Polish President Vetoes Crypto Bill Over Startup Exodus Concerns

CROSS/USDT

$944,653.22

$0.10413 / $0.09857

Change: $0.005560 (5.64%)

+0.0050%

Longs pay

Contents

Poland’s President Karol Nawrocki vetoed the Crypto-Asset Market Act due to concerns over excessive regulations that could drive startups abroad and threaten economic freedoms. The bill’s provisions for website blocking and high fees were seen as overreach, favoring foreign entities over Polish innovation in the cryptocurrency sector.

-

President’s Veto Reasons: Provisions allowing easy website blocking in the crypto market were criticized as opaque and prone to abuse.

-

The bill’s complexity and length reduce transparency compared to simpler frameworks in neighboring EU countries like the Czech Republic and Slovakia.

-

High supervisory fees could stifle startups, pushing companies to Lithuania or Malta and harming Poland’s competitive crypto market, with potential economic losses estimated in the billions from lost tax revenue.

Poland crypto bill veto sparks debate as President Nawrocki blocks strict regulations to protect innovation. Discover why this move challenges government plans and boosts crypto freedoms—read now for expert insights.

What is the Poland crypto bill veto and why did it happen?

Poland crypto bill veto refers to President Karol Nawrocki’s rejection of the Crypto-Asset Market Act on Monday, citing threats to personal freedoms, property rights, and national stability. The legislation, passed by parliament in June, aimed to impose stringent controls on cryptocurrency operations but was deemed overly burdensome. Nawrocki emphasized that such measures could relocate innovative firms outside Poland, undermining the domestic economy.

How does the veto impact Poland’s cryptocurrency regulations?

The veto halts immediate implementation of rules that would have allowed authorities to swiftly block crypto-related websites, a provision the president’s office described as lacking transparency and inviting potential misuse. According to statements from the press office, the bill’s extensive 200-plus pages create unnecessary complexity, contrasting with more streamlined approaches in EU peers like Hungary and Slovakia, where crypto firms face fewer administrative hurdles. Industry experts, including Polish economist Krzysztof Piech, argue this overregulation could deter investment; for instance, similar frameworks in other nations have led to a 15-20% drop in local startup registrations within the first year of enactment.

Furthermore, excessive supervisory fees outlined in the bill—potentially reaching thousands of euros annually for small operators—were flagged as barriers to entry for startups. Nawrocki stated in his official release that this setup inverts market logic, stifling competition and innovation while benefiting established foreign banks and corporations. Data from the European Banking Authority indicates that such fee structures have already prompted a 25% exodus of fintech firms from over-regulated markets to hubs like Malta in recent years. This decision aligns with broader EU efforts under the Markets in Crypto-Assets Regulation (MiCA), which will standardize protections across member states by July 1, 2026, without the need for national overhauls.

Source: Press office of Polish President Karol Nawrocki (post translated by X)

The crypto community has largely praised the move, with advocates like politician Tomasz Mentzen predicting the veto and highlighting its role in preserving a vibrant market. Mentzen noted on social media that the bill ignored lessons from past regulatory missteps, where heavy-handed tactics failed to curb fraud but succeeded in chasing away legitimate businesses.

Frequently Asked Questions

What are the main provisions of the vetoed Poland crypto bill?

The Crypto-Asset Market Act sought to regulate cryptocurrency exchanges and assets through mandatory licensing, website blocking powers for authorities, and steep supervisory fees. It aimed to enhance investor protection but was criticized for its potential to hinder operations, as per analyses from the president’s office and industry reports.

Why are government officials criticizing the Poland crypto bill veto?

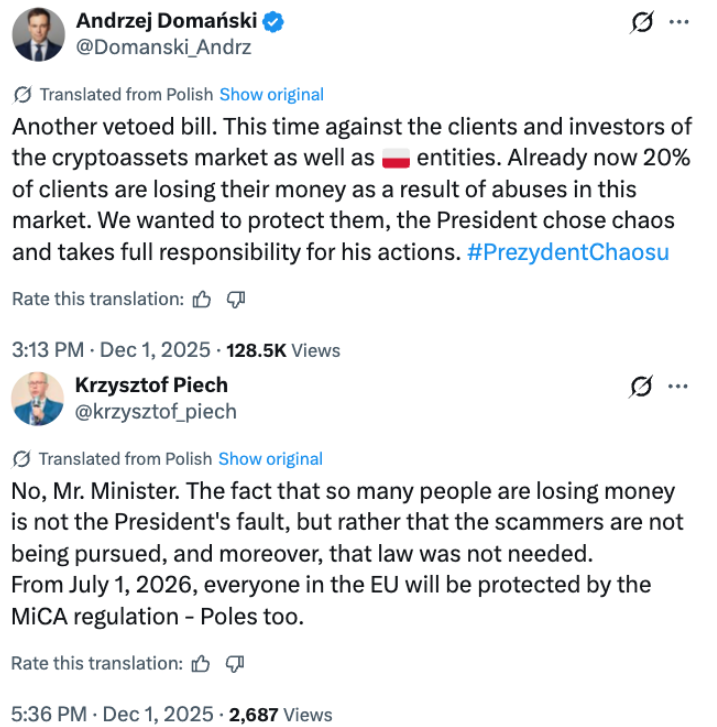

Officials like Finance Minister Andrzej Domański argue the veto invites market chaos, pointing to current abuses where 20% of clients reportedly lose funds to scams. Deputy Prime Minister Radosław Sikorski warned on social media that without regulation, a crypto bubble burst could devastate Polish savers, holding the president accountable for any fallout.

Key Takeaways

- Protection of Innovation: The veto prevents overregulation that could push crypto startups to neighboring countries, potentially saving Poland millions in lost economic activity and tax revenue.

- Government Backlash: Critics from the administration, including key ministers, decry the decision as risky amid rising crypto fraud, emphasizing the need for swift protections ahead of EU-wide MiCA implementation.

- Future Implications: Stakeholders should monitor upcoming EU regulations, as this pause allows Poland to align with balanced frameworks that foster growth without excessive barriers—consider reviewing your crypto strategies now.

Source: Finance Minister Andrzej Domański (posts translated by X)

Economic analyst Krzysztof Piech countered the criticism, stating that enforcement failures, not lack of rules, drive scams, and MiCA will soon address cross-border issues. He emphasized in a recent commentary that blaming the president overlooks systemic gaps in pursuing fraudsters under existing laws.

Conclusion

The Poland crypto bill veto by President Nawrocki underscores a pivotal tension between regulatory zeal and economic vitality in the cryptocurrency landscape. By rejecting provisions for website blocks and high fees, the decision safeguards innovation while inviting scrutiny over investor safeguards. As EU’s MiCA framework approaches in 2026, Poland stands at a crossroads to refine its cryptocurrency regulations for sustainable growth—industry players are urged to stay informed and adapt to evolving policies that balance protection with opportunity.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

2/28/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/27/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/26/2026

DeFi Protocols and Yield Farming Strategies

2/25/2026