Plasma (XPL) Price May Extend Declines Amid Token Unlocks and Weak On-Chain Activity

XPL/USDT

$75,795,088.71

$0.0961 / $0.0856

Change: $0.0105 (12.27%)

+0.0031%

Longs pay

Contents

Plasma (XPL) price dropped over 11% recently despite a green broader market, driven by upcoming token unlocks, declining on-chain activity, and reduced stablecoin TVL. This weakened the token’s short-term structure amid fading post-launch hype.

-

Upcoming unlocks of 88.88 million XPL tokens worth $18.13 million on November 25 could pressure supply.

-

On-chain metrics show declining DEX volume from $47.81 million to $8.39 million and fewer daily users.

-

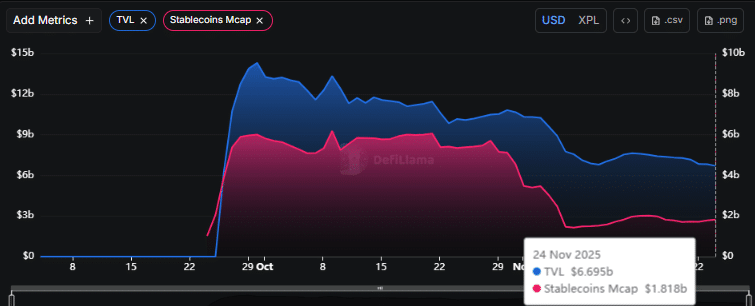

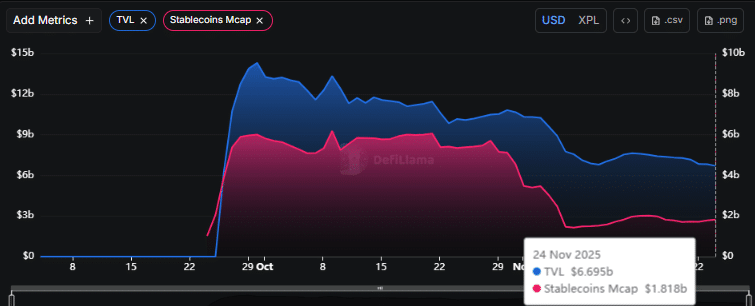

Stablecoin TVL fell 68% since October to $1.82 billion, with overall TVL at $6.695 billion, signaling reduced ecosystem traction.

Discover why Plasma XPL price is dropping despite market gains. Explore on-chain data, unlocks, and technicals in this analysis. Stay informed on crypto trends today.

Why is Plasma’s price sliding despite a green market?

Plasma (XPL) price has declined more than 11% in recent hours, even as the broader cryptocurrency market traded positively for most of the day. This movement placed XPL alongside other tokens like Starknet (STRK), which also experienced double-digit losses during the same period. The drop extended XPL’s downtrend following the fade of initial post-launch hype, which was initially bolstered by an airdrop distributing about 10,000 XPL to early users, leading to cooled price action and reduced on-chain activity that further eroded momentum.

What on-chain signals indicate Plasma’s momentum is fading?

