Norway’s Wealth Fund Backs Metaplanet’s Bitcoin Treasury Expansion Plans

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

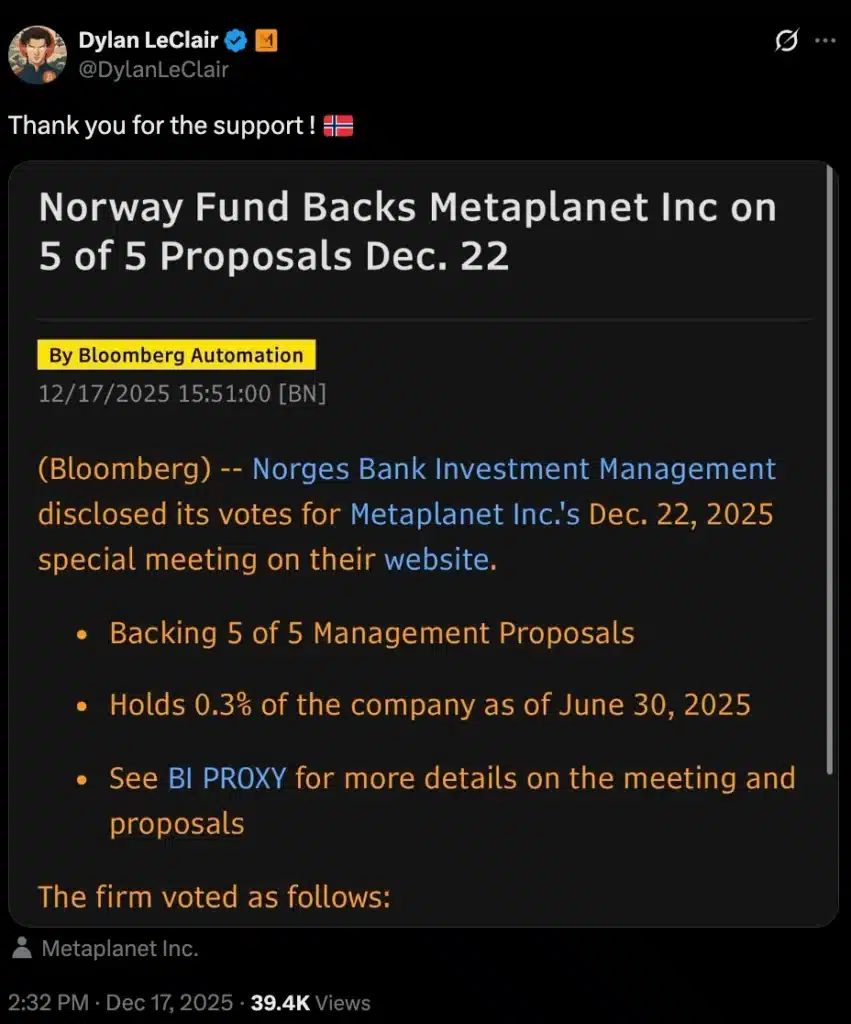

Metaplanet has received unanimous support from Norges Bank Investment Management (NBIM) for its Bitcoin treasury strategy, endorsing proposals to accelerate BTC accumulation and strengthen capital structure. This backing from Norway’s sovereign wealth fund manager validates the model as a viable corporate approach amid growing institutional interest in digital assets.

-

NBIM’s endorsement covers all five management proposals at Metaplanet’s upcoming EGM, focusing on Bitcoin-centric treasury enhancements.

-

Proposals include capital stock reductions and new preferred share issuances to fund Bitcoin purchases without diluting existing shareholders.

-

Metaplanet’s strategy aims to scale holdings to 100,000 BTC by 2026, positioning it as a major global player, with NBIM’s 0.3% stake signaling broader adoption of Bitcoin-backed equities.

Discover how NBIM’s support bolsters Metaplanet’s Bitcoin treasury strategy, unlocking new capital for BTC buys and institutional appeal. Explore the implications for crypto adoption in Asia—stay informed on this pivotal shift today.

