MYX Finance Surges 23% on Binance Listing Speculation and Technical Breakout

Contents

MYX Finance experienced a significant price rally, surging over 23% in the past 24 hours according to CoinMarketCap data. This breakout erased weekly losses, positioning the altcoin up 19% for the week amid broader market declines. Speculation around a potential Binance listing and technical indicators fueled the momentum.

-

Key drivers of the MYX Finance rally include speculation on a Binance listing in December and a technical breakout above the $3 resistance level.

-

The surge outperformed the overall crypto market, which saw capitalization drop below $3 trillion with a 5% loss.

-

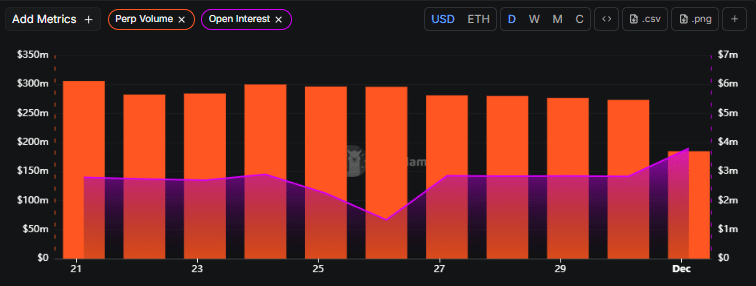

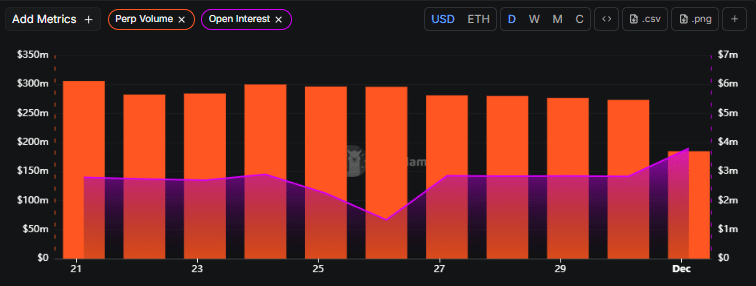

Open Interest for MYX perpetual futures tripled from $1.33 million to $3.80 million, signaling renewed investor interest despite flat trading volumes around $300 million.

Discover the MYX Finance price rally: Over 23% gains amid market downturns. Explore technical breakouts, Binance speculation, and trading insights for informed crypto decisions today.

What Caused the MYX Finance Price Rally?

MYX Finance saw a robust price rally, climbing more than 23% in the past 24 hours based on data from CoinMarketCap. This surge, which positioned MYX among the top performers in the top 100 coins by market cap, was primarily driven by speculation surrounding a potential Binance listing in December and a decisive technical breakout on the charts. The rally not only erased all weekly losses but also marked a 19% gain for the week, standing out as the market capitalization dipped below $3 trillion with an overall 5% decline.

Amid a subdued broader cryptocurrency landscape where most assets recorded losses, MYX Finance and MemeCore [M] emerged as the only coins achieving double-digit daily gains. Traders’ growing optimism stemmed from the recent launch of MYX perpetual futures, a development that has historically paved the way for spot listings on major exchanges like Binance. This combination of fundamental speculation and technical momentum created a perfect storm for the altcoin’s upward trajectory.

Why Did Open Interest Spike for MYX Finance?

The spike in Open Interest (OI) for MYX Finance underscores the heightened trader engagement that bolstered the price rally. Data from DefiLlama indicates that OI surged from a low of $1.33 million to over $3.80 million within a single day, representing more than a threefold increase. This rapid escalation reflects investors returning to the altcoin, particularly fueled by the Binance listing rumors, which have historically amplified trading activity for similar projects.

Supporting this, the perpetual futures volume for MYX remained consistently flat around the $300 million mark, a notable figure especially as activity stalled for many other coins in the market. Experts in the derivatives space, such as those cited in reports from on-chain analytics platforms, note that sustained perp volumes like this often indicate underlying liquidity and confidence. For instance, a trading analyst from a leading blockchain research firm stated, “The tripled OI amid flat volumes signals that new positions are being opened with conviction, potentially setting the stage for sustained gains if market sentiment holds.”

