OKX and Securitize Launch Tokenized STBL Stablecoin

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

Securitize, in partnership with STBL, Hamilton Lane, and OKX Ventures, is launching a new stablecoin backed by tokenized private credit assets on OKX's X Layer network. The stablecoin is backed by exposure to Hamilton Lane's Senior Credit Opportunities Fund through a feeder structure. This move combines institutional private credit, regulated tokenization, and programmable settlement to target next-generation onchain financial infrastructure.

STBL Stablecoin's Dual Token Architecture and Features

- Backing Asset: Tokenized private credit via Hamilton Lane’s Senior Credit Opportunities Fund.

- Network: OKX X Layer – Layer 2 optimized for fast and low-cost transactions.

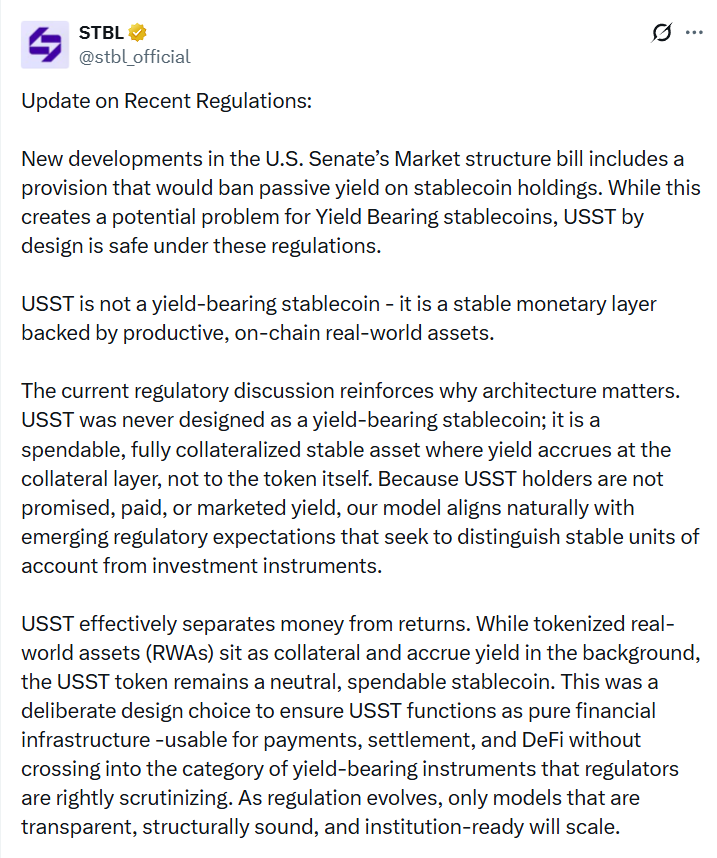

- Compliance: Compliant with US regulators; yield is kept separate from the stable unit.

The product, designed with a dual token architecture, ensures compliance with audits for yield-bearing stablecoins by separating yield generation from the stable unit. Yield accumulates in the collateral layer and is not paid directly to stablecoin holders; thus, distinguishing between a payment instrument and an investment product. STBL stands out as a significant step in the integration of institutional private markets with onchain finance.

Source: OKX Ventures, Securitize

Source: STBL

BTC Market and STBL Stablecoin Integration

RWA-based stablecoins like STBL offer alternatives to investors seeking stability and yield in the context of BTC detailed analysis. Positioned as a hedge against BTC volatility, tokenized assets are growing the sector. Securitize is the largest platform with $4 billion in tokenized assets, backed by BlackRock and Morgan Stanley. This partnership can be integrated with instruments like BTC futures.

Frequently Asked Questions About STBL Stablecoin

- What assets back the STBL stablecoin? Tokenized private credit with Hamilton Lane’s Senior Credit Opportunities Fund.

- What is the dual token architecture for? It ensures regulatory compliance by separating yield and stable.

- How is STBL used on OKX X Layer? Ideal for DeFi integration with programmable settlement.

- What is Securitize's role? Leading player backed by BlackRock as a tokenization platform.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/3/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

3/2/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

3/1/2026

DeFi Protocols and Yield Farming Strategies

2/28/2026