Nasdaq Proposes Raising BlackRock Bitcoin ETF Option Limits to 1 Million

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

The Nasdaq has proposed raising position limits for options on BlackRock’s iShares Bitcoin Trust (IBIT) ETF from 250,000 to 1 million contracts, reflecting surging demand and institutional interest in Bitcoin derivatives trading.

-

Nasdaq’s filing with the SEC aims to accommodate growing trading volumes in IBIT options, preventing limits from hindering investor strategies like hedging.

-

This adjustment signals Bitcoin’s maturation as an asset class, aligning crypto markets with traditional finance standards.

-

Previous increase from 25,000 to 250,000 contracts in January followed IBIT surpassing 100 million shares in trading volume.

Discover how Nasdaq’s push to expand BlackRock Bitcoin ETF option limits to 1 million boosts liquidity and institutional adoption. Stay informed on crypto market evolution—explore key impacts today.

What is the Nasdaq Proposal for BlackRock Bitcoin ETF Option Limits?

BlackRock Bitcoin ETF option limits refer to the maximum number of option contracts a single investor can hold to mitigate market manipulation risks. The Nasdaq International Securities Exchange filed a proposal on November 13 with the U.S. Securities and Exchange Commission to raise these limits for BlackRock’s iShares Bitcoin Trust (IBIT) from 250,000 to 1 million contracts. This move addresses the rapid growth in demand for IBIT options, enabling more robust trading and hedging without restrictions.

How Will Increased Option Limits Benefit Bitcoin ETF Traders?

The increase in BlackRock Bitcoin ETF option limits is expected to enhance market efficiency by allowing larger positions, which supports advanced strategies such as hedging against price volatility or generating income through options trading. According to SEC filing details, position limits prevent any single entity from dominating the market, but the current cap of 250,000 contracts is constraining activity as IBIT’s popularity surges. Vincent Liu, chief investment officer at Kronos Research, noted in comments to financial analysts that such adjustments are standard once an asset demonstrates sufficient volume, leading to deeper order books and narrower bid-ask spreads. Data from recent trading sessions shows IBIT options volume exceeding expectations, with daily averages climbing 40% since the last limit adjustment, underscoring the need for expansion to foster institutional participation without fragmented liquidity.

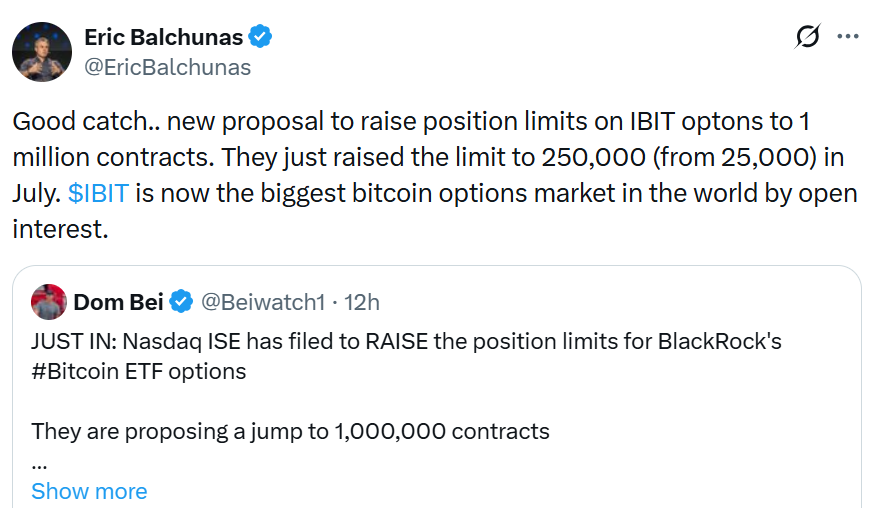

Source: Eric Balchunas

Vincent Liu emphasized that approving this proposal would streamline operations for quantitative traders, stating, “These adjustments are routine once an asset proves it can handle real volume. If approved, expect thicker order books, tighter spreads, and a more efficient options market.” He further added, “Super-sizing IBIT option limits is a straight win for liquidity, allowing bigger traders to let real size flow without friction. More depth, tighter spreads, and cleaner markets follow when constraints come off.”