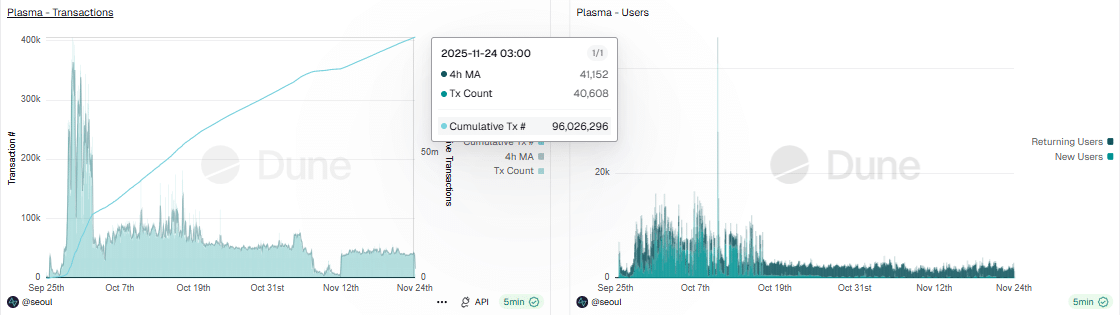

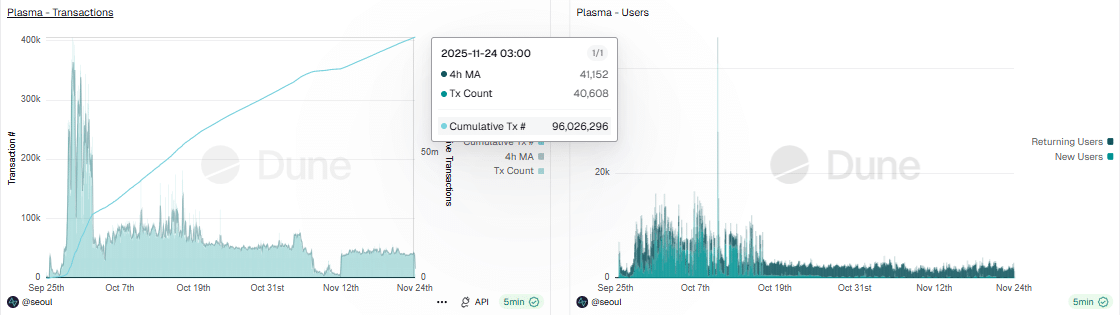

On-chain data reveals a clear decline in Plasma’s activity levels. DEX volume has dropped sharply to $8.39 million from a peak of $47.81 million on November 19, according to Dune analytics. Daily active users have fallen, with only 137 new users and 1,831 returning users recorded recently, while transaction counts slipped from 42,398 to 39,725. Stablecoin total value locked (TVL) has decreased by 68% since October, now standing at $1.82 billion, with an 8.24% weekly decline; overall TVL is at $6.695 billion, primarily from bridges contributing $5.79 billion, as reported by DefiLlama. These metrics, combined with cumulative transactions reaching a new high but daily engagement cooling, highlight waning ecosystem adoption and align with the observed bearish price structure.

Frequently Asked Questions

What is causing the upcoming token unlock for Plasma XPL?

The unlock scheduled for November 25 involves 88.88 million XPL tokens valued at $18.13 million, representing the largest weekly unlock across the sector at around $80 million total. This event stems from vesting schedules post-launch, with over 80% of the supply still locked, potentially increasing selling pressure as early investors gain liquidity, according to data from DefiLlama.

How does Plasma’s technical setup look amid the price drop?

