OpenEden Raises Funds from Ripple to Potentially Scale Tokenized Treasurys and USDO

XRP/USDT

$2,480,132,667.31

$1.3653 / $1.27

Change: $0.0953 (7.50%)

-0.0099%

Shorts pay

Contents

OpenEden, a leading real-world asset tokenization platform, has secured an undisclosed funding round backed by Ripple and prominent institutions to accelerate the expansion of tokenized US Treasurys, enhancing on-chain access to traditional financial products.

-

New funding supports scaling of TBILL tokenized Treasury fund and USDO yield-bearing stablecoin.

-

Investors include Ripple, Lightspeed Faction, Gate Ventures, and Anchorage Digital Ventures.

-

Tokenized money market funds have grown to nearly $9 billion in assets as of 2025, per Bank for International Settlements data.

OpenEden funding round boosts tokenized US Treasurys growth with Ripple backing. Discover how this investment expands RWA tokenization for DeFi integration and yield opportunities. Explore now for insights on crypto’s evolving finance landscape.

What is the OpenEden funding round for tokenized US Treasurys?

OpenEden funding round represents a significant milestone for the real-world asset (RWA) tokenization sector, enabling the platform to scale its offerings in tokenized US Treasurys. Backed by major investors including Ripple, the round follows OpenEden’s earlier 2024 raise with YZi Labs and aligns with the rapid growth of tokenized government debt in the crypto space. This investment will enhance compliant infrastructure for bringing traditional assets on-chain, fostering adoption among institutions and protocols.

How will OpenEden utilize the funds from this investment?

The funds will primarily drive the expansion of OpenEden’s tokenization-as-a-service platform, introducing new products linked to traditional markets while prioritizing core offerings like the TBILL tokenized US Treasury fund and USDO, a yield-bearing stablecoin collateralized by these treasuries. According to Jeremy Ng, founder and CEO of OpenEden, the investment strengthens the company’s ability to deliver regulated, market-ready solutions that bridge traditional and decentralized finance. USDO and its wrapped variant, cUSDO, are already integrated into various decentralized exchanges and lending protocols, with cUSDO recently approved as collateral for off-exchange trading on platforms like Binance. Furthermore, OpenEden is developing tokenized bond exposures, multi-strategy yield tokens, and structured products to diversify its portfolio.

In a strategic move earlier this year, OpenEden appointed The Bank of New York Mellon Corporation (BNY) as the custodian and investment manager for the underlying treasuries in TBILL. This partnership, combined with investment-grade ratings from S&P Global and Moody’s, underscores the platform’s commitment to security and compliance. These enhancements position tokenized US Treasurys as reliable on-chain assets, offering yields comparable to traditional money market funds without the volatility risks associated with other cryptocurrencies.