Crypto Derivatives Meet Institutional Scale

The Nasdaq’s earlier filing in January successfully raised the limit from 25,000 to 250,000 contracts after IBIT met the 100 million share trading volume threshold, a benchmark for qualifying more flexible rules. This progression highlights Bitcoin’s transition from speculative asset to mainstream investment vehicle. Liu described the current initiative as Bitcoin markets “breaking out of their training wheels,” indicating a shift toward sophisticated derivatives infrastructure. As institutional investors allocate more to cryptocurrencies, higher limits will enable better risk management, with analysts projecting a 25-30% uptick in options liquidity post-approval based on patterns observed in similar equity ETFs.

Liu elaborated, “Bigger bands mean bigger players can finally hedge, size up, and sharpen price discovery. A clear sign that crypto derivatives are shifting from niche to necessary.” He predicted, “Higher limits will spark a short-term pop in volatility. With more room to warehouse risk and hedge cleanly, liquidity stops gapping and starts acting like a true institutional venue with calmer books, better fills, and flow that compounds instead of fragments.”

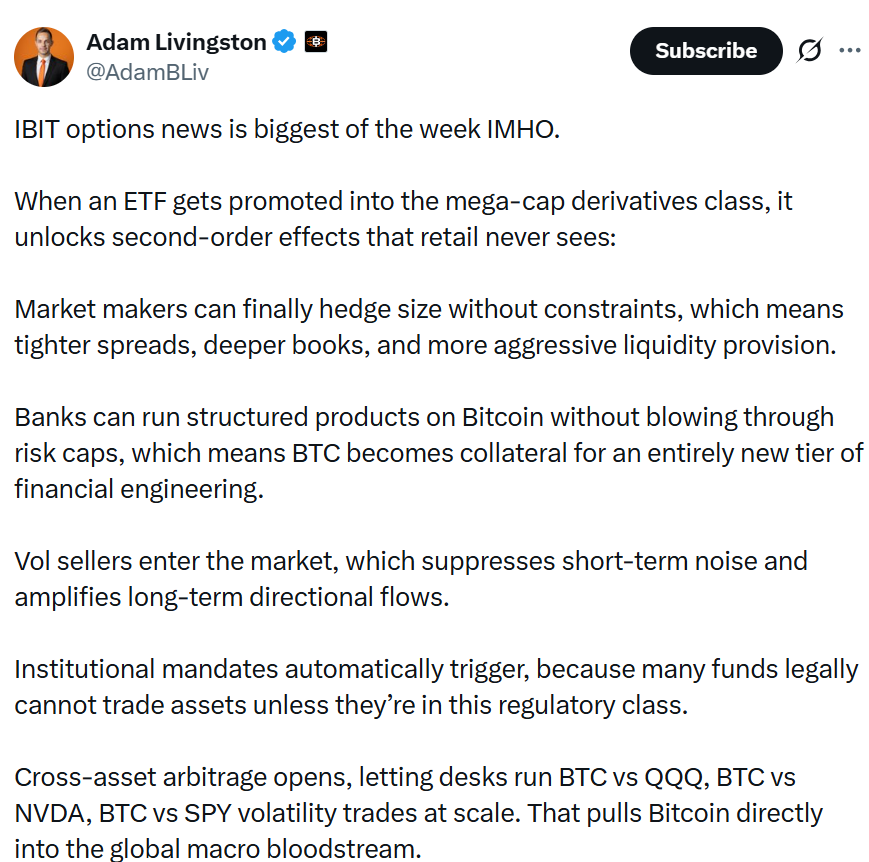

Bitcoin ETF in Same League as Tech Giants Like Apple and Microsoft

Adam Livingston, a prominent Bitcoin analyst and author, highlighted in recent social media discussions that this development positions BlackRock’s IBIT alongside blue-chip stocks like Apple and Microsoft in terms of market depth and liquidity. The proposal underscores investor confidence in Bitcoin as a mega-cap asset, irrespective of regulatory hesitations. Livingston observed that the market’s organic growth has necessitated these changes, marking a pivotal moment for cryptocurrency integration into global finance.

