Poland's Second Veto on MiCA Bill: Nawrocki Decision

BTC/USDT

$25,688,978,986.00

$71,632.08 / $68,176.47

Change: $3,455.61 (5.07%)

-0.0000%

Shorts pay

Contents

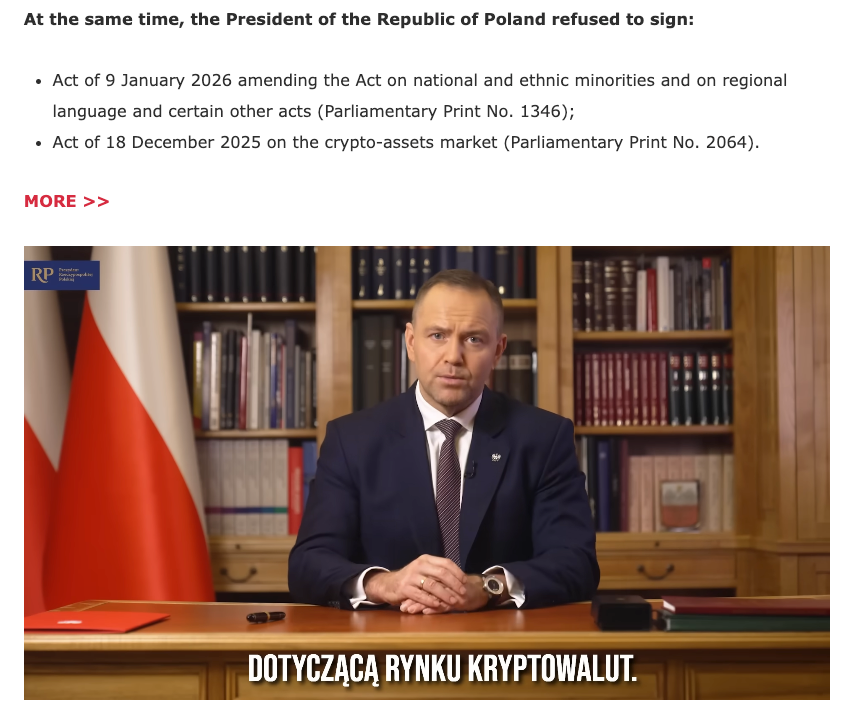

Polish President Karol Nawrocki vetoed the second bill (Bill 2064) aimed at aligning the country's cryptocurrency regulations with the European Union's Markets in Crypto-Assets Regulation (MiCA). This decision follows his veto of a similar bill (Bill 1424) in December and comes after warnings from the Polish Financial Supervision Authority (KNF) that no competent authority has been appointed. MiCA's full transition date is set for July 1, 2026; this veto delays Poland's EU compliance process.

Source: President Karol Nawrocki

What is MiCA and Why is Poland Delaying?

MiCA is the framework providing transparent regulation of crypto assets across the EU. The bills were criticized by crypto supporters as overly regulatory. Nawrocki said, “I will not sign a wrong law; Poland should attract innovation, not push it away.” While local platforms face uncertainty, Luxembourg MiCA-licensed firms like Coinbase can operate in Poland.

- Reasons for Veto: KNF's lack of authority and innovation barrier.

- Affected: Local exchanges like Kanga Exchange and Zonda Crypto.

- Solution: Economist Krzysztof Piech is preparing a new crypto-friendly MiCA draft.

Polish economist Krzysztof Piech is finalizing a crypto-friendly MiCA implementation bill. Source: Krzysztof Piech

Impact of Poland's MiCA Veto on BTC Market

The uncertainty in Poland is slowing down European crypto adoption. This could create short-term volatility for investors examining BTC detailed analysis. Local CEOs: Sławek Zawadzki from Kanga says they are preparing alternative solutions, while Przemysław Kral from Zonda states that small firms will exit the market. For those following global BTC futures, BTC futures opportunities may increase.

Frequently Asked Questions About Poland's Crypto Regulations

- When does MiCA fully come into effect? July 1, 2026.

- What will Poland do after the veto? Krzysztof Piech is preparing a new crypto-friendly draft.

- Will local exchanges be affected? Yes, licensed foreigners like Coinbase have an advantage.

- Is there risk for BTC investors? Short-term uncertainty, long-term EU compliance positive.

Kanga CEO Zawadzki: “Our alternative solutions are ready.”

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/12/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

3/11/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

3/10/2026

DeFi Protocols and Yield Farming Strategies

3/9/2026