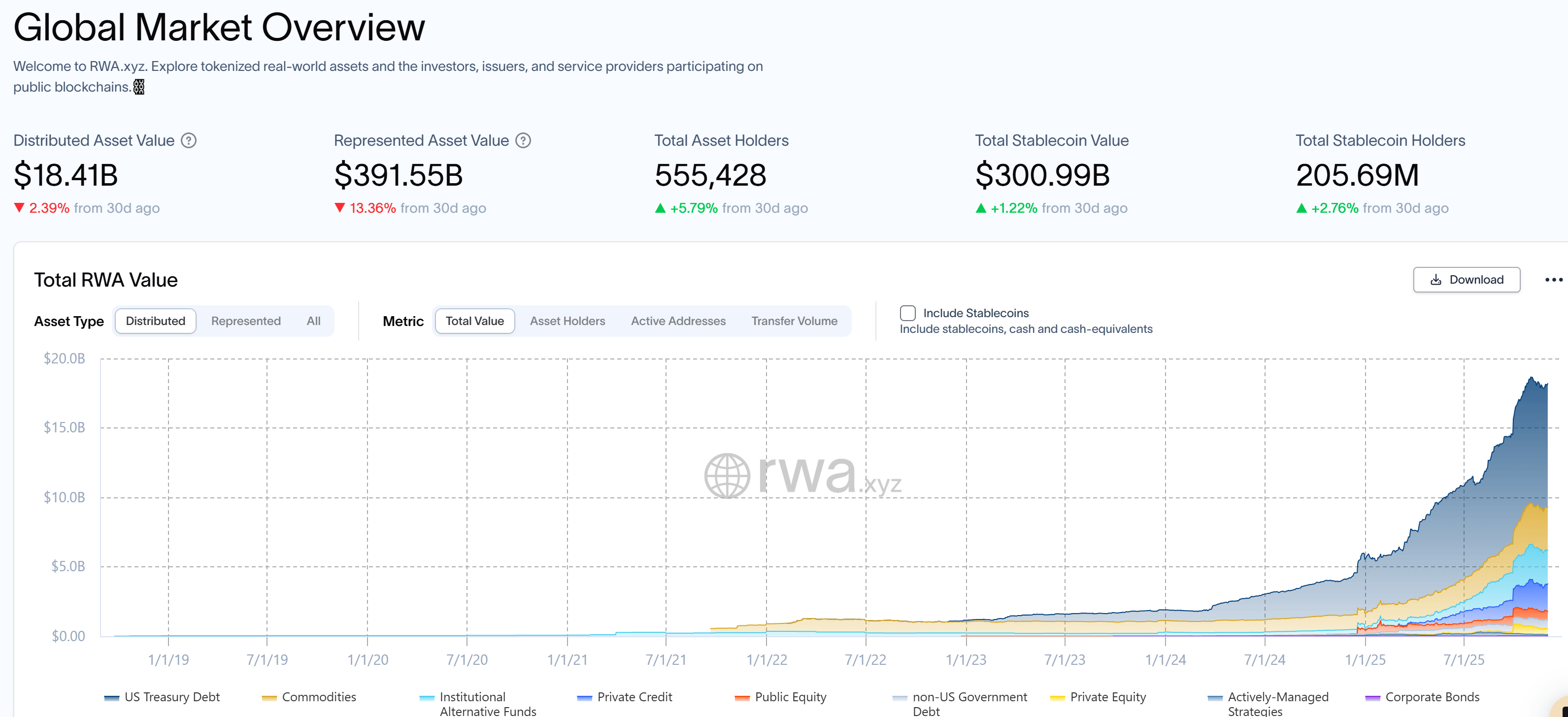

Total RWA market overview. Source: RWA.xyz

The broader context of this funding highlights the surging interest in RWAs. Tokenized versions of short-dated government debt have emerged as one of the fastest-growing areas in cryptocurrency throughout 2025. Institutions are increasingly turning to these assets for their stability and yield potential, integrating them into blockchain ecosystems for seamless liquidity and transparency.

Expert analysis from the Bank for International Settlements (BIS) emphasizes the role of tokenized money market funds as a key yield engine in public blockchains. These funds provide returns similar to their off-chain counterparts, estimated at around 4-5% annually based on current Treasury rates, while incorporating safeguards that surpass those of typical stablecoins. The BIS report notes that assets under management in these tokenized funds have surged to nearly $9 billion by late 2025, a dramatic increase from approximately $770 million at the end of 2023. This growth trajectory reflects broader market confidence in tokenized assets as a bridge between legacy finance and blockchain innovation.

Jeremy Ng elaborated on the implications, stating, “As tokenization scales in adoption, institutions and protocols are seeking trusted, compliant infrastructure to bring traditional assets on-chain.” This perspective aligns with observations from financial analysts who point to the regulatory clarity and technological advancements enabling such integrations. For instance, the involvement of established players like BNY as custodian not only mitigates counterparty risks but also facilitates institutional-grade operations on decentralized networks.

The investor lineup further bolsters OpenEden’s credibility. Participants in the round include trading firms such as FalconX and Flowdesk, venture capital entities like Lightspeed Faction and Gate Ventures, blockchain networks including the Kaia Foundation, and infrastructure providers like Anchorage Digital Ventures, P2 Ventures, Selini Capital, and Sigma Capital. Ripple’s participation is particularly noteworthy, given its focus on cross-border payments and asset tokenization through initiatives like the XRP Ledger. Although the exact amount raised remains undisclosed, the diverse backing signals strong market validation for OpenEden’s vision.

Beyond immediate product development, the funding will support enhancements in interoperability and compliance features. OpenEden aims to ensure its tokenized assets meet global standards, appealing to a wide array of users from retail investors to large institutions. This includes ongoing audits and partnerships to maintain high security protocols, as evidenced by the S&P and Moody’s ratings for TBILL, which affirm its low-risk profile.

Frequently Asked Questions

Who are the key investors in OpenEden’s latest funding round for tokenized US Treasurys?

The funding round features backing from Ripple, Lightspeed Faction, Gate Ventures, FalconX, Anchorage Digital Ventures, Flowdesk, P2 Ventures, Selini Capital, Kaia Foundation, and Sigma Capital. These investors represent a mix of venture capital, trading expertise, and blockchain infrastructure, providing OpenEden with comprehensive support to scale its RWA platform without disclosing the investment amount.

What role do tokenized US Treasurys play in the crypto yield market?

Tokenized US Treasurys serve as a stable, yield-generating asset in the crypto space, offering blockchain-based exposure to short-term government debt with returns around traditional money market levels. They enhance DeFi liquidity and provide a safer alternative to volatile stablecoins, with market assets growing to $9 billion as reported by the Bank for International Settlements, making them ideal for institutional and retail yield strategies.

Key Takeaways

- Strategic Funding Boost: OpenEden’s undisclosed round, supported by Ripple and top institutions, accelerates the growth of tokenized US Treasurys like TBILL and USDO.

- Market Expansion: The investment enables new products such as tokenized bonds and structured yields, backed by custodians like BNY and ratings from S&P Global and Moody’s.

- RWA Growth Insight: Tokenized money market funds have reached $9 billion in assets, positioning them as a cornerstone of on-chain yield opportunities for 2025 and beyond.

Conclusion

The OpenEden funding round marks a pivotal advancement in the tokenized US Treasurys and RWA tokenization landscape, integrating traditional finance with blockchain efficiency through compliant infrastructure and innovative products like TBILL and USDO. With endorsements from authoritative sources such as the Bank for International Settlements and expert insights from CEO Jeremy Ng, this development underscores the maturing intersection of crypto and legacy markets. As adoption continues to rise, stakeholders should monitor these evolutions for opportunities to leverage secure, yield-bearing assets in decentralized ecosystems, paving the way for broader financial inclusion.