Polish President’s Crypto Bill Veto Triggers Government Probe and Bitcoin Market Fears

BTC/USDT

$23,298,561,101.23

$66,025.52 / $63,030.00

Change: $2,995.52 (4.75%)

-0.0012%

Shorts pay

Contents

President Karol Nawrocki vetoed Poland’s Crypto-Asset Market Act, sparking a political firestorm as Prime Minister Donald Tusk launches probes into alleged crypto scandals and accuses the president of serving Russian interests through cryptocurrency policies.

-

President’s veto blocks harsh EU-aligned crypto rules that could stifle Poland’s digital asset sector.

-

Critics warn the bill’s bureaucratic burdens exceed MiCA standards, risking business exodus to nations like Estonia.

-

Government claims 3 million Polish investors need protection, vowing to resubmit the legislation amid escalating tensions.

Explore the Polish crypto bill veto controversy: President’s stand against overreaching rules divides government and boosts investor debates. Stay informed on Europe’s crypto regulations—read now for key insights.

What is the Polish crypto bill veto controversy?

The Polish crypto bill veto refers to President Karol Nawrocki’s rejection of the Crypto-Asset Market Act, a legislative effort by Prime Minister Donald Tusk’s government to implement EU’s Markets in Crypto-Assets (MiCA) framework into Polish law. This move has ignited fierce political debates, with the government accusing the president of ties to questionable crypto dealings and foreign influences. Nawrocki cited concerns over economic freedoms and national stability, arguing the bill imposes excessive restrictions beyond EU requirements.

Why did President Nawrocki veto the crypto bill?

President Nawrocki vetoed the bill on Monday, highlighting its potential to undermine personal economic freedoms and Poland’s stability, as detailed in official statements. The legislation, spanning over 100 pages, includes ambiguities and bureaucratic hurdles that industry experts, such as those cited by Bitcoin.pl, describe as a “legislative nightmare” far stricter than MiCA. According to analyses from Polish crypto observers, these provisions could devastate local blockchain firms by imposing onerous compliance costs and operational barriers. Nawrocki emphasized the need for balanced rules that foster innovation rather than hinder it, protecting the interests of Poland’s vibrant Web3 community without succumbing to overregulation.

Poland’s crypto sector, one of the largest in Eastern Europe within the EU, has seen significant growth, with estimates from local reports indicating millions of users engaging in digital assets. The president’s decision provides a window for revisions, potentially aligning the law more closely with investor protections while avoiding the pitfalls that could drive companies abroad. Data from European blockchain associations underscore that overly rigid national implementations of MiCA have already prompted relocations in other member states, a trend Nawrocki aims to prevent.

Frequently Asked Questions

What are the main criticisms of Poland’s proposed crypto bill?

The Crypto-Asset Market Act faces backlash for exceeding MiCA’s scope with excessive bureaucracy, including unclear definitions and high compliance demands that could cripple small crypto businesses. Experts from Bitcoin.pl argue it risks a capital flight, harming Poland’s 3 million digital asset investors by prioritizing stringent controls over practical safeguards, potentially leading to an exodus of firms to more lenient EU neighbors.

How might the Polish crypto bill veto impact EU-wide regulations?

The veto highlights tensions in transposing MiCA across the EU, potentially delaying Poland’s full compliance and influencing other nations to scrutinize their implementations. It underscores the need for flexible national laws that support crypto innovation, as rigid approaches could fragment the single market and encourage cross-border shifts, ultimately benefiting jurisdictions like Estonia with investor-friendly policies.

President Karol Nawrocki’s veto on a controversial law to regulate the Polish crypto market has been met with threats and attacks by the government. Prime Minister Donald Tusk has ordered an investigation into an alleged “crypto affair,” implicating the head of state, while members of his ruling coalition are accusing him of attending to Russian interests.

Halted Polish crypto bill stirs political storm in Warsaw

Poland is descending into a major political clash over Nawrocki’s decision to stop the Tusk cabinet’s attempt to impose legislation transposing the EU’s latest crypto rules into national law. On Monday, the president vetoed the Crypto-Asset Market Act passed by the Polish parliament, which critics say is much harsher than Europe’s Markets in Crypto Assets (MiCA) regulation.

The local Bitcoin community has already warned it may literally kill crypto business in the country, and the recently elected Polish leader expressed additional concerns in his motives, including regarding Poles’ personal and economic freedoms and their state’s stability. Tusk’s government counterattacked, alleging Nawrocki’s participation in a “crypto affair” and exposing his “weird relationship” with the digital asset industry, as reported by Bitcoin.pl portal.