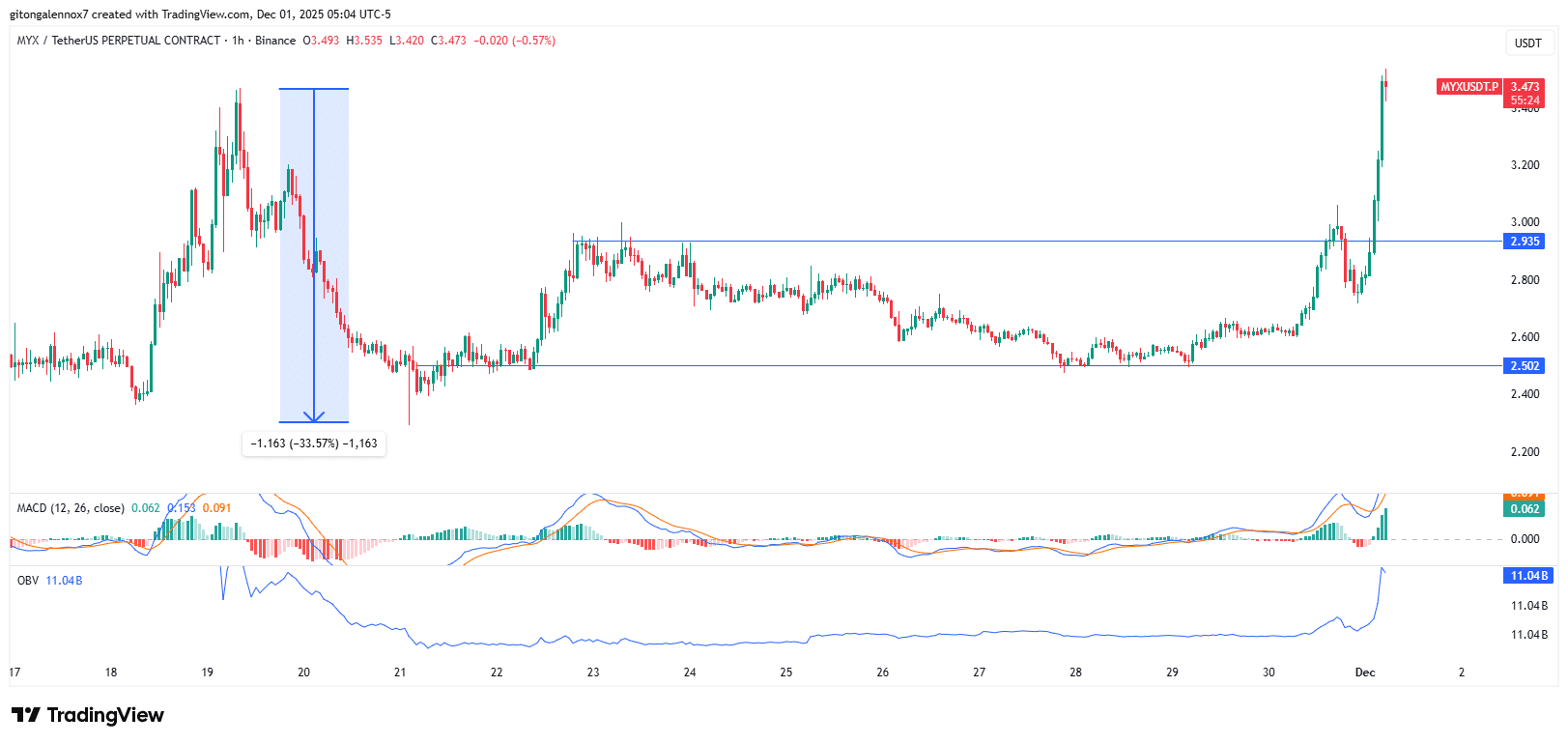

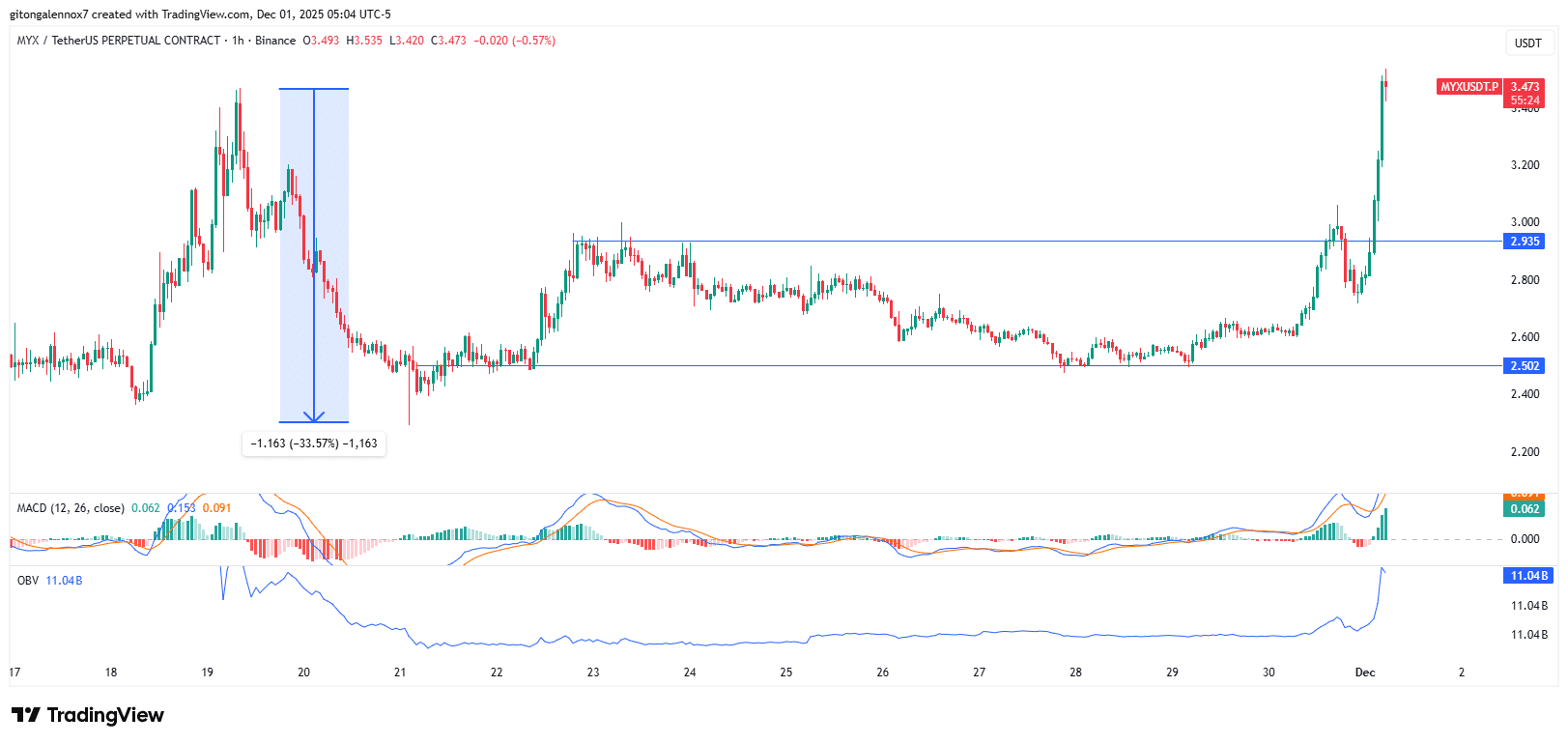

Technically, the rally was marked by a clear breakout. After a period of consolidation for over 10 days in November, bullish momentum propelled MYX above the $3 level. Indicators like the Moving Average Convergence Divergence (MACD) flipped to green, with signal lines rising above expanding histogram bars, confirming strengthening buyer control. The On Balance Volume (OBV), which had been flat for two weeks, also spiked past $11 billion, evidencing increased accumulation.

At the time of this analysis in December 2025, MYX was trading around $3.50, with bulls demonstrating resilience against sell pressure in that zone. The key demand area at $2.60 initially supported the breakout, though it faced rejection before stabilizing at $2.70 for a confirmed upward move. Hourly candle volumes highlighted sufficient liquidity, underscoring the rally’s volatility even as the wider market trended red. However, bears remain active at $3.50, where prior resistance could trigger a potential 33% decline if momentum wanes, reminiscent of recent bearish actions that tested lows near $2.29.

Source: TradingView

This technical setup, combined with on-chain metrics, positions MYX Finance as a standout in the current market cycle. The altcoin’s focus on derivatives trading has allowed it to maintain relevance, with perpetual futures serving as a key liquidity hub. As per insights from CoinMarketCap and TradingView analyses, such breakouts often correlate with increased adoption in DeFi protocols, where MYX aims to carve out a niche in efficient perpetual trading solutions.

Further, the rally highlights the resilience of mid-cap altcoins like MYX during broader market corrections. While the total crypto market cap fell below $3 trillion, losing approximately 5%, MYX’s performance demonstrates how project-specific catalysts can decouple from macroeconomic pressures. Data from on-chain platforms shows that trading pairs involving MYX saw heightened activity, with the altcoin’s market cap reflecting renewed confidence from both retail and institutional participants.

