Plume CEO Predicts RWA Market Could Triple to Over $100 Billion by 2026

PLUME/USDT

$11,311,048.68

$0.009700 / $0.008520

Change: $0.001180 (13.85%)

+0.0050%

Longs pay

Contents

Plume, a layer-2 blockchain for real-world assets (RWAs), has partnered with Securitize to deploy institutional-grade tokenized assets on its Nest staking protocol, potentially tripling the RWA market value to over $100 billion by 2026 through expanded utility and user growth.

-

Plume’s Nest protocol enables staking and yield generation on tokenized funds like those from Hamilton Lane.

-

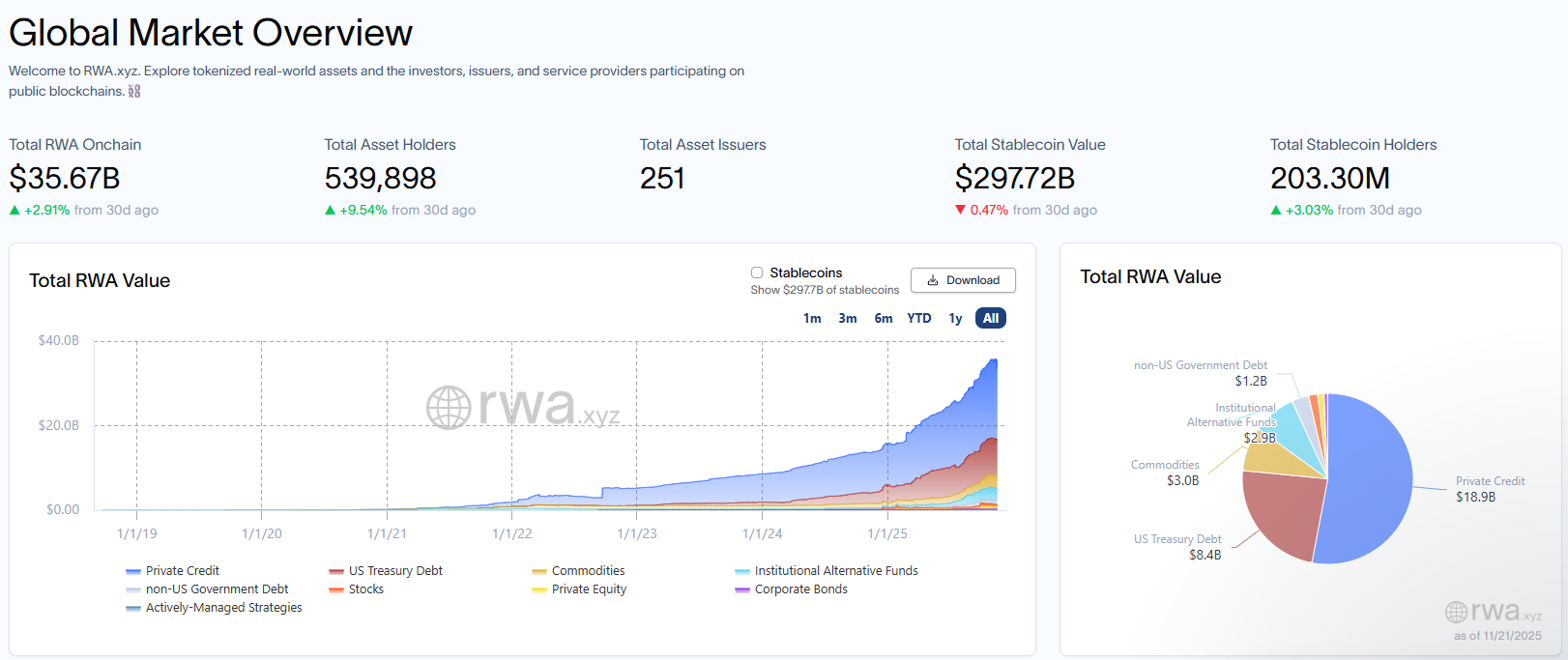

The RWA market, currently valued at over $35 billion across 539,000 holders, is poised for exponential expansion into new asset classes.

-

According to RWA.xyz data, holder numbers have increased 10-fold this year, with projections for 25x user growth in 2025.

Discover how Plume’s partnership with Securitize boosts RWA tokenization on blockchain. Explore market growth to $100B+ by 2026 and staking opportunities. Stay ahead in crypto investments today.

What is the Plume and Securitize Partnership for RWA Tokenization?

The Plume and Securitize partnership involves deploying institutional-grade tokenized assets on Plume’s Nest staking protocol, enabling investors to earn yields on real-world assets (RWAs) like funds from Hamilton Lane. Announced on Wednesday, this collaboration connects Securitize’s platform, backed by major financial institutions, to Plume’s network of over 280,000 RWA holders. It aims to bridge traditional finance with blockchain, starting with select funds in 2025 and expanding to more asset classes in 2026.

How Will the RWA Market Grow Under This Initiative?

