Phantom Wallet Integrates Kalshi for Event-Based Prediction Trading

Contents

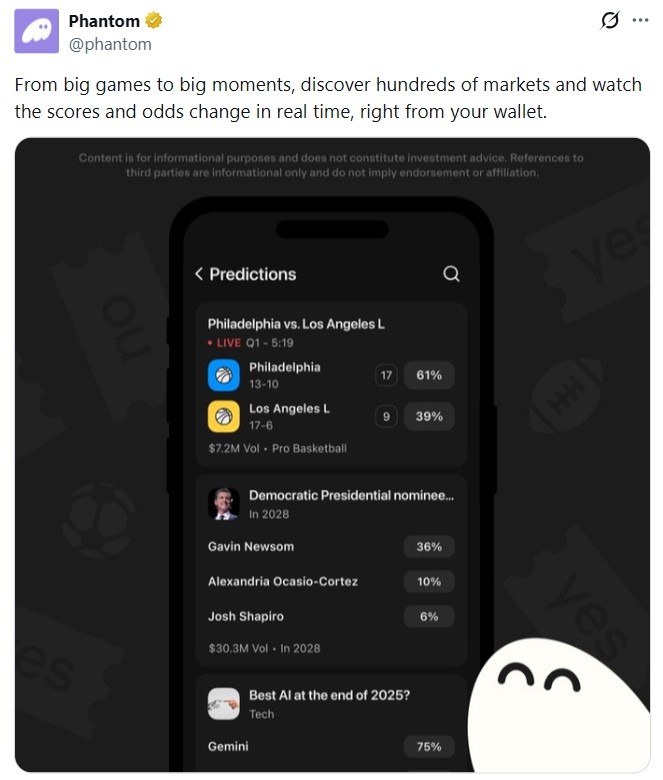

Phantom Prediction Markets integrate regulated event trading from Kalshi directly into the Phantom wallet, allowing users to bet on politics, economics, sports, and culture without leaving the app. This wallet-native feature tokenizes positions for seamless onchain finance and real-world outcomes.

-

Phantom partners with Kalshi to embed prediction markets in its wallet interface.

-

Users can discover events, track odds, and trade tokenized contracts effortlessly.

-

The integration covers diverse categories like politics and sports, boosting accessibility with 24/7 trading availability.

Discover Phantom Prediction Markets: Trade tokenized events from politics to culture via Kalshi integration in your wallet. Explore real-time odds and secure bets now for the future of onchain finance.

What Are Phantom Prediction Markets?

Phantom Prediction Markets represent a groundbreaking wallet-native feature that enables users to engage in event-based trading directly within the Phantom cryptocurrency wallet. Developed through a partnership with the regulated prediction market platform Kalshi, this integration allows seamless access to tokenized positions referencing real-world events in politics, economics, sports, and culture. By keeping all actions inside the wallet, it eliminates the need for external platforms, enhancing user convenience and security in the evolving landscape of decentralized finance.

How Does the Kalshi Integration Enhance Phantom Wallet Functionality?

The collaboration between Phantom and Kalshi introduces a streamlined way for wallet users to participate in prediction markets without disrupting their workflow. Users can now discover trending events, monitor live odds, and execute trades on tokenized contracts that mirror Kalshi’s regulated offerings. This setup leverages blockchain technology to ensure transparency and immutability, with positions settled based on verified outcomes from authoritative sources like official election results or economic reports.

According to Phantom CEO Brandon Millman, “By integrating a layer of tokenized positions referencing Kalshi’s regulated event markets with Phantom, users can trade what they care about in real time.” This feature not only democratizes access to prediction markets but also aligns with broader trends in crypto where wallets are becoming comprehensive financial hubs. Data from similar platforms indicates that event trading volumes have surged by over 200% in the past year, driven by interest in high-stakes outcomes such as political elections and major sporting events.

Source: Phantom

Experts in the field, including analysts from financial research firms, highlight that such integrations reduce barriers to entry, potentially onboarding millions of new users to crypto ecosystems. Kalshi’s compliance with U.S. Commodity Futures Trading Commission (CFTC) regulations adds a layer of legitimacy, distinguishing it from unregulated alternatives and mitigating risks associated with volatile markets.