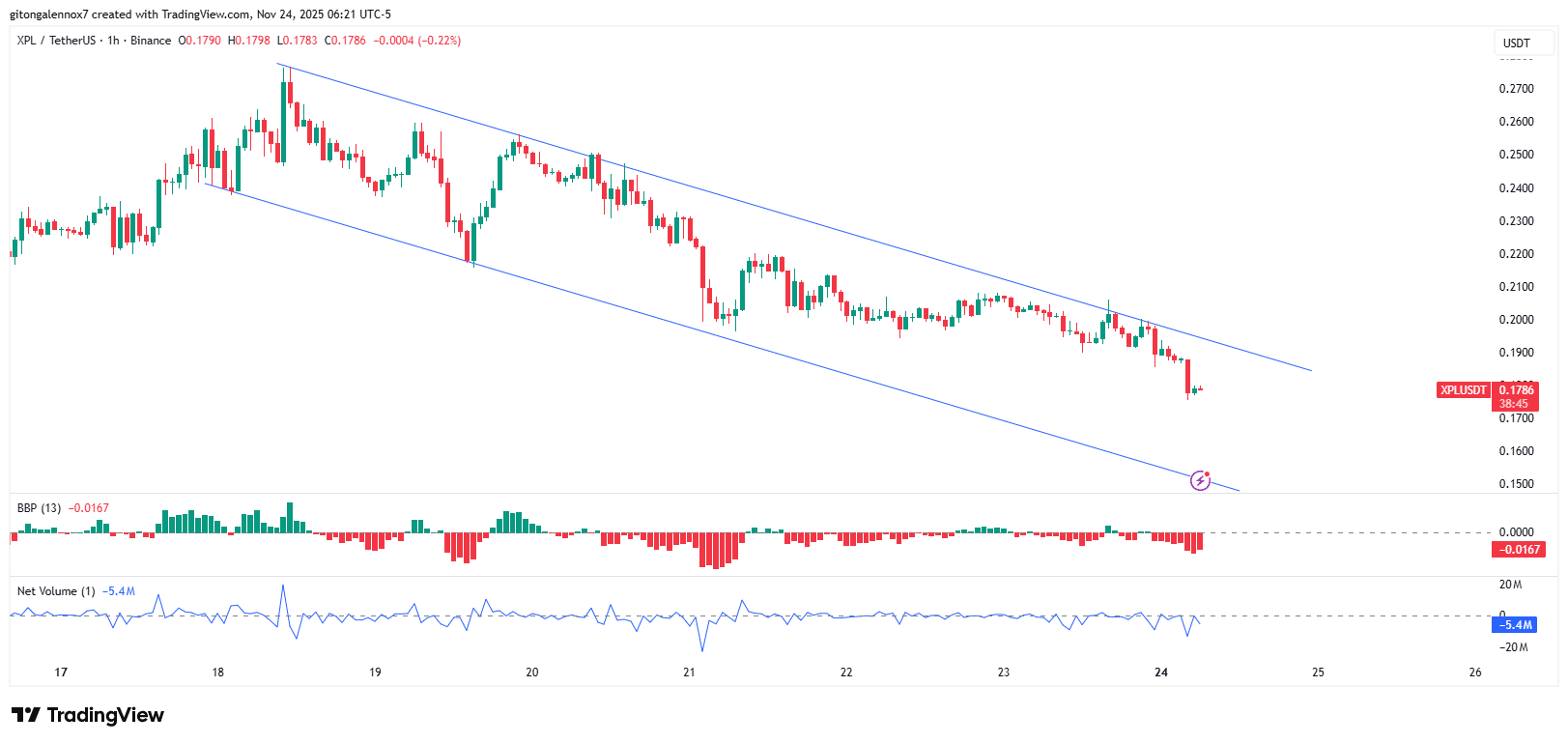

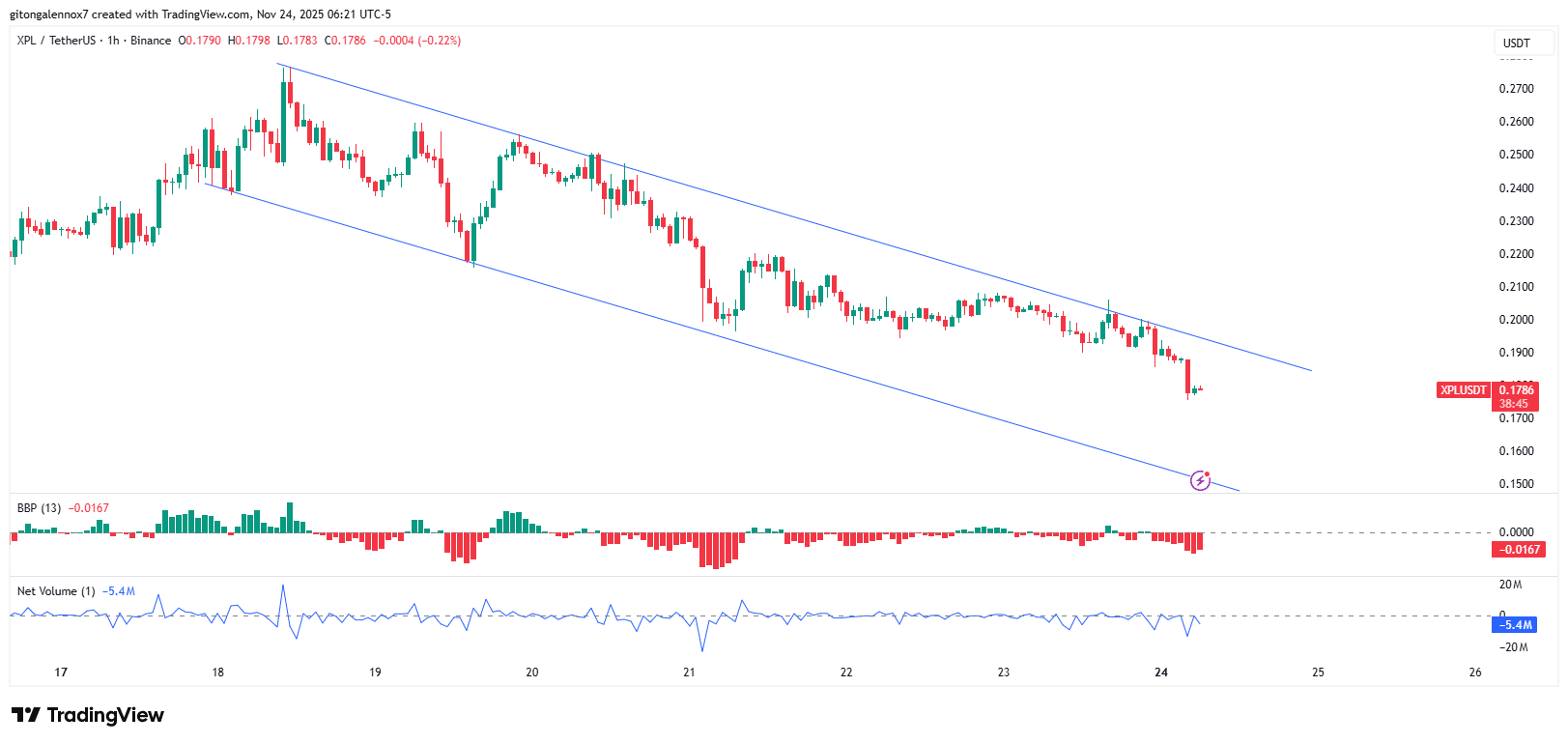

Plasma XPL is trading within a bearish trend channel, down over 36% in the last five days. The Bull Bear Power indicator shows bearish dominance, with negative net volume of $5.07 million, targeting $0.15 if the downtrend persists; a break above upper resistance could signal reversal, based on TradingView chart analysis.

Key Takeaways

- Token Unlocks Drive Pressure: The November 25 unlock of 88.88 million XPL worth $18.13 million is the primary catalyst, increasing available supply in a low-activity environment.

- Declining On-Chain Metrics: DEX volume and user counts have steadily fallen since late October, with stablecoin TVL down 68%, reflecting reduced network traction per Dune and DefiLlama data.

- Bearish Technical Outlook: XPL’s 36% five-day drop and negative indicators suggest further downside to $0.15 unless resistance breaks, urging caution for investors.

Conclusion

In summary, the Plasma (XPL) price drop is fueled by impending token unlocks, fading on-chain activity, and a bearish technical structure, despite broader market gains. As stablecoin TVL and DEX volumes continue to decline, the token faces short-term challenges. Investors should monitor upcoming unlocks and activity metrics closely for potential recovery signals, positioning themselves for informed decisions in the evolving crypto landscape.

Key Takeaways

Why is Plasma’s price sliding despite a green market?

Upcoming unlocks, collapsing activity, and a sharp drop in stablecoin TVL weakened XPL’s short-term structure.

What on-chain signals showed XPL’s momentum fading?

DEX volume, daily users, and transaction counts fell steadily through November, aligning with a bearish technical setup.

Plasma dropped more than 11% in recent hours, even as the broader market traded green for most of the day.

The decline put Plasma [XPL] alongside Starknet [STRK], which also posted double-digit losses during the same window.

