PIPPIN AI Token Rallies to February Levels Amid Whale Activity and Selling Pressure

SOL/USDT

$4,203,361,175.30

$82.37 / $77.12

Change: $5.25 (6.81%)

-0.0056%

Shorts pay

Contents

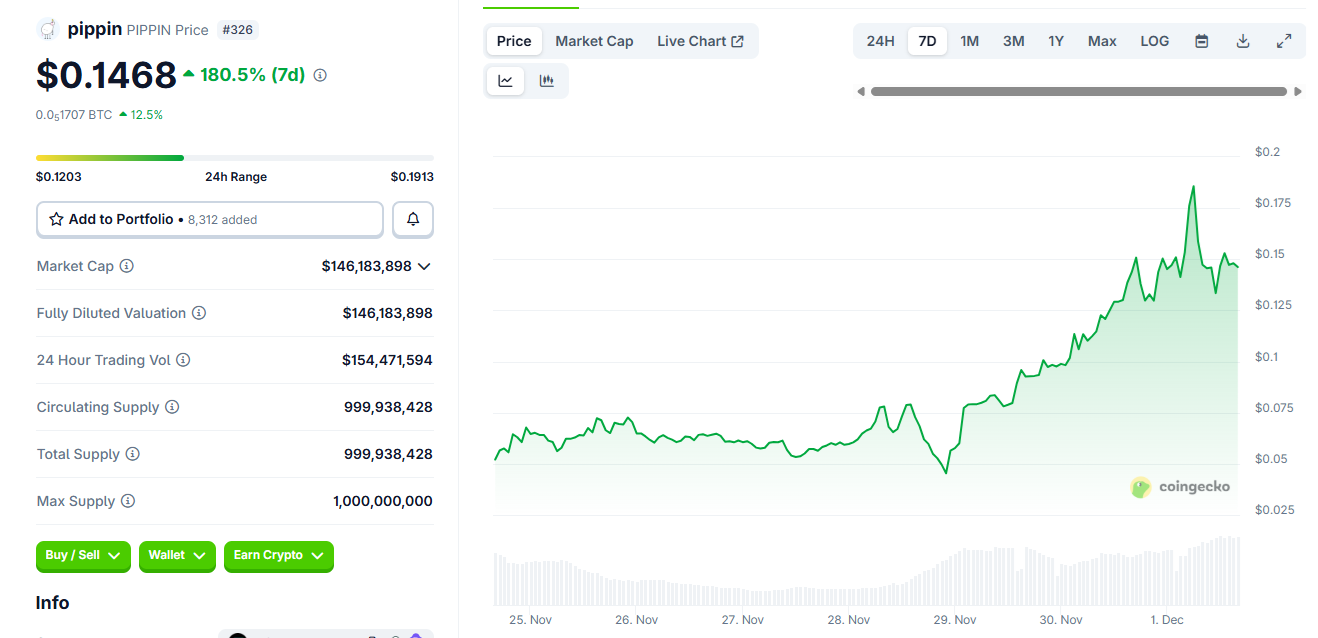

The PIPPIN token has staged a notable recovery in December 2025, surging from $0.023 to $0.18 amid renewed whale interest and rising trading volumes on Raydium. This AI agent token now ranks among the top performers in its sector, with daily volumes exceeding $154 million, though analysts caution about potential profit-taking.

-

PIPPIN token recovery highlights: Surged over 600% from recent lows, driven by AI agent hype without official announcements.

-

Whale activity intensified, with major holders realizing profits up to $3.74 million after long-term accumulation.

-

Trading volumes hit $154 million in 24 hours, capturing over 50% of Raydium’s activity; market cap for AI agents remains under $3 billion.

Discover the PIPPIN token recovery: From $0.023 lows to $0.18 highs in December 2025. Explore whale moves, volume spikes, and AI agent trends. Stay ahead in crypto—read now for investment insights!

What is Driving the PIPPIN Token Recovery in December 2025?

The PIPPIN token recovery in December 2025 stems from a sudden surge in trading activity and whale accumulation, pushing the price from a local low of $0.023 to a peak of $0.18. This movement occurred without any official announcements from the project’s team or confirmed airdrop details, relying instead on market speculation within the AI agent sector. Despite broader sector stagnation, PIPPIN’s performance has outpaced peers, drawing significant volumes to decentralized exchanges like Raydium.

PIPPIN rallied in the past week, but fell after one of the major whales realized profits through Raydium. | Source: Coingecko

PIPPIN rallied in the past week, but fell after one of the major whales realized profits through Raydium. | Source: CoingeckoThe token’s ascent reflects a broader, albeit limited, revival in AI-driven cryptocurrencies, where total sector capitalization hovers just above $3 billion. PIPPIN, as one of the leading AI agent tokens, has captured over 47% of its trading volumes on Raydium, briefly dominating more than half of the platform’s activity on December 1. This consolidation at higher levels marks a departure from months of flat performance, signaling potential renewed interest in AI narratives amid a challenging market environment.

