Pi Network Rallies on MiCA Compliance News Amid Persistent Bearish Trend

OP/USDT

$91,578,723.81

$0.1211 / $0.1092

Change: $0.0119 (10.90%)

+0.0019%

Longs pay

Contents

Pi Network’s PI token has rallied 8.78% amid the release of its MiCA compliance whitepaper, outlining low-energy operations and non-custodial wallets for EU regulatory alignment. This development signals potential expansion into European exchanges, boosting liquidity for the mobile-mining cryptocurrency.

-

MiCA compliance whitepaper release: Details Pi Network’s energy-efficient mining and wallet security to meet EU standards.

-

PI price surge of 8.78% since November 17, driven by regulatory progress.

-

Bearish technical indicators persist, with $0.258-$0.282 resistance capping gains despite short-term momentum.

Pi Network’s MiCA compliance whitepaper fuels 8.78% PI rally: Explore EU expansion potential, technical outlook, and key supports in this in-depth analysis. Stay ahead in crypto—read now!

What is the Impact of MiCA Compliance on Pi Network?

Pi Network’s MiCA compliance represents a pivotal step toward regulatory acceptance in the European Union, potentially unlocking new trading opportunities and enhancing the project’s credibility. The whitepaper, released recently, emphasizes the network’s sustainable, low-energy mining process and the security of its non-custodial wallet, where users retain full control over their assets. This alignment with the EU’s Markets in Crypto-Assets (MiCA) framework could facilitate listings on compliant exchanges, broadening Pi Network’s global footprint.

Pi Network, launched in 2019 as a mobile-accessible cryptocurrency, has long focused on user-friendly mining without high energy demands. By addressing MiCA’s requirements for transparency and consumer protection, the project mitigates risks associated with unregulated operations. According to data from TradingView, this news has correlated with a noticeable uptick in trading activity, though sustained growth depends on broader market conditions.

How Does Pi Network’s Technical Outlook Affect Its Price Rally?

