Nasdaq Proposes Quadrupling Options Limits for BlackRock’s Bitcoin ETF

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Nasdaq’s International Securities Exchange has proposed raising position limits for BlackRock’s iShares Bitcoin Trust (IBIT) options from 250,000 to 1,000,000 contracts to boost institutional participation and market liquidity in Bitcoin ETF options.

-

The proposal also seeks to eliminate limits for customized FLEX options, aligning IBIT with other commodity ETFs.

-

This change aims to shift trading from over-the-counter markets to regulated exchanges, enhancing transparency.

-

IBIT’s $86.2 billion market cap and 44.6 million average daily volume as of September 22, 2025, support the need for higher limits, representing a conservative 8% of BlackRock’s $71 billion Bitcoin holdings.

Discover Nasdaq ISE’s proposal to quadruple IBIT options position limits, boosting Bitcoin ETF liquidity amid rising institutional interest. Learn impacts on trading and ETF performance—stay ahead in crypto investments today.

What is the Nasdaq ISE Proposal for BlackRock’s iShares Bitcoin Trust Options?

Nasdaq’s International Securities Exchange (ISE) has submitted a filing to the US Securities and Exchange Commission (SEC) to significantly expand position limits on options for BlackRock’s iShares Bitcoin Trust (IBIT) from the current 250,000 contracts to 1,000,000 contracts. This adjustment is designed to enable institutional traders and market makers to take on larger positions, which would deepen market liquidity and support more efficient trading in Bitcoin ETF options. The proposal underscores the growing maturity of spot Bitcoin ETFs as mainstream financial products.

The filing comes at a pivotal time for cryptocurrency-linked investments, as Bitcoin ETFs like IBIT continue to attract substantial institutional capital. By increasing these limits, Nasdaq ISE aims to foster greater participation from large players, reducing fragmentation in trading activity. This move reflects broader industry trends toward integrating digital assets into traditional finance frameworks.

How Will Eliminating Position Limits for FLEX Options Benefit IBIT?

The Nasdaq ISE proposal extends beyond mere increases, requesting a full exemption from position limits for customized FLEX options that involve physical delivery. FLEX options allow for tailored strike prices and expiration dates, providing flexibility that standard options lack. According to the filing, removing these limits would position IBIT alongside major commodity-based exchange-traded funds (ETFs), drawing more trading volume from less transparent over-the-counter (OTC) markets to regulated venues.

This alignment is crucial for market efficiency. OTC trading often involves higher costs and counterparty risks, whereas exchange-traded options offer standardized contracts and centralized clearing. Nasdaq highlighted IBIT’s robust scale as justification: the ETF boasts a market capitalization of $86.2 billion and an average daily trading volume of 44.6 million shares as of September 22, 2025. BlackRock, the issuer, manages over $71 billion in Bitcoin across its portfolios. The proposed limits would permit positions equivalent to about $5.3 billion, or roughly 8% of that Bitcoin value—a figure consistent with prudent risk management practices for large-scale ETFs.

The SEC must approve the proposal, with a public comment period open until December 17, 2025. Industry observers view this as a positive step for Bitcoin’s financial ecosystem. Eric Balchunas, Senior ETF Analyst at Bloomberg, noted, “IBIT is now the biggest bitcoin options market in the world by open interest.” Similarly, Jeff Park from Bitwise Investment Advisors commented, “At last, IBIT options is finally getting the treatment it deserves. Institutional vol is finally here.” These insights from established analysts underscore the proposal’s potential to elevate IBIT’s role in derivatives trading.

Parallel developments show BlackRock’s ongoing commitment to Bitcoin exposure. A recent filing indicated that the firm’s Strategic Income Opportunities Portfolio boosted its IBIT holdings by 14% in the third quarter, reaching $155.8 million. This accumulation signals sustained confidence in the asset class despite short-term market fluctuations.

Frequently Asked Questions

What Are the Current Position Limits for IBIT Options and Why Increase Them?

Currently, position limits for IBIT options stand at 250,000 contracts on the Nasdaq ISE, a threshold set to manage risk in emerging markets. Increasing to 1,000,000 contracts would accommodate larger institutional trades, enhancing liquidity and depth without excessive speculation, as supported by IBIT’s strong fundamentals and trading volumes.

How Are Recent Outflows Affecting BlackRock’s iShares Bitcoin Trust?

IBIT experienced over $2 billion in monthly outflows amid a 22% Bitcoin price drop over the past month, reducing wallet values from $117 billion to $78.4 billion. However, long-term demand remains solid with cumulative inflows of $9.98 billion, and analysts like Eric Balchunas emphasize that core investors are holding firm as short interest collapses.

