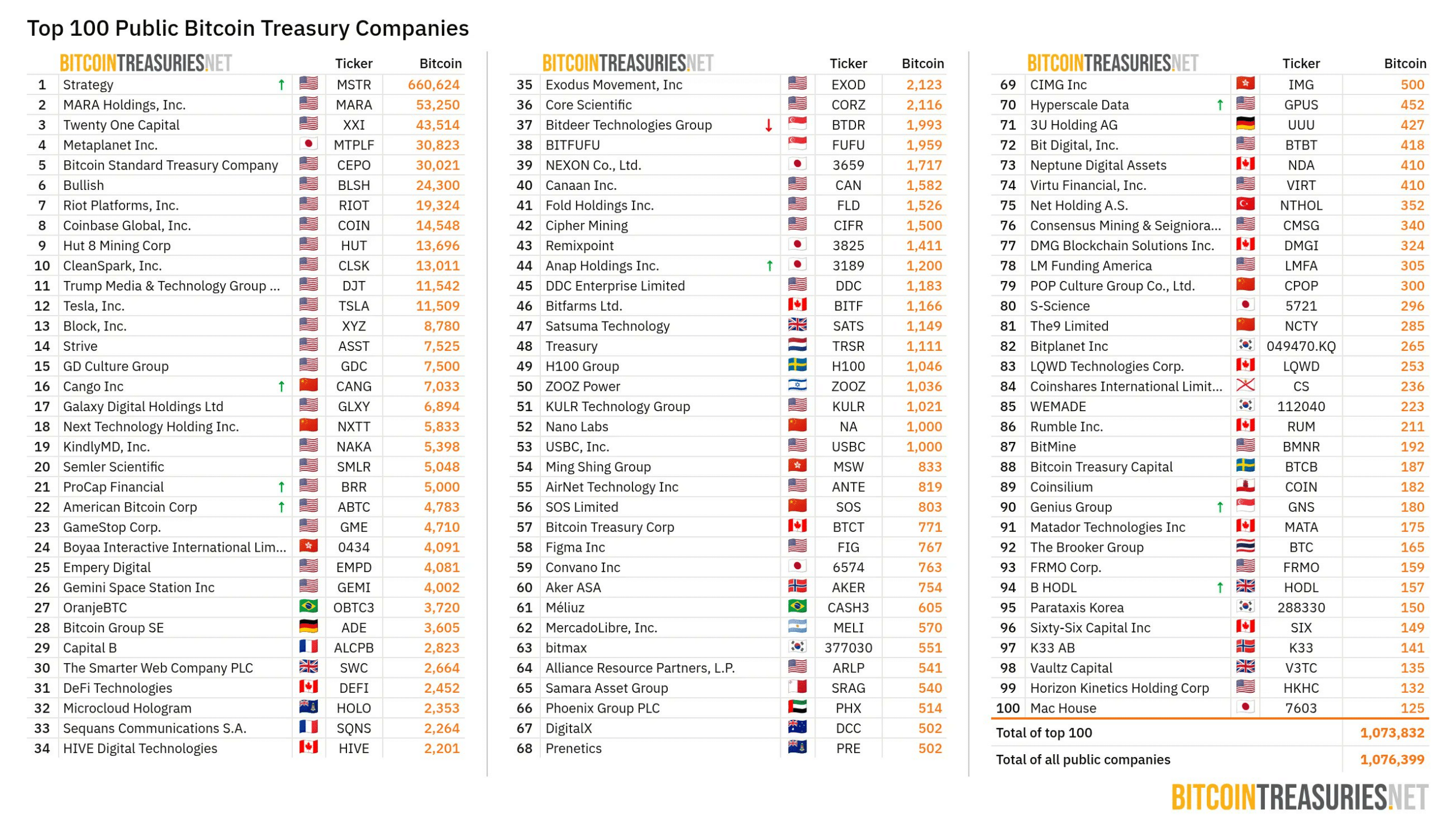

Top 100 Bitcoin digital asset treasuries collectively hold 1,073,832 BTC, per BitcoinTreasuries.net data, underscoring market-wide exposure.

Explore MicroStrategy MSCI exclusion risks and Bitcoin digital asset treasuries’ vulnerabilities in Q4’s downturn. Stay informed on BTC treasury shifts and on-chain signals for smarter investment decisions. Read now!

What is the MicroStrategy MSCI Exclusion Risk?

MicroStrategy MSCI exclusion risk refers to the potential removal of MicroStrategy from the MSCI index due to its heavy Bitcoin holdings, which dominate over 50% of its treasury. This could lead to significant passive outflows estimated at $2.8 billion by Bloomberg analysts, impacting index-tracking investors. The broader implication affects Bitcoin digital asset treasuries across the market, as increased scrutiny targets single-asset heavy portfolios in a bearish Q4 environment.