What is Metaplanet’s Bitcoin Treasury Strategy?

Metaplanet’s Bitcoin treasury strategy involves aggressively accumulating Bitcoin as a core reserve asset to drive long-term corporate value and hedge against traditional financial risks. The Tokyo-listed company, often compared to global Bitcoin advocates, plans to leverage structural reforms to raise capital specifically for BTC purchases, targeting a significant increase in holdings from current levels to 100,000 BTC by 2026. This approach mirrors successful models in the U.S., emphasizing Bitcoin’s role in enhancing shareholder returns through innovative financing tools like preferred shares.

How Does NBIM’s Support Strengthen Metaplanet’s Position?

Norges Bank Investment Management (NBIM), overseeing Norway’s $2 trillion sovereign wealth fund, has voted in favor of all five proposals ahead of Metaplanet’s Extraordinary General Meeting on December 22. This endorsement from a major institutional investor, holding approximately 0.3% of Metaplanet, underscores confidence in the firm’s Bitcoin-focused initiatives. The proposals encompass reducing capital stock to free up reserves for dividends, share buybacks, or Bitcoin acquisitions; expanding authorized shares; and issuing new Class A (MARS) and Class B (MERCURY) preferred shares. These instruments offer variable or fixed dividends, conversion options, and redemption features, appealing to institutional investors seeking yield with Bitcoin exposure. By approving a $150 million raise through MERCURY shares earmarked for Bitcoin, NBIM’s support provides Metaplanet with scalable funding mechanisms. Financial data from public filings indicates Metaplanet’s current market capitalization supports this pivot, with its stock trading around 404 JPY as of late 2025, reflecting a 1.51% uptick. Experts in sovereign wealth management, such as those cited in annual NBIM reports, highlight the diversification benefits of digital assets, noting Bitcoin’s historical 200%+ annual returns in volatile periods. This alignment positions Metaplanet to build resilient infrastructure, potentially rivaling larger holders and demonstrating the maturity of Bitcoin treasuries in Asian markets. Short sentences aid clarity: The strategy mitigates dilution risks. It attracts global capital. Ultimately, it accelerates BTC accumulation beyond market cycles.

Norges Bank Investment Management (NBIM), the manager of Norway’s $2 trillion sovereign wealth fund, has made a bold investment move.

Metaplanet, the Tokyo-listed firm often dubbed “Asia’s MicroStrategy,” has secured unanimous support from NBIM for all five of its management proposals.

Metaplanet Gets Support from NBIM

Ahead of an Extraordinary General Meeting (EGM) on 22 December, NBIM, which holds a stake of roughly 0.3% in the company, has publicly signaled its total alignment with Metaplanet’s aggressive Bitcoin treasury strategy.

Source: Dylan LeClair/X

By voting “Yes” on every proposal, NBIM isn’t just a passive observer now. In fact, it is endorsing the Bitcoin Treasury Model as a legitimate corporate strategy. This move reflects NBIM’s broader portfolio strategy, where it maintains exposure to Bitcoin through established players, holding about 1.05% in MicroStrategy—a stake valued at over $1.1 billion as of late 2025, according to fund disclosures. The fund’s increasing position in Metaplanet, up from 0.3% in June to 0.49% currently, indicates a deliberate effort to balance global Bitcoin treasury investments. Such diversification aligns with principles outlined in NBIM’s annual investment reports, which emphasize risk-adjusted returns from emerging asset classes like cryptocurrencies.

Details of the Proposals

The five proposals represent comprehensive structural changes to fortify Metaplanet’s capital base and expedite its Bitcoin accumulation. Primarily, the firm will reduce its capital stock and reserves, releasing surplus funds for strategic uses such as dividends, share repurchases, or direct Bitcoin investments— all without impacting the circulating share count. This preserves shareholder equity while enabling proactive treasury management.

