Nasdaq IBIT Options Expansion Could Boost Bitcoin Liquidity as Recovery Faces Hurdles

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Nasdaq’s IBIT options expansion raises the contract limit from 25,000 to 1 million, enabling 40 times more derivatives exposure for BlackRock’s Bitcoin ETF. This move aims to enhance liquidity amid Bitcoin’s recovery to $92,000, though market fear and ETF outflows persist, testing investor conviction.

-

Nasdaq’s filing boosts IBIT options capacity by 400%, aligning it with major stocks like the Magnificent Seven for deeper trading.

-

Bitcoin’s open interest surged $4 billion to $62 billion, signaling increased derivatives activity tied to the expansion.

-

Despite a V-shaped recovery to $92,000, BlackRock’s IBIT saw $3 billion in November outflows, with 30,000 BTC offloaded since October.

Discover how Nasdaq’s IBIT options expansion impacts Bitcoin trading and liquidity. Explore ETF outflows, price recovery, and market implications for crypto investors today.

What is Nasdaq’s IBIT options expansion?

Nasdaq’s IBIT options expansion refers to a recent SEC filing proposing to increase the options contract limit for BlackRock’s iShares Bitcoin Trust (IBIT) from 25,000 to 1 million contracts. This 400% increase, or 40 times more exposure, seeks to facilitate greater derivatives trading and liquidity for the Bitcoin ETF. The move comes as Bitcoin shows signs of recovery, potentially stabilizing institutional participation in the crypto market.

How does the IBIT expansion affect Bitcoin derivatives activity?

The expansion allows for significantly higher trading volumes in IBIT options, drawing parallels to options depth seen in leading equities. According to data from CoinGlass, Bitcoin’s options open interest rose by approximately $4 billion in one day, reaching $62 billion, which underscores the immediate boost in derivatives engagement. This surge aligns with Bitcoin’s 3.51% daily rally, pushing prices toward the $92,000 level and marking the asset’s first V-shaped recovery in nearly a month.

