PENGU May See Deeper Decline After Hitting Key Resistance Amid Capital Flight

PENGU/USDT

$83,668,733.85

$0.006884 / $0.006264

Change: $0.000620 (9.90%)

+0.0028%

Longs pay

Contents

PENGU memecoin has experienced a sharp 12% price drop in the last 24 hours, trading at $0.0097 amid heavy capital outflows and broader memecoin market losses of 27%. Selling pressure at key resistance levels and fading bullish indicators signal potential further declines for this once-popular asset.

-

PENGU memecoin faces sustained capital flight, with $6.5 million withdrawn from derivatives positions recently.

-

Bullish momentum is waning, as shown by Parabolic SAR dots above the price and Money Flow Index in the sell zone.

-

Community sentiment has dropped to 72% bullish from over 90%, based on data from 375,000 investors per CoinMarketCap.

Discover why PENGU memecoin is declining sharply, with 12% drop and bearish signals. Explore price analysis, market trends, and expert insights on memecoin volatility. Stay informed on crypto shifts today.

What is Causing the PENGU Memecoin Price Decline?

PENGU memecoin is undergoing a notable price decline primarily due to intensified selling pressure after hitting a key resistance level, resulting in a 12% drop over the past 24 hours to $0.0097. This movement aligns with broader memecoin sector losses averaging 27%, driven by capital outflows totaling around $6.5 million from derivatives markets. Technical indicators further confirm the bearish shift, with community optimism waning significantly.

How Are Technical Indicators Influencing PENGU’s Market Momentum?