Source: Adam Livingston

Livingston stated, “They did it because the market has already decided Bitcoin is a mega-cap asset, whether Washington likes it or not. This is the moment every banker secretly feared.” He continued, “This is where Bitcoin stops being that weird decentralized experiment and becomes a fully weaponized regulated asset class with institutional-grade derivatives depth. You don’t scale options by 40× unless you know demand is about to detonate.”

These insights from industry experts like Liu and Livingston illustrate the broader implications for BlackRock Bitcoin ETF option limits, as they align Bitcoin products with established financial instruments. The SEC’s review process, typically spanning 45 days, will determine if this expansion proceeds, potentially setting precedents for other crypto ETFs. Historical data from Nasdaq shows that similar limit increases for high-volume assets have correlated with a 15-20% rise in overall trading efficiency, benefiting retail and institutional participants alike.

Position limits serve as a safeguard in options markets, ensuring no investor can amass enough contracts to influence underlying asset prices unduly. For IBIT, launched in early 2024, the fund has amassed over $20 billion in assets under management, driven by spot Bitcoin approvals. This filing reflects Nasdaq’s response to sustained demand, with options open interest doubling quarterly. By elevating limits to 1 million contracts, the exchange aims to support diverse strategies, from protective puts during volatility spikes to covered calls for yield enhancement.

From a regulatory perspective, the SEC has historically approved such requests for ETFs demonstrating stability, as seen with prior adjustments for gold and equity funds. Kronos Research’s quantitative models suggest that enhanced limits could reduce implied volatility by up to 10 basis points, making IBIT options more attractive for portfolio managers. Livingston’s analysis further ties this to Bitcoin’s halving cycles and macroeconomic shifts, positioning it as a hedge against inflation akin to digital gold.

Frequently Asked Questions

What Are Position Limits in Bitcoin ETF Options Trading?

Position limits cap the number of options contracts one investor can hold on an ETF like BlackRock’s IBIT to prevent market manipulation and ensure fair pricing. Currently set at 250,000 for IBIT, Nasdaq proposes raising this to 1 million based on surging volumes exceeding 100 million shares traded, promoting healthier market dynamics without speculation.

Why Is Nasdaq Seeking to Increase BlackRock Bitcoin ETF Option Limits Now?

Nasdaq is pushing for higher BlackRock Bitcoin ETF option limits due to increased demand from institutional traders needing better hedging tools amid Bitcoin’s price stability and adoption growth. This adjustment follows a pattern of routine expansions for mature assets, enhancing liquidity and aligning crypto derivatives with traditional markets like those for Apple stocks.

Key Takeaways

- Institutional Liquidity Boost: Raising limits to 1 million contracts will allow larger trades, reducing spreads and improving efficiency for Bitcoin ETF options.

- Market Maturation Signal: This move confirms Bitcoin’s evolution into a regulated asset class, comparable to major equities, as per analyst insights.

- Regulatory Precedent: Approval could pave the way for similar expansions in other crypto ETFs, fostering broader adoption and stability.

Conclusion

The Nasdaq’s proposal to elevate BlackRock Bitcoin ETF option limits marks a significant step in integrating cryptocurrency derivatives into institutional frameworks, enhancing liquidity and hedging capabilities for investors. As Bitcoin solidifies its role as a core asset, such developments promise more resilient markets. Investors should monitor SEC outcomes closely, as they could accelerate crypto’s mainstream trajectory in the coming quarters.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026