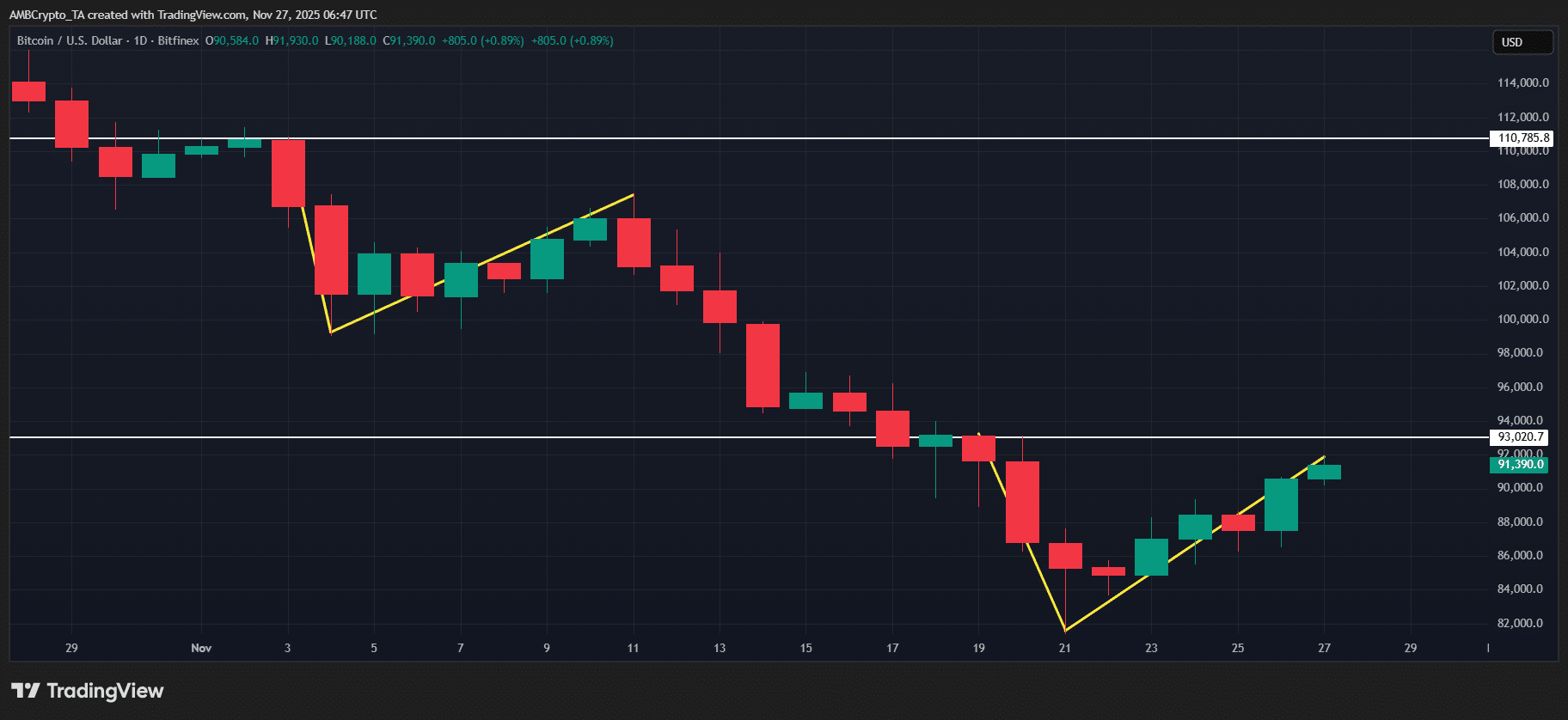

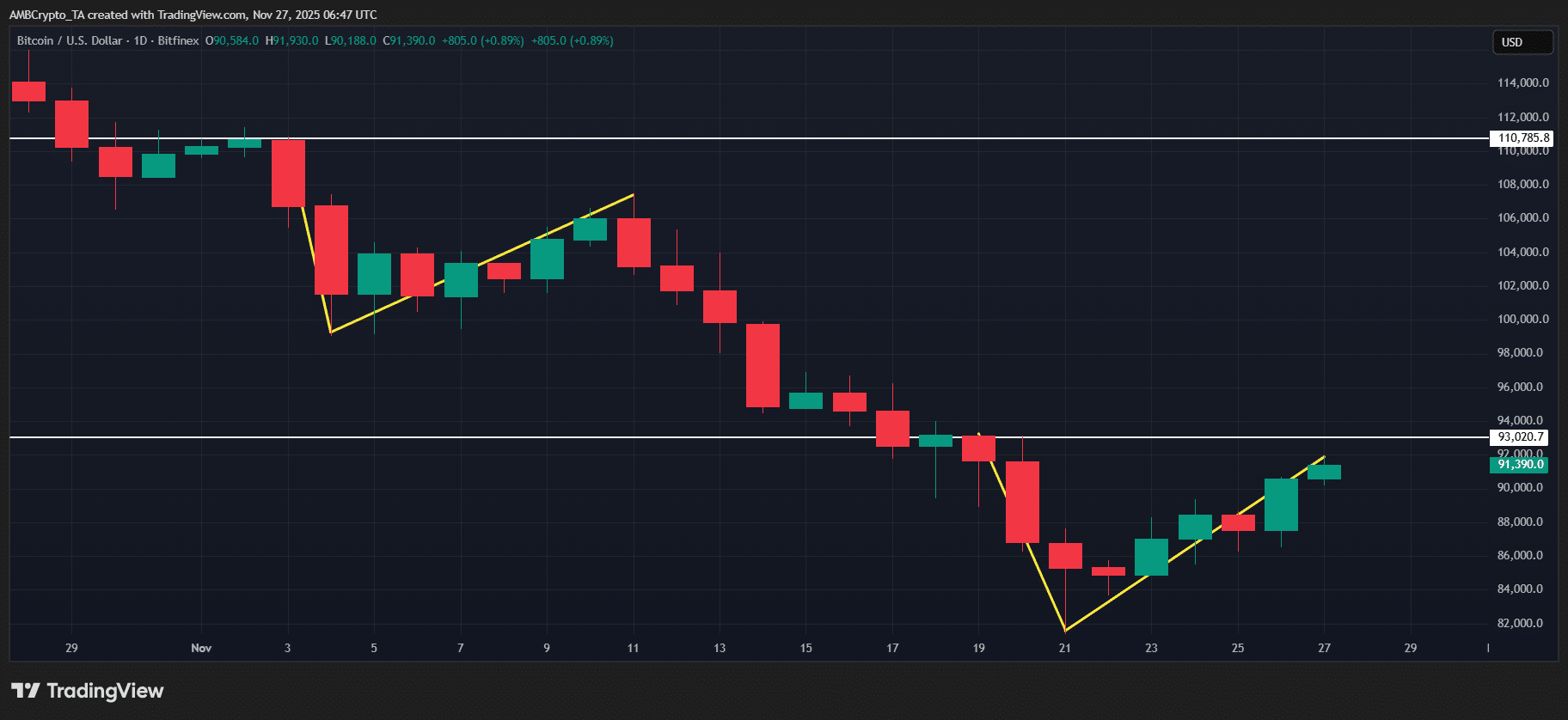

Market indicators reveal ongoing challenges, however. Bitcoin encountered resistance at $110,000 in early November, leading to lower lows around $80,000. Breaking $94,000 could signal stronger upward momentum, supported by the expanded options framework. Experts note that while this enhances liquidity, it also amplifies leverage risks, as evidenced by persistent fear indices in the crypto space.