XPL extended its downtrend after the post-launch hype faded. That early rally had been supported by an airdrop worth about 10,000 XPL for initial users.

As price cooled, on-chain activity followed the same path, weakening the token’s momentum.

What’s driving Plasma token down?

The first wave of selling stemmed from the upcoming unlock on the 25th of November.

About 88.88 million XPL, valued at $18.13 million, was set to unlock, leaving over 80% of the supply still locked. It was the largest of the roughly $80 million in weekly token unlocks across the sector.

Source: DefiLlama

Even so, long-term traction struggled elsewhere.

Stablecoin TVL fell 68% since October and declined 8.24% on a weekly basis. Stablecoin Market Cap rested near $1.82 billion, while overall TVL slipped to $6.695 billion, with bridges contributing $5.79 billion of that total.

Source: Dune

Cumulative Transactions hit a new high, but daily activity cooled.

Transaction Count slipped from 42,398 to 39,725. Daily New Users were only 137, and returning users totaled 1,831.

DEX Volume dropped to $8.39 million at press time from its high of $47.81 million on the 19th of November. Most usage metrics trended lower since late October, a slide reflected in price charts.

Bears extend control

On the charts, XPL price showed that the altcoin was in a bearish structure, trading inside a trend channel. XPL was down by more than 36% for the last five days.

The Bull Bear Power (BBP) was dominant for the last five days, while the net volume was negative $5.07 million. XPL bears seemed to be gaining momentum, and the next target was at $0.15 if dominance was maintained.

Conversely, breaking above the upper resistance would invalidate the current setup, which suggests a drop to $0.15.

Source: TradingView

Altogether, XPL was largely bearish, with sellers showing more momentum. This hinted at more breakdown, as on-chain activity was also following the same trajectory as price.

However, a resurgence in bull action could reverse the direction, though the price had not shown any signs.