Netherlands Approves 36% Crypto Tax: BTC Analysis

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

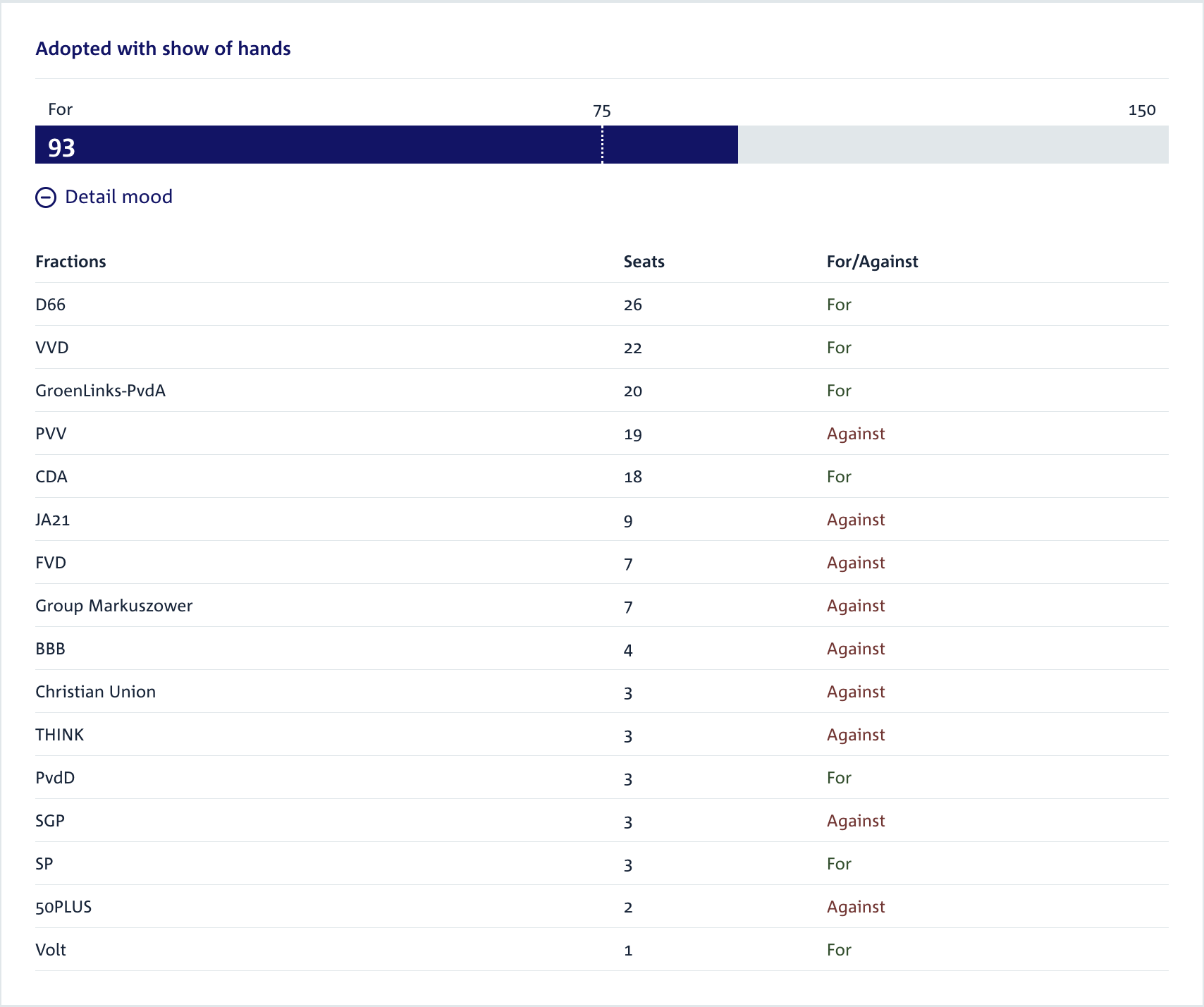

The Dutch House of Representatives approved a bill on Thursday introducing a 36% capital gains tax on earnings from savings accounts, cryptocurrencies, stocks, and interest-bearing financial instruments. The proposal advanced by surpassing the 75-vote threshold with 93 votes from parliamentarians. The tax will apply regardless of whether the assets are sold.

The vote tally for the 36% capital gains tax bill. Source: Dutch House of Representatives

Dutch 36% Capital Gains Tax Details

For the proposal to become law, Senate approval is required, and if accepted, it will take effect from the 2028 tax year. This unrealized gains tax will tax annual value increases. Critics note that investments subject to the tax could lead to capital flight, drawing from similar practices in France.