Market data from platforms like Coingecko indicate that PIPPIN’s 24-hour trading volume surpassed $154 million, a level not seen earlier in 2025. This spike, coupled with unverified rumors of an airdrop—though no active distribution page exists—has fueled speculative buying. However, the rally’s foundation appears fragile, with liquidity in the primary trading pair at approximately $7.4 million, making it susceptible to large trades.

How Are Whales Influencing the PIPPIN Token Price Action?

Whale involvement has been pivotal in the PIPPIN token’s recent dynamics, with major holders both accumulating and offloading positions to capitalize on the upswing. One prominent whale, who began building a position a month ago near all-time lows, now holds 8.15 million PIPPIN tokens valued at around $1.2 million at current prices—peaking at $1.5 million during the rally’s high. This accumulation underscores confidence in the token’s potential, even as the AI agent sector has seen most tokens decline by up to 99% from their peaks.

Conversely, profit-taking by other whales has introduced volatility. A key address, which acquired PIPPIN a year ago and endured the February downturn, recently liquidated its entire holdings. This move converted an initial investment of 450 SOL—worth about $90,000 at the time—into 29,527 SOL, yielding proceeds of $3.74 million. Such sales triggered a swift price drop from $0.18 to $0.14, highlighting the influence of large players in a market with limited liquidity.

Analysts from sources like Coingecko note that the top two whales secured profits of $2.3 million and $2.2 million, respectively, contributing to the day’s selling pressure. This pattern echoes past meme coin rallies, such as those seen with POPCAT and JellyJelly, though PIPPIN’s momentum is tied more closely to Raydium’s Solana-based ecosystem rather than external speculation like Hyperliquid. Experts emphasize that while whale activity can drive short-term gains, it often leads to corrections in nascent markets like AI agents, where total losses for most tokens exceed 80% year-to-date.

The AI agent narrative, which gained traction earlier in 2025, has cooled significantly, with platforms and tokens reverting to lows. PIPPIN’s outlier status—recovering to enter the top five AI agent tokens by performance—may stem from its strong on-chain presence on Raydium, where it displaced other Solana tokens in volume share. However, sustainability remains in question, as the rally lacks fundamental catalysts like team updates or verified partnerships.

Frequently Asked Questions

What Caused the Recent PIPPIN Token Surge from Its December Lows?

The PIPPIN token surged from $0.023 in December 2025 due to increased speculative trading and whale accumulation, without official project announcements. Volumes on Raydium jumped to over $154 million daily, pushing it to $0.18 before profit-taking ensued. This outperformed the stagnant AI agent sector, where most tokens remain down 99% from highs.

Is the PIPPIN Token Rally Sustainable in the Current AI Crypto Market?

The PIPPIN token rally in late 2025 shows short-term momentum from whale activity and volume spikes, but long-term sustainability is uncertain given the AI agent’s subdued $3 billion market cap. Low liquidity of $7.4 million in key pairs risks volatility, and experts advise caution without new developments like confirmed airdrops or ecosystem growth.

Key Takeaways

- PIPPIN Token’s Impressive Recovery: Climbed over 600% to $0.18, marking levels unseen since February 2025 amid AI sector revival.

- Whale Profits and Volatility: Major holders cashed out up to $3.74 million, causing a pullback to $0.14 and underscoring liquidity risks.

- Trading Volume Dominance: Captured over 50% of Raydium’s activity; monitor for sustained interest to gauge AI agent trends.

Conclusion

The PIPPIN token recovery in December 2025 exemplifies the volatile yet opportunistic nature of AI agent cryptocurrencies, surging to $0.18 on whale-driven volumes exceeding $154 million while the broader sector languishes below $3 billion in market cap. With influences from Raydium trading and unconfirmed airdrop rumors shaping price action, investors should weigh the token’s top-five ranking against evident profit-taking risks. As AI narratives evolve, staying informed on whale movements and liquidity metrics will be essential for navigating future opportunities in this dynamic space—consider tracking on-chain data for the next developments.

Comments

Other Articles

Solana Leads 2025 Revenue as Bulls Test $130 Resistance

January 1, 2026 at 10:32 AM UTC

Bitwise Files for 11 Altcoin ETFs Including AAVE, UNI Amid SOL, XRP Muted Gains

December 31, 2025 at 08:47 PM UTC

Ethereum Whales Trim ETH Longs and Pivot to BTC in Dec 31 On-Chain Rebalance Update

December 31, 2025 at 01:27 PM UTC