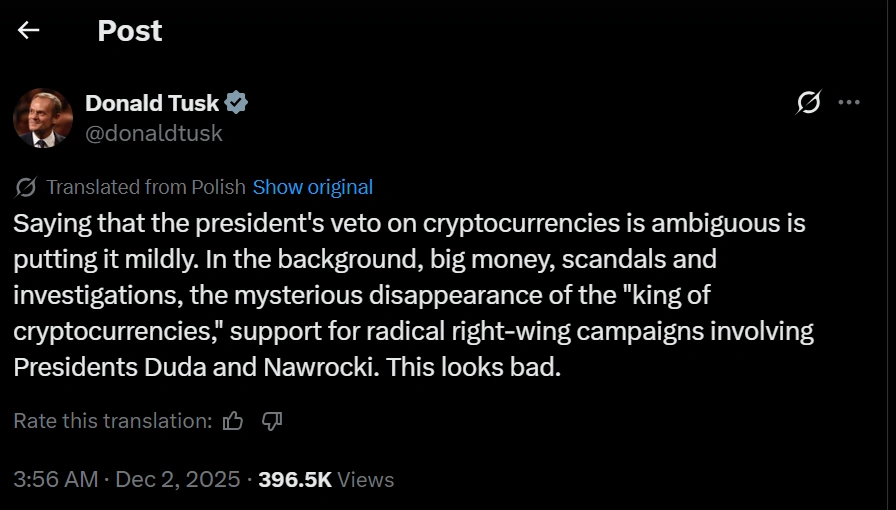

“Everyone is already talking about a crypto scam. This involves a large company, lawsuits, investigations, suspected murder, the disappearance of the manager of a key crypto firm,” the prime minister stated, quoted by the RIA Novosti news agency. He also saw a “political campaign” behind the president’s move and spoke about right-wing leaders and media advertising one of the investigated companies. On Tuesday, Tusk also lashed out in a post on X.

Screenshot of the English translation of Tusk’s tweet. Source: @donaldtusk via X/Twitter

Screenshot of the English translation of Tusk’s tweet. Source: @donaldtusk via X/TwitterThe head of the Polish government announced he had instructed his colleagues in the government to collect details on the case, stating: “I expect the Minister of Finance to provide full information about the negative consequences of this veto, and I ask Ministers Siemoniak, Kerwiński, and Żurek for information about the context of this case and who is behind the blocking of this law.” Tomasz Siemoniak is Poland’s coordinating minister of intelligence, Marcin Kerwiński is the head of the Ministry of the Interior, and Waldemar Żurek serves as minister of justice and prosecutor general.

Donald Tusk vowed to push the law through parliament again and resubmit it for signature from Nawrocki, whom he directly threatened: “I ask you to treat this as your last chance to remove your name from the crypto scam, which has become a very public fact in recent days.” Meanwhile, Deputy Prime Minister Gawkowski blamed the president for “blocking progress in digitalization.” And the government said the bill will be “immediately” sent back to Polish lawmakers to ensure protection for 3 million Polish investors, as Tusk insisted.

Ruling coalition alleges Russian connection in presidential veto

The Civic Coalition, which holds the executive power in Warsaw, went even further, with its representatives suggesting that Nawrocki’s halt of their legislative initiative actually serves Putin’s Russia, because Moscow is using cryptocurrencies to circumvent Western sanctions. Bitcoin.pl, which registered the attack on social media, described the claim as “bold but misguided.” The crypto news outlet insisted that “a well-constructed law could block this without destroying the Polish Web3 ecosystem.”

The website pointed out that the proposed crypto law is “more than 100 pages of legislative nightmare, full of mistakes, ambiguities and bureaucratic barriers” that can “finish off” Polish blockchain businesses. It also commented: “The president vetoed it not to defend fraudsters, but to give time to correct fundamental mistakes. It’s not a blocking of innovation, but an attempt to save it from the legislative molochs.”

The online edition called the moment critical for the Polish crypto market, arguably Eastern Europe’s largest within the EU, as it provides an opportunity to adopt rules that protect investors, without strangling entrepreneurs. “If the bill passes in its current form, we are in for a massive exodus of companies and capital to more friendly jurisdictions,” the Bitcoin portal wrote, listing some of the more welcoming nations in Europe such as Estonia, Switzerland and Portugal, besides Poland’s Czech and Hungarian neighbors.

This ongoing dispute reflects broader challenges in harmonizing EU crypto regulations at the national level. Authoritative sources like the European Securities and Markets Authority (ESMA) emphasize the importance of MiCA implementations that balance anti-money laundering measures with market growth. Industry experts, including those from Polish blockchain associations, warn that Poland’s approach could set a precedent for overregulation, potentially deterring foreign investment in the region’s digital economy, valued at billions in transaction volume annually.

Key Takeaways

- Political Escalation: The veto has triggered government probes and accusations, intensifying divisions over Poland’s crypto future.

- Regulatory Risks: The bill’s strict measures may exceed MiCA, threatening the exodus of crypto firms to Estonia and Portugal.

- Investor Protection: With 3 million users at stake, revisions could safeguard the market while promoting innovation—monitor parliamentary resubmission.

Conclusion

The Polish crypto bill veto underscores the delicate balance between regulatory oversight and fostering a thriving digital asset ecosystem in Europe. As Prime Minister Tusk pushes for resubmission amid allegations of scandals and foreign ties, President Nawrocki’s stance highlights the need for refined legislation that aligns with MiCA without overburdening businesses. Looking ahead, this clash could shape Poland’s role in the EU’s crypto landscape, urging stakeholders to prioritize investor safeguards and innovation for sustained growth.

Comments

Other Articles

Bitcoin Price Analysis: Will the Uptrend Continue?

3/1/2026

Ethereum 2.0 Update: How Will It Affect the Crypto Market?

2/28/2026

The Coming of Altcoin Season: Which Coins Will Stand Out?

2/27/2026

DeFi Protocols and Yield Farming Strategies

2/26/2026