How Are Bitcoin Digital Asset Treasuries Affected by This Scrutiny?

Bitcoin digital asset treasuries face heightened risks from the MicroStrategy MSCI exclusion review, as many firms hold substantial BTC allocations. For instance, the top 100 such treasuries control 1,073,832 BTC, according to data from BitcoinTreasuries.net. This concentration amplifies vulnerability to market downturns, with Q4’s bearish conditions exacerbating pressures on these portfolios. Expert analysis from Bloomberg indicates that exclusion could trigger $2.8 billion in outflows, signaling a sector-wide event rather than an isolated issue. On-chain data further reveals shifting dynamics, with firms like American Bitcoin Corp adding 416 BTC to reach 4,783 BTC, overtaking competitors and climbing to the 22nd rank. Short sentences highlight the competitive landscape: more companies are accumulating BTC despite risks. This trend demonstrates long-term conviction but underscores the need for vigilant monitoring of index decisions. Sources like Strategy.com report MSTR’s positive response, including a 3.16% stock jump, which bolsters confidence amid on-chain improvements such as a 30-day trading volume increase and an mNAV of 1.18, trading at an 18% premium to its Bitcoin-backed net asset value.

Source: BitcoinTreasuries.net

The fourth quarter has proven challenging for digital asset treasuries, particularly those heavily weighted toward Bitcoin. Single-asset dominant portfolios are under greater examination, extending beyond MicroStrategy to a wider array of firms. With Bitcoin comprising the majority of many balance sheets, the collective holdings of the top 100 Bitcoin digital asset treasuries stand at 1,073,832 BTC, illustrating the scale of exposure.

While MicroStrategy holds the largest share with over 50% of its treasury in BTC, the risks are not confined to it. Bloomberg analysts project $2.8 billion in passive outflows if exclusion occurs, a figure that could ripple through index-dependent investments. This development prompts questions about safeguards for other Bitcoin digital asset treasuries, many of which continue to expand holdings amid bearish pressures, reflecting sustained belief in Bitcoin’s future value.

Source: Strategy.com

MicroStrategy’s recent formal response to MSCI, urging withdrawal of the exclusion proposal, has elicited a positive market reaction, with shares rising 3.16% intraday. On-chain indicators support this optimism: the 30-day average trading volume has increased by $4, and daily volumes now exceed those of Amazon in e-commerce metrics. Notably, MicroStrategy’s mNAV stands at 1.18, indicating the stock trades at an 18% premium to its Bitcoin-supported net asset value, a sign of robust investor faith.

Frequently Asked Questions

What Are the Potential Outflows from MicroStrategy’s MSCI Exclusion?

Bloomberg analysts estimate $2.8 billion in passive outflows if MicroStrategy faces MSCI exclusion due to its Bitcoin-heavy treasury. This stems from index-tracking funds forced to divest, impacting liquidity and highlighting risks for similar Bitcoin digital asset treasuries in the top 100 holdings.

Why Are Bitcoin Digital Asset Treasuries Expanding Holdings Despite Risks?

Many Bitcoin digital asset treasuries, including American Bitcoin Corp which added 416 BTC to total 4,783, are expanding due to long-term conviction in Bitcoin’s value. On-chain data from sources like Strategy.com shows competitive shifts, with firms overtaking others in rankings amid Q4 bearishness, driven by strategic accumulation for future growth.

Key Takeaways

- MicroStrategy MSCI Exclusion as Sector Risk: The review amplifies scrutiny on Bitcoin digital asset treasuries, with top 100 holdings at 1,073,832 BTC exposing broader vulnerabilities in single-asset portfolios.

- On-Chain Improvements Signal Confidence: Metrics like mNAV at 1.18 and rising trading volumes indicate strong investor support, countering Q4 bearish trends for Bitcoin-heavy firms.

- Competitive Accumulation Continues: Firms such as American Bitcoin Corp are adding BTC, reshaping rankings and underscoring the need to monitor MSCI updates for potential market catalysts.

Conclusion

The MicroStrategy MSCI exclusion risk underscores ongoing challenges for Bitcoin digital asset treasuries in a bearish Q4, where single-asset dominance invites greater scrutiny across the sector. With collective holdings surpassing 1 million BTC and on-chain signals pointing to resilience, such as improved trading volumes and premium valuations, the market demonstrates enduring confidence. As competition intensifies among treasuries, staying abreast of MSCI developments remains essential for investors navigating these dynamics toward potential Bitcoin catalysts ahead.