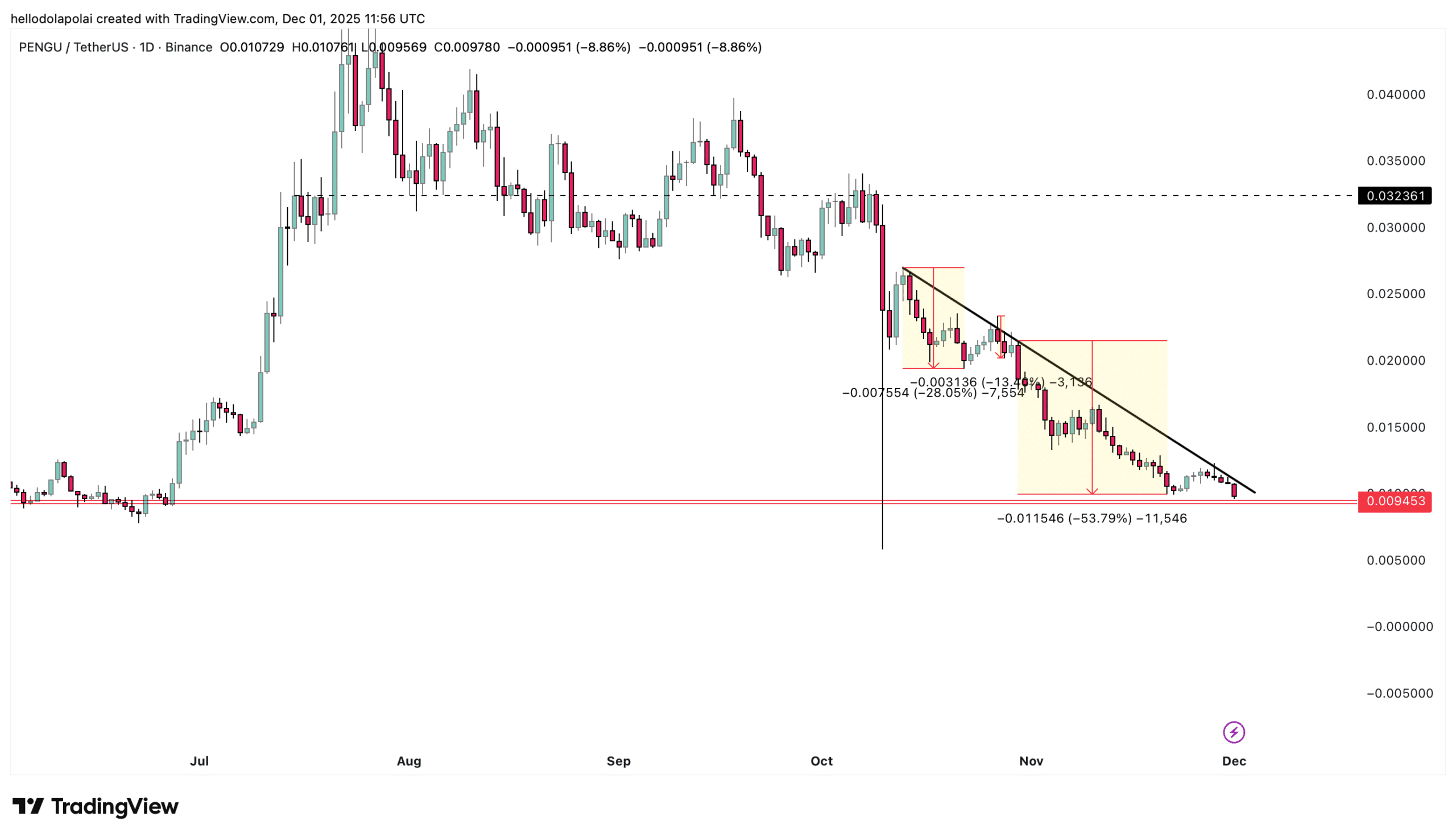

Technical analysis reveals that PENGU memecoin encountered strong resistance, leading to a sell-off that mirrors previous patterns, including a 53% drop in a prior instance. On average, interactions with this resistance zone have resulted in 31.7% declines across three recent occasions, according to chart data from TradingView. Without a breakout above the declining resistance, the asset is poised to test nearby support levels.

Source: TradingView

Bullish momentum for PENGU has dissipated, as evidenced by the Parabolic SAR indicator, which now shows dots positioned above the price candles, indicating a bearish trend and potential for additional downside. This tool, widely used by traders to gauge trend direction, suggests that market participants are leaning toward short positions. Complementing this, the Money Flow Index (MFI) lingers in the sell zone between 30 and 50, though it shows a slight upward tick toward neutral territory, hinting at possible minor capital inflows amid the outflows.

Source: TradingView

Market analysts note that such indicator alignments often precede prolonged corrections in memecoins, with historical data from similar assets showing average recovery times of 7-14 days following resistance rejections. In PENGU’s case, the combination of these signals underscores a cautious outlook, urging investors to monitor liquidity clusters for signs of stabilization.

Frequently Asked Questions

What Factors Are Driving Capital Outflows from PENGU Memecoin?

Capital outflows from PENGU memecoin stem from heavy selling at resistance levels and declining community sentiment, with $6.5 million pulled from derivatives positions recently. This reflects broader memecoin market pressures, including a 27% sector-wide drop, as investors seek safer assets amid volatility.

Is PENGU Memecoin Likely to Rebound Soon?

Based on current technicals, PENGU memecoin may test support levels before any rebound, as Parabolic SAR indicates ongoing bearish pressure and MFI remains in sell territory. A shift toward the buy zone could signal recovery, but sustained outflows suggest near-term downside risks persist.

Key Takeaways

- PENGU Memecoin’s Resistance Challenge: Hitting a key resistance wall triggered a 12% price drop to $0.0097, echoing past 31.7% average declines and highlighting liquidity-driven sell-offs.

- Fading Momentum Indicators: Parabolic SAR above price and MFI in the sell zone confirm bearish trends, though slight MFI upticks point to potential minor inflows.

- Declining Community Sentiment: Bullish views fell to 72% from over 90%, per CoinMarketCap data from 375,000 investors, amplifying downside pressure in derivatives markets.

Source: CoinMarketCap

Conclusion

The PENGU memecoin price decline, marked by a 12% drop and bearish technical indicators like Parabolic SAR and MFI, reflects broader challenges in the memecoin sector amid 27% average losses. Community sentiment shifts to 72% bullish, as reported by CoinMarketCap, combined with $6.5 million in outflows, emphasize the need for vigilant monitoring. As market dynamics evolve, investors should watch for support tests and potential rebounds, staying informed on memecoin trends for strategic decisions.