The RWA market, currently exceeding $35 billion in on-chain value according to RWA.xyz, is expected to more than triple by 2026, driven by diversification beyond U.S. Treasury bills into private credit, mineral rights, oil, GPUs, and energy assets. Chris Yin, co-founder and CEO of Plume, noted in an interview with Cointelegraph that the market doubled last year and could see three- to five-fold growth as a baseline, with holder numbers already up over 10 times year-to-date. As interest rates fall, on-chain users are shifting toward higher-yield alternatives, fueling this expansion. Regulatory advancements in stablecoins and tokenized assets across various countries will further accelerate adoption, moving RWAs from experimental stages into mainstream applications. Yin emphasized that demand-side participation from traditional investors will soon integrate with blockchain ecosystems, enhancing liquidity and utility.

Chris Yin thinks the real-world asset market value could surge past its current value of $35 billion. Source: RWA.xyz

RWA Market Will Grow Exponentially

Today, the tokenized RWA sector primarily caters to cryptocurrency enthusiasts, but Yin predicts substantial growth in total value locked, user base, asset diversity, and practical applications. With over $35 billion in RWAs on-chain and more than 539,000 holders as tracked by RWA.xyz, the sector is maturing rapidly. Plume’s integration with Securitize exemplifies this shift, allowing seamless staking and trading of high-quality assets.

Lower interest rates are encouraging investors to explore yields from alternative investments like private credit and commodities. This evolution is not limited to traditional holdings; innovative assets such as energy resources and computing infrastructure are gaining traction on blockchain platforms. Regulatory frameworks for stablecoins and other digital representations of value are progressing in multiple jurisdictions, paving the way for broader real-world integration. As Yin stated, “Outside of pure issuance on the supply side, we expect to begin to see the demand side finally come onchain,” highlighting the impending influx of institutional participation.

Plume Inks Deal with Securitize

Plume’s announcement details how Securitize, supported by prominent firms like BlackRock and Morgan Stanley, will bring tokenized institutional assets to the Nest staking protocol. This setup facilitates trading and yield earning on these assets, linking Securitize’s offerings to Plume’s extensive holder community.

The initial rollout features funds from Hamilton Lane, with additional issuers and asset types scheduled for 2026. Plume’s network boasts 279,692 holders, representing about half of all RWA participants across blockchain ecosystems, though it ranks outside the top ten by total value on RWA.xyz, where Ethereum and BNB Chain dominate. Yin clarified that Plume prioritizes user engagement over sheer volume: “Plume has 280k users holding an aggregate $200 million of RWAs, which is a much healthier measure of usage on a network.”

Source: Plume

This partnership underscores Plume’s strategic position in the RWA space, leveraging its layer-2 architecture to offer efficient, scalable solutions for tokenization. By focusing on institutional-grade assets, Plume addresses key barriers to adoption, such as compliance and interoperability, drawing from established platforms like Securitize. As the ecosystem evolves, such collaborations could catalyze wider acceptance of RWAs in global finance.

Earlier developments, including Plume’s attainment of SEC transfer agent status, further solidify its role in onboarding traditional finance to blockchain environments. This status enhances credibility and operational efficiency for tokenized securities. With a user base holding $200 million in RWAs, Plume demonstrates robust activity metrics that surpass many competitors in terms of engagement density.

Frequently Asked Questions

What Does the Plume Securitize Deal Mean for RWA Investors?

The deal enables RWA investors to stake and earn yields on tokenized institutional assets via Plume’s Nest protocol, starting with Hamilton Lane funds. It connects over 280,000 holders to Securitize’s high-quality offerings, potentially increasing liquidity and returns while complying with financial standards. This step integrates TradFi assets into crypto ecosystems seamlessly.

How Can Tokenized Real-World Assets Benefit from Plume’s Network?

Plume’s layer-2 blockchain provides a specialized environment for RWAs, offering low-cost transactions and staking rewards through the Nest protocol. Investors can access diverse assets like private credit and commodities, benefiting from projected market growth to over $100 billion by 2026. This setup supports efficient yield generation and broadens participation beyond crypto natives.

Key Takeaways

- RWA Market Expansion: The sector, valued at $35 billion today, may triple by 2026, incorporating new assets like GPUs and energy amid falling rates.

- Partnership Impact: Securitize’s deployment on Plume’s Nest starts with Hamilton Lane funds, linking to 280,000 holders for enhanced staking and trading.

- User Growth Projection: Expect 25x increase in RWA holders, driven by regulatory progress and demand from traditional investors entering blockchain.

Conclusion

The Plume and Securitize partnership marks a pivotal advancement in RWA tokenization, facilitating the on-chain deployment of institutional assets and projecting exponential growth for the real-world asset market. With insights from experts like Chris Yin highlighting three- to five-fold value increases by 2026, alongside regulatory tailwinds, this collaboration positions blockchain as a cornerstone for modern finance. Investors and institutions alike should monitor these developments closely, as they signal a transformative era in asset management and yield opportunities on platforms like Plume.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026