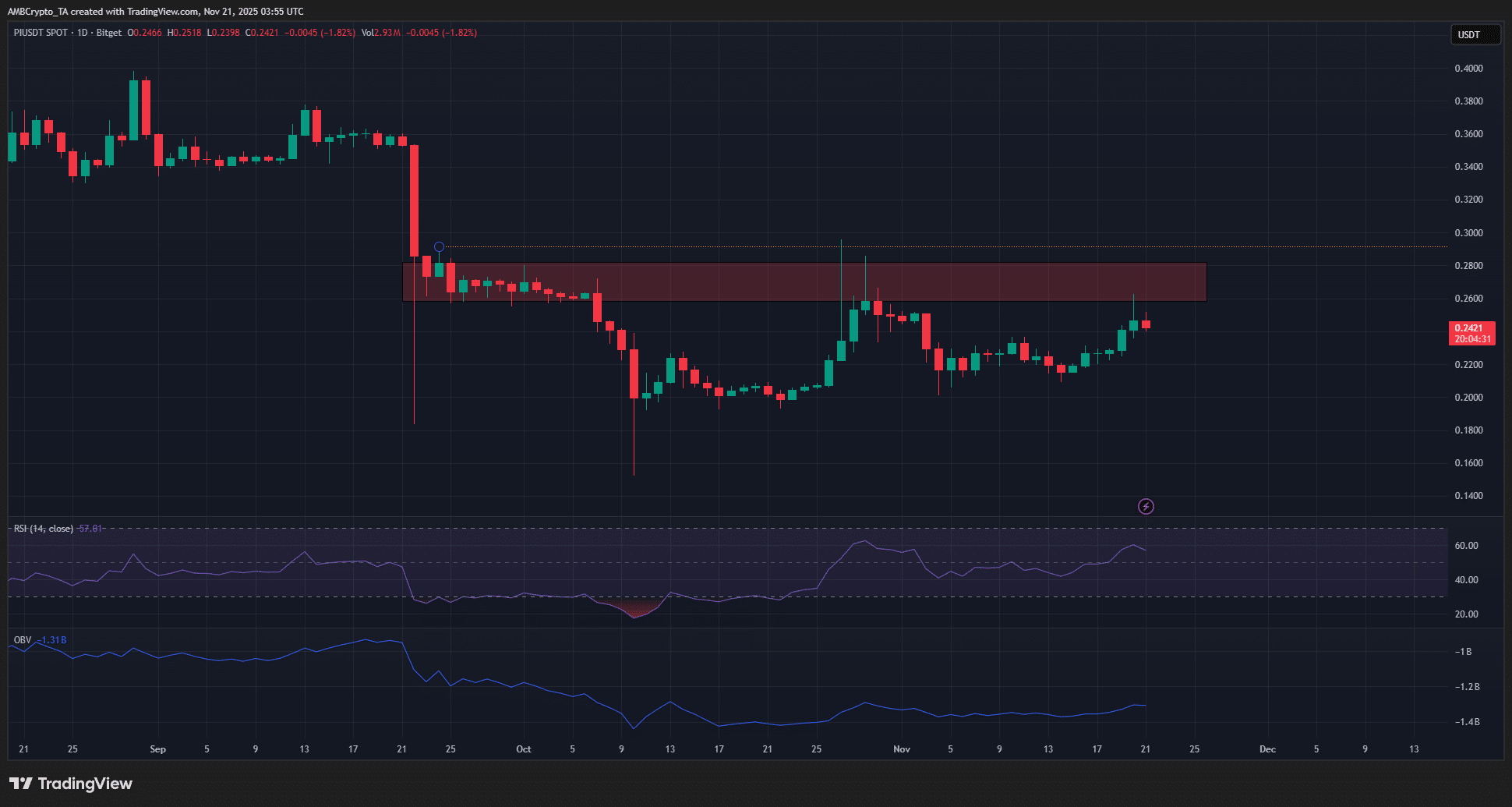

The 8.78% rally in PI since November 17 reflects short-term optimism, but the overall technical structure remains bearish on higher timeframes. On the 1-day chart, PI struggles against the $0.258-$0.282 resistance zone, established since late September, with a rejection in late October underscoring seller dominance.

Source: PI/USDT on TradingView

Despite the Relative Strength Index (RSI) climbing above 50, indicating building bullish momentum, on-balance volume (OBV) shows no significant uptrend, highlighting limited buying conviction. Trading volume has remained subdued, suggesting the rally may be a temporary bounce rather than a trend reversal. Sellers could capitalize on this, especially as Bitcoin’s weakness continues to pressure altcoins like PI.

Zooming into the 4-hour chart reveals a more favorable short-term setup, with upward momentum and improved buying pressure. However, this lower timeframe’s bullishness is overshadowed by the dominant 1-day bearish trend, which typically guides longer-term directions. The $0.291 level stands as a critical pivot; flipping it to support could signal a structural shift.

Source: PI/USDT on TradingView

The non-custodial Pi wallet’s emphasis in the whitepaper addresses key MiCA concerns around asset custody, potentially attracting institutional interest. As noted by blockchain analysts at CoinMarketCap, such regulatory steps often precede liquidity boosts, with PI’s current market cap hovering around $1.5 billion. Yet, without volume confirmation, the rally risks fading against ongoing market headwinds.

Pi Network’s community-driven model, with over 35 million users worldwide, positions it uniquely for MiCA adoption. The whitepaper details how its Stellar Consensus Protocol ensures efficient, eco-friendly transactions, contrasting with energy-intensive proof-of-work systems. This could enable seamless integration with EU platforms like OKX Europe, increasing accessibility for European miners and traders.

Frequently Asked Questions

What triggered the recent Pi Network price rally?

The PI token’s 8.78% increase since November 17 stems from the MiCA compliance whitepaper release, which outlines regulatory alignment and highlights low-energy mining. This news fosters confidence in EU expansion, though technical resistances may limit further gains in the short term.

Is Pi Network ready for EU trading under MiCA?

Pi Network is advancing toward MiCA readiness through its whitepaper, focusing on transparency, user asset control, and sustainability. While not fully operational yet, this positions PI for potential listings on EU-compliant exchanges, enhancing liquidity for its global user base of mobile miners.

Key Takeaways

- Regulatory Milestone: Pi Network’s MiCA whitepaper boosts credibility, emphasizing low energy use and non-custodial wallets for EU compliance.

- Price Dynamics: An 8.78% rally signals short-term optimism, but bearish 1-day trends and low volume suggest caution against resistances like $0.282.

- Future Outlook: Monitor $0.291 pivot for bullish shift; broader Bitcoin weakness could hinder sustained PI growth—consider diversified strategies.

Conclusion

Pi Network’s MiCA compliance whitepaper marks a significant advancement for the project’s regulatory standing in the EU, driving the recent PI price rally while addressing key concerns like energy efficiency and user security. Despite technical hurdles on daily charts, this development lays groundwork for expanded liquidity and adoption. As crypto markets evolve, staying informed on MiCA impacts will be crucial—explore Pi Network’s potential today to navigate upcoming opportunities.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026