36% Tax Loss in Long-Term Investments

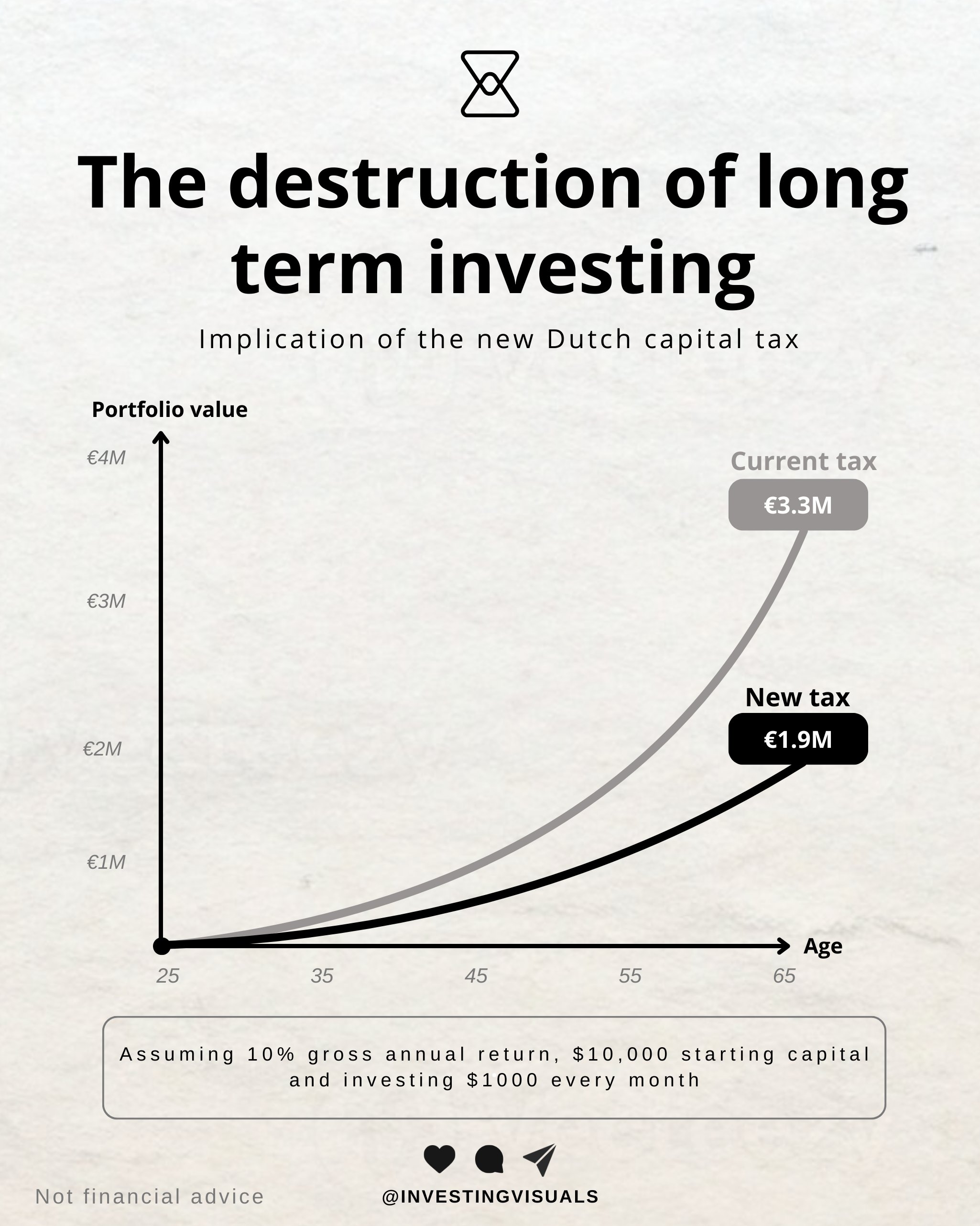

According to Investing Visuals, a 10,000 euro portfolio growing with monthly 1,000 euro investments over 40 years reaches 3.32 million euros without tax, but stays at 1.885 million euros with 36% tax, resulting in a 1.435 million euro loss.

A comparison of an investment compounded over 40 years without the 36% unrealized gains tax and with the tax. Source: Investing Visuals

BTC Price and Dutch Tax Impact

Today BTC price is at 68,750.75 USD, 24-hour change +%4.67. RSI at 35.44 in oversold territory, but downtrend and bearish Supertrend dominant. EMA 20: 74,760 USD. The tax news is pressuring BTC by increasing European regulation fears. Click for detailed BTC analysis.

Institutional BTC Purchases: Binance SAFU and Goldman Sachs

Despite Dutch tax pressure, institutions are accumulating BTC. According to Arkham data, Binance SAFU fund bought 4,545 BTC worth 304.58 million USD. Goldman Sachs holds 1.1 billion USD BTC, 1 billion USD ETH, 153 million USD XRP, and 108 million USD SOL. This shows long-term confidence.

BTC Support and Resistance Levels Table

| Level | Price (USD) | Score | Distance | Sources |

|---|---|---|---|---|

| S1 | 62,997.33 | 83/100 ⭐ | -8.58% | S3, POC, Fibo |

| S2 | 66,682.95 | 71/100 ⭐ | -3.23% | S1, Ichimoku |

| R1 | 70,235.41 | 77/100 ⭐ | +1.92% | Fibo, MACD |

| R2 | 76,010.89 | 63/100 ⭐ | +10.30% | BB, SMA20 |

S1 strong support, R1 first target. Check BTC futures.

BTC Strategies for Dutch Investors

Switching to altcoins like ETH or offshore storage is recommended before the tax. NYSE American's crypto ETF options could accelerate institutional inflows.