In the derivatives arena, MYX Finance continues to meet its objectives by providing robust perpetual futures options. The flat yet significant volume at $300 million indicates steady utilization, even as competing protocols experience declines. This stability is a testament to the platform’s infrastructure, designed to handle volatility without compromising user experience.

Source: DefiLlama

Frequently Asked Questions

What is the latest price performance of MYX Finance after its recent rally?

According to CoinMarketCap data from December 2025, MYX Finance rallied over 23% in 24 hours, trading around $3.50 after breaking above key resistance. This erased weekly losses for a net 19% gain, making it a top performer among top 100 coins despite a 5% market-wide decline.

How has the MYX Finance perpetual futures launch impacted trader sentiment?

The launch of MYX perpetual futures has notably boosted trader sentiment by providing accessible leverage trading options. With Open Interest tripling to $3.80 million per DefiLlama, it signals growing confidence, especially with Binance listing speculation. This setup historically leads to spot market expansions, attracting more participants to the ecosystem.

Key Takeaways

- MYX Finance Surge: The 23%+ rally was propelled by Binance listing speculation and a technical breakout above $3, erasing weekly losses amid a declining market.

- Technical Indicators: MACD turning green and OBV spiking past $11 billion confirm bullish momentum, with potential to test $3.50 resistance further.

- Derivatives Strength: Tripled Open Interest and steady $300 million perp volumes highlight sustained liquidity and investor return, positioning MYX for continued growth in DeFi trading.

Conclusion

The MYX Finance price rally represents a bright spot in an otherwise challenging crypto market, driven by technical breakouts, increased Open Interest, and speculation on major exchange listings. With trading volumes holding steady and indicators pointing to sustained momentum, MYX underscores the potential for altcoins to thrive independently. As developments unfold in the derivatives space, investors should monitor key levels like $3.50 for future opportunities—stay informed to navigate the evolving landscape effectively.