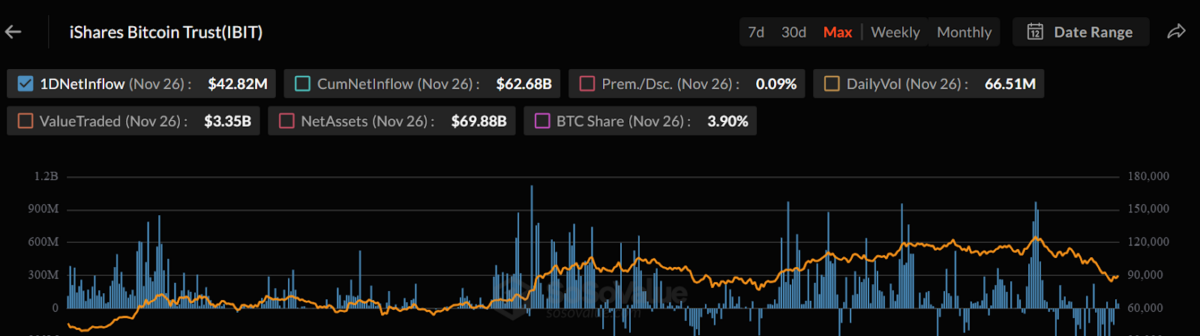

iShares Bitcoin Trust. Sources: Sosovalue

iShares Bitcoin Trust. Sources: SosovalueDespite these outflows, trading activity tells a story of resilience. Last week’s volumes across the 11 US-listed spot Bitcoin ETFs exceeded $40.32 billion, with IBIT dominating at $27.79 billion—nearly 70% of the total, per data from SoSoValue, a market analytics provider. On November 26, 2025, IBIT saw a one-day inflow of $42.82 million, reinforcing underlying strength.

The ETF’s net assets are currently at $33.5 billion, holding approximately 665,500 BTC. Its premium/discount ratio is a tight 0.05%, indicating close alignment with Bitcoin’s spot price and minimal arbitrage opportunities. Visual representations, like the orange line for Bitcoin’s price trend and blue bars for daily flows, illustrate this stability amid volatility.

Bitcoin’s price recovery adds optimism, climbing 5% in the last 24 hours to $91,254, according to CoinMarketCap data. This rebound from recent lows could stabilize ETF flows and support the Nasdaq ISE proposal’s rationale.

Walter Bloomberg, a market commentator, observed, “…After months of steady inflows, the outflows reflect rising caution as Bitcoin falls ~22% over the past month and 7% year-to-date.” Yet, ETF analyst Eric Balchunas counters concerns, pointing to declining short interest as evidence of tactical covering by traders who short during rallies and buy back in dips. This dynamic highlights Bitcoin ETFs’ maturation, where volatility prompts repositioning rather than exodus.

Key Takeaways

- Nasdaq ISE’s Proposal Enhances Liquidity: Raising IBIT options limits to 1,000,000 contracts will enable bigger institutional plays, pulling activity from OTC markets to exchanges.

- FLEX Options Exemption Aligns with Industry Standards: Eliminating limits for customized options positions IBIT like top commodity ETFs, backed by its $86.2 billion market cap.

- Resilient Demand Despite Outflows: With $9.98 billion in cumulative inflows and dominant trading volumes, IBIT shows strong long-term investor commitment—monitor SEC approval for next steps.

Conclusion

The Nasdaq ISE proposal to increase position limits for BlackRock’s iShares Bitcoin Trust (IBIT) options marks a significant evolution in Bitcoin ETF accessibility, promoting deeper liquidity and institutional engagement in Bitcoin ETF options trading. By seeking exemptions for FLEX options and leveraging IBIT’s impressive scale, this initiative could redirect volumes from opaque markets, benefiting the broader ecosystem. As Bitcoin hovers near $91,000 and ETF trading surges, investors should watch the SEC’s decision by December 2025, positioning themselves for enhanced opportunities in digital asset derivatives.

Comments

Other Articles

Oil Prices Surge 3% After Trump Cancels Iran Meetings and Promises Protesters ‘Help Is on the Way’ – What It Means for Bitcoin

January 13, 2026 at 05:49 PM UTC

Bitcoin Surges to $93,888: How Venezuela-US Tensions Triggered a Crypto Rally

January 5, 2026 at 07:04 AM UTC

Bitcoin (BTC) Eyes Short-Term Bottom Rebound as On-Chain Flows Align with USDC/USDT Premium and Market Liquidity, but Bearish Longer-Term Outlook Persists

January 1, 2026 at 03:41 PM UTC