Crypto Exchanges Eye US Prediction Markets

The launch of Phantom Prediction Markets occurs amid a competitive rush among major cryptocurrency platforms to capture the growing U.S. prediction markets sector. This space, which allows betting on future events through contracts, has seen increased interest due to its potential for hedging risks and gaining insights into market sentiments. Platforms are vying for regulatory approvals to offer these services legally within the United States.

Recently, Gemini Titan, an entity affiliated with the Gemini crypto exchange, secured a designated contract market license from the CFTC. This approval positions Gemini to expand into prediction markets, enabling users to trade event contracts via its web platform. Following the announcement, Gemini’s shares experienced a notable uptick of nearly 14% in after-hours trading, reflecting investor enthusiasm for diversified revenue streams in crypto.

Separately, reports from tech researcher Jane Manchun Wong indicated that Coinbase is developing its own prediction market feature. Wong, recognized for uncovering pre-release functionalities on major tech sites, shared visual evidence of an unreleased platform. Bloomberg, citing anonymous sources, further reported that Coinbase intends to roll out prediction markets alongside tokenized equities, marking a significant pivot toward real-world asset integration.

A representative from Coinbase confirmed an upcoming livestream to unveil new products but did not specify details on prediction markets or tokenized stocks. This development underscores Coinbase’s strategy to innovate in compliance with U.S. regulations, potentially challenging incumbents like Kalshi. Industry observers note that the CFTC’s oversight ensures these markets operate as legitimate financial instruments rather than speculative gambles.

Prediction Markets Face Regulatory Pushback

Despite the momentum, prediction markets in the U.S. continue to navigate regulatory challenges, with some states imposing restrictions on unlicensed operations. The state of Connecticut recently issued cease and desist orders to several platforms, including Robinhood, Kalshi, and Crypto.com, accusing them of engaging in unauthorized online gambling activities. This action highlights ongoing tensions between state regulators and federally compliant entities.

Kalshi responded swiftly by filing a lawsuit against the Connecticut Department of Consumer Protection (DCP), asserting that its event contracts adhere to federal law under CFTC jurisdiction. In a ruling, U.S. District Judge Vernon Oliver ordered the DCP to halt enforcement against Kalshi, providing temporary relief and affirming the platform’s legal standing. This decision reinforces the argument that prediction markets serve as tools for information aggregation and risk management, not mere betting.

Such regulatory scrutiny is not isolated; it reflects broader efforts to balance innovation with consumer protection in the crypto sector. According to CFTC data, licensed prediction markets have processed billions in trading volume since 2020, with low default rates due to robust settlement mechanisms. Financial experts emphasize that clear federal guidelines could accelerate adoption, potentially integrating these markets into mainstream portfolios.

The Phantom-Kalshi integration benefits from Kalshi’s established regulatory framework, offering users peace of mind amid these developments. By tokenizing positions onchain, Phantom ensures that trades are verifiable and resistant to manipulation, aligning with best practices in blockchain security.

Frequently Asked Questions

What Is the Phantom Prediction Markets Feature and How Do I Access It?

The Phantom Prediction Markets feature allows wallet users to trade tokenized event contracts on various real-world outcomes through the Kalshi integration. To access it, simply update your Phantom wallet app and navigate to the dedicated markets section, where you’ll find live events and trading options available 24/7 without additional setups.

Are Phantom Prediction Markets Legal in the United States?

Yes, Phantom Prediction Markets operate legally in the U.S. by leveraging Kalshi’s CFTC-regulated status, ensuring all event contracts comply with federal guidelines. This setup distinguishes it from unregulated platforms, providing secure and transparent trading for users across eligible states while ongoing court rulings protect against local restrictions.

Key Takeaways

- Seamless Integration: Phantom’s partnership with Kalshi brings regulated event trading directly into the wallet, simplifying access for crypto users.

- Market Expansion: Major exchanges like Gemini and Coinbase are entering prediction markets, signaling industry-wide growth and competition.

- Regulatory Resilience: Despite state-level challenges, federal approvals and court protections bolster the legitimacy of platforms like Kalshi.

Conclusion

The introduction of Phantom Prediction Markets through the Kalshi integration marks a pivotal advancement in wallet functionality, blending onchain finance with real-world event trading across politics, economics, sports, and culture. As crypto exchanges like Gemini and Coinbase pursue similar expansions, the sector’s regulatory landscape continues to evolve, with federal oversight ensuring stability. Looking ahead, this convergence promises enhanced tools for informed decision-making, inviting users to explore these opportunities responsibly in the dynamic crypto ecosystem.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026