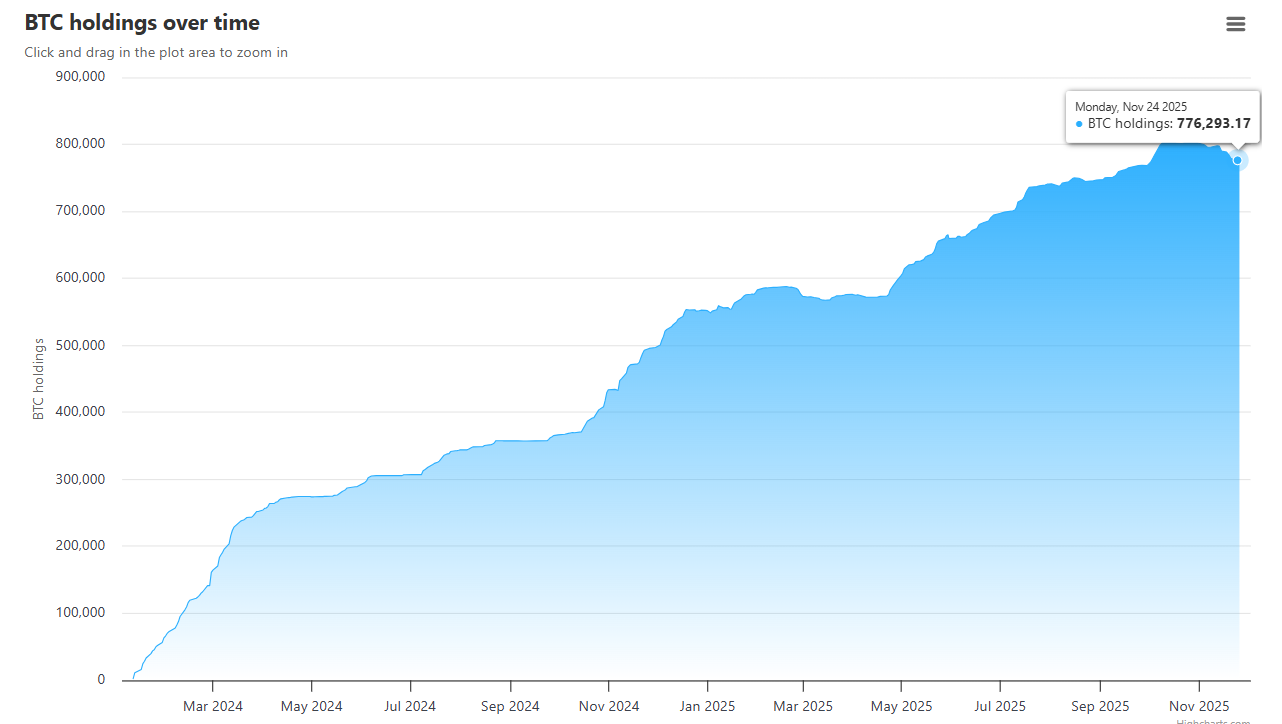

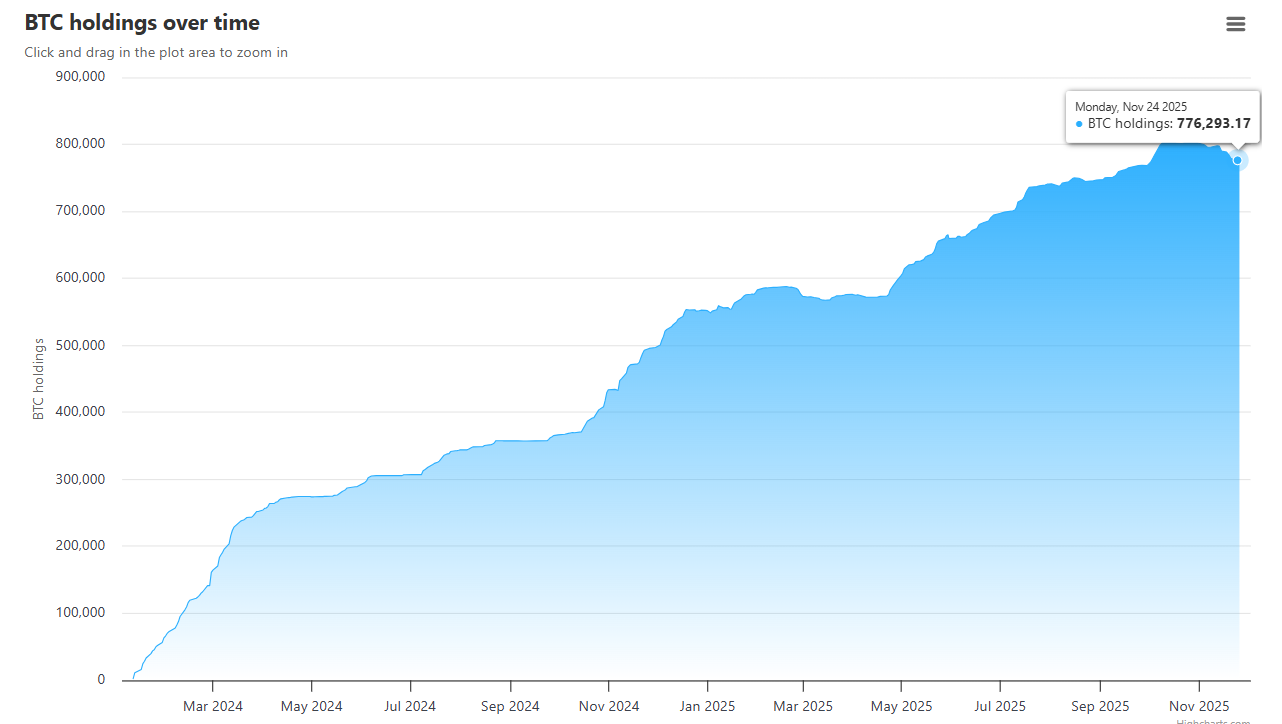

Institutional behavior provides further context. BitBo reports that BlackRock has reduced its direct Bitcoin holdings by about 30,000 BTC since the October downturn. Additionally, IBIT experienced over $3 billion in outflows during November, reflecting a cautious stance among large investors protecting balance sheets amid declining purchasing power for digital assets trackers.

Source: BitBo

The filing positions IBIT alongside high-profile stocks in terms of options accessibility, potentially attracting more sophisticated traders. Yet, with the SEC’s approval pending, the market’s current fear sentiment—highlighted by ETF net outflows—suggests that the expansion’s full benefits may hinge on broader Bitcoin price stability.

IBIT expansion drives Bitcoin activity, but volatility looms

The market’s response to Nasdaq’s proposal is visible in trading metrics. Bitcoin’s price has reclaimed territory above $90,000 following the news, supported by heightened options interest. This development occurs against a backdrop of institutional adjustments, where firms like BlackRock are recalibrating positions after significant sell-offs.

TradingView data illustrates Bitcoin’s chart patterns, showing the recent uptick from $80,000 lows. The V-shaped recovery indicates resilient buying pressure, but sustaining above key resistance remains critical. As options leverage intensifies, traders monitor for potential volatility spikes that could either solidify gains or trigger corrections.

Source: TradingView (BTC/USDT)

Analysts from financial institutions emphasize that such expansions can democratize access to Bitcoin exposure for retail and institutional players alike. One market observer stated, “The IBIT limit increase is a pivotal step toward mainstreaming crypto derivatives, but it requires careful navigation of regulatory and volatility hurdles.” This perspective highlights the balance between opportunity and risk in the evolving ETF landscape.

