Pi Network’s MiCA Filing May Pave Way for EU Listings Amid Community Concerns and Price Uptick

XRP/USDT

$2,480,132,667.31

$1.3653 / $1.27

Change: $0.0953 (7.50%)

-0.0099%

Shorts pay

Contents

Pi Network has filed for compliance under the European Union’s Markets in Crypto-Assets (MiCA) regulations, granting Pi Coin legal standing in the European market. This filing confirms no initial coin offering, implementation of KYC processes, and plans for listings on regulated exchanges, marking a significant step toward broader adoption without fundraising activities.

-

Pi Network distributed tokens via mobile mining and community participation, avoiding any ICO or fundraising.

-

Comprehensive KYC/KYB requirements and third-party audits ensure security and user control through non-custodial wallets.

-

With 8.2 billion of 100 billion total supply in circulation, Pi aims for pan-European entry via exchanges like OKCoin and OKX in MiCA-compliant jurisdictions such as Malta.

Pi Network MiCA filing secures EU compliance for Pi Coin. Explore token distribution, KYC measures, and exchange plans. Stay informed on this crypto milestone—read now for regulatory insights.

What is the Pi Network MiCA Filing?

Pi Network MiCA filing refers to the project’s official submission under the European Union’s Markets in Crypto-Assets (MiCA) regulations to establish Pi Coin’s legal framework in Europe. This process, initiated with a start date of November 28, 2025, for public trading, positions Pi as a compliant crypto-asset without any initial coin offering or fundraising. By meeting MiCA’s requirements, Pi Network aims to facilitate secure, regulated access for users across member states like Germany, France, and Italy.

Pi Network emphasizes its community-driven model, where tokens were distributed through mobile mining rather than sales. The filing details robust security measures, including fraud prevention and user-controlled wallets, ensuring transparency and alignment with EU standards.

🚨BREAKING: Pi has officially filed under the EU regulation MiCA — a major step towards legal listing and adoption in the future. #PiNetwork pic.twitter.com/7rwhaNUq6a

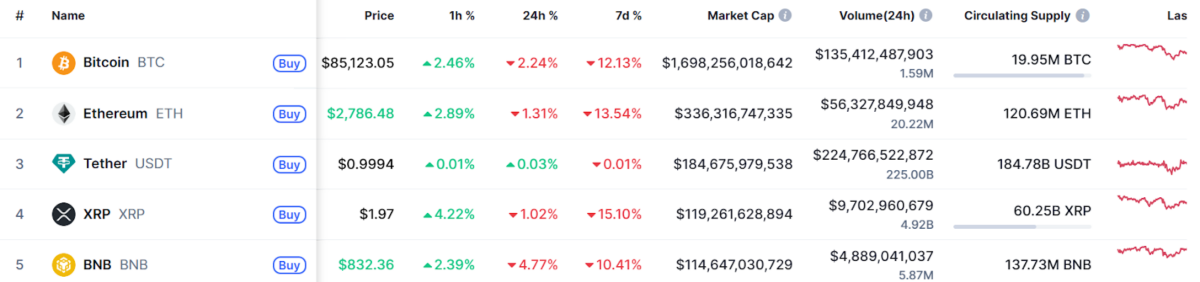

Top 5 crypto coin performance. Source: CoinMarketCap

Top 5 crypto coin performance. Source: CoinMarketCap