Furthermore, Metaplanet intends to broaden its authorized shares and launch specialized preferred classes for enhanced capital-raising flexibility. Class A shares, termed MARS, function as perpetual senior securities with variable monthly dividends, delivering yield to investors while safeguarding against dilution for common holders. Complementing this, Class B shares (MERCURY) serve as a robust capital vehicle, featuring fixed quarterly dividends, conversion privileges to common stock, and redemption options—ideal for institutions desiring stable income paired with Bitcoin growth potential.

A key component involves raising $150 million via MERCURY shares targeted at institutional buyers, with proceeds explicitly allocated to Bitcoin acquisitions. Public regulatory filings confirm these mechanisms comply with Tokyo Stock Exchange rules, ensuring transparency and investor protection. If executed effectively, this framework could elevate Metaplanet to among the top corporate Bitcoin holders worldwide, trailing only prominent U.S. entities. Market analysts, drawing from data in Bloomberg terminals, project that such strategies could yield compounded returns exceeding traditional reserves, given Bitcoin’s average 150% yearly growth over the past five years.

Norges Bank’s Strategic Role in Bitcoin Equities

NBIM’s involvement extends beyond Metaplanet, as evidenced by its substantial commitment to MicroStrategy, where the 1.05% ownership translates to significant Bitcoin exposure. This pattern—from U.S. to Asian markets—suggests NBIM is methodically indexing Bitcoin treasuries as a distinct asset category. By supporting Metaplanet, the fund affirms the viability of Bitcoin-backed stocks for long-term portfolios, potentially influencing other sovereign investors. Recent trading data shows Metaplanet shares at 404 JPY, a 1.51% rise, while MicroStrategy traded at $167.50, up 3.34%—correlating with positive sentiment around treasury adoptions.

Metaplanet’s Current Bitcoin Acquisition Dynamics

Despite the momentum, Metaplanet has halted Bitcoin purchases since September 29, attributed to its market-to-net asset value dipping below 1x, a prudent measure to maintain valuation discipline. The December 22 EGM looms as a critical juncture, where approval could reignite acquisitions and affirm the path to 100,000 BTC by 2026. Balance sheet reviews from company statements reveal strong liquidity, with reserves supporting ongoing operations and strategic pivots. This pause, far from a setback, highlights disciplined execution in a volatile asset class.

Frequently Asked Questions

What Are the Key Benefits of Metaplanet’s Preferred Share Proposals for Bitcoin Accumulation?

Metaplanet’s proposals enable efficient capital raises through MARS and MERCURY shares, providing dividends and conversion features that attract institutions. This funds Bitcoin buys without diluting common stock, enhancing treasury growth while offering investors yield tied to BTC performance—directly supporting the 100,000 BTC target by 2026.

Why Is NBIM’s Endorsement Significant for Institutional Adoption of the Bitcoin Treasury Model?

NBIM’s full support for Metaplanet’s strategy validates Bitcoin treasuries for large-scale investors, mirroring its MicroStrategy position. Managing $2 trillion, NBIM’s actions signal to global funds that these models offer diversification and returns, potentially accelerating corporate Bitcoin adoption worldwide through proven, compliant structures.

Key Takeaways

- Strategic Validation: NBIM’s unanimous vote on Metaplanet’s proposals confirms the Bitcoin treasury model as a credible path for corporate finance in Asia.

- Capital Innovation: New preferred shares like MARS and MERCURY provide flexible funding for BTC accumulation, balancing yield for investors with treasury expansion.

- Global Indexing: NBIM’s stakes in Metaplanet and MicroStrategy position Bitcoin equities as an emerging asset class, urging firms to integrate digital reserves.

Conclusion

Metaplanet’s Bitcoin treasury strategy, bolstered by NBIM’s endorsement, marks a milestone in institutional crypto integration, enabling scalable BTC holdings through innovative capital tools. As the December EGM approaches, this development highlights Asia’s rising role in global digital asset adoption. Investors should monitor outcomes, as they could catalyze further corporate treasuries and enhance Bitcoin’s legitimacy in mainstream finance—positioning early adopters for substantial long-term gains.