Broader market dynamics play a role too. The Q4 cycle has intensified scrutiny on Bitcoin’s role as a store of value, with data asset trackers (DATs) facing erosion in real terms. Institutional sales to safeguard portfolios underscore a testing phase for long-term conviction, even as the expansion promises renewed inflows if sentiment shifts positively.

Frequently Asked Questions

What impact does Nasdaq’s IBIT options expansion have on Bitcoin’s liquidity?

The expansion increases options contract availability to 1 million, potentially boosting Bitcoin’s liquidity by enabling larger derivatives trades. This could attract more institutional volume, as seen in the recent $4 billion open interest spike to $62 billion, though approval and market conditions will determine the extent of inflows.

Is BlackRock’s IBIT ETF recovering from November outflows?

BlackRock’s IBIT ETF is showing early signs of stabilization with Bitcoin’s price push to $92,000, but November’s $3 billion outflows and 30,000 BTC sales indicate ongoing caution. Recovery depends on sustained price action above resistance and broader crypto market rebound.

Key Takeaways

- Increased derivatives exposure: Nasdaq’s proposal for 1 million IBIT contracts expands trading capacity 40-fold, enhancing Bitcoin’s options market depth.

- Price recovery signals: Bitcoin’s V-shaped rebound to $92,000 reflects bullish momentum from heightened activity, though $94,000 resistance tests durability.

- Institutional caution persists: Despite expansion potential, BlackRock’s recent outflows highlight the need for resolved market fears before full conviction returns.

Conclusion

Nasdaq’s IBIT options expansion and its implications for Bitcoin derivatives underscore a maturing crypto ecosystem, where enhanced liquidity could counter recent ETF outflows and price volatility. As BlackRock navigates institutional shifts, Bitcoin’s path toward $94,000 resistance will clarify the expansion’s role. Investors should monitor SEC decisions and market indicators closely for